IRS Tax Debt Relief Programs: Your Complete Freedom Guide

Understanding What The IRS Really Wants From You

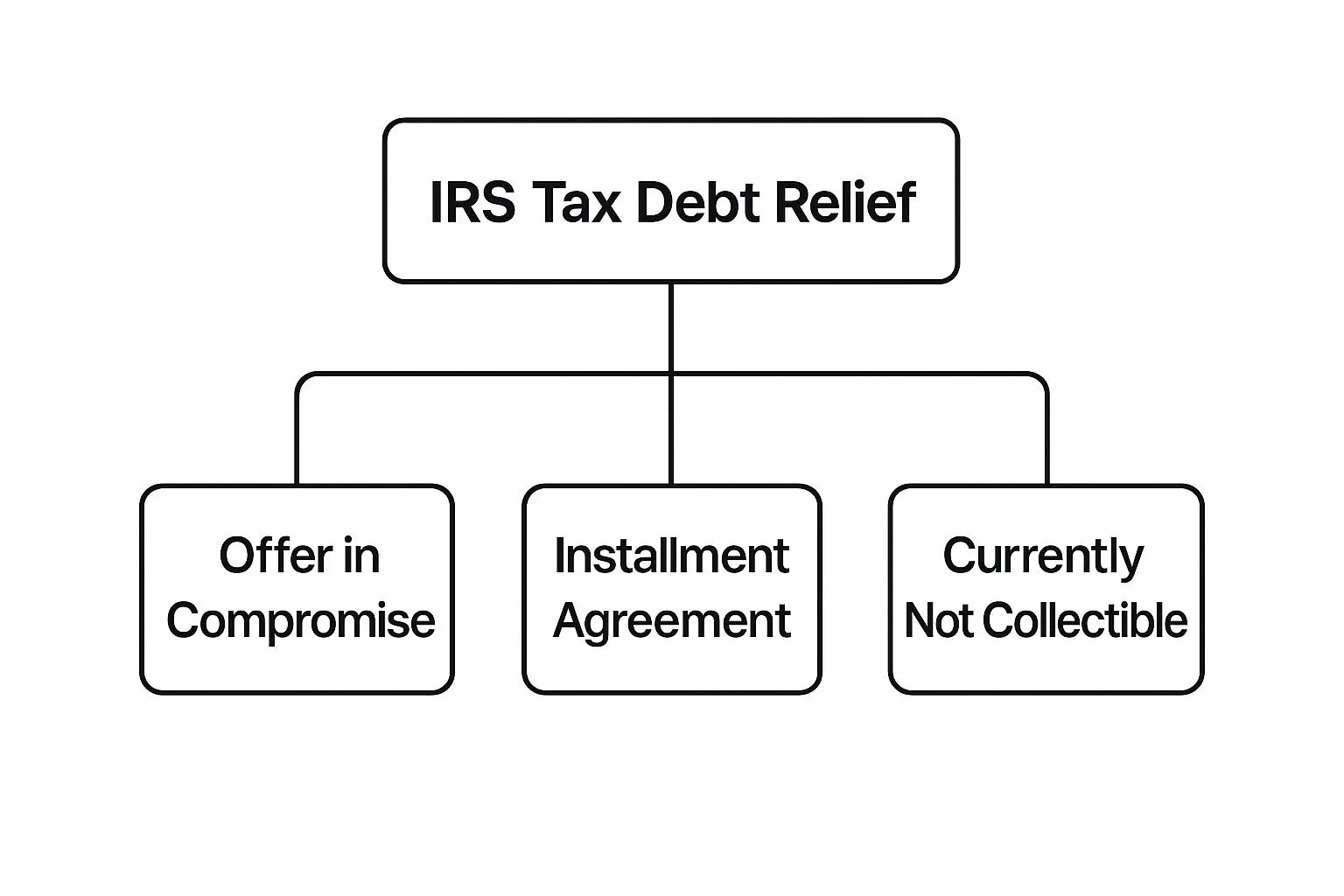

This infographic gives you a visual overview of how IRS tax debt relief programs work. Think of it like a branching tree, with the main trunk representing all the programs, and the branches leading to the key options.

These core programs – Offer in Compromise (OIC), Installment Agreement, and Currently Not Collectible – offer structured ways to deal with tax debt. Choosing the right one depends on your specific situation.

For instance, an OIC could be a good fit if you simply can't afford to pay your full tax liability. On the other hand, an Installment Agreement works if you can afford the full amount, just not all at once.

The IRS Wants Solutions, Not Standoffs

Many people see the IRS as the enemy. But actually, their main goal is just to collect taxes efficiently. Think of it like this: they'd rather get something than nothing.

That's why these relief programs exist. They help taxpayers get back on solid financial footing and contribute what they can. This creates a more cooperative relationship, not a combative one.

The IRS also knows that unexpected financial hardships happen. They've built in options to deal with these situations. So, resolving tax debt isn't about begging for mercy; it's about finding a solution that works for both sides.

Exploring Installment Agreements

The IRS offers flexible options like installment agreements. These plans let you pay your tax debt in monthly installments for up to ten years, as long as you owe less than $50,000 (this includes combined tax, penalties, and interest for new simple plans).

Starting in 2025, you can even apply for these plans online and get an immediate response about your application status. Want to explore these options further? You can find more information about IRS resources here.

Understanding the "Why" Behind the Programs

Understanding why these programs exist can help you approach the process strategically. Knowing the IRS prefers resolution empowers you to move from feeling afraid to proactively solving the problem.

This is especially important with an OIC, where showing you can't pay the full amount is key. This understanding isn't just theoretical; it can completely change how you present your finances and negotiate a resolution. Ultimately, understanding the IRS's perspective is the first step to real tax debt relief.

To help you compare the different programs, take a look at the table below:

IRS Tax Debt Relief Programs Comparison: A comprehensive comparison of major IRS relief programs including eligibility requirements, time frames, and potential outcomes

| Program Type | Eligibility Requirements | Maximum Timeline | Debt Reduction Potential | Application Complexity |

|---|---|---|---|---|

| Offer in Compromise (OIC) | Doubt as to collectability; offer represents the most the IRS believes it can collect | Varies, typically resolved within a year | Significant, can settle for less than full amount owed | Complex, requires detailed financial documentation |

| Installment Agreement | Ability to pay full amount over time; generally under $50,000 total owed for streamlined agreements | Up to 72 months (6 years) for regular agreements, up to 10 years for some options starting 2025 | None, pays full amount but over time | Relatively simple, especially for online streamlined agreements |

| Currently Not Collectible (CNC) | Severe financial hardship, inability to pay even basic living expenses | Temporarily suspends collection activity, can last for years | None, debt remains but collection is deferred | Moderate, requires proof of hardship |

This table summarizes the key differences between the main IRS tax debt relief programs. As you can see, each program has its own set of eligibility rules and potential outcomes. Choosing the right one depends on your unique circumstances and financial situation.

Offer In Compromise: The Art Of Paying Pennies On The Dollar

Imagine settling a $50,000 tax debt for just $5,000. That's the potential power of an Offer in Compromise (OIC). Think of it as a careful negotiation with the IRS, not a desperate plea for forgiveness. It's a way to potentially resolve your tax debt for less than the full amount owed, but it requires a strategic approach.

An OIC works by presenting a compelling argument to the IRS, showing why accepting your reduced offer is in their best interest.

The IRS granted over 13,165 OICs in fiscal year 2022, totaling over $252 million in tax relief. This shows that while it’s not a guaranteed solution, it can be a significant lifeline for eligible taxpayers. You can find more information on OICs and tax relief here.

Decoding OIC: It's Not About Begging

The key to a successful OIC lies in understanding what the IRS looks for. They aren't swayed by emotional appeals. Instead, you need to demonstrate doubt as to collectability.

This means proving, with solid evidence, that the IRS is unlikely to collect the full amount from you, even with enforced collection efforts. This requires a thorough and honest disclosure of your financial situation.

Your goal is to paint a clear picture of your finances, demonstrating why paying the full debt is truly beyond your capabilities. This involves meticulous documentation – think of it as building a strong case file.

Three Flavors of OIC: Which One Is Yours?

OICs come in three distinct types, each designed for specific situations:

Doubt as to Liability: Use this type if you believe the IRS made a mistake, and you don't actually owe the stated amount. You'll need strong evidence to back up your claim.

Doubt as to Collectability: This is the most frequently used type of OIC. It focuses on your inability to pay the full debt, even over an extended period.

Effective Tax Administration: This type is rare. It's used when you could technically pay, but exceptional circumstances, like a severe medical hardship, would create an undue burden.

Inside the IRS Examiner’s Mind: What Makes Them Say "Yes"?

IRS examiners evaluate OICs objectively, focusing on your Reasonable Collection Potential (RCP). This is their assessment of what they realistically expect to collect from you, based on your assets, income, and expenses.

Your offer needs to be close to or exceed your RCP to be considered. This is where meticulous documentation pays off. Bank statements, pay stubs, asset valuations – every document contributes to the overall picture of your financial standing.

A well-prepared OIC application not only provides the required information but also presents it clearly and concisely, making the examiner's job easier. You may find this helpful: IRS Offer in Compromise: A Complete Guide to Tax Debt Settlement

The Danger of a Weak Application: Don't Shoot Yourself In The Foot

A poorly crafted OIC application can actually hurt your chances. It may appear as a lack of seriousness and could even lead the IRS to pursue more aggressive collection strategies.

Before you invest time and resources, honestly assess your eligibility. If you’re unsure, consider consulting a tax professional. They can help you determine if an OIC is the right path for you and provide expert guidance through the process. A strong OIC requires a well-planned strategy, not just a hopeful wish.

Installment Agreements: Making The Impossible Manageable

Sometimes, the best way to tackle IRS tax debt isn't about getting a discount, but about making the payments fit your life. An Installment Agreement does just that.

It’s a payment plan that lets you pay off your tax debt in monthly installments. Think of it as a lifeline for those who can eventually pay their full debt, but need a little breathing room to get there.

This approach has some real benefits. It stops the IRS from taking aggressive collection actions like levies (seizing your assets) and garnishments (taking a portion of your paycheck).

It also minimizes penalties, although interest will continue to accrue. This means the overall cost of your debt is reduced, even though you're paying over time.

Real-World Relief: Turning Debt Into Digestible Payments

Imagine a family staring down a $25,000 tax bill. Paying that all at once would be crippling. But with an Installment Agreement, that amount could be spread out into smaller monthly payments over a few years.

Suddenly, what seemed impossible becomes a realistic, step-by-step climb. This kind of IRS tax debt relief helps families meet their obligations without sacrificing essentials or drastically changing their lifestyle. It gives them the time and space they need to regain their financial footing.

Types of Installment Agreements: From Simple to Strategic

There are a few different types of Installment Agreements, each designed for different situations and debt amounts.

Short-Term Payment Plan: For smaller debts, you might qualify for a short-term payment plan (up to 180 days).

Streamlined Installment Agreement: This option is for balances under a certain limit and often involves a simple online application with quick approval.

Long-Term Payment Plan: Larger debts usually require a more formal long-term payment plan (typically up to 72 months). These often involve sharing more detailed financial information and may even include negotiating a payment amount with the IRS. For helpful negotiation tips, take a look at our guide on how to negotiate IRS debt.

Calculating Your Payment: Balancing Needs and Obligations

Figuring out the right monthly payment is key to a successful Installment Agreement. It’s a balancing act. The payment needs to be affordable, protecting your family’s basic needs, but also substantial enough to satisfy the IRS.

This involves a close look at your income and expenses. Where can you potentially cut back on spending? Can you create a realistic budget that includes your tax debt payments? The goal is a sustainable plan that lets you repay your debt responsibly while maintaining financial stability.

Being proactive like this can help you avoid future tax issues and build a path towards long-term financial well-being.

Currently Not Collectible: When Life Hits Rock Bottom

Life has a way of throwing unexpected challenges our way. Sometimes, these challenges can lead to serious financial hardship, making it impossible to manage basic living expenses, let alone IRS tax debt.

For those facing such overwhelming circumstances, the IRS offers a program called Currently Not Collectible (CNC) status. This isn't about avoiding your tax obligations; it's a safety net designed to help you when you're truly struggling. Learn more in our article about Currently Not Collectible with the IRS.

CNC status is like hitting the pause button on your IRS debt collection efforts. It's an acknowledgment from the IRS that, at this moment, you simply cannot afford to pay anything.

This often-overlooked program can provide immediate relief during a financial crisis. Think of it as the IRS saying, "We understand you're going through a tough time." However, it's important to remember that interest and penalties continue to accrue during this period.

Real-Life CNC: Stories of Relief

Imagine a family burdened with mounting medical bills after a sudden illness. Their income has drastically reduced, making it difficult to afford even basic necessities. CNC status could offer temporary relief from IRS collection actions, allowing them to focus on recovery and getting back on their feet.

Consider a small business owner whose business was devastated by a natural disaster. They've lost everything and are struggling to rebuild.

CNC status could provide the much-needed breathing room to restart their business without the added stress of IRS collections. These are real-life scenarios where CNC status can be a critical lifeline.

What Qualifies as "Rock Bottom" for the IRS?

The IRS has specific criteria for determining financial hardship. It's not simply a matter of feeling broke; it's about demonstrating a genuine inability to meet even essential living expenses like food, housing, and transportation.

You'll need to provide thorough documentation of your income, expenses, and assets. This might include bank statements, pay stubs, medical bills, and any other relevant evidence that clearly illustrates your financial hardship. This documentation must paint a complete picture of your situation and justify your request for CNC status.

CNC and Anxiety: Relief and Uncertainty

While CNC status offers a sense of relief, it can also be a source of anxiety. The debt remains, and the knowledge of its existence can be a significant burden.

It's crucial to understand that CNC status isn't a permanent fix. It's a temporary measure designed to give you time to regain your financial footing. You'll eventually need to work towards a longer-term solution, such as an Offer in Compromise, an Installment Agreement, or ultimately paying the debt in full.

Transitioning from CNC: Planning for the Future

As your financial situation improves, you'll need to transition from CNC status to a more permanent IRS tax debt relief program. The IRS will periodically review your finances, and when you're in a position to start making payments, you'll need to collaborate with them to establish a payment plan.

This could involve setting up an Installment Agreement or exploring other options. The key is to use the time afforded by CNC status wisely, planning for your financial recovery and preparing to eventually repay your debt.

This proactive approach will make the transition smoother and contribute to your long-term financial stability.

Building Your Case Like A Pro

Think of IRS tax debt relief not as a form-filling exercise, but as a strategic negotiation. It's a serious financial discussion, and approaching it that way makes all the difference. Timing, for instance, is key.

Don’t apply when it's convenient for you, apply when your finances are most likely to support your request. Imagine asking for a raise – you wouldn’t do it after a bad performance review. Similarly, applying for tax relief when your finances are relatively stable might not yield the best outcome.

Highlighting Your Strengths, Honestly

Honesty is paramount when presenting your financial information. But, within that honesty, you can strategically highlight elements that strengthen your position.

For example, a recent, significant drop in income due to unexpected circumstances can greatly impact your eligibility for certain programs.

Focus on the real challenges you face while showcasing your commitment to resolving your tax debt. This builds trust and encourages a cooperative environment with the IRS.

Documentation: Your Proof of Hardship

Solid documentation is crucial for your case. Imagine presenting evidence in court. Bank statements, pay stubs, medical bills, and asset valuations are the building blocks of your argument. They offer concrete proof of your financial situation and the hardships you face.

Missing or incomplete documents, on the other hand, can raise red flags and possibly delay or even jeopardize your application. The number of accepted Offers in Compromise (OIC) demonstrates how important a strong case is.

In fiscal year 2024, taxpayers submitted 33,591 OICs, but the IRS accepted only 7,199. This acceptance rate highlights the competitive nature of the program and the value of careful preparation and potentially professional guidance.

Learn more about IRS collections here.

The Emotional Toll: Navigating Vulnerability and Confidence

Opening up your financial life to the government can be emotionally draining. It requires vulnerability and can bring up feelings of shame or fear. Remember, though, that IRS representatives are trained to assess financial situations objectively.

Maintaining confidence throughout the process, even when discussing sensitive details, is essential. This doesn’t mean being arrogant, but rather presenting your case clearly and convincingly, demonstrating your commitment to finding a resolution.

Building Bridges, Not Walls: Effective Communication

How you communicate with IRS representatives matters. Instead of seeing them as adversaries, think of them as partners in finding a solution. Clear, respectful communication encourages collaboration.

Asking clarifying questions, responding quickly to information requests, and maintaining a professional demeanor can significantly improve your chances of a positive outcome.

Building a cooperative, rather than a confrontational, relationship is essential for navigating tax debt relief programs and reaching a successful resolution. Your aim is a mutually beneficial agreement, not a fight.

Going Solo Versus Getting Professional Backup

Tackling IRS tax debt relief can feel like navigating a dense forest. You could venture in alone, armed with a compass and a hope, or you could hire an experienced guide who knows the terrain. Both options have their upsides, and the best path depends on your specific situation and how thick the undergrowth is.

DIY or Delegate: Honestly Assessing Your Hike

Deciding between handling your IRS tax debt yourself and bringing in a professional isn't just about cost. It's about honestly evaluating your situation, your comfort level, and your chances of success.

Imagine you're building a deck – sure, you could try to learn carpentry on the fly, but sometimes it’s wiser (and safer) to hire a professional to avoid costly mistakes.

Some taxpayers are motivated and capable of managing the process solo, especially with simpler tax debt scenarios. They’re comfortable with research, forms, and communicating with the IRS.

For them, the DIY approach can be a real money-saver. But for more complex situations, like those involving large amounts of debt or complicated tax issues, professional representation can be a game-changer.

Professional Help: Your Experienced Guide

There are countless stories where professional help has transformed a potential tax debt disaster into a manageable solution. Picture a taxpayer facing a massive tax bill with limited resources.

A skilled tax professional can navigate the intricacies of an Offer in Compromise (OIC), potentially shrinking the debt significantly. In these cases, the cost of professional help is often small compared to the potential savings.

Professionals also offer vital guidance during IRS audits, shielding taxpayers from unnecessary assessments and penalties.

Think of a tax attorney as your legal navigator, expertly guiding you through the complex world of tax law and fighting for your best interests. There are several types of professionals available, each with specific strengths:

Tax Attorneys: These professionals hold law degrees and specialize in tax law, offering comprehensive legal representation.

Enrolled Agents (EAs): EAs are federally licensed tax practitioners specializing in representing taxpayers before the IRS.

Certified Public Accountants (CPAs): CPAs are licensed accounting professionals who can offer tax advice and prepare returns, but their ability to represent you before the IRS may be more limited compared to tax attorneys or EAs. For help finding the right professional, check out our guide on finding expert help with tax debt relief companies.

The Price of Peace of Mind: Cost vs. Benefit

The cost of professional help is a key consideration. While some professionals charge hourly rates, others offer flat fees depending on the case's complexity.

Weighing the potential cost against the potential benefits is crucial. A successful OIC, for instance, could save you thousands, far outweighing the cost of professional guidance.

Red Flags and Predators: Watch Out for the Traps

Unfortunately, the tax resolution industry has its share of bad actors. Some companies exploit vulnerable taxpayers, promising unrealistic outcomes and charging outrageous fees.

Be wary of companies that guarantee results or demand large upfront payments without a thorough evaluation of your situation.

Thorough research and choosing a reputable professional are essential. Seek professionals with proven track records, positive client testimonials, and transparent fee structures.

Your Path to Success: Choosing the Right Trail

Ultimately, the best approach hinges on your individual circumstances. Consider these factors when deciding:

Debt Amount: Smaller debts might be manageable solo, while larger debts often benefit from professional expertise.

Complexity: Simple tax situations might suit a DIY approach, whereas complex issues, like business taxes or multiple years of unfiled returns, likely require professional guidance.

Personal Capabilities: If you’re comfortable with tax laws, paperwork, and IRS communication, you might succeed on your own. If you feel overwhelmed or unsure, professional help can provide crucial support and expertise.

Before making your decision, take a look at this comparison to help you weigh the pros and cons:

Professional Tax Help Cost-Benefit Analysis Comparison of DIY versus professional assistance costs, success rates, and time investment for different types of tax debt situations

| Debt Amount Range | DIY Success Rate | Professional Success Rate | Average Professional Cost | Time Investment | Recommended Approach |

|---|---|---|---|---|---|

| Under $10,000 | Moderate | High | $1,000 - $3,000 | Low - Moderate | DIY for simple cases, Professional for complex cases |

| $10,000 - $50,000 | Low | Medium | $3,000 - $7,000 | Moderate - High | Professional Recommended |

| Over $50,000 | Very Low | Medium | $7,000+ | High | Professional Highly Recommended |

Note: The figures presented in this table are estimates and can vary significantly depending on individual circumstances and the complexity of the tax situation.

As the table suggests, professional help becomes increasingly valuable as the debt amount and complexity rise. While DIY might be feasible for smaller, simpler debts, professional assistance greatly increases the likelihood of success and can save you significant time and stress with larger, more complex tax issues.

Your Next Steps Start Right Now

Understanding IRS tax debt relief programs is a great start, but taking action is key. Think of this section as your roadmap to financial freedom, outlining practical steps you can take today, no matter which program you choose.

Prioritize and Plan: Your Personalized Action Steps

Just like planning a road trip, tackling IRS tax debt requires a map and a timeline. We'll help you create a prioritized action plan based on your specific debt and financial situation.

For a smaller debt, a simple Installment Agreement might be the solution. But for a larger liability, an Offer in Compromise or even Currently Not Collectible status could be more suitable. Think of it like choosing the right vehicle – a compact car for a short trip, a truck for hauling a heavy load.

Building in realistic timelines, including potential IRS processing times, is crucial. Just as you'd factor in traffic and rest stops on a road trip, you need to anticipate the IRS's processing time.

Gather Your Toolkit: Documentation Checklist

Think of the required documents as your toolkit for this journey. We'll provide checklists to help you gather everything efficiently. This includes:

Tax Returns: Past returns give the IRS a clear view of your tax history.

Financial Statements: Bank statements, pay stubs, and asset valuations show your current financial situation.

Proof of Hardship (if applicable): Documents like medical bills or job loss verification support hardship claims.

Having these ready streamlines the process and shows the IRS you’re serious about resolving your debt.

Assess Your Options: Finding Your Best Route

Choosing the right program is crucial. We'll help you conduct an initial assessment, considering your unique situation, to determine the best fit.

This assessment considers your total debt, current income and expenses, and the type of tax liability. It's like choosing the right route on your map – the scenic route might be tempting, but the fastest route might be more practical.

Overcoming Mental Roadblocks: Fear, Shame, and Overwhelm

Dealing with tax debt can be emotionally challenging. Feelings of fear, shame, and overwhelm are normal, but they can hold you back. We’ll address these feelings with practical strategies to turn them into positive action.

Think of these emotions as roadblocks on your journey. We'll help you navigate around them, replacing fear with action, shame with self-compassion, and overwhelm with a clear, manageable plan.

Inspiration and Hope: Stories of Success

Just as hearing about others who’ve successfully completed similar journeys can be inspiring, we’ll share stories from taxpayers who have navigated IRS tax debt relief. These stories offer hope, proving that resolution is possible even in difficult circumstances. They remind you that you are not alone on this journey.

Maintaining Financial Discipline: The Long-Term Journey

Resolving your current tax debt is a significant step, but maintaining good financial habits is key to preventing future problems. We’ll provide strategies for budgeting, managing expenses, and staying on track. Think of it as regular maintenance for your car, ensuring it keeps running smoothly.

Don't let tax debt control your life. Take the first step toward resolving your tax issues and regaining control of your finances.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034