IRS Notice CP14: How to Resolve Your Balance Due Quickly

Decoding the IRS Notice CP14: What It Really Means

That sinking feeling in your stomach? It's probably not indigestion. Receiving a letter from the IRS can be stressful. This guide clarifies what an IRS Notice CP14 actually means and why it might have landed in your mailbox.

In short, the CP14 is a balance due notice. It's the IRS's way of letting you know they believe you have outstanding taxes.

Understanding the Components of a CP14 Notice

A CP14 notice is packed with important details. First, it will clearly state the amount you owe, which may include penalties and interest. It also specifies the tax year the balance is for – this is critical for cross-referencing with your own records.

The notice will outline the reason for the balance. This could range from unpaid taxes to an underpayment, or even a potential processing error.

Finally, the notice will include a payment due date and instructions on how to pay. Understanding each section is essential for taking the right steps.

The IRS CP14 notice is among the most frequently issued balance due notices in the United States. It informs taxpayers of outstanding tax liabilities, including any interest and penalties, and typically requests payment within 21 days.

These notices are a key tool for the IRS in collecting outstanding taxes. They're automatically generated when the IRS system identifies a discrepancy or unpaid balance. Find more details from the IRS Statement on Balance Due Notices.

Why You Might Have Received a CP14 Notice

There are a few possible reasons for receiving a CP14. A simple overlooked payment or a miscalculation on your tax return are common culprits.

Occasionally, the IRS itself may make a processing error, particularly with electronic payments or changes to bank information.

Sometimes, a payment might have been incorrectly applied to a different tax year or account. The notice might also stem from unreported income or deductions. Carefully review your situation to identify the root cause.

For further reading on IRS notices, see Understanding Notice Levy: The Ultimate Guide for Taxpayers with the IRS.

What a CP14 Notice Means For You

Receiving a CP14 requires action. Ignoring it can lead to additional penalties and collection efforts.

However, it's important to remember that receiving the notice doesn’t automatically mean you owe the full amount. Carefully review the notice and compare it to your records.

If you believe the notice is incorrect, you have the right to dispute it. If the balance is accurate, explore your payment options.

These can include paying the balance in full or setting up a payment plan with the IRS. Determining the next steps is key to effectively resolving the issue.

When the IRS Gets It Wrong: Why You Got a CP14 After Paying

It’s incredibly frustrating to receive an IRS notice CP14 claiming you owe money, especially after diligently paying your taxes. This situation, while upsetting, is more common than you might think.

The disconnect often stems from issues within the IRS's complex processing systems. Let's explore some of the most frequent reasons for this confusing scenario.

Timing is Everything: Payments and Processing Delays

One of the most common reasons for a CP14 notice after payment is simply timing. The IRS processes a massive volume of payments, especially during peak tax season.

If your payment arrives close to the filing deadline, it might not be processed and posted to your account before the system automatically generates the CP14.

This delay is particularly common with check payments, which can take several weeks to process.

For example, if you mailed a check right before the deadline, the IRS might generate the notice before your check clears. This can lead to unnecessary worry and confusion.

Electronic Glitches: When Technology Fails

While electronic payments are generally faster, problems can still occur. System errors, incorrect routing numbers, or issues with your bank can cause payment delays or rejections. Even a small error can cause a significant headache.

If you recently changed banks or updated your payment information with the IRS, there's a possibility the update didn't register correctly. This could cause your payment to be misapplied or rejected, resulting in a CP14 notice.

Processing Errors: The Human Factor

Despite increasing automation, the IRS system still involves human input at various stages. Data entry errors, misfiled paperwork, or even a simple oversight can lead to an inaccurate balance due notice.

Your payment might have been correctly processed but accidentally applied to the wrong tax year or a different account altogether. These types of errors, while unintentional, can be frustrating to resolve.

In 2024, the IRS acknowledged that some taxpayers who paid their 2023 tax returns electronically or by check received CP14 notices before their payments were processed. This affected a significant number of filers nationwide, highlighting the complexities of the IRS notice systems.

You can discover more insights about this issue here.

Identifying the Real Issue: Error or Oversight?

How can you determine if your CP14 is a simple processing error or a genuine issue? The key is to carefully compare the notice against your records. Check your bank statements for proof of payment, including the date and amount.

Review your tax return to confirm the original amount owed. If these details align with your payment information, the CP14 is likely erroneous.

However, if you find discrepancies, address them promptly to avoid penalties or collection actions. Understanding these potential pitfalls is the first step toward resolving your IRS notice CP14.

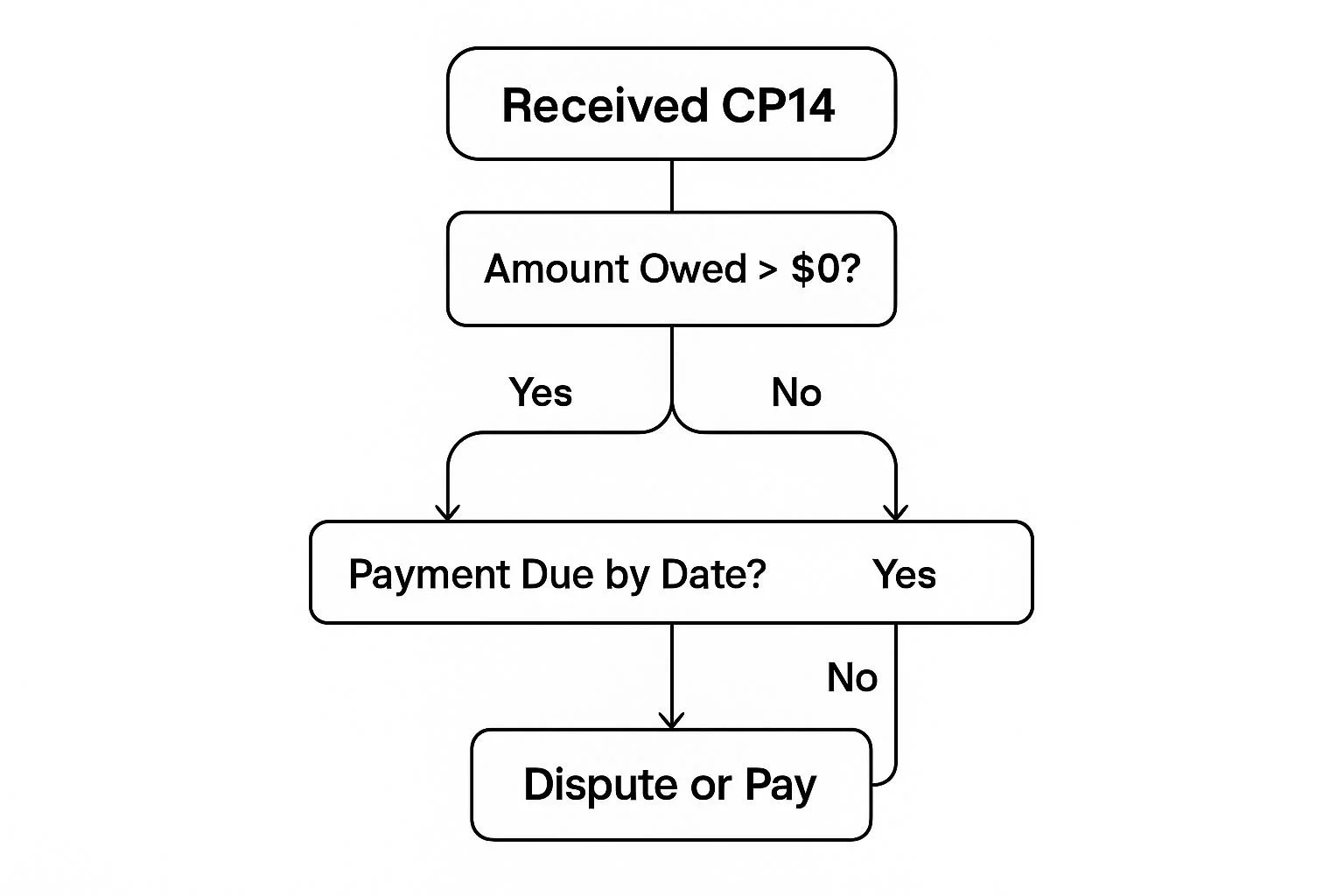

Your Action Plan: Responding to an IRS Notice CP14

This infographic helps visualize the steps you need to take when dealing with an IRS Notice CP14. It walks you through confirming the amount due, checking the payment deadline, and deciding how to move forward.

Importantly, receiving a CP14 doesn't necessarily mean you have to pay right away; you might be able to dispute the balance.

First Steps: Verify and Organize

Getting a CP14 can be stressful, but don't panic. The first step is to carefully compare the notice with your own records. Check your bank statements for proof of payment, noting the date and amount of any transactions.

Make sure the tax year on the notice is correct and understand the reason for the alleged balance due.

Next, find your filed tax return for the year in question. Confirm that the amount the IRS says you owe matches your own calculations.

Gather all documentation related to your payment, such as canceled checks, online confirmations, or money order receipts. Having organized records is key to resolving the issue quickly.

Contacting the IRS: Direct and Indirect Approaches

If your records indicate the CP14 is incorrect, contact the IRS directly. Use the phone number on the notice. Explain the discrepancy clearly and provide supporting documentation. You have 60 days from the date of the notice to respond.

If you prefer online interaction, the IRS provides several digital tools. You can access your account online, review the notice details, and even track your response status. For complicated situations, or if you'd simply prefer professional help, consider talking to a tax attorney.

Payment Strategies: Beyond the Lump Sum

If you confirm the balance is accurate, you'll need to figure out how to pay. While paying the full amount immediately is the simplest option, the IRS offers flexible alternatives if you can't afford a lump sum.

These include short-term payment extensions and installment agreements, which let you pay over time.

You might find this helpful: The Ultimate Guide to IRS Back Taxes and Payment Plan Strategies.

Negotiating an installment agreement involves understanding the terms and any potential fees. The total amount you owe and your ability to pay will affect the specifics of the agreement.

The IRS provides online tools to apply for payment plans and manage your payments electronically, making the process much simpler and allowing you to track your progress.

Document Everything: Create a Protective Paper Trail

Keep detailed records of every interaction you have with the IRS, including copies of letters, emails, and notes from phone calls. Write down the date, time, and the name of any IRS representative you speak to.

These records create a crucial paper trail. This can protect you in case of future disagreements.

It also provides essential information for a tax professional if you decide to seek expert advice.

Being proactive and organized will make resolving your CP14 notice much easier.

To help you choose the best way to respond to a CP14 notice, we've compiled the following comparison table:

CP14 Response Options Comparison: This table compares different ways to respond to a CP14 notice based on your specific situation.

| Response Option | When to Use | Timeline | Documentation Needed | Pros/Cons |

|---|---|---|---|---|

| Full Payment | When you agree with the balance and can afford to pay it immediately | Within 60 days of notice date | Bank statement, payment confirmation | Pros: Resolves issue quickly, avoids penalties. Cons: May not be feasible for everyone. |

| Short-Term Extension | When you agree with the balance but need a little extra time to pay | Up to 180 days | Justification for extension | Pros: Provides extra time. Cons: Interest and penalties still accrue. |

| Installment Agreement | When you agree with the balance but can't afford to pay in full | Varies depending on amount owed and ability to pay | Financial information, proposed payment plan | Pros: Makes payment manageable. Cons: Requires ongoing payments, potential fees. |

| Dispute the Balance | When you believe the notice is inaccurate | Within 60 days of notice date | Tax returns, payment records, supporting documentation | Pros: Can correct errors, avoid unnecessary payments. Cons: Requires thorough documentation, may involve extended communication with the IRS. |

This table outlines various options for responding to a CP14 notice, helping you select the most appropriate course of action based on your individual circumstances. Remember, addressing the notice promptly and maintaining organized records are vital for a smooth resolution.

Smart Payment Strategies for Your IRS Balance Due

So, you’ve received your IRS CP14 notice and confirmed the balance due. What comes next? If paying the full amount isn't immediately possible, the IRS offers several payment options beyond a single lump sum. This gives taxpayers flexibility in managing their tax debt. Let’s explore these alternatives.

Exploring Your IRS Payment Options

The IRS provides a range of payment solutions to accommodate different financial situations. These go beyond a one-time payment and offer structured approaches for handling your tax liability. This is particularly helpful for those facing financial difficulties.

Full Payment: This is the ideal scenario, but not always realistic. Paying in full minimizes additional penalties and interest.

Short-Term Payment Extension: This option gives you up to 180 days to pay your balance. However, interest and penalties still accrue during the extension.

Offer in Compromise (OIC): An OIC allows you to settle your tax debt for less than the full amount. Approval depends on your individual financial situation and the IRS’s assessment of your ability to pay. Learn more about how to settle IRS debt.

Installment Agreement: This option lets you pay your balance over time with scheduled monthly payments. This is a manageable option for those who can’t afford a lump-sum payment.

The following table outlines the various payment methods available when responding to a CP14 notice.

| Payment Method | Processing Time | Associated Fees | How to Access | Best For |

|---|---|---|---|---|

| Full Payment | Immediate | None | IRS website, phone, mail | Those who can afford to pay the full amount upfront |

| Short-Term Payment Extension (up to 180 days) | Varies | Interest and penalties continue to accrue | IRS website, phone | Those needing a short-term extension to gather funds |

| Offer in Compromise (OIC) | Several months | Application fee | IRS website, Form 656 | Those who cannot afford to pay the full amount |

| Installment Agreement | Varies based on agreement terms | Setup fees may apply, waived for low-income taxpayers | IRS website, phone, Form 9465 | Those who need to pay their balance over time |

This table summarizes the key payment options available from the IRS, providing a snapshot of processing times, potential fees, and access methods. Choosing the right option depends on individual circumstances.

Navigating Installment Agreements

Installment agreements are a common choice for managing IRS tax debt. They involve making regular monthly payments, often directly from your bank account. Understanding the different types is crucial for selecting the best fit for your finances.

Short-Term Payment Plan (STPP): This gives you up to 180 days to pay, but penalties and interest still accumulate.

Long-Term Payment Plan (LTTP) (Installment Agreement): This option allows for monthly payments over an extended period. Setup fees may apply, but low-income taxpayers may qualify for a fee waiver.

Minimizing Penalties and Interest

Regardless of your chosen strategy, acting quickly is crucial. Penalties and interest can add up quickly, increasing your total debt.

The late payment penalty is 0.5% of the unpaid taxes per month, capped at 25%. Interest also compounds daily on your unpaid balance, starting from the original due date of your tax return.

Making Strategic Decisions: Seeking Professional Guidance

Choosing the right payment strategy requires carefully evaluating your finances and the long-term effects of each option. For example, while an installment agreement makes payments more manageable, it also increases the time penalties and interest accrue.

You can learn more about mastering tax relief success. Consulting a tax professional can provide personalized advice and guide you through the complexities of IRS payment options.

They can also help you negotiate with the IRS and ensure you meet all requirements. Understanding your options and acting strategically are key to resolving your CP14 notice effectively.

Who Gets Targeted: The Real Data Behind CP14 Notices

Ever wonder if you're being singled out upon receiving an IRS notice CP14? This section explores the patterns behind who receives these notices and their effectiveness in prompting payments.

We'll examine which taxpayer demographics are most likely to receive a CP14 and how the IRS prioritizes its collection activities by exploring IRS collection data.

Income and Assets: A Key Factor

One might assume CP14 notices are distributed randomly, but data suggests otherwise. The IRS tends to focus its collection efforts on taxpayers with a demonstrable ability to pay.

This means individuals with higher incomes or significant assets are more likely to receive a CP14. This targeted approach helps maximize the IRS’s chances of collecting outstanding balances.

When considering how to manage your IRS Notice CP14 balance, researching available payment plans, similar to how businesses handle customer balances, can be beneficial.

This focus on taxpayers with a greater capacity to pay isn't arbitrary; it’s a practical approach to resource allocation. The IRS prioritizes cases where the potential return on investment, in terms of collected revenue, is highest.

From an efficiency standpoint, this strategy allows the IRS to concentrate its resources where they are most likely to yield results.

For example, a taxpayer with substantial assets is more likely to satisfy a tax debt than someone with limited income and no assets. The IRS may prioritize sending CP14 notices to individuals with a higher likelihood of being able to pay.

This doesn’t mean lower-income taxpayers are exempt from receiving notices, but their cases might be handled differently or prioritized based on available resources.

Statistical analysis confirms this trend. An IRS study found that the majority of taxpayers receiving CP14 notices had incomes exceeding the minimum annual living expense (ALE) or possessed systemically detected assets.

Specifically, 74.3% (9,803 out of 13,201) taxpayers in the study met these criteria.

These individuals accounted for a significant portion of total payments: $40.8 million (93%) in the first year and $80.1 million (92.7%) in the second.

Understanding IRS Prioritization

The IRS uses data analysis to identify and categorize taxpayers based on factors like income, assets, and compliance history.

This allows them to prioritize cases and tailor collection strategies accordingly. This data-driven approach helps the IRS streamline its processes and focus on the most impactful cases.

Understanding how the IRS prioritizes cases offers valuable perspective on your own situation.

Knowing where you fit within the broader system of tax enforcement helps you anticipate potential follow-up actions and prepare your response.

By understanding these patterns, you’re better equipped to navigate the process and efficiently resolve your CP14 notice.

The High Cost of Inaction: What Happens If You Ignore CP14

Ignoring an IRS notice CP14 might be tempting, especially if you're facing financial hardship or believe the notice is a mistake. However, disregarding this notice can lead to a series of consequences, turning a manageable balance into a significant financial burden. Let's explore what can happen if you don't respond.

The Escalation Process: From Notice to Levy

The IRS uses a structured process when taxpayers don't respond to a CP14. First, you'll receive additional notices, each one more urgent. These notices will repeat the amount owed and warn you about collection actions.

For example, you may receive a CP501 notice, a final notice before collections begin, offering a last chance to pay or make arrangements.

If you continue to ignore these notices, the IRS may file a Notice of Federal Tax Lien. This lien is publicly recorded and attached to your assets, like property and bank accounts. It can significantly impact your ability to get loans, sell property, or even find a job.

The final step is a levy. A levy allows the IRS to seize assets or garnish wages to cover your tax debt.

This can include freezing bank accounts, seizing property, or taking a portion of your paycheck. The impact of a levy can be devastating, affecting your financial stability and creating long-term problems.

The Financial Penalties: Interest and Fees

Ignoring a CP14 means more than just dealing with the initial balance due. It also leads to additional penalties and interest.

The late payment penalty is 0.5% of the unpaid taxes each month the taxes remain unpaid, up to a maximum of 25%.

Interest compounds daily on the unpaid balance, increasing the total amount you owe.

Failing to respond can also mean losing certain appeal rights. If you later decide to dispute the notice, your options may be limited, making resolution more difficult.

Impact on Credit and Financial Standing

CP14 notices can have major consequences for your credit score and overall financial standing. Unpaid balances can be reported to credit bureaus, affecting your ability to get loans, credit cards, or rent an apartment.

In 2022 and 2023, public concern and media reports highlighted cases where incorrect CP14 notices were issued, impacting hundreds of thousands of taxpayers.

Learn more about CP14 notices. The potential damage to your credit makes it critical to address the notice quickly, even if you think it's wrong.

Long-Term Consequences: Future Interactions With the IRS

Ignoring a CP14 can also create problems for future dealings with the IRS. It can lead to more scrutiny during audits and make it harder to negotiate payment plans or other resolutions down the road.

A history of not responding can create a negative impression and complicate future tax filings.

By understanding what can happen if you don't act, you can make better decisions about how to handle your IRS notice CP14.

Even if you can't pay the full amount, contacting the IRS to explore payment options or dispute the notice is a crucial step.

Taking any action, big or small, is the first step toward resolving the issue and protecting your finances.

Never Again: Tax Strategies That Prevent Future Notices

Receiving an IRS notice CP14 is a hassle nobody wants to experience twice. Thankfully, proactive tax planning can significantly lower your chances of getting one again. By putting a few key strategies into action, you can create a solid system that keeps you in the IRS's good graces.

Masterful Record-Keeping: Your First Line of Defense

Well-organized financial records are crucial for preventing future CP14 notices. Keep detailed records of all income, expenses, and tax payments.

This should include pay stubs, bank statements, receipts, and any other documents that support your tax filings.

Think of it as building a solid foundation of proof – if the IRS ever questions your return, you'll have the documentation to support it.

Digital Organization: Scan and save your documents electronically. This not only saves space but also makes it much easier to find information during tax season or in case of an audit.

Categorization: Carefully categorize your expenses. Use accounting software like QuickBooks or a simple spreadsheet to track income and expenses by category. This organized approach simplifies tax preparation and helps you identify potential deductions.

Regular Review: Review your records regularly to ensure they are accurate and complete. Catching mistakes early can prevent larger problems later on.

Optimize Payment Timing: Avoiding Processing Delays

Timing your tax payments strategically can also help prevent processing issues that can sometimes trigger CP14 notices.

If paying by mail, send your payment well in advance of the deadline to account for processing time.

Electronic payments, while generally faster, should also be submitted a few days before the due date to avoid any last-minute technical difficulties.

You might be interested in: How to master tax debt settlement.

Confirmation is Key: Always get confirmation of your payment, whether it’s an electronic confirmation number or a canceled check. This acts as your proof of payment should any questions arise.

Payment Tracking: Use the IRS website to track the status of your payments. This provides peace of mind and alerts you to any potential processing delays.

Clear Communication With the IRS: Staying Informed

Open communication with the IRS is essential. If you change your address, bank information, or any other important details, notify the IRS immediately.

Keeping your information current prevents misdirected notices and ensures smooth payment processing.

Ignoring a CP14 notice can lead to serious consequences; it's also crucial to have a process for deactivating inactive users.

Online Account Access: Create an online account with the IRS to view your tax records, track payments, and manage communication preferences. This gives you direct access to your tax information and simplifies communication with the IRS.

Professional Guidance: A Proactive Approach

Regularly consulting with a tax professional can offer helpful advice and keep you ahead of potential tax problems.

A professional can advise you on tax planning strategies, optimize deductions, and ensure you are complying with all relevant tax laws.

Their expertise can help you avoid expensive errors and allow you to maintain a proactive approach to tax management.

By incorporating these preventative measures, you’ll not only reduce the risk of future IRS notices but also gain greater control over and confidence in your tax management. A proactive approach minimizes stress and allows you to focus on your financial goals.

For expert guidance on navigating the complexities of tax law and resolving IRS issues, contact Attorney Stephen A. Weisberg. With over 10 years of experience, Attorney Weisberg provides personalized solutions for individuals and businesses facing tax challenges.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034