How to File Back Taxes: Complete Guide That Actually Works

Understanding What You're Really Facing

Facing unfiled tax returns can be daunting, but it's more common than you might think. Life has a way of throwing curveballs – job losses, family emergencies, or financial hardships – and sometimes, tax filing falls by the wayside.

Understanding what "back taxes" are is the first step toward resolving the issue.

Essentially, any tax return that was due but remains unfiled is considered a back tax return. This is important because the implications of owing taxes are different from simply not filing them, even if you don't owe anything.

This means that even if you're due a refund, failing to file could mean losing that money. For example, the IRS has a three-year rule for claiming refunds. If you don't file within three years of the return's due date, you forfeit any refund you were entitled to.

Taking swift action to file is crucial to protecting your finances and avoiding potential penalties.

You might be interested in: How to master your tax debt solution.

Why People Fall Behind on Taxes

Millions of Americans find themselves dealing with back taxes for a variety of reasons. Sometimes, it's a simple oversight – a missed deadline or misplaced paperwork.

Other times, more complex situations like a sudden illness or a major life change can disrupt even the best intentions.

Regardless of the reason, procrastination only worsens the situation. The financial impact of filing back taxes can be significant for both individuals and the economy.

In 2022, taxpayers reported nearly $14.8 trillion in Adjusted Gross Income (AGI) on 153.8 million tax returns. This represents an increase of $30 billion in AGI and 211,000 returns compared to 2021.

This growth in economic activity can also lead to more complex tax situations requiring careful handling of back taxes.

Find more detailed statistics here: https://taxfoundation.org/data/all/federal/latest-federal-income-tax-data-2025/.

How the IRS Prioritizes Enforcement

Understanding how the IRS operates can help alleviate anxiety. The IRS doesn't pursue every case of unfiled returns with the same level of urgency. They prioritize cases based on several factors.

These factors include the amount owed, the likelihood of collecting, and the presence of other red flags. They also tend to focus on recent tax years before older ones.

This doesn't mean you should ignore older unfiled returns. However, understanding their prioritization system can help you strategize your approach.

Taking Immediate Action

Taking the first step is often the hardest, but it’s also the most crucial. Even if you can't file all your back taxes at once, taking some initial steps can significantly reduce potential problems.

Gathering any available tax documents, such as W-2s and 1099s, is a good starting point. This early preparation will streamline the actual filing process. Remember, acknowledging the issue and taking proactive steps is key to regaining control of your tax situation.

Hunting Down Your Missing Tax Documents

Filing back taxes can be a daunting task. It often feels like searching for a needle in a haystack. This section simplifies the process of gathering your necessary tax documents, breaking it down into manageable steps. Having the correct paperwork is key to successfully filing. We'll guide you through locating every document you need.

Understanding What You Need

Before you begin your search, it's crucial to understand exactly what you're looking for. Different tax situations require different documents. If you were employed, you'll need W-2 forms. These show your wages and withheld taxes.

If you were self-employed, you’ll need 1099 forms. These detail your income. You'll also need records of your business expenses. Be sure to gather documentation related to any deductions or credits you might be eligible for.

These documents might include student loan interest payments, medical expenses, or charitable contributions. They can significantly impact your tax liability or the refund you might receive.

Requesting Information from the IRS

The IRS can be a surprising ally in your quest to file back taxes. They can provide wage and income transcripts. These transcripts summarize the information reported to them by employers and other payers.

These transcripts are often sufficient for filing if you’re missing original documents. Requesting transcripts is a straightforward process. You can do it online through the IRS website's "Get Transcript" tool, by phone, or by mail.

This step is important for verifying the accuracy of your records. It also helps prevent processing delays.

Contacting Former Employers and Banks

If you’re missing W-2s or other employment-related documents, contact your former employers. Even if a company has moved or changed systems, they are still required to keep payroll records. Have your employment dates and social security number ready to help them with their search.

You should also contact your banks for old statements. These can verify income deposits, deductible expenses, and other financial transactions.

Many banks provide access to electronic statements online, even for older accounts. This is much faster than requesting paper copies.

Reconstructing Lost Records

Sometimes, despite your best efforts, original records are lost. If this happens, don’t panic. You can create reasonable facsimiles of lost documents.

Use other available information like pay stubs, bank statements, or even client testimonials if you were self-employed.

While not ideal, reconstructed records can fill in the gaps and allow you to file.

Organizing Your Documents

As you gather your documents, organize them chronologically by tax year. This simplifies the filing process and helps prevent errors. A dedicated folder or binder for each tax year is helpful.

Clearly label each document type and include all supporting materials. This organized approach will save you time and reduce the risk of overlooking important information.

The following table provides a handy checklist to help you stay organized:

Essential Documents Checklist by Tax Year

| Document Type | Required For | How to Obtain if Missing | Time Limit |

|---|---|---|---|

| W-2 | Employment income | Contact former employer | Employers are required to keep records for several years, often up to 7. |

| 1099 | Self-employment income, interest, dividends, etc. | Contact the payer (client, bank, etc.) | Varies depending on the type of 1099. |

| Bank Statements | Proof of income, expenses, and other transactions | Contact your bank | Most banks retain records for several years, often 5–7, but electronic access may vary. |

| Student Loan Interest Documents (1098-E) | Student loan interest deduction | Contact your loan servicer | Contact your loan servicer. |

| Medical Expense Records | Itemized medical expense deduction | Contact healthcare providers, pharmacies | Keep records for at least 3 years from the date you filed your return. |

| Charitable Contribution Receipts | Charitable contribution deduction | Contact the charity | Maintain records indefinitely for significant contributions. |

This table provides a quick overview of key document types and how to obtain them if they are missing. Remember to check the specific time limits for retaining records, as these can vary.

Filing back taxes takes patience and diligence. By following these strategies, you’ll be able to locate the necessary documents and confidently file your taxes.

Choosing Your Filing Strategy That Fits Your Life

When it comes to back taxes, there's no one-size-fits-all solution. Your filing strategy should reflect your specific situation. This includes factors like the complexity of your taxes, how many years you need to file, and your comfort level with tax forms.

Let's explore different filing methods and their pros and cons. This will help you determine the best approach.

DIY vs. Professional Help

Filing your back taxes yourself can save money. However, it requires a significant time commitment and a good grasp of tax law. If your tax situation is simple—for example, if you only have W-2 income and take the standard deduction—DIY filing might work.

However, if you have self-employment income, multiple deductions, or potential penalties, things can get complicated quickly. In these situations, hiring a tax professional can be a smart investment.

A qualified professional understands complex tax laws. They can accurately calculate penalties and interest, and identify potential deductions or credits you might have overlooked. They can also represent you before the IRS and negotiate on your behalf, if necessary.

Check out this helpful resource: How to master negotiating IRS debt.

The Power of E-filing

Whether you choose DIY or professional help, e-filing offers significant advantages for back taxes. E-filing is much faster than paper filing. It also offers better tracking, giving you peace of mind knowing the IRS has received your return.

The efficiency of processing and refunding back taxes is affected by how you file. E-filing has become the preferred method, offering quicker processing times compared to paper filings.

As of April 4, 2025, the IRS received approximately 98,184,000 e-filed returns. This represents a small decrease of 0.2% from the previous year.

The use of tax professionals for e-filing increased by 0.4% to 53,392,000 returns. This suggests that many individuals seek professional assistance for complex back tax situations.

You can find more detailed statistics here: https://www.irs.gov/newsroom/filing-season-statistics-for-week-ending-april-4-2025.

Software Solutions for Back Taxes

If you decide to go the DIY route, choosing the right software is crucial. Not all tax software handles back taxes. Look for software specifically designed for amended returns and prior-year filing. Make sure it supports the specific tax forms you need.

Cost-Effective Strategies

Finding the most cost-effective approach depends on a few factors. The number of years you need to file will impact the overall cost. Your comfort level with tax forms will determine if you need professional help.

Filing a single year with simple income is less complex and less expensive than filing multiple years with complicated business income and deductions. Consider your individual circumstances and resources to make the best choice.

Your Step-By-Step Filing Roadmap

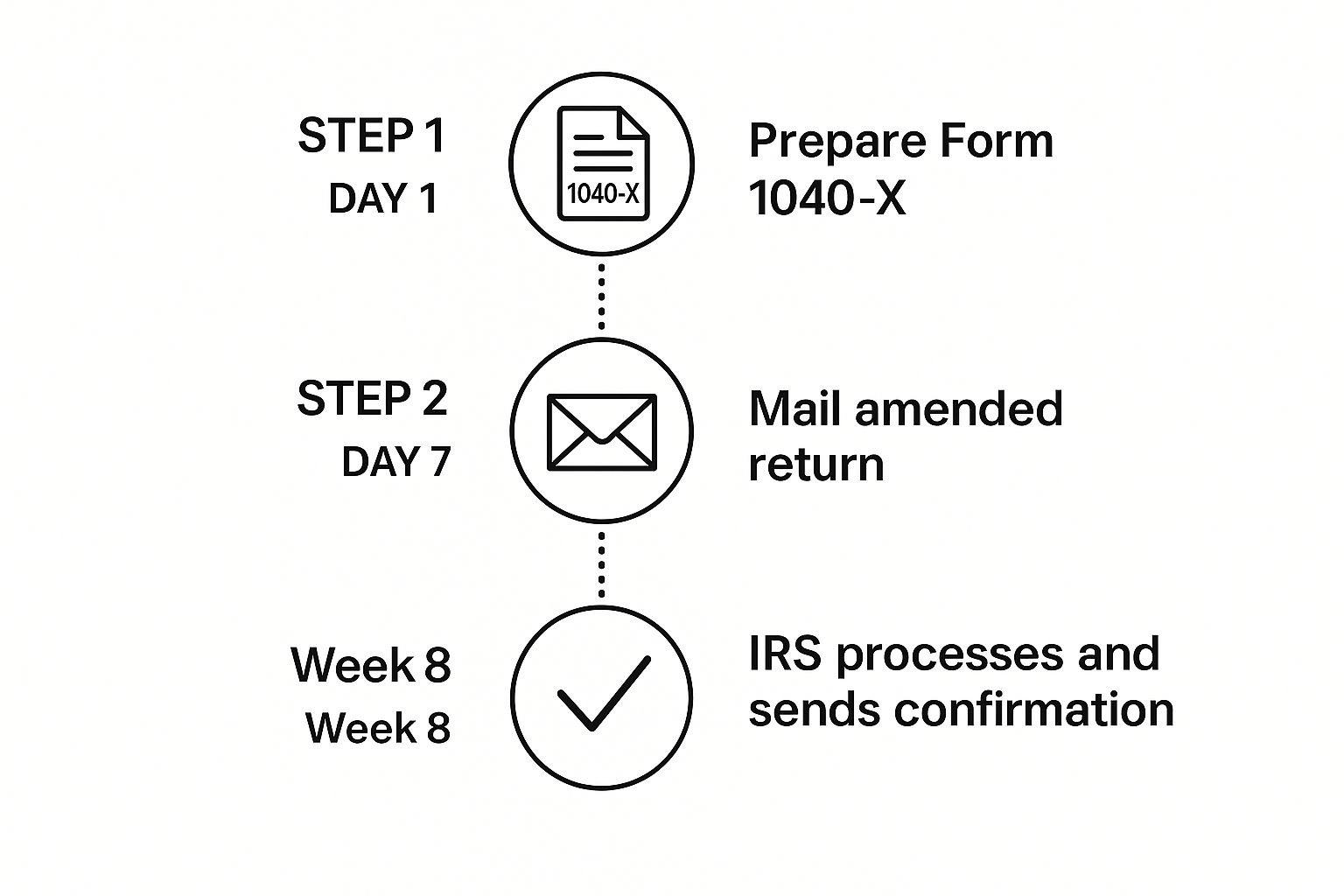

This infographic helps visualize the process of filing amended tax returns. It breaks down the key steps, from preparing Form 1040-X to finally receiving confirmation from the IRS. The first step, as you can see, is preparing the form itself.

Then, mailing it promptly gets the form into the IRS processing queue. After approximately eight weeks, the IRS processes the return and sends you confirmation.

The following information details the step-by-step process involved in filing your back taxes. We’ll explore different scenarios, from straightforward W-2 income to more complex deductions. We'll also touch on how tax laws and forms can change over the years.

Start With The Oldest Tax Year

When you’re filing multiple years of back taxes, it's generally recommended to start with the oldest year first. This strategic approach helps ensure you capture any applicable deductions or credits that could impact subsequent years.

It also makes tracking down necessary documents more efficient, as you'll be building upon the information gathered for each year.

Navigating Forms and Law Changes

Tax laws and forms can change over time. What applied a few years ago might not be relevant today. For instance, some deductions might have been phased out, while new tax credits might have been introduced.

Older tax forms can also become obsolete, requiring you to use updated versions. Using the correct forms and understanding the applicable tax laws for each specific year is essential for accurate filing.

Handling Different Income Situations

The filing process varies depending on individual income situations. If your income primarily came from a W-2, your process will likely be simpler than someone with business income or rental properties.

Business owners, for example, need to use Schedule C to report their income and expenses. Those with rental properties will use Schedule E. No matter your income source, having all the necessary supporting documentation is key.

Before we discuss payment options and common errors, let's take a look at the back tax filing timeline and priorities in the table below.

This table helps break down the process into manageable steps and highlights the importance of prioritizing certain actions.

Back Tax Filing Timeline and Priorities

| Step | Action Required | Timeline | Priority Level | Potential Consequences |

|---|---|---|---|---|

| 1 | Gather necessary tax documents (W-2s, 1099s, etc.) | Immediately | High | Inability to file accurately |

| 2 | Determine which tax forms are needed for each year | As soon as documents are gathered | High | Filing with incorrect forms, leading to delays or penalties |

| 3 | Complete the appropriate tax forms for the oldest year first | As soon as possible | High | Missing deadlines and accruing additional penalties and interest |

| 4 | Calculate any penalties and interest owed | Before filing | High | Underestimating total tax liability |

| 5 | File completed tax returns, starting with the oldest year | Before the tax deadline or as soon as possible for past due returns | High | Continued accrual of penalties and interest |

| 6 | Explore payment options if unable to pay in full (e.g., installment agreement) | After filing | Medium | Potential collection actions by the IRS |

| 7 | Keep records of filed returns and payments | Ongoing | High | Difficulty resolving any future discrepancies |

This table provides a general framework. Specific situations may require additional steps or adjustments.

Calculating Penalties and Interest

Filing back taxes often involves penalties and interest. The failure-to-file penalty is usually 5% of the unpaid taxes for each month or part of a month that a return is late, up to a maximum of 25%.

The failure-to-pay penalty is generally 0.5% of the unpaid taxes for each month or part of a month that taxes remain unpaid, up to a maximum of 25%. Accurately calculating these is important to understand your full liability.

Payment Options and Sequencing

Understanding your payment options is essential. If you can’t pay the full amount owed immediately, an installment agreement with the IRS might be an option. This allows you to make payments over time.

You might find this helpful: Our article about how to get help with your unfiled tax returns and avoid penalties.

Avoiding Common Errors

Certain errors can cause significant delays or increased IRS scrutiny. These include using the wrong forms, math errors, and failing to sign and date your return. Double-checking everything and considering a professional review can save you time, money, and potential frustration in the long run.

Mastering Deadlines And Minimizing Financial Damage

Dealing with back taxes can be stressful, especially when facing potential penalties. Understanding how these penalties work is crucial for minimizing their financial impact.

This section explains how failure-to-file and failure-to-pay penalties accrue. We'll also explore ways to potentially reduce these penalties and discuss various payment strategies.

Understanding Penalties: Failure-to-File vs. Failure-to-Pay

It's important to know the difference between failure-to-file and failure-to-pay penalties. The failure-to-file penalty is usually 5% of the unpaid taxes for each month or part of a month your return is late. This penalty is capped at a maximum of 25%, and it applies even if you don’t owe any taxes.

The failure-to-pay penalty is typically 0.5% of the unpaid taxes each month or part of a month that the taxes go unpaid, also with a 25% maximum. These penalties often accrue simultaneously.

For example, imagine you owe $10,000 and file six months late. Your failure-to-file penalty could be $2,500 (25% of $10,000).

If you then take another six months to pay, the failure-to-pay penalty could add an additional $1,500 (0.5% per month for six months on the initial $10,000).

A year's delay, in this scenario, could cost you $4,000 in penalties, in addition to the original $10,000 owed.

Exploring Penalty Relief Options

While the penalties can be significant, the IRS offers some relief options. The First Time Penalty Abatement program might waive penalties for first-time offenders who meet certain requirements.

If you have a reasonable cause for not filing or paying on time, such as a natural disaster or a serious illness, you can also request penalty abatement.

Keeping up with current tax deadlines is essential when dealing with back taxes. The start of the tax filing season varies each year. The IRS provides weekly filing updates on their website, which can be a useful resource.

You can learn more about filing statistics here: https://www.irs.gov/newsroom/filing-season-statistics-by-year.

Demystifying Payment Options

The IRS offers a range of payment options to help manage back taxes. If you can't pay the full amount immediately, you can establish an installment agreement to make monthly payments over a set period.

Another option is an Offer in Compromise (OIC). An OIC allows some taxpayers to resolve their tax debt for less than the full amount if they demonstrate specific financial hardships.

Penalty Calculators and Payment Scenarios

Understanding potential penalty amounts is key to effective planning. Online penalty calculators can help you estimate your potential penalties based on your specific situation. This allows you to avoid unexpected costs and make informed decisions.

It's helpful to create different payment scenarios, exploring options like an installment agreement or an OIC, to understand what you can realistically afford to pay each month. Successfully navigating back taxes involves understanding the IRS penalty system and available relief options.

By carefully assessing your financial situation and available payment strategies, you can minimize the financial impact and resolve your tax debt.

Claiming Every Dollar You Deserve

Filing back taxes can feel daunting, but it could result in a refund. Many people miss potential deductions and credits, leaving money behind. Understanding tax law changes, common omissions, and the three-year refund rule can maximize your recovery. But you have to act within the legal timeframe.

Identifying Overlooked Deductions and Credits

Think of tax deductions and credits as discounts on your tax bill. Deductions lower your taxable income, while credits directly reduce your tax owed. Commonly missed deductions include business expenses, charitable contributions, and medical expenses.

For example, if you worked from home but didn't claim the home office deduction, you might be eligible for a refund. Forgotten charitable donations or unreimbursed medical expenses can also add up. Carefully reviewing past tax years could reveal hidden refunds.

The Three-Year Refund Rule and Your Strategy

The IRS generally allows three years from the filing deadline to claim a refund. After that, the money is usually gone. Prioritize which years to file first.

Focus on the most recent years within the three-year window. Also, prioritize years with significant life changes, like marriage, having a child, or starting a business. These changes often open up new deductions or credits.

The total amount refunded in the 2025 tax season hit $253.116 billion, a 3.2% increase from the prior year, even with similar refund numbers. This suggests refunds are getting larger, perhaps due to tax law changes or deductions claimed when filing back taxes.

Learn more: https://taxfoundation.org/data/all/federal/latest-federal-income-tax-data-2025/.

Amending Returns and Supporting Your Claims

If you find errors after filing, you can amend past returns with Form 1040-X, Amended U.S. Individual Income Tax Return. This form lets you correct mistakes, claim missed deductions, or adjust your income.

Keep receipts, invoices, bank statements, and other records. This documentation is essential if the IRS questions your amended return.

You might also be interested in: A complete guide to tax debt settlement.

Recognizing Red Flags and Maintaining Documentation

While claiming refunds is important, avoid red flags that could trigger IRS review. Exaggerated deductions or inconsistencies between your amended and original returns can raise concerns.

Honesty and accuracy are key. Ensure your amended returns match your documentation. Organized records protect you during an audit and simplify filing back taxes.

By reviewing past tax years, understanding deductions and credits, and keeping accurate records, you can reclaim any money owed and get your taxes back on track.

Key Takeaways

Filing back taxes can be stressful and confusing. But with a good plan, you can take control of your tax situation. This guide offers key takeaways to help you organize, minimize penalties, and potentially even claim refunds. Think of it as your roadmap to getting back on track and staying compliant.

Organization Is Key: Building Sustainable Systems

Good organization is essential for dealing with back taxes. Creating a sustainable system for managing your tax documents is the first step.

Creating Checklists: Use checklists to make sure you have all the required documents for each tax year. This might include W-2s, 1099s, and any documents supporting deductions.

Realistic Timelines: Set realistic timelines for gathering documents, filling out forms, and filing. This helps you stay organized and avoid last-minute stress.

Progress Tracking: Track your progress using a spreadsheet or a tax organizer. Regularly checking your progress helps you stay motivated and spot any potential problems.

Technology and Tools: Simplifying the Process

Technology can make filing back taxes much easier. Here are a few tools to consider:

Tax Software: Use tax software like TurboTax or H&R Block designed for amended returns and prior-year filing. Make sure it supports the tax forms you need and offers helpful features like error checking and calculations.

Automated Reminders: Set up automated reminders for tax deadlines and payment due dates. This helps you avoid missed deadlines and penalties.

Secure Document Storage: Store your tax documents securely, either digitally or in a physical filing system. This keeps your information safe and accessible.

Professional Guidance: Knowing When to Seek Help

While you can often manage back taxes on your own, sometimes professional help is the best option.

Complexity Assessment: Be honest about the complexity of your taxes. If you have multiple income sources, complicated deductions, or potential penalties, a tax professional can provide valuable assistance.

Cost-Benefit Analysis: Compare the cost of hiring a professional with the potential benefits. A tax professional can help reduce penalties, find missed deductions, and navigate complicated tax laws.

Ongoing Support: If you expect ongoing tax challenges, consider building a relationship with a tax professional for continued support.

Staying Compliant: Maintaining Good Standing with the IRS

Filing your back taxes is the first step. Staying compliant with the IRS requires ongoing effort.

Regular Filing: File your taxes on time every year to avoid falling behind again.

Payment Plans: If you owe taxes, explore payment options like installment agreements with the IRS.

Communication with the IRS: Keep in contact with the IRS and respond to any notices promptly.

These key takeaways provide a strong foundation for successfully handling back taxes. By staying organized, using technology, and seeking professional help when needed, you can regain control of your tax situation and maintain compliance.

Need expert help navigating your back taxes? Attorney Stephen A. Weisberg has over 10 years of experience helping individuals and businesses with tax debt, audits, and other IRS issues. Schedule a free consultation today.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034