How to Stop State Tax Garnishment Quickly & Safely

Understanding What You're Really Dealing With

Getting hit with a state tax garnishment notice can feel like the world is ending. Panic, confusion, and helplessness are common reactions. Take a deep breath.

You're not alone. I've been there with countless others, and I can tell you, the first step to taking back control is understanding what you're really up against.

This isn’t just about the state taking your hard-earned cash. It's about a system—a legal process—that gives them the right to do it. Think of it as a chess match. The state has made its move (the garnishment), but you have options.

You have counter-moves. Most people don't realize they have more power in this situation than they think. This isn’t checkmate; it’s the opening gambit. Understanding the rules of the game is how you win.

One crucial thing to understand is the difference between state tax garnishments and other types of wage garnishments. Credit card companies and medical debt collectors operate under different rules.

State tax authorities have a unique set of powers, yes, but they also have specific limitations. It's not a wild west scenario; there are regulations, procedures, and even potential loopholes.

I once worked with a client who discovered the state had miscalculated their tax liability, resulting in a way-too-high – and totally illegal – garnishment.

Knowing your rights and the legal boundaries can make all the difference. This ties into the larger picture of state tax policies, which can impact how garnishments are processed.

For instance, some states, like South Carolina, are looking at potential changes to their tax rates, showcasing just how fluid these things can be. Discover more insights into state income tax rates.

Uncovering Your Rights and Protections

Here’s the good news: you have protections. The system isn't completely stacked against you. Safeguards are in place to prevent abuse and ensure a degree of fairness.

These protections are often hidden in legalese that most people never bother to read. But knowing what they are and how to use them is incredibly powerful.

I've seen situations where garnishments were stopped dead in their tracks simply because the state didn't follow the correct notification process. In other cases, we've been able to negotiate lower garnishment amounts based on hardship provisions.

These provisions exist in most states, but they're rarely publicized. They're like hidden exits that can significantly reduce the financial strain. Knowing they exist is half the battle.

Another important step is to carefully review your garnishment paperwork for any red flags. Does everything add up? Are the calculations correct? Is the state following proper procedure?

I had a client who found a date error on their notice, and that one small detail gave us the leverage we needed to challenge the entire garnishment. These seemingly minor things can be crucial. Don't just take the notice at face value; scrutinize it. It’s your money on the line, so be your own advocate.

Emergency Moves To Save Your Paycheck

When a state tax garnishment hits, you need to act fast. The first 72 hours are critical for damage control. Think of it like this: tax professionals have an "emergency playbook" for these situations. Knowing their strategies can help you protect your earnings. One key move is figuring out exactly how much of your paycheck can legally be garnished. You'd be surprised how often states overstep their bounds. I've seen cases where people were losing way more than they should have been. Knowing your state's specific rules is a must.

Communicating Effectively With Your Employer and the State

Dealing with your employer during a garnishment can be awkward. They're legally required to follow the garnishment order, but they're also often stuck in the middle. Giving them clear documentation, like the garnishment notice itself, is key.

Knowing your state’s specific procedures, maybe even providing them with pre-filled forms, can make the whole process smoother.

For more information on wage garnishment, you can check out our guide on stopping IRS wage garnishment: Check out our guide on stopping IRS wage garnishment.

Understanding federal protections is also helpful. Even with state tax garnishments, federal rules about wage garnishment still play a role.

The Debt Collection Improvement Act allows up to 15% of your disposable income to be garnished for federal debts. This doesn't directly apply to state taxes, but it does set a kind of benchmark for what's considered a reasonable amount to withhold. Learn more about wage garnishment protections.

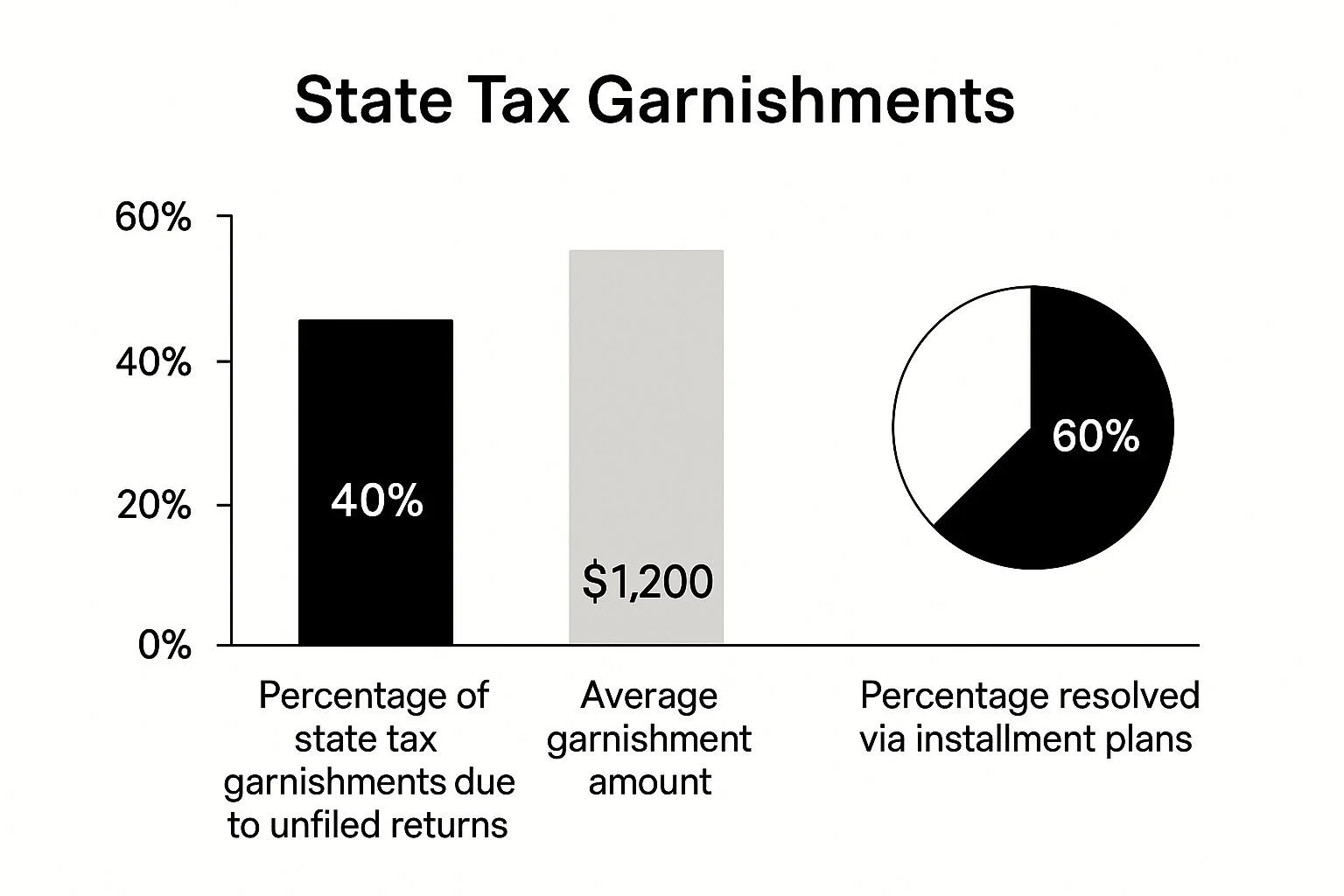

This infographic shows some important data: 40% of state tax garnishments are due to unfiled returns, the average garnishment is $1,200, and 60% are resolved with installment plans. This really underscores the importance of communicating with the state and exploring payment options.

Utilizing Emergency Hardship Provisions

Many states have these "emergency hardship provisions" that can temporarily lower or even stop a garnishment. They're not well-advertised; you often have to dig to find them. But they're there to prevent undue financial hardship during a crisis.

Gathering the necessary documentation, like proof of your essential expenses and income, is essential for a quick resolution. A clear, concise request explaining your hardship and showing you're willing to work with them can really improve your chances. Buying time is often half the battle.

Effective Communication is Key

Knowing how to communicate with the state tax department can make or break your case. Understanding what information they need and how to present it can prevent costly delays.

I've seen some approaches completely backfire, so having a clear strategy is essential. Sometimes, just presenting your situation effectively can open doors to solutions you didn't even know existed.

Getting Payment Plans That Actually Stick

Let me tell you something: state tax agencies aren't trying to make your life miserable. Their main goal is to get paid, and setting up a payment plan is often the easiest route for everyone.

The key is showing them you’re serious. This isn't about playing the victim; it's about presenting a practical, workable plan. I've been in these meetings, and a well-prepared proposal makes a world of difference.

Understanding How Tax Departments Evaluate Your Request

Tax departments have their own internal checklists when they review payment plan requests. They're looking at your ability to pay, the total debt, and your past compliance history.

Having your financial information (income, expenses, assets) organized upfront shows you’re not messing around. Think of it like applying for a loan–the more prepared you are, the better your chances.

For example, imagine you owe $5,000 and suggest paying $100 a month. That might seem reasonable to you, but to the state, it could signal a lack of commitment, especially if you have extra income after covering necessities.

A solid explanation of your finances, paired with a realistic (even if smaller) payment offer, can often be much more effective. You might find this helpful: Learn more in our article about negotiating IRS debt.

Calculating Realistic Payment Amounts and Getting Garnishments Released

Knowing what you can actually afford is crucial. Don't promise the moon. Build a realistic budget that includes both essential expenses and your tax debt. Sharing this budget demonstrates transparency and builds trust.

You can also ask for the garnishment to be lifted while your payment plan is being reviewed. It’s not guaranteed, but it's possible. Explain how the garnishment creates a hardship, and stress your commitment to repaying through the proposed plan. Highlighting your proactive efforts can greatly improve your chances.

Successful Negotiations and Handling Curveballs

I've seen people negotiate lower debt amounts through penalty abatement and even lower interest rates. It takes solid documentation and a compelling argument, but it's definitely doable. Present your case clearly and respectfully. Remember, you’re proposing a solution, not begging for a favor.

Let’s face it, life throws curveballs. What if you miss a payment? Don’t freak out. Contact the state immediately. Honestly explain the situation and suggest a revised payment schedule.

Proactive communication can prevent them from automatically reinstating the garnishment. Staying in contact and showing your continued commitment is key. This same idea applies to renegotiating terms. If your financial situation shifts, don’t hesitate to reach out and discuss adjusting your plan.

Creating Your Financial Defense System

Stopping a garnishment is a huge win, but it's just the beginning. The real goal is building a financial defense system that keeps this nightmare from ever happening again.

This isn't about a quick fix; it's about changing your whole relationship with your finances. I've seen people turn their lives around after facing tax garnishments, not just surviving but truly thriving.

Building a Budget That Works With Back Taxes

People often ask me how they can possibly budget for back taxes while also building an emergency fund. It feels overwhelming, I know. The key is prioritizing, like triage. Your essential expenses – housing, food, and transportation – come first.

Then, set aside a realistic portion of what's left for your tax debt. Even small, consistent payments show the state you’re serious about taking care of it. Whatever remains, no matter how small, goes directly into your emergency fund. It grows slowly, but that safety net is crucial.

Real-World Strategies for Long-Term Stability

I’ve seen families use some really smart strategies to protect their assets and rebuild after a garnishment. One family adjusted their tax withholdings to prevent future underpayment. They treated it like a forced savings plan, and it really worked.

Another family I worked with got their adult children involved in the recovery plan, which created a shared sense of responsibility and a great support system. The point is, finding solutions that work for your specific situation is key.

Early Warning Systems and Course Correction

Think of this like a financial smoke detector. What signs might tell you you’re headed for trouble? Maybe it’s consistently dipping into savings or growing credit card debt. Recognizing these patterns lets you make changes before things get out of hand.

For example, if you see your credit card balances rising, it might be time to re-evaluate your spending or maybe even look into credit counseling. Catching these issues early can prevent them from becoming major tax headaches down the road.

Rebuilding Credit and Seeking Professional Guidance

Tax problems can really damage your credit score. Rebuilding takes time and effort. Start by checking your credit report for errors and disputing anything that’s inaccurate.

Then, concentrate on consistently making on-time payments on all your debts. This might involve getting a secured credit card or working with a credit repair agency.

Sometimes, you just need professional help. A financial advisor who understands tax debt recovery can be incredibly valuable. They can help you create a personalized plan for managing your debt, rebuilding your credit, and achieving long-term financial stability.

Choosing the right advisor is critical, so do your research and find someone specializing in tax-related financial issues. It's an investment in your future financial well-being. Knowing when to ask for help isn't a weakness—it’s a smart move towards a more secure financial future.

Knowing When You Need Professional Backup

Let's be honest, dealing with state tax garnishment is a headache. Sometimes, going it alone just isn't the smartest move. Knowing when to call in a professional can save you stress and potentially a significant amount of money. It’s not about giving up; it's about being strategic.

Evaluating Tax Professionals: Attorneys, Enrolled Agents, and CPAs

So, who are these tax professionals and what do they do? It can feel like navigating a maze. Tax attorneys are your legal experts in the tax world. They understand the complexities of tax law and can represent you in court if needed.

Enrolled agents are federally authorized to represent taxpayers before the IRS. They often handle a wide range of tax issues, including garnishments. Then there are Certified Public Accountants (CPAs). They can also provide tax advice and representation, though their scope might be broader than just tax disputes.

While hiring a professional comes with a cost, think about the potential long-term savings. A good tax pro can negotiate lower payments, help reduce penalties, and might even find errors that could get your garnishment reduced or completely eliminated. I've seen it happen – a skilled attorney can completely turn a situation around.

Avoiding Scams and Finding the Right Fit

Unfortunately, not everyone in the tax resolution business is legitimate. There are scammers out there, so watch out for companies promising the impossible or demanding huge upfront fees.

Ask about their credentials and experience, specifically with state tax garnishments. How do they structure their fees? A trustworthy firm will be upfront about their pricing and explain the process clearly.

For example, a big upfront fee before they even look at your situation? Huge red flag. You might be interested in: Learn more in our article about how to qualify for tax forgiveness.

When Professional Help is Absolutely Essential

Some situations just scream for professional help. A complex tax issue, a large tax debt, or just feeling completely overwhelmed – these are all good reasons to bring in an expert. I’ve worked with people facing massive penalties and interest they didn't even know about; a tax professional got those amounts significantly reduced.

If you think the garnishment might be illegal or based on wrong information, you definitely need professional representation. A tax attorney can challenge the garnishment in court and protect your rights. This is particularly important if the state made a mistake calculating your tax liability or didn’t follow the correct procedures.

Getting the Most Value From Professional Services

Even with a professional, you still need to be involved. Gather all your documents, be honest about your finances, and don’t be afraid to ask questions. A good tax professional will keep you updated and explain your options clearly. Remember, you’re hiring them for their expertise, but it's your financial future.

To help you choose the right tax professional, check out the table below:

Tax Professional Comparison Guide Comparing qualifications, typical fees, and services offered by different types of tax professionals

| Professional Type | Qualifications | Average Fees | Best For | IRS Representation Rights |

|---|---|---|---|---|

| Tax Attorney | Juris Doctor (JD) degree, licensed to practice law | Varies widely, often hourly rates | Complex tax issues, legal representation, court cases | Unlimited |

| Enrolled Agent | Passes a three-part IRS exam or has significant IRS experience | Generally lower than attorneys | Wide range of tax issues, including garnishments | Unlimited |

| CPA | Licensed by state, passes Uniform CPA Examination | Varies, can be hourly or project-based | Tax planning, compliance, and some representation | Limited to matters where they've prepared the return |

As you can see, each type of professional brings different strengths to the table. Consider your specific situation and needs when making your decision. Choosing the right professional can make all the difference.

Exploring Options Beyond Standard Payment Plans

So, state tax garnishment has you feeling choked, and regular payment plans seem like just another weight around your neck? Trust me, you're not the only one. What many people don't realize is there are other ways to deal with this besides those standard plans. Let's dive into some less common strategies that might actually give you some breathing room.

Considering an Offer in Compromise (OIC)

An Offer in Compromise (OIC) is basically striking a deal with the state tax agency. You offer a lower amount than what you owe, and if they accept, the rest is forgiven.

Now, the IRS has a pretty established OIC program, but states handle them differently. Some are much more willing to work with you than others. Your success really depends on showing them you’re truly in a tough spot financially.

Take a look at how the IRS approaches OICs – it gives you an idea of what states might consider, too: Key factors are things like doubt as to liability, doubt as to collectibility, and effective tax administration. These often influence state decisions as well.

The main point? An OIC isn’t a get-out-of-jail-free card. You have to show a legitimate reason why you can’t pay the full amount. Want more details on the IRS program? Check out this guide: Read also: IRS Offer in Compromise: A Complete Guide to Tax Debt Settlement.

Penalty Abatement and Hardship Provisions

Don't forget about penalty abatement. Penalties can seriously bloat your tax debt, sometimes even more than the original tax! If you can show a reasonable cause for late payment or unfiled returns, you might get some or all penalties waived.

That can make a huge difference. Also, many states have hardship provisions – these can offer temporary or even permanent relief from tax debt, especially for situations like job loss or medical emergencies.

Other Alternatives: Statute of Limitations, Innocent Spouse Relief, and Bankruptcy

Sometimes, the solution lies outside the usual payment options. The statute of limitations on tax debt varies by state. If the state hasn't acted within that time, you might have a good defense against the garnishment.

If your tax debt is due to your spouse's actions and you meet certain requirements, innocent spouse relief could remove your responsibility.

Finally, in extreme cases, there's bankruptcy. While it doesn’t always erase tax debt, it can offer a fresh start by discharging other debts and stopping collections, including garnishments.

Lesser-Known Programs: Currently Not Collectible and Partial Payment Installment Agreements

Ever heard of Currently Not Collectible (CNC) status? It's where the state suspends collection efforts because you're simply unable to pay. It's not forgiveness, but it offers relief from garnishment and other collection actions.

Another option is a Partial Payment Installment Agreement (PPIA). It’s similar to a regular installment agreement, but you pay less each month, which can really help if your funds are tight.

Finally, look into state-specific hardship programs, separate from the standard provisions. They may have more flexible requirements for certain financial difficulties.

Each strategy has its own timeline, success rate, and paperwork. Figuring out which one fits your situation and debt level best is key to getting the best outcome. No matter which route you take, building a strong case with detailed documentation is essential. This could include financial statements, proof of income and expenses, medical records – anything that proves you can’t pay the full amount.

Your Complete Action Plan For Moving Forward

This whole process really comes down to building your own personalized plan to stop state tax garnishment and create some long-term financial stability.

We're not just putting out fires here; we're building a solid foundation to weather any future financial storms. I want to give you the tools to tackle this head-on and make a real, lasting difference.

Checklists, Timelines, and Warning Signs – Your Personal Strategy Guide

Think of it like this: a personalized checklist built just for your garnishment situation. That’s exactly what I want you to have—a practical, step-by-step guide. Let's say you’re dealing with a wage garnishment.

Your checklist would include immediate actions like confirming everything is legally sound and reaching out to the state tax department directly. It also includes reasonable timelines so you can stay organized and know what to expect.

If you’re considering an Offer in Compromise, that timeline might stretch over several months, covering everything from gathering paperwork and submitting the offer to negotiating with the state.

Knowing the warning signs is key, too. These signs tell you when your plan needs tweaking. Missed a payment on your installment agreement? That's a big red flag to contact the state immediately and renegotiate.

Being proactive can actually prevent the garnishment from starting back up. Think of these warning signs as your early warning system, helping you make small corrections before things get out of hand.

Scripts, Templates, and Decision Trees – Practical Tools for Success

Talking to tax departments can be nerve-wracking, right? I get it. That’s why I want to arm you with scripts that actually work. Imagine having a template for a hardship letter—something that clearly explains your situation and asks for some relief. These tools take out the guesswork, giving you the confidence to communicate effectively and get the results you need.

Sometimes figuring out the best way forward can feel overwhelming. That’s where decision trees come in. Suppose you’re trying to decide between a payment plan and an Offer in Compromise. A decision tree walks you through all the important factors—your income, expenses, total debt, and the likelihood of each option succeeding.

Maintaining Progress and Building a Secure Future

Stopping the garnishment isn’t the end goal; it’s just the beginning of a fresh financial start. This means setting up systems to stay on top of your future taxes, like adjusting your withholdings or scheduling quarterly estimated tax payments.

Building a financial safety net—your emergency fund—is equally important. It’s not about going without; it’s about creating stability so a minor financial setback doesn’t turn into a major crisis.

By using these strategies, you’ll not only solve your current tax problems but also gain the confidence and tools to build a secure financial future.

Ready to take control of your tax situation?