How to Settle Tax Debt with IRS: Top Strategies

Understanding Your Tax Debt Reality

Dealing with IRS tax debt can be a daunting experience. Many people feel overwhelmed, but understanding your specific situation is the first step towards resolution.

This involves accurately assessing your total liability, which includes penalties and interest. This guide will help you gain clarity on your tax debt and prepare to address it effectively.

Assessing Your Total Tax Liability

Knowing the full extent of your debt is crucial. This includes not only the initial tax you owed but also any accrued penalties and interest. These additions can substantially increase your overall balance.

It's essential to factor them into your assessment. Obtaining your tax transcripts directly from the IRS provides a detailed breakdown of your liability for each tax year. These transcripts are essential for accurate assessment and planning.

Obtaining and Understanding Your Tax Transcripts

Requesting your tax transcripts is a straightforward process. You can do so online through the IRS website or by mail. These documents serve as a financial report card from the IRS, outlining your tax history.

Understanding these transcripts is key to seeing how your debt has accumulated. For instance, they detail the original tax, penalties for late filing or payment, and the accumulating interest. This information is critical when considering how to settle your tax debt with the IRS.

The Statute of Limitations and Filing Requirements

Before considering settlement options, it's important to understand the statute of limitations on collections. This timeframe dictates how long the IRS has to collect outstanding debt.

However, this doesn't mean you can simply ignore the debt. Filing all required tax returns is crucial before engaging with the IRS for any relief program.

The IRS has been actively pursuing tax debt resolution, collecting $104.1 billion in unpaid taxes during Fiscal Year 2023 through enforcement actions. Of this, $68.3 billion was collected as net proceeds.

Taxpayers with significant balances can explore programs like the Offer in Compromise (OIC). This program allows for settling debts for less than the full amount owed under specific hardship circumstances.

A 2025 CNBC report indicated that 25% of taxpayers anticipated incurring debt to pay IRS bills. This highlights the increasing demand for settlement options like installment agreements or OICs. Find more detailed statistics here.

Addressing your tax debt proactively is always the best approach. Taking these initial steps empowers you to make informed decisions about your tax debt and move towards a resolution.

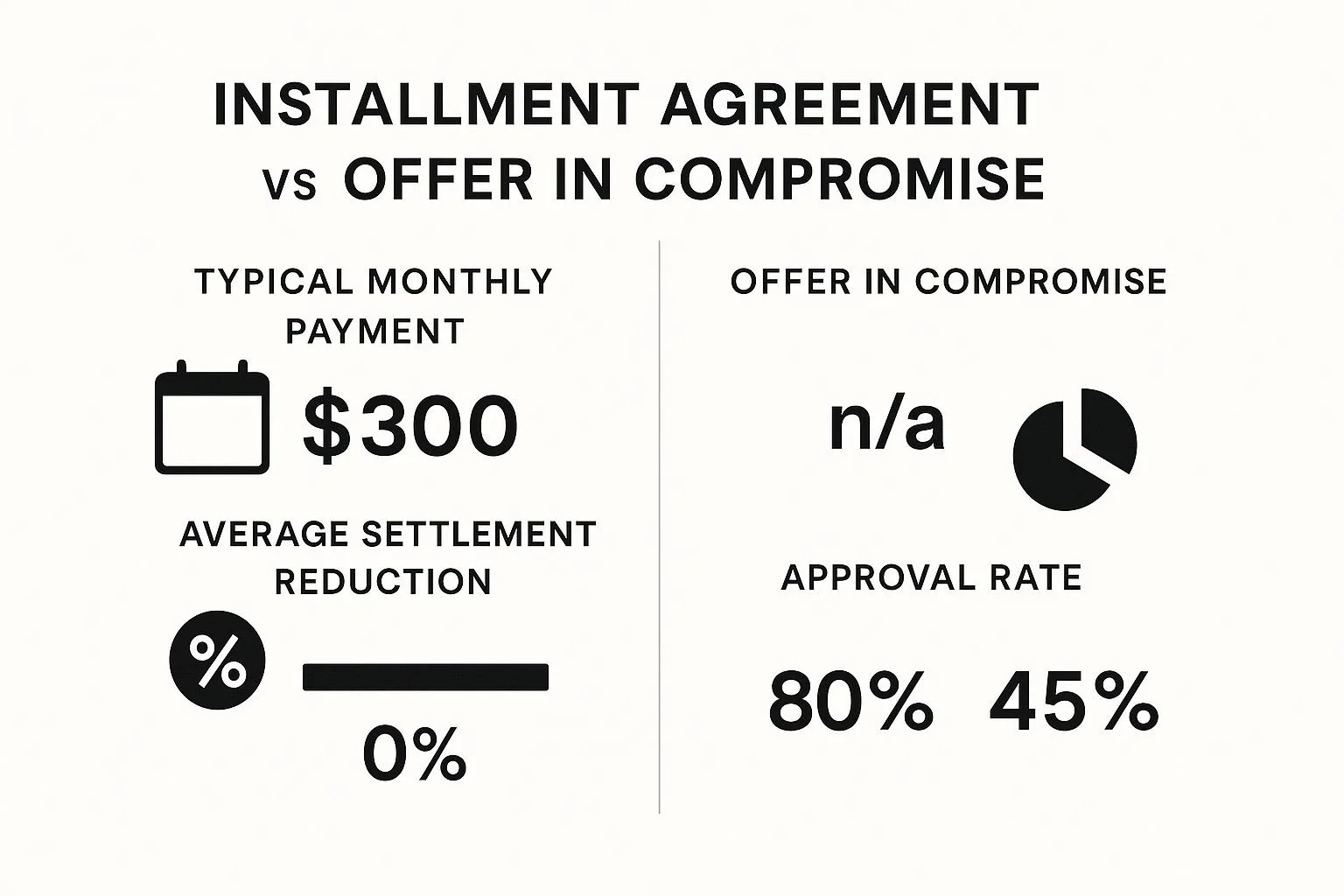

Installment Agreements: Payment Plans That Actually Work

When you can't pay your full tax debt upfront, an installment agreement can be a lifeline. This sets up a payment plan with the IRS, allowing you to pay off your debt over time. Understanding the different types of installment agreements is key to effectively settling your tax debt.

Different Types of Installment Agreements

The IRS offers several installment agreement options designed for various situations. These include short-term payment plans (up to 180 days) for smaller balances and long-term payment plans (also known as guaranteed installment agreements) for larger debts. The best plan for you depends on how much you owe and your ability to pay.

For example, a streamlined installment agreement is available for those who owe less than a certain amount. This option simplifies the application process, making managing your debt easier.

Partial payment installment agreements allow you to pay a portion of your debt over an extended period.

Check out our guide on ultimate guide to IRS back taxes payment plan strategies.

Applying for an Installment Agreement: Form 9465 and Online Options

Applying for an installment agreement involves completing Form 9465, Installment Agreement Request. This form asks for information about your finances and proposes a monthly payment amount. You can submit this form by mail or online through the IRS website.

The IRS also offers online payment options, providing a convenient way to manage your agreement and make payments on time. However, understanding the implications of an installment agreement is important.

There are often setup fees, and interest continues to accrue on the unpaid balance. This means the total amount paid will exceed the original tax debt. Future refunds may also be applied to your outstanding balance. You might be interested in: How to settle tax debt with IRS.

Maintaining Compliance and Handling Changes in Your Financial Situation

Once your installment agreement is in place, staying compliant is crucial. Missing payments can default the agreement, potentially leading to collection actions.

If your financial situation changes, such as job loss or unexpected expenses, contact the IRS immediately. You may be able to modify your agreement. In 2025, streamlined installment agreements became more accessible for taxpayers owing less than $50,000.

For larger debts, the IRS assesses individual repayment capacity through a detailed financial analysis. Learn more about streamlined installment agreements here: https://traxiontax.com/how-to-settle-tax-debt-2025/. Staying proactive and communicating with the IRS can help avoid future problems.

Mastering the Offer in Compromise: Pay Less Than You Owe

An Offer in Compromise (OIC) lets some taxpayers settle their IRS tax debt for less than the full amount. It's a valuable tool, but navigating the process requires a well-planned strategy. This involves understanding the qualifications and how the IRS assesses your ability to pay.

Understanding the Three Grounds for OIC Qualification

The IRS looks at three main factors when reviewing OIC applications: doubt as to collectibility, doubt as to liability, and effective tax administration. Doubt as to collectibility is the most common reason. This applies when your combined assets and income are less than your total tax debt.

Doubt as to liability is used when you believe the calculated tax amount is wrong. Effective tax administration is rarely used. It applies in unique situations where collecting the full tax creates an unfair hardship.

This qualification requires thorough financial documentation to demonstrate your inability to pay the full amount. You're essentially showing the IRS that paying the full balance would create excessive financial strain. Read also: IRS Offer in Compromise: A Complete Guide to Tax Debt Settlement

Calculating Your Reasonable Collection Potential

The IRS uses the reasonable collection potential (RCP) formula to figure out the lowest offer they'll accept. This calculation includes your assets, income, and allowed expenses.

They estimate your future income potential over a set time, usually five years for lump-sum offers and two years for payments made over time. The IRS then compares your RCP to your total tax liability. The amount the IRS considers collectible is usually the base for a successful OIC.

The IRS OIC program approves about 40-45% of applications each year. Acceptance depends on the taxpayer's 'reasonable collection potential' formula. This compares monthly disposable income (after acceptable expenses) to the total tax debt.

Lump-Sum vs. Periodic Payment Options

You can submit an OIC with two payment choices: lump-sum or periodic payments. A lump-sum offer means paying the agreed-upon amount within five months of acceptance.

Periodic payments let you pay in installments, usually over a maximum of 24 months. The best choice depends on your individual financial situation.

The following data chart illustrates typical OIC acceptance rates, categorized by offer type and financial hardship. As the chart demonstrates, applicants facing severe hardship have much better approval odds, whether they choose a lump-sum or periodic payment offer. Lump-sum offers tend to have a slightly higher overall acceptance rate.

OIC Acceptance Rates by Offer Type and Hardship Level

| Hardship Level | Lump-Sum Acceptance Rate | Periodic Payment Acceptance Rate |

|---|---|---|

| Severe | 65% | 55% |

| Moderate | 45% | 35% |

| Low | 25% | 15% |

Understanding these details, including how job loss, medical emergencies, or other financial problems might affect your offer, is essential for a successful OIC.

Taxpayers usually have to offer a lump-sum payment within five months or installment payments over 24 months.

As of March 2025, the IRS confirmed that OICs are still an option for eligible taxpayers, especially those facing job loss, medical crises, or other financial difficulties.

The program is more accessible since the Fresh Start reforms, though strict documentation rules still apply.

The table below compares the different payment structures available under the Offer in Compromise program, highlighting key differences in terms, requirements, and considerations.

Offer in Compromise Payment Options Comparison

| Payment Option | Initial Payment Required | Payment Period | Total Payment Timeline | Best For |

|---|---|---|---|---|

| Lump-Sum | 20% of offer amount with application | N/A | Up to 5 months after acceptance | Taxpayers with available assets or access to funds |

| Periodic Payment | Initial payment with application (varies) | Monthly installments | Up to 24 months after acceptance | Taxpayers with steady income but limited liquid assets |

This table clarifies the two main OIC payment options. While lump-sum offers require a quicker full payment, periodic payments provide more flexibility. Choosing the right option depends on your individual financial capabilities.

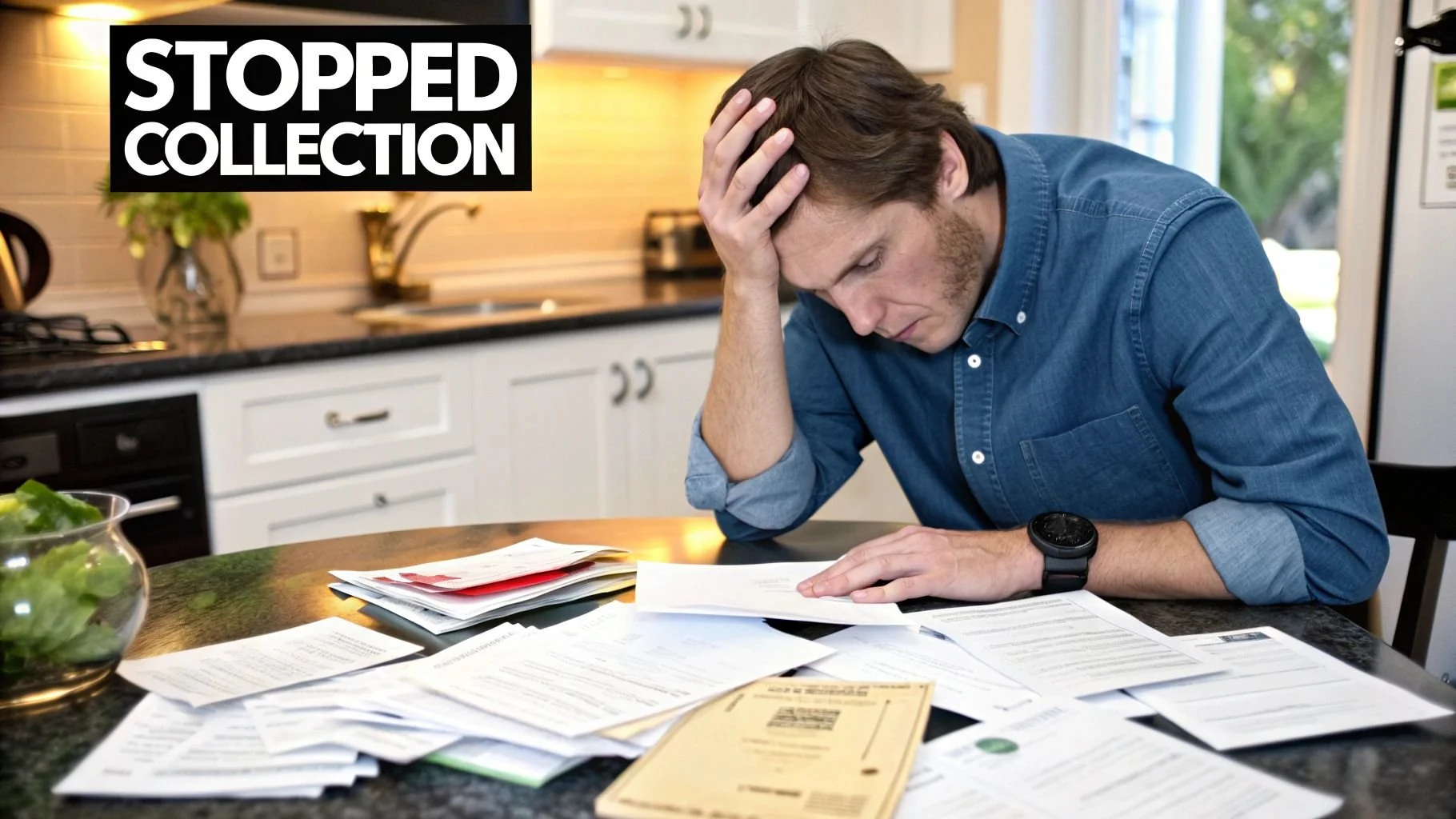

Currently Not Collectible Status: When You Need Breathing Room

When facing significant financial hardship, Currently Not Collectible (CNC) status can provide temporary relief from IRS collections. This status recognizes your current inability to pay your tax debt. This section explores how CNC status works, its benefits and limitations, and its role in your overall strategy for resolving tax debt.

How CNC Status Works: A Temporary Pause

CNC status doesn't eliminate your tax debt. It temporarily suspends collection actions like levies and garnishments. This gives you time to improve your financial situation. The IRS typically reviews CNC status every year or two to reassess your ability to pay.

For instance, if you lose your job or face a serious medical emergency, CNC status can protect you. It can prevent the IRS from seizing assets or garnishing wages while you're getting back on your feet. This pause can be critical during difficult times.

Documenting Hardship: Form 433-F and Necessary Expenses

Qualifying for CNC status requires demonstrating genuine financial hardship. This involves completing Form 433-F, Collection Information Statement. This form requests detailed information about your income, expenses, assets, and liabilities.

The IRS uses this information to determine if you truly can't afford to make any payments towards your tax debt. Accurate and honest representation of your finances is crucial. Be ready to provide supporting documentation like bank statements and pay stubs.

Limitations of CNC Status: Interest and Periodic Reviews

CNC status offers temporary relief, but it's essential to understand its limitations. Interest and penalties continue to accrue on your unpaid balance, even during CNC status. This means your total debt will grow over time.

The IRS also conducts periodic reviews of your financial situation. If your finances improve, they may resume collection activities. Keeping accurate records of your ongoing hardship is therefore essential.

When CNC Status Makes Sense (and When It Doesn't)

CNC status is a valuable tool for taxpayers experiencing severe financial hardship. It can act as a bridge to a more permanent solution like an Offer in Compromise (OIC) or an Installment Agreement. However, CNC status isn't a long-term fix.

If your financial difficulties are temporary, CNC status can provide valuable time. But if you anticipate long-term financial challenges, other settlement options like an OIC may be more beneficial.

Choosing the right path depends on your individual circumstances and financial outlook. Consulting a tax professional can help you determine the best strategy for resolving your tax debt.

Fresh Start Initiative: Unlocking Modern Relief Programs

The IRS Fresh Start Initiative, launched in 2011, changed how taxpayers can settle tax debt. It introduced more flexible and accessible options. However, many taxpayers are still unaware of these helpful programs. This section explores the key parts of the Fresh Start Initiative and how they can offer real relief.

Modified Installment Agreements: Increased Accessibility

One key element of the Fresh Start Initiative is the change to installment agreement terms. The initiative simplified qualifying for installment agreements and expanded who is eligible for streamlined installment agreements. This makes managing tax debt easier for those with lower balances.

For example, the debt limit for streamlined agreements increased. This allows more taxpayers to avoid the complex application process for traditional installment agreements. This change shows the IRS's efforts to simplify debt resolution.

Easier Offer in Compromise Qualifications

The Fresh Start Initiative also improved access to the Offer in Compromise (OIC) program. The IRS updated its financial analysis standards. This makes it easier for taxpayers facing financial hardship to qualify for an OIC. This means more individuals and businesses may be able to settle their tax debt for less than the full amount.

For example, the IRS updated its guidelines for allowable expenses. This makes it easier to show financial hardship.

Relief for Self-Employed and Small Business Owners

The Fresh Start Initiative included specific help for self-employed individuals and small business owners. These provisions acknowledge the financial challenges these taxpayers face.

For example, the initiative offered more flexibility in calculating reasonable collection potential for businesses. This accounts for fluctuating income. The IRS also simplified the OIC application process for businesses, reducing paperwork.

Updated Financial Analysis Standards: A Better Chance of Qualification

The IRS changed how it evaluates a taxpayer's ability to pay under the Fresh Start Initiative. This includes updates to how the IRS calculates disposable income and asset equity. These changes can significantly impact your chances of qualifying for programs like OICs and installment agreements.

For instance, the IRS may now prioritize necessary living expenses when figuring out your ability to pay. This can make it easier to show financial hardship and qualify for an OIC.

Understanding these updated IRS financial analysis standards helps determine the best approach for your tax debt.

To help you understand the different options available, here's a comparison table:

IRS Tax Debt Settlement Options Comparison

This table presents a comprehensive comparison of the main IRS tax debt settlement options, helping readers identify which approach might be most suitable for their situation.

| Settlement Option | Best For | Maximum Debt Amount | Timeline | Impact on Credit | Pros | Cons |

|---|---|---|---|---|---|---|

| Offer in Compromise (OIC) | Taxpayers with significant financial hardship and little ability to pay | No limit, but acceptance depends on reasonable collection potential | Several months to a year | Negative impact, but less than full debt | Can significantly reduce tax debt | Difficult to qualify; requires detailed financial disclosure |

| Installment Agreement | Taxpayers who can afford to pay their debt over time | Generally up to $50,000, but higher amounts may be considered | Up to 72 months | Negative impact, but can be improved with consistent payments | Allows for manageable monthly payments | Accrues penalties and interest until debt is paid |

| Streamlined Installment Agreement | Taxpayers with relatively low tax debt | Generally up to $25,000, but can be higher | Up to 72 months | Negative impact, but can be improved with consistent payments | Easier and faster application process than a regular installment agreement | Accrues penalties and interest until debt is paid |

This table summarizes the key differences between the main IRS tax debt settlement options. It's essential to consider your financial situation and consult with a tax professional for personalized guidance.

This initiative has significantly impacted how tax debt can be resolved. Using these programs strategically, based on your financial situation, can improve your chances of a successful resolution.

Consider talking to a tax professional to find out which programs fit your circumstances and financial goals. They can help you navigate settling tax debt with the IRS and explain how these relief programs can benefit you.

DIY vs. Professional Help: Making the Right Choice

Deciding whether to handle your IRS tax debt yourself or get professional help is a big decision. It can significantly impact both your financial outcome and your peace of mind. This section will help you determine the best path forward based on the complexity of your situation, your resources, and your comfort level with negotiating with the IRS.

Navigating the IRS on Your Own: The DIY Approach

Handling your tax debt yourself can potentially save money on professional fees. However, this route demands a significant investment of time and effort, along with a thorough understanding of tax law.

You'll be solely responsible for all communications with the IRS, including deciphering complex terminology and accurately completing all required forms.

Maintaining detailed records throughout the entire negotiation process is also essential for a successful DIY approach.

The IRS offers various resources for taxpayers choosing the DIY route, including online tools and publications. Be prepared to dedicate significant time to researching and understanding these resources.

You should also be aware that mistakes or requests for additional information from the IRS can lead to delays.

Seeking Professional Guidance: When to Call in the Experts

Complex tax situations often benefit from the guidance of experienced professionals. Enrolled Agents (EAs), Certified Public Accountants (CPAs), and tax attorneys can provide specialized support.

Each credential signifies different qualifications, so it's important to choose a professional with specific experience in IRS tax debt resolution.

Professional help can streamline the often-complicated process, especially if your tax debt involves multiple years or complex issues like levies or liens.

These experts can handle all communication with the IRS, ensuring all requirements are met and deadlines are adhered to, minimizing the risk of errors and potential penalties.

They can also help you determine the best settlement option, such as an Offer in Compromise (OIC), for your individual circumstances. Learn more in our article about tax debt relief companies.

Beware of Predatory Tax Resolution Companies

While many reputable tax professionals can assist with IRS tax debt, it’s important to be cautious of companies making unrealistic promises. Some companies guarantee significant debt reduction for exorbitant fees, often targeting vulnerable taxpayers.

They may also employ aggressive marketing tactics and pressure you to sign contracts quickly. Be wary of red flags like upfront fees before a thorough evaluation of your situation and guarantees of specific outcomes.

Choosing the Right Path: Factors to Consider

Deciding between a DIY approach and professional help hinges on several factors. Consider the complexity of your tax debt, your available time and resources, and your comfort level in dealing directly with the IRS.

Simple Tax Debt: For smaller, more straightforward tax debts, a DIY approach might be a reasonable option.

Complex Tax Debt: Complex cases involving multiple tax years, penalties, or other complicated issues typically benefit from professional assistance.

Limited Time or Resources: If you lack the time or resources to effectively manage the process, a tax professional can significantly lighten your burden.

Discomfort with IRS Negotiations: If the prospect of negotiating with the IRS causes you significant stress or anxiety, consider hiring a professional to advocate on your behalf.

By carefully considering these factors, you can make an informed decision about the best way to address your tax debt with the IRS, ensuring the most favorable outcome for your financial future.

After Settlement: Building Your Tax-Free Future

Successfully resolving your tax debt with the IRS is a major step. But it's not the end of the journey. Think of it as a new beginning, an opportunity to improve your financial health and stay compliant in the future. This section covers practical strategies to maintain financial well-being and avoid future tax issues.

Effective Tax Management: Payments and Record-Keeping

After settlement, setting up a reliable system for managing your taxes is critical. This includes making timely estimated tax payments if you're self-employed or have income not subject to withholding. A good rule of thumb is to save a portion of each payment you receive to cover your tax liability.

Maintaining organized financial records is also key. This means keeping track of income, expenses, and all tax-related documents. A well-organized system makes tax preparation easier and helps ensure accuracy, minimizing the chance of future problems.

Handling Refunds and Rebuilding Credit

You may receive a refund after settling your tax debt. However, if you have other outstanding tax liabilities, the IRS might apply the refund to those balances. Keep this in mind when expecting any refunds.

Tax problems can have a negative impact on your credit score. Rebuilding your credit takes time and consistent effort. Some helpful strategies include paying bills on time, keeping credit card balances low, and regularly checking your credit report for errors. Positive financial habits will gradually improve your credit standing.

Building Financial Security: Emergency Funds and Sustainable Habits

Setting up an emergency fund specifically for potential tax liabilities can prevent future debt. This fund acts as a safety net, providing a cushion if unexpected income changes or expenses occur. Contribute regularly to this fund until you reach a comfortable savings level.

Developing sustainable financial habits is just as important. This includes creating a realistic budget, tracking spending, and avoiding unnecessary debt. Living within your means and making thoughtful financial decisions contribute to long-term financial stability.

Resources for Ongoing Tax Education and Financial Management

Staying informed about tax laws and best practices for financial management is crucial for continued compliance. The IRS offers a variety of resources, such as publications and online tools, to help taxpayers understand their obligations and manage their finances effectively.

Many financial management tools, like budgeting apps and online resources, can also help you track expenses and manage your finances. Using these tools can help maintain financial stability and prevent future tax problems.

Continued learning and the use of helpful resources empower you to stay in control of your finances and maintain long-term tax compliance.

Are you ready to take control of your tax situation and build a secure financial future? Contact Attorney Stephen A. Weisberg today for a free consultation.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034