Effective Tax Debt Relief Strategies for 2025

Facing a Tax Debt? You're Not Alone.

Millions struggle with tax debt. This listicle provides seven key tax debt relief options for 2025. Understanding these options is crucial for regaining financial control.

Learn how an Offer in Compromise (OIC), Installment Agreement, Currently Not Collectible status, Penalty Abatement, Innocent Spouse Relief, Bankruptcy, and the Statute of Limitations can provide tax debt relief.

These solutions can significantly impact your financial future, so understanding them is the first step towards resolution.

1. Offer in Compromise (OIC)

An Offer in Compromise (OIC) is a powerful tax debt relief program offered by the IRS that allows eligible taxpayers to settle their tax debt for less than the full amount owed.

This program can provide a much-needed lifeline for individuals and businesses struggling under the weight of significant tax liabilities.

The IRS evaluates your ability to pay, income, expenses, and asset equity to determine if you qualify.

Essentially, the IRS assesses whether you truly cannot afford to pay your full tax debt, or if doing so would cause significant financial hardship.

This makes an OIC a viable option for those facing overwhelming tax burdens.

An OIC works by allowing you to submit an offer to the IRS, proposing a lower settlement amount.

This offer is submitted using Form 656, along with a non-refundable application fee of $205 (as of 2023).

There are three payment options available if your OIC is accepted: a lump sum cash payment, periodic payments, or a combination of both.

A significant benefit during the evaluation process is the temporary suspension of collection activities, providing a breather from IRS levies and liens.

Features of an OIC:

Settles tax debt for less than the full amount owed

Requires Form 656 submission with an application fee

Three payment options: lump sum, periodic, or combined

Temporary suspension of collection activities during evaluation

Pros:

Can significantly reduce your total tax liability

Provides a fresh start upon acceptance

Stops collection actions, including liens and levies

Fee waivers are available for low-income taxpayers

Cons:

Difficult to qualify for (approximately 40% acceptance rate)

Lengthy process (6-24 months for a decision)

Requires detailed financial disclosure

May require a significant initial payment

When and Why to Use an OIC:

An OIC is ideal for taxpayers facing significant tax debt that they cannot realistically repay.

This could include individuals with limited income and assets, small business owners struggling with financial hardship, or those facing potential bankruptcy due to tax burdens.

If you are experiencing significant financial hardship and believe paying your full tax liability is impossible, an OIC is worth considering.

Examples of Successful OICs:

A retired individual with limited income and few assets owing $100,000 successfully settled their debt for $15,000 through an OIC.

A small business owner facing bankruptcy due to a tax debt of $300,000 qualified for an OIC and settled for $50,000.

Tips for a Successful OIC Application:

Consider professional help: Engaging a qualified tax professional can significantly improve your chances of acceptance. They can navigate the complex process, ensure proper documentation, and negotiate effectively with the IRS.

File all tax returns: Ensure all required tax returns are filed before applying for an OIC. The IRS will not consider an OIC if you have outstanding unfiled returns.

Be transparent: Provide complete and accurate information about all your assets and income. Honesty and transparency are crucial throughout the process.

Continue making payments: While your OIC is under review, continue making any required tax payments, if possible. This demonstrates good faith and can strengthen your case.

The OIC program gained popularity as part of the IRS Fresh Start Program, which aimed to help taxpayers struggling with the aftermath of the 2008 financial crisis.

Tax resolution companies like Optima Tax Relief and Tax Defense Network often highlight OICs as a potential solution for tax debt relief.

An OIC deserves its place on this list because it offers a legitimate pathway to significantly reduce overwhelming tax debt.

While it's not a guaranteed solution and requires careful consideration, the potential benefits – a fresh financial start and freedom from crippling tax burdens – make it a valuable option for those who qualify.

2. Installment Agreement

An Installment Agreement (IA) offers significant tax debt relief by allowing you to pay off your IRS debt in manageable monthly installments instead of one daunting lump sum.

This is a popular and often accessible option for individuals and businesses facing overwhelming tax burdens.

It's relatively easy to qualify for compared to other tax relief strategies, making it a viable solution for many taxpayers. It's a common choice for those seeking structured tax debt relief.

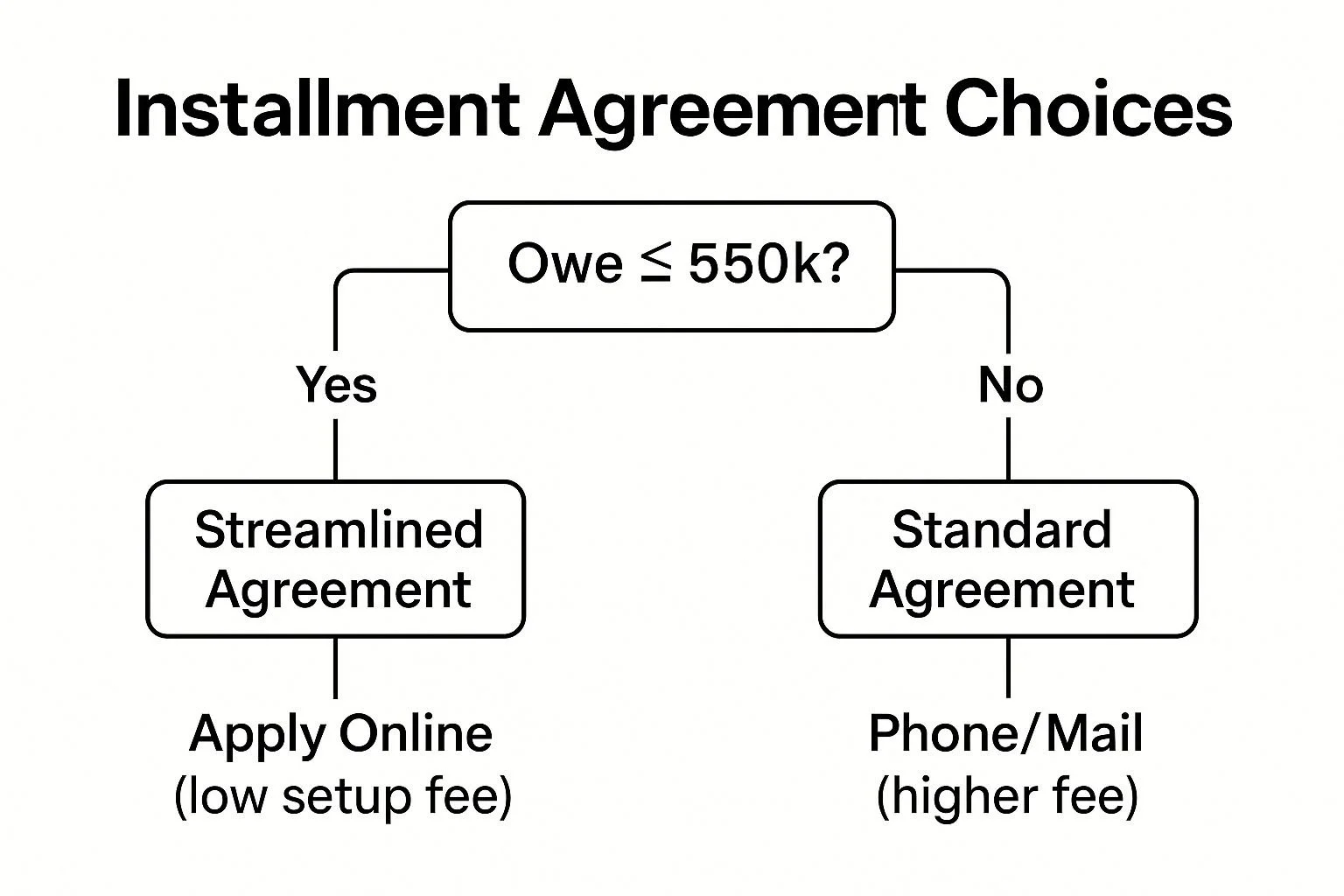

The infographic above provides a decision tree to help you determine if an Installment Agreement is the right solution for your tax debt. It starts by asking if your total tax liability, including penalties and interest, is less than $50,000.

If yes, you are likely eligible for a streamlined installment agreement process. If no, the next question is whether you can pay off your debt within 180 days. If not, an Installment Agreement is likely your best option.

If you can pay within 180 days, a short-term payment plan may be more suitable. This decision tree helps taxpayers quickly assess their eligibility and explore alternative solutions when applicable.

Specifically, an IA can provide monthly payment plans lasting up to 72 months (6 years). For debts under $50,000, the IRS offers a streamlined processing option.

You can apply online, by phone, mail, or even in person, though setup fees range from $31 to $225 depending on your chosen application method and payment type.

Learn more about Installment Agreement at this helpful resource. This approach deserves a place on this list because of its accessibility and potential to provide immediate relief from aggressive collection actions.

Pros:

High approval rate: IAs boast a higher approval rate compared to Offers in Compromise or other more complex tax relief options.

Quick setup: Online applications often receive same-day approval.

Halts collection actions: An approved IA generally stops levies, liens, and other collection activities.

Affordable payments: Payments are based on your ability to pay, making them more manageable than a lump-sum payment.

Cons:

Accruing penalties and interest: While an IA allows you to pay in installments, interest and penalties continue to accrue on the unpaid balance.

Total cost: The total amount paid will exceed the initial tax debt due to the accrued interest and penalties.

Potential tax liens: The IRS may still file a Notice of Federal Tax Lien to protect their interest, which can impact your credit rating.

Default consequences: Missing payments can lead to the termination of the IA and a resumption of collection actions.

Examples:

A taxpayer owing $30,000 could set up a monthly payment plan of $500 over 60 months.

A self-employed individual with fluctuating income could establish a variable payment plan with higher payments during peak business months.

Tips for Success:

Apply online: Online applications offer the fastest approval and lowest setup fees.

Set up direct debit: Direct debit payments minimize the risk of missed payments and can lower setup fees.

Maximize repayment term: Request the longest possible repayment term if cash flow is a concern.

Explore Partial Payment Installment Agreements: If you absolutely cannot afford to pay the full amount, a Partial Payment Installment Agreement (PPIA) might be an option. This involves paying what you can afford for a specific time, after which the IRS may forgive the remaining balance.

This option is particularly beneficial for self-employed individuals, small business owners, S corporations, and anyone struggling with income tax debt or payroll tax debt.

It's also a valuable tool for tax professionals, bankruptcy attorneys, family law attorneys, and financial planners who advise clients facing tax issues.

An Installment Agreement offers a practical and readily available path towards tax debt relief, providing a structured way to regain financial stability while addressing outstanding tax liabilities.

3. Currently Not Collectible (CNC) Status

Currently Not Collectible (CNC) status offers significant tax debt relief for those facing extreme financial hardship.

It's a temporary designation granted by the IRS when they determine a taxpayer is genuinely unable to pay their current tax debt.

This effectively puts a pause on aggressive collection actions like levies and garnishments. While the tax debt doesn't disappear, the IRS acknowledges the taxpayer's inability to pay and temporarily suspends enforcement.

The IRS continues to recognize the existence of the debt and will periodically review the taxpayer's financial situation to determine if their ability to pay has improved. This provides breathing room to get back on your feet financially.

How CNC Status Works and When to Use It:

CNC status is designed for individuals and businesses experiencing severe financial difficulties. Consider pursuing this option if your necessary living expenses (food, shelter, clothing, transportation, basic healthcare) exceed your current income, leaving you genuinely unable to make any tax payments.

This might be due to job loss, unexpected medical expenses, a natural disaster, or other significant life events. The IRS will assess your financial situation, including income, expenses, assets, and liabilities, to determine eligibility.

Features and Benefits of CNC Status:

Temporary Halt on Collection Activities: The IRS suspends most collection efforts, including wage garnishments, bank levies, and asset seizures. This offers immediate relief from the intense pressure of IRS collections.

No Minimum or Maximum Debt Amount: CNC status is available regardless of the size of your tax debt.

Potential for Partial Debt Expiration: While unlikely, a portion of your tax debt could expire due to the 10-year collection statute while under CNC status.

Pros:

Immediate relief from collection pressure.

No required monthly payments.

Potential for partial debt expiration due to the 10-year collection statute.

Time to improve financial situation without IRS enforcement.

Cons:

Not a permanent solution: CNC status is temporary and can be revoked if the IRS determines your financial situation has improved.

Interest and penalties continue to accrue: While collections are paused, interest and penalties will still be added to your overall tax debt.

Tax liens may still be filed: The IRS can still file a Notice of Federal Tax Lien, which can impact your credit rating.

May require extensive financial documentation: You'll need to provide detailed records of your income and expenses to prove your hardship.

Examples of Successful CNC Status Implementation:

A taxpayer facing serious medical issues and mounting medical bills, resulting in drastically reduced income, could be placed in CNC status until their health and financial situation stabilize.

An unemployed professional experiencing a period of joblessness can be granted CNC status until they secure new employment and regain financial stability.

Tips for Applying for CNC Status:

Document all financial hardships thoroughly: Gather pay stubs, medical bills, bank statements, and any other documents that prove your financial hardship.

Report only necessary living expenses: Be honest and accurate when reporting your expenses. Ensure they align with IRS allowable standards.

Be prepared for annual financial review by the IRS: The IRS will review your financial situation annually to determine if your ability to pay has changed.

Consider this a temporary solution: Work towards a permanent tax debt resolution strategy, such as an Offer in Compromise or an Installment Agreement, while under CNC status.

CNC status can be a valuable tool for taxpayers facing overwhelming tax debt. While it's not a permanent fix, it offers much-needed breathing room to address the underlying financial issues and work towards a long-term solution.

For additional support and guidance, consider consulting with a tax professional experienced in tax debt resolution, including resources like the Taxpayer Advocate Service and tax resolution firms specializing in these matters.

This option deserves its place on this list because it provides a crucial safety net for those struggling to meet their tax obligations during times of significant financial hardship.

4. Penalty Abatement: A Powerful Tool for Tax Debt Relief

Penalty Abatement is a significant form of tax debt relief that focuses specifically on removing penalties imposed by the IRS. These penalties, often levied for failure to file or pay taxes on time, can substantially increase your overall tax debt.

This makes Penalty Abatement a valuable option to explore if you're seeking ways to reduce your tax burden. It's particularly relevant for self-employed individuals, small business owners, S corporations, and anyone facing income or payroll tax debt.

How Penalty Abatement Works:

The IRS assesses several types of penalties, including failure-to-file, failure-to-pay, and failure-to-deposit penalties. Penalty Abatement can potentially eliminate these, offering substantial savings. There are several avenues for abatement:

First-Time Penalty Abatement (FTA): This is the most common type and is generally granted to taxpayers with a clean compliance history who have a reasonable cause for failing to meet their tax obligations. If you’ve consistently filed and paid on time in the past, this might be a viable option.

Reasonable Cause Abatement: This applies to situations where circumstances beyond your control prevented you from fulfilling your tax obligations. This could include natural disasters, serious illness, or other significant life events.

Statutory Exception Abatement: In rare cases, penalties may be abated if they were assessed based on incorrect written advice received directly from the IRS.

Examples of Successful Penalty Abatement:

A business owner facing $10,000 in late-filing penalties successfully had them abated after demonstrating that a family emergency prevented timely filing. This illustrates how Reasonable Cause Abatement can provide relief in difficult circumstances.

A taxpayer with a clean compliance history for the previous three years received FTA approval, removing $5,300 in penalties. This highlights the benefits of maintaining good standing with the IRS.

Pros of Penalty Abatement:

Significant Reduction in Tax Debt: Penalties can represent a substantial portion of your total tax liability (often 25% or more). Abating these can significantly reduce the overall amount owed.

Relatively Straightforward Application Process: Especially for First-Time Abatement, the application process can be relatively simple.

No Limit on Penalty Amount Abated: Unlike some other tax relief options, there's no cap on the amount of penalties that can be removed.

Can Be Combined with Other Tax Relief Strategies: Penalty Abatement can be used in conjunction with other strategies like an Offer in Compromise or an Installment Agreement to further reduce your tax burden.

Cons of Penalty Abatement:

Addresses Penalties Only: Penalty Abatement only removes penalties, not the underlying tax or interest accrued.

FTA Limitations: First-Time Penalty Abatement can only be used once every three to four years.

Documentation Requirements: Reasonable cause claims require substantial documentation to support the claim.

Varying Success Rates: Approval depends on the specific circumstances and the quality of the documentation provided.

Tips for Pursuing Penalty Abatement:

Request FTA by Phone: If you qualify for First-Time Penalty Abatement, a phone call to the IRS might be the fastest way to achieve results.

Detailed Documentation for Reasonable Cause: Provide a comprehensive timeline and supporting documents for reasonable cause requests.

Written Requests for Complex Situations: For complex situations, a written request is recommended to ensure clarity and a complete record.

Consider Professional Assistance: For significant penalty amounts or complex cases, consider engaging a tax professional specializing in IRS representation. Taxpayers owed more penalties in 2023 than ever before, making professional help even more valuable.

➥ Learn more about Penalty Abatement.

Penalty Abatement is a valuable tool for individuals and businesses seeking tax debt relief.

By understanding the different types of abatement, the requirements, and the potential benefits, taxpayers can effectively utilize this strategy to minimize their tax liabilities.

This method deserves its place on this list because it can significantly reduce the overall burden of tax debt, particularly when combined with other relief options.

It offers a powerful pathway to resolving tax issues and regaining financial stability.

5. Innocent Spouse Relief

Innocent Spouse Relief is a crucial form of tax debt relief that can protect you from financial liability for tax debts you didn't incur.

If you filed a joint tax return and your spouse (or former spouse) either underreported income, improperly claimed deductions or credits, or completely failed to report tax liabilities, you may be held responsible for the resulting tax debt, interest, and penalties.

Innocent Spouse Relief aims to alleviate this burden for taxpayers who were unaware of their spouse's actions.

This relief option can be a lifeline, offering a path to separate your legitimate tax obligations from those unfairly imposed due to a partner's wrongdoing.

It deserves a place on this list because it addresses a unique and often devastating situation faced by many taxpayers, offering a way to achieve true tax debt relief.

There are three specific types of relief available under Internal Revenue Code Section 6015:

Innocent Spouse Relief

Separation of Liability Relief

Equitable Relief

Each type has specific requirements and provides varying levels of tax debt relief.

Innocent Spouse Relief, for example, may completely absolve you of responsibility, while Separation of Liability Relief divides the liability based on each spouse's income and involvement.

Equitable Relief is a catch-all provision for situations where the other two forms of relief don't apply, and it's based on fairness principles.

To qualify for any of these, you must generally request relief within two years of the IRS initiating collection activities.

The IRS will evaluate your claim based on factors like your knowledge of the understatement, whether you benefited from it, and overall fairness.

Depending on your circumstances, you might receive partial or complete relief from the tax debt, interest, and penalties.

For example, a divorced spouse might be granted relief after discovering their ex-husband failed to report significant business income on their joint returns.

Similarly, a widow could be relieved of a substantial tax debt after finding out her deceased spouse had hidden gambling income and the associated tax liabilities.

➥ Learn more about Innocent Spouse Relief.

Pros of Innocent Spouse Relief:

Elimination of Debt: Can eliminate responsibility for the entire tax debt or a significant portion.

Protection from Spouse's Actions: Shields innocent taxpayers from the financial consequences of their spouse's tax issues.

Availability After Separation/Divorce: Remains an option even after the relationship has ended.

Relief from Penalties: Provides relief from both the underlying tax and associated penalties.

Cons of Innocent Spouse Relief:

Burden of Proof: Demonstrating a lack of knowledge can be challenging and requires substantial documentation.

Time Limitations: Strict deadlines apply for filing a claim.

Complex Application: The process is complex and requires meticulous record-keeping and documentation.

Spouse Notification: The IRS notifies the other spouse, who has the opportunity to contest the claim.

Tips for Pursuing Innocent Spouse Relief:

File Form 8857: Submit IRS Form 8857 (Request for Innocent Spouse Relief) as soon as you become aware of the tax liability.

Gather Documentation: Compile all evidence demonstrating you had no reason to know of the tax understatement. This might include bank statements, household budgets, and communication records.

Consider Multiple Relief Options: You can apply for both Innocent Spouse Relief and Equitable Relief as alternatives. This increases your chances of receiving some form of tax debt relief.

Consult a Tax Professional: Working with a tax attorney or enrolled agent experienced in innocent spouse cases is highly recommended. They can navigate the complexities of the process and effectively represent your interests. This is especially important given the intricacies of tax law and the potential challenge of interacting with the IRS.

Innocent Spouse Relief is a powerful tool for those facing tax debt through no fault of their own. While the process can be complex, the potential benefits – including significant tax debt relief and financial peace of mind – make it a valuable option to explore.

6. Bankruptcy: A Last Resort for Tax Debt Relief

Bankruptcy, while often considered a last resort, can provide significant tax debt relief under specific circumstances.

It offers a legal process to either discharge certain tax debts entirely or reorganize them into a manageable repayment plan.

This makes it a viable option for individuals and businesses overwhelmed by tax liabilities they can no longer afford. Its inclusion on this list is warranted due to its potential for offering a fresh financial start, even in seemingly insurmountable tax situations.

Bankruptcy operates under Title 11 of the Bankruptcy Code and encompasses different chapters, each with unique implications for tax debt.

Two chapters are particularly relevant for tax relief:

Chapter 7: Liquidation Bankruptcy: This type of bankruptcy can completely discharge qualifying tax debts. Essentially, eligible tax liabilities are wiped out, offering a clean slate. However, this comes with the potential downside of liquidating non-exempt assets to pay creditors.

Chapter 13: Reorganization Bankruptcy: This chapter focuses on creating a structured repayment plan for your debts, including taxes, over a period of 3-5 years. While taxes aren't necessarily discharged, Chapter 13 allows you to consolidate your debts, potentially reduce penalties, and make manageable payments under court supervision.

How it Works for Tax Debt Relief:

Not all tax debts are dischargeable through bankruptcy. For income tax debt to be eligible for discharge under Chapter 7, it generally must meet the following criteria:

Three-Year Rule: The tax debt must be at least three years old. This means the tax return for the debt in question must have been due at least three years before filing for bankruptcy.

Two-Year Filing Rule: The tax return must have been filed at least two years before the bankruptcy filing date.

240-Day Assessment Rule: The tax debt must have been assessed by the IRS at least 240 days before filing for bankruptcy.

Features and Benefits:

Discharge of Qualifying Debts (Chapter 7): Offers the potential for complete elimination of eligible tax liabilities.

Structured Repayment Plan (Chapter 13): Provides a manageable repayment schedule over several years.

Automatic Stay: Upon filing for bankruptcy, an automatic stay goes into effect, immediately halting all collection actions by the IRS, including levies and wage garnishments.

Discharge of Penalties and Interest: In some cases, bankruptcy can eliminate not just the primary tax debt, but also associated penalties and interest.

Examples of Successful Implementation:

A small business owner, overwhelmed by $75,000 in personal income tax debt following a business failure, successfully discharged the debt through Chapter 7 bankruptcy.

A taxpayer facing $60,000 in back taxes used Chapter 13 bankruptcy to create a five-year repayment plan with reduced penalties, allowing them to repay the debt at a manageable pace.

Pros:

Potential for complete elimination of eligible tax debts (Chapter 7).

Immediate halt to collection actions.

Possible discharge of penalties and interest.

Organized structure for repayment of non-dischargeable taxes (Chapter 13).

Cons:

Significant negative impact on credit score: Bankruptcy will remain on your credit report for 7-10 years, making it difficult to obtain loans or credit.

Not all tax debts qualify for discharge: Recent taxes, fraud penalties, and trust fund recovery penalties are typically non-dischargeable.

Complex timing rules: The rules regarding dischargeability are complex and must be followed precisely.

Asset Surrender (Chapter 7): May require the surrender of non-exempt assets.

Tips for Considering Bankruptcy for Tax Debt Relief:

Consult with Experts: Seek advice from both a qualified tax attorney and a bankruptcy attorney before making any decisions. They can assess your specific situation and advise you on the best course of action.

Ensure Tax Returns are Filed: Make sure all required tax returns are filed before considering bankruptcy. Unfiled returns can complicate the process and limit your options.

Time Your Filing Strategically: Carefully consider the age of your tax debts and coordinate your bankruptcy filing to maximize the potential for discharge.

Explore Alternatives: Consider non-bankruptcy alternatives, such as an Offer in Compromise (OIC) or an Installment Agreement, for more recent tax debts.

Bankruptcy can be a powerful tool for tax debt relief, but it's crucial to understand the complexities and potential consequences before pursuing this option. Thorough planning and expert advice are essential for navigating the process successfully and achieving the desired financial outcome.

7. Statute of Limitations Expiration: A Long-Term Strategy for Tax Debt Relief

Statute of limitations expiration offers a unique form of tax debt relief by leveraging the IRS's own time constraints.

For many struggling with overwhelming tax debt, the idea of complete relief without negotiation or payment can seem too good to be true.

However, understanding how the statute of limitations works can be a powerful tool, particularly for those facing large, older tax debts.

This strategy deserves its place on this list because it provides a potential escape route for taxpayers who might otherwise feel trapped by insurmountable debt.

This approach revolves around the fact that the IRS generally has a 10-year window to collect outstanding tax liabilities, starting from the date of assessment (usually after you file your return). After this period, the IRS can no longer pursue collection actions.

This isn't about hiding assets; it's about understanding your rights and legally waiting out the collection period.

➥ Learn more about Statute of Limitations Expiration

How it Works:

The 10-year collection period is a key feature of this strategy. The statute begins from the date the IRS assesses the tax, not the date the tax return was due.

The IRS maintains a Collection Statute Expiration Date (CSED) for each tax debt.

However, various actions can extend this period, such as submitting an Offer in Compromise (OIC), filing for bankruptcy, or leaving the country. Therefore, careful monitoring and strategic planning are crucial.

When and Why to Use This Approach:

This strategy is generally most effective for taxpayers with older tax debts who are struggling to pay. It can be particularly beneficial for those with limited income or assets, or those facing a significant disparity between their income and the amount owed.

While the long waiting period can be daunting, the prospect of complete debt forgiveness can make it a worthwhile pursuit.

This strategy can also be combined with other tax debt relief options to minimize payments during the waiting period.

For instance, taxpayers might consider Currently Not Collectible status while waiting for the statute to expire.

Pros:

Complete Debt Forgiveness: After the statute expires, the tax debt legally disappears.

No Negotiation or Payment Required: Unlike other strategies, this doesn't involve negotiating with the IRS or making payments.

Applies to All Types of Tax Debt: This strategy works for income tax debt, payroll tax debt, and penalties.

Combinable with Other Strategies: It can be used in conjunction with other methods to minimize payments during the waiting period.

Cons:

Long Waiting Period: The 10-year timeframe requires significant patience.

Potential for Extension: Several actions can extend the statute, delaying or even preventing expiration.

Increased IRS Scrutiny: The IRS may increase collection efforts as the expiration date approaches.

Lingering Tax Liens: While the debt disappears, tax liens may remain on your credit report even after the statute expires.

Examples of Successful Implementation:

A taxpayer with limited income had a $40,000 tax debt expire after maintaining Currently Not Collectible status for most of the 10-year period.

A self-employed individual strategically made minimal payments while waiting for $25,000 in older tax debt to expire.

Actionable Tips:

Request Transcripts: Obtain your IRS account transcripts to identify your exact CSED for each tax year.

Avoid Extending Actions: Refrain from actions that extend the statute, especially as the expiration date nears.

Consider Currently Not Collectible: Explore Currently Not Collectible status to temporarily halt collection efforts during the waiting period.

Consult a Professional: Seek guidance from a tax professional before relying solely on this strategy, especially given the potential pitfalls and complexities.

This strategy, popularized by Internal Revenue Code Section 6502 and often utilized by tax resolution specialists and tax attorneys specializing in procedural defense, offers a legitimate pathway to tax debt relief.

However, it’s crucial to understand the complexities and potential challenges before pursuing this long-term strategy.

For individuals and business owners alike, from sole proprietors and single-member LLCs to multi-member LLCs, S corporations, and those facing the Trust Fund Recovery Penalty, a thorough understanding of statute of limitations expiration can be a powerful tool in navigating tax debt.

7 Tax Debt Relief Strategies Compared

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Offer in Compromise (OIC) | High: Detailed financial disclosure, 6–24 months | Moderate: Application fee ($205), possible professional help | Significant reduction in tax debt if accepted (~40% acceptance rate) | Taxpayers with inability to pay full amount, financial hardship | Can reduce total tax liability substantially; stops collections |

| Installment Agreement | Low: Streamlined for debts ≤ $50k, quick setup | Low to Moderate: Setup fees $31–$225, manageable monthly payments | Avoids lump sum payment; debt paid over up to 6 years | Taxpayers who can pay over time but not immediately | High approval rates; quick setup; stops most collections |

| Currently Not Collectible (CNC) Status | Moderate: Requires proof of hardship, annual reviews | Low: No payments required but documentation needed | Temporary halt on collections; debt remains due | Taxpayers facing severe temporary financial hardship | Immediate relief from collections; no payments required |

| Penalty Abatement | Low to Moderate: Mostly straightforward, requires documentation | Low: No fees, may require professional help | Removal of penalties but not tax or interest | Taxpayers with reasonable cause or first-time penalties | Reduces penalty amounts significantly; relatively simple |

| Innocent Spouse Relief | High: Complex process, detailed documentation and strict deadlines | Moderate: May need professional representation | Partial or full relief from joint tax liability | Taxpayers unaware of spouse’s tax errors or fraud | Eliminates liability for spouse's tax errors; protects innocent party |

| Bankruptcy | High: Complex legal process, timing critical | High: Legal fees, impact on credit | Discharge or repayment of certain tax debts | Taxpayers with qualifying old tax debt, no recent liabilities | Can eliminate qualifying tax debts; stops collections immediately |

| Statute of Limitations Expiration | Low: Passive strategy, monitoring required | Low: Minimal except for professional advice | Debt expires legally after 10 years, no payment needed | Taxpayers with old debts near or past the 10-year limit | Debt legally unenforceable; no payment or negotiation needed |

Need Expert Help with Tax Debt Relief?

Successfully resolving tax debt requires a thorough understanding of your options.

This article has explored several key strategies, including Offer in Compromise (OIC), Installment Agreements, Currently Not Collectible (CNC) status, Penalty Abatement, Innocent Spouse Relief, Bankruptcy, and leveraging the Statute of Limitations.

Each of these approaches offers potential tax debt relief, but the best fit depends on your individual circumstances.

Mastering these concepts, or having expert guidance to navigate them, can significantly impact your financial well-being and provide peace of mind.

Additionally, if you're considering selling your business, navigating the tax landscape is critical. Understanding the selling business tax implications can significantly impact your profit.

For in-depth information on this topic, explore resources on Selling Business Tax Implications: Optimize Your Sale from Acquire.com.

Don't let the complexities of tax debt overwhelm you. Achieving the best possible outcome requires a strategic approach tailored to your specific situation.

For expert guidance and a FREE Tax Debt Analysis to determine the most effective tax debt relief solution for you, contact Attorney Stephen A Weisberg.

With over 10 years of experience, Attorney Weisberg can help you navigate the complexities of IRS tax issues and find the best path forward.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034