How to Appeal Property Tax Assessment: Step-by-Step Guide

Understanding When Your Assessment Deserves a Challenge

Challenging your property tax assessment could save you a significant amount of money. However, it's important to know when an appeal is warranted.

This begins with recognizing the indicators of an inaccurate assessment.

A disproportionate increase in your property's value compared to similar properties in your neighborhood could suggest an overvaluation.

Outdated property characteristics, such as incorrect square footage or unrecorded renovations, can also lead to an inflated assessment.

Understanding how valuations work, and their common inaccuracies, is the first step toward a successful appeal.

Common Assessment Errors

Overworked assessors sometimes make mistakes, resulting in an unfair tax burden for homeowners. One common error is failing to account for property depreciation. As properties age, their value typically declines. Assessors may not always accurately reflect this in their calculations.

Another frequent problem is the inclusion of assets you no longer own, such as outdated equipment or demolished structures. This can significantly inflate your assessed value.

Double assessments, where the same property is valued twice, can also occur due to clerical errors. Knowing these common errors helps you identify when your assessment might be incorrect.

Market Fluctuations and Your Assessment

Market fluctuations significantly impact property tax assessments. A rising market can lead to increased property values and higher assessments. A declining market, however, can present an opportunity for appeal.

The landscape of property tax appeals is complex, particularly with rising home prices. In 2022, homeowners faced difficulties proving overassessment due to the substantial increases in existing-home prices.

Despite these challenges, some homeowners may still succeed by demonstrating that their property's assessed value has increased disproportionately compared to comparable properties.

Learn more about property tax appeals and market fluctuations. Even recent buyers might have grounds for appeal if the assessment doesn't reflect the actual purchase price or if there are errors in the recorded property characteristics.

Researching Your Local Assessment Cycle

Understanding your local assessment cycle is crucial for a successful appeal. This includes knowing when assessments are conducted, their frequency, and appeal deadlines. Some jurisdictions reassess properties annually, while others do so less often.

Timing your appeal strategically can improve your chances of success. Learn more about appealing IRS decisions. Knowing your local assessment process helps you gather the necessary evidence and prepare your case effectively within the given timeframe.

Why Appeals Work Better Than Most People Think

Property tax appeals often have higher success rates than many assume. One reason for this is the sheer number of properties assessors must review, which can sometimes result in valuations that aren't entirely accurate.

Market fluctuations also play a role, creating discrepancies between assessed values and true market values. These discrepancies can be significant enough to justify an appeal.

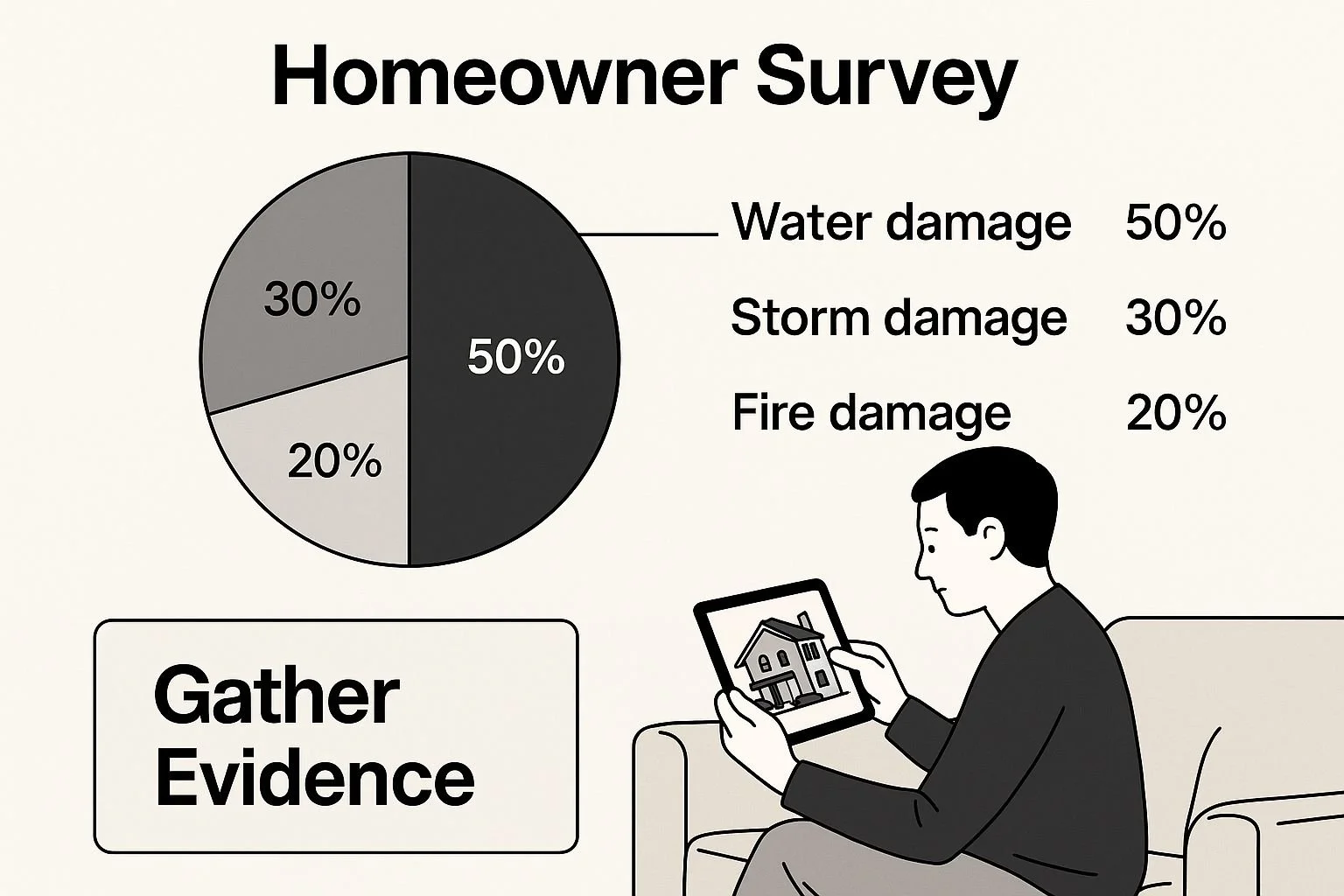

The infographic above shows a homeowner reviewing property details. This highlights the importance of strong evidence in a successful property tax appeal.

Gathering detailed documentation of property characteristics, recent comparable sales, and any unique factors affecting your property's value can significantly bolster your case.

This proactive approach is essential for presenting a persuasive argument to the assessment board.

Success Rates and Potential Savings

Property tax appeals can be quite successful. Studies indicate that between 40% to 60% of appeals lead to a lower assessed property value.

This high success rate suggests that many properties are overvalued, particularly in areas experiencing changing market conditions.

Successful appeals often result in a 10% to 15% reduction in assessed values, translating into considerable tax savings for property owners.

These savings accumulate over time, making the appeal process a worthwhile endeavor. Find more detailed statistics here.

The following table provides a more detailed breakdown of potential savings:

Property Tax Appeal Success Rates by Property Type Comparison of success rates and average savings across residential, commercial, and industrial properties

| Property Type | Success Rate | Average Reduction | Typical Savings |

|---|---|---|---|

| Residential | 45% | 12% | $1,200 |

| Commercial | 55% | 15% | $3,000 |

| Industrial | 60% | 18% | $7,200 |

This table highlights that industrial properties see the highest success rates and largest average reductions, likely due to their complex valuations. While residential properties have lower success rates, the savings can still be substantial.

Reasons Behind Appeal Approvals

Assessment boards approve a significant portion of appeals due to several key factors. They acknowledge the possibility of errors in the assessment process, considering the large number of properties they evaluate and the intricacies of valuation methods.

Furthermore, they are legally bound to consider all credible evidence submitted by property owners. Well-prepared appeals, supported by comprehensive data and documentation, have a high probability of success.

Systematic Issues That Work in Your Favor

Several systemic issues can benefit you when you appeal your property tax assessment. Assessors might use outdated information or make clerical errors, resulting in inflated assessments.

They may also overlook property depreciation or unique factors influencing market value. Understanding these potential vulnerabilities in the assessment process can help you effectively challenge your assessment.

Knowing the appeal process empowers you to navigate it confidently and increase your chances of lowering your property taxes.

A comprehensive appeal package with compelling evidence is crucial for demonstrating your property's actual market value and achieving a favorable outcome.

Building Evidence That Assessment Boards Can’t Ignore

The foundation of a successful property tax appeal lies in the evidence presented. Understanding what documentation truly resonates with assessment boards is key to a winning case.

This section explores the most impactful forms of evidence, including comparable sales data and property condition reports.

The Power of Comparable Sales

Comparable sales, often referred to as "comps," showcase the market value of similar properties. Ideally, these comps should be located in your neighborhood and have sold recently (within the past six to twelve months).

Focus on properties with similar characteristics like square footage, lot size, and age.

Online real estate platforms like Zillow can be helpful resources for finding comps. However, it's crucial to verify the accuracy and current relevance of the data.

The objective is to demonstrate that your property's assessed value is inflated compared to the actual selling prices of comparable properties.

Documenting Property Condition

Detailed property condition reports are essential for highlighting how specific property characteristics affect its value. This includes any defects, needed repairs, or unique circumstances that influence market value.

For instance, a cracked foundation, outdated plumbing, or functional obsolescence (like a poor floor plan) can all decrease a property's value. Thoroughly document these issues with photos, repair estimates, or professional opinions from contractors.

Additionally, if your property has unique features that detract from its value, such as proximity to a busy highway or limited access, document these factors as well. This evidence adds weight to your case, explaining why your property warrants a lower assessment.

Leveraging Public Records and Professional Appraisals

Public records, such as deeds and assessment histories, can further strengthen your appeal. These records provide valuable insights into your property's history and can help establish a clear understanding of its value over time. You might be interested in: How to master negotiating IRS debt.

While gathering your own evidence is often sufficient, a professional appraisal can be invaluable, especially for complex properties or appeals involving high-value properties.

Appraisals offer an independent, expert opinion of your property's worth and can significantly bolster your argument before the assessment board.

Presenting Your Case Effectively

Organize your evidence into a clear and concise narrative. Present your appeal as a story about your property, logically connecting the evidence to your argument. Clearly demonstrate why your assessed value is incorrect.

By combining compelling comps, detailed property condition reports, and potentially a professional appraisal, you can construct a strong case that assessment boards will find difficult to dismiss.

This persuasive presentation of evidence greatly increases your chances of a successful appeal and a reduced property tax bill.

Mastering the Appeal Process From Start to Finish

Successfully appealing your property tax assessment requires a well-defined strategy. This guide covers the entire process, from the initial filing to confidently presenting your case. We'll simplify the paperwork, explain each step, and offer communication tips for interacting with assessment officials.

Understanding Local Deadlines and Filing Requirements

The first step is understanding your local appeal deadlines. Missing these strict deadlines can invalidate your appeal. Your local assessor's office provides the specific dates and necessary forms.

You generally have 30-45 days from the assessment notice date to file. This typically involves a formal letter stating your intent to appeal, including your account number and reasons for the challenge. Some jurisdictions may require specific forms.

Preparing for Your Hearing

Thorough preparation is key to a successful hearing. Organize your evidence into a clear, concise narrative that presents a compelling case for your property's true value.

Gather supporting documents like appraisals, comparable sales data, and photos.

Create a logical presentation flow that highlights key points.

Practice your presentation to ensure clear and effective communication.

This preparation allows you to confidently address the board's questions.

Navigating Informal Reviews vs. Formal Hearings

Many jurisdictions offer an informal review before a formal hearing. This involves meeting with an assessor to discuss your concerns and potentially resolve the issue.

If the informal review doesn't yield a satisfactory outcome, you can proceed to a formal hearing before the assessment board. Understanding the differences between these processes helps you choose the best approach.

Communication is Key

Maintain open communication with assessment officials throughout the process. Respond promptly to information requests and be respectful. Effective communication builds rapport and facilitates a smoother appeal.

Clarify any assessor questions about your property to prevent misunderstandings.

Follow up after the hearing to show your commitment and ensure proper attention to your appeal.

Common Procedural Obstacles

Unprepared appellants often face procedural obstacles that can hinder their appeals.

Missing documentation deadlines

Failing to follow up after the initial filing or informal review

Being proactive and organized helps avoid these common mistakes.

Follow-Up Techniques

After your hearing, follow up with the assessment board. Confirm they received all your documents and inquire about the decision timeline.

This demonstrates your commitment and ensures your case receives due consideration. Stay persistent and organized to maximize your chances of success.

A reduced assessed value can lead to significant tax savings, making mastering the appeal process a worthwhile endeavor.

When Professional Help Makes Financial Sense

Knowing how to appeal a property tax assessment often involves understanding when to bring in expert help. Simple cases with minor discrepancies can often be handled on your own.

However, certain situations definitely call for professional assistance. Understanding the property tax services industry can help you make the best decision.

Navigating the Complexities of Property Tax

The global property tax services market is growing rapidly. This points to the increasing complexity of property tax laws and the significant savings that might be possible.

As of 2025, this market was valued at USD 3.78 billion, and it's projected to reach USD 6.28 billion by 2032. This growth shows a real need for expert guidance when navigating property tax assessments and appeals. Explore this topic further.

This increasing complexity often makes professional help a necessity. For example, complex properties, like commercial real estate or properties with unusual features, often require specialized knowledge for accurate valuations.

Professional appraisers and tax consultants can effectively analyze these properties and build a strong case for your appeal. Furthermore, cases involving significant discrepancies between the assessed value and the market value might benefit from the expertise of a property tax lawyer.

You might be interested in: IRS tax forgiveness programs.

Understanding Property Tax Service Fees

Property tax services use a variety of fee structures. Some operate on a contingency-based pricing model, meaning they receive a percentage of your tax savings only if the appeal is successful.

Others charge flat fees for their services. Understanding these structures is important for budgeting and selecting the right service provider.

Evaluating Potential Representatives

When you are considering professional help, carefully evaluate potential representatives. Look for professionals with a proven track record of successful appeals and specific expertise in your property type and local jurisdiction.

Seek referrals, read online reviews, and verify their credentials. Be cautious of providers who guarantee specific outcomes, because the appeal process always has some uncertainty.

Red Flags and Emerging Trends

Some red flags to watch out for include unusually high upfront fees, pressure to make quick decisions, and a lack of transparency about their methods.

Emerging trends in property tax consulting include the increasing use of technology for property valuation and data analysis, as well as a greater focus on personalized service and clear client communication.

Cost-Benefit Analysis

A thorough cost-benefit analysis is essential. Weigh the potential tax savings against the cost of professional services.

Consider factors like the complexity of your case, the potential reduction in your tax bill, and how comfortable you feel handling the process on your own.

Making the right choice for your individual situation empowers you to effectively navigate the appeals process and potentially achieve significant tax savings.

Creating a System for Ongoing Tax Savings

A successful property tax assessment appeal isn't just a one-time win; it's the foundation of a long-term tax strategy. By creating a system for ongoing savings, you can proactively manage your property taxes and potentially save thousands of dollars over time.

Monitoring Future Assessments

After a successful appeal, it's important to stay vigilant. Actively monitor future assessments to make sure your property isn't overvalued again. This means understanding your local reassessment cycle.

Some areas reassess annually, while others do so every few years. Knowing this timeline lets you anticipate and prepare for future appeals.

Use online resources from your local assessor's office to track property value trends in your area. This helps you spot any unusual increases in assessed value that might need further investigation.

Maintaining Organized Records

Keeping detailed records is crucial for supporting future appeals. Maintain a complete file with all documents related to your property. This should include past assessments, appeal paperwork, comparable sales data, and any property improvements.

This organized system provides easy access to important evidence if you need to appeal again. For example, documented renovations or repairs can support a claim of increased property value, bolstering your case for a lower assessment.

Implementing Early Warning Systems

Catching assessment errors early can prevent costly disputes. Sign up for property tax alerts from your local government or use online tools that monitor assessment changes.

Check out our guide on finding expert help with tax debt relief companies. This allows you to quickly identify and address discrepancies before they become bigger problems. Think of it as a financial safety net, alerting you to potential issues before they cause significant financial damage.

Tailored Strategies for Different Property Owners

Different types of property owners need different strategies. Homeowners facing infrequent reassessments can focus on maintaining accurate property records and watching local market trends.

Commercial property managers, on the other hand, often handle multiple properties across various locations. They benefit from using automated tracking systems and possibly hiring professional property tax consultants.

Leveraging Past Success

Your initial appeal success can make future cases stronger. Use the documentation and arguments from your previous appeal as a template for future challenges.

This saves time and shows a consistent pattern of overvaluation. Also, build a good working relationship with local assessment officials. Open communication can often resolve small disagreements without a formal appeal.

Identifying Optimal Timing for Future Appeals

Understanding reassessment cycles and local market conditions is key for timing future appeals effectively. Appealing during a market downturn, when property values are generally lower, can improve your chances of success.

Appealing during a period of rapid price increases might be less effective unless you have strong evidence showing a much larger increase in your property’s assessed value compared to similar properties.

Practical Tools for Tracking and Analysis

Use spreadsheets or specialized software to track assessment trends and analyze comparable sales data. This helps you identify patterns and unusual changes, letting you make informed decisions about when and how to appeal.

Some online tools even offer automatic alerts for assessment changes, making sure you never miss a deadline. By using these strategies, you turn a one-time appeal into a proactive, long-term approach to managing your property taxes, potentially saving a lot of money over time.

To help illustrate the potential long-term savings, let's look at some examples:

Long-Term Property Tax Savings Calculator

Analysis showing cumulative savings over time based on different assessment reduction percentages

| Reduction Percentage | Annual Savings | 5-Year Savings | 10-Year Savings |

|---|---|---|---|

| 5% | $500 | $2,500 | $5,000 |

| 10% | $1,000 | $5,000 | $10,000 |

| 15% | $1,500 | $7,500 | $15,000 |

This table uses hypothetical figures for illustrative purposes. Actual savings will vary.

As you can see, even small reductions in your assessment can add up to significant savings over the long term. By implementing a proactive system for managing your property taxes, you can ensure you are paying only what you owe.

Key Takeaways

This section provides actionable steps for appealing your property tax assessment. Whether it's your first appeal or you manage numerous properties, these takeaways offer clear guidance, timelines, and checklists for a successful appeal.

Prioritize Your Efforts

Start by comparing your property's assessed value with its actual market value. Look for major differences, outdated information, or errors in the assessor's data. A difference of 10-15% often justifies an appeal.

Gather strong evidence that will resonate with assessment boards. This includes comparable sales data (comps) from similar properties, property condition reports highlighting any issues, and possibly a professional appraisal for complex cases.

Be mindful of strict local appeal deadlines, which are usually 30-45 days from when you receive the assessment notice. Missing these deadlines can invalidate your appeal.

Measure Your Progress Effectively

Use a checklist to track every step, from the initial filing to hearing preparation and any necessary follow-up.

Keep all your documents organized. Maintain a comprehensive file with assessment notices, appeal documents, evidence, and all communication with assessment officials. This organized record-keeping will be invaluable for any future appeals.

Define clear goals for your appeal. Determine whether you aim for a specific percentage reduction or a reassessment based on accurate property details.

Troubleshooting and Ongoing Education

Be aware of common procedural pitfalls, such as missed deadlines or insufficient evidence. Consistent follow-up with assessment officials is crucial.

Stay informed about changes in property tax laws, assessment procedures, and appeal strategies. Resources like online guides and consultations with tax professionals can be valuable resources.

Building Confidence and Navigating the Process

Consider starting with an informal review with your assessor. This can sometimes resolve the issue before a formal hearing becomes necessary.

Maintain respectful and proactive communication with assessment officials. Clarify any questions and ensure your appeal receives proper attention.

For complex cases, especially those involving commercial properties or significant value discrepancies, consider seeking professional help from a property tax consultant or an attorney.

These key takeaways provide a practical roadmap for successfully appealing your property tax. Proactive planning, thorough preparation, and persistent follow-up are key to maximizing your chances of a lower assessment and reducing your tax burden.

For expert guidance on the complexities of property tax appeals, consider a consultation with a qualified tax attorney.

Attorney Stephen A. Weisberg offers a free tax debt analysis to help you understand your options and develop the best strategy. He has extensive experience representing individuals and businesses in various tax matters, including property tax appeals.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034