What Is a Levy Notice? How to Protect Your Assets

What Is a Levy Notice: Breaking Down the Basics

Receiving a levy notice can be a stressful experience. It marks a serious escalation in the debt collection process, often leaving people feeling confused and anxious.

This notice grants a taxing authority, such as the IRS, the legal right to seize your assets to cover an outstanding tax debt. Understanding the fundamentals of levy notices—what they are, why they're issued, and their financial implications—is crucial for taking the right steps.

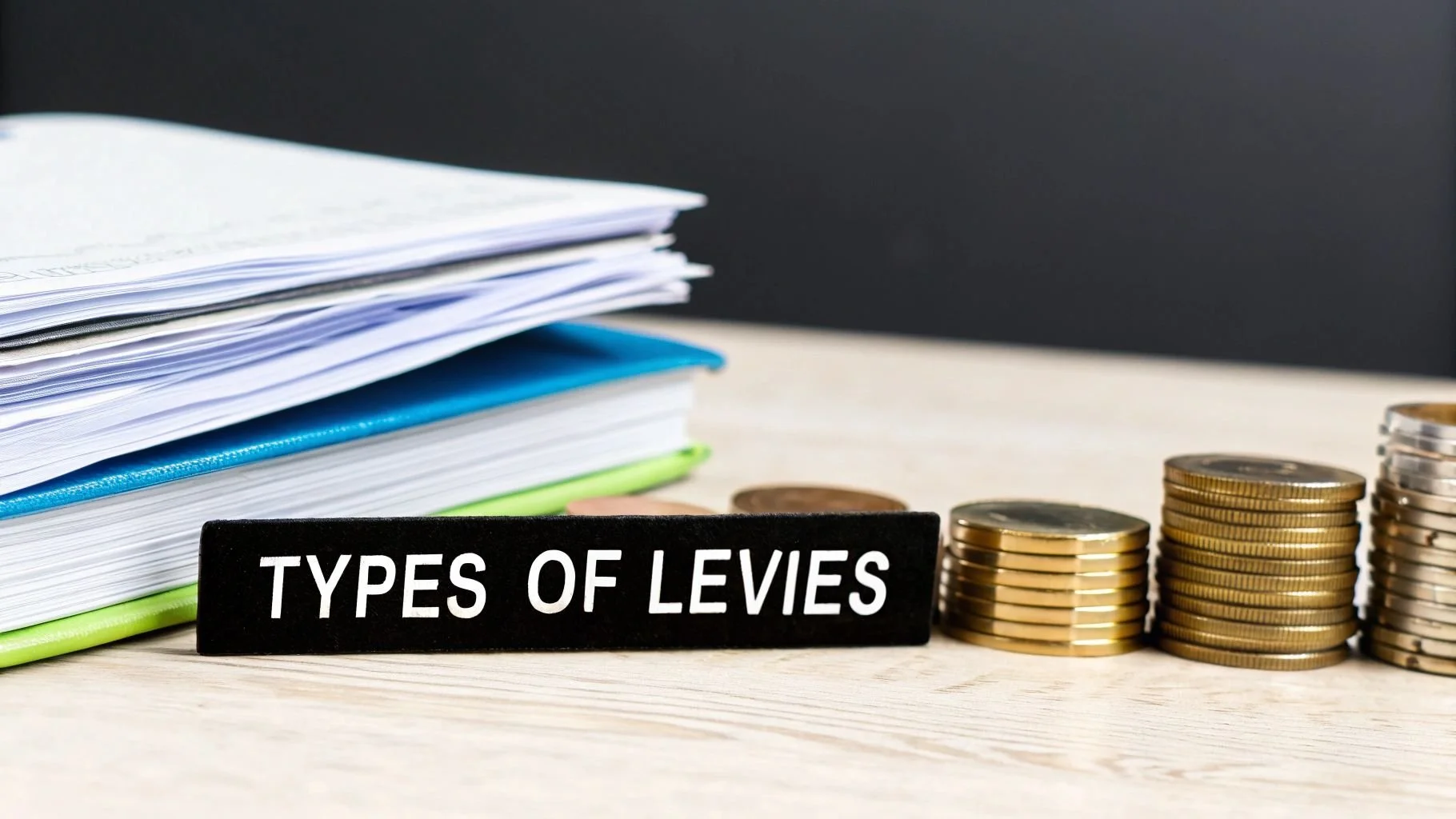

Different Types of Levy Notices

While "levy notice" is commonly linked to taxes, these notices can appear in several situations. The three primary categories are tax levies, judicial levies, and administrative levies.

Tax levies: Issued by government agencies (like the IRS) for unpaid taxes.

Judicial levies: Result from court orders regarding legal judgments or debts.

Administrative levies: Used by government agencies to collect non-tax debts, such as unpaid student loans.

Knowing these distinctions helps clarify the source and reason for the notice.

For example, the IRS issues notices for back taxes. An unpaid court judgment might lead to a notice from a local sheriff or court clerk. Identifying the issuing authority and the underlying reason for the levy is essential.

A levy notice is a critical step in tax collection. The IRS issues a 'Final Notice of Intent to Levy and Notice of Your Right to a Hearing' only after meeting strict procedures.

These include assessing the tax, demanding payment, confirming non-payment, and issuing the final levy notice at least 30 days in advance.

Why Levy Notices Are Issued

Levy notices are more than just about collecting money. They represent a vital stage in the legal process, ensuring due process and providing opportunities for resolution. The notice acts as a formal warning, allowing you time to address the debt before enforcement action.

This period provides opportunities to explore options like payment plans, offers in compromise, or challenging the debt's validity.

For further information, read: Understanding Notice of Levy

Understanding why levy notices are issued highlights the importance of acting quickly. Ignoring a notice can have serious consequences, such as asset seizure, wage garnishment, and damage to your credit rating.

Taking prompt action to understand your rights and available options is key to protecting your finances.

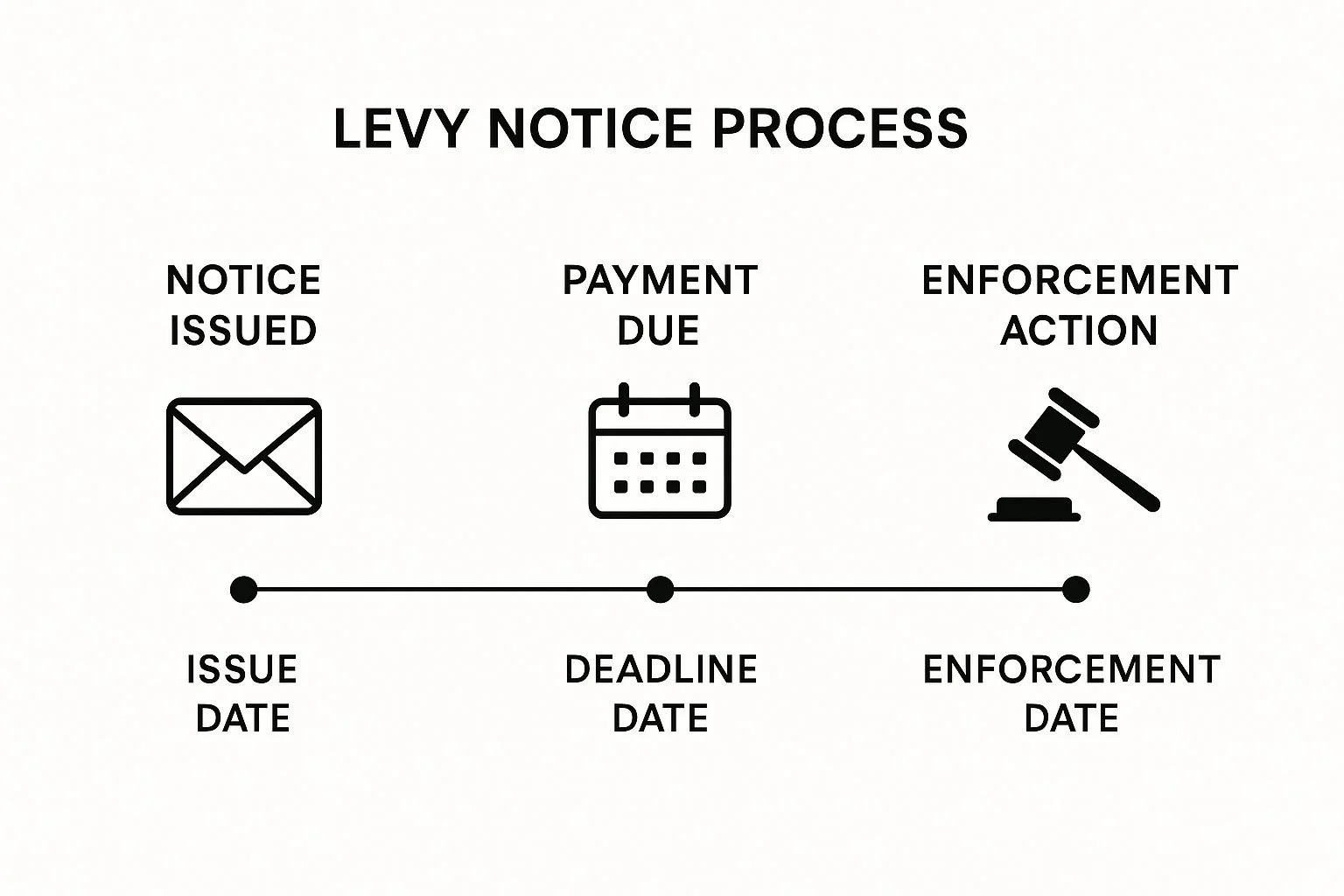

The Levy Notice Timeline: What Happens When

A levy notice doesn't just appear. It's the result of a series of events, and understanding this timeline is crucial for protecting your assets. This guide will walk you through the process, from the initial tax assessment to potential enforcement action.

From Assessment to Notice: Understanding the Triggering Events

The levy process begins with the assessment of unpaid taxes. This is when the taxing authority officially determines how much you owe.

You'll then receive a notice and demand for payment, outlining the amount due and the payment deadline. Ignoring this initial notice is a common mistake.

This inaction triggers further action from the taxing authority, often leading to additional penalties and interest on the outstanding balance.

For instance, the IRS might send several increasingly urgent notices before resorting to a levy. These notices offer opportunities to resolve the debt before more drastic measures are necessary.

It's also essential to understand the difference between a lien and a levy. A lien is a legal claim against your property, while a levy is the actual seizure of assets.

A lien is a public record of the debt and can affect your ability to sell or refinance property. A levy, however, directly impacts your finances by seizing your assets.

The Final Countdown: Notice, Deadline, and Enforcement

The timeline typically ends with a final notice of intent to levy, a formal warning that asset seizure is imminent. This notice must be sent within a specific timeframe before the levy, providing a final chance to address the debt.

This notice usually includes information about your right to a Collection Due Process (CDP) hearing. This hearing allows taxpayers to challenge the levy and present their case.

To help visualize the process, the table below outlines the key steps involved in an IRS levy.

IRS Levy Notice Timeline and Requirements

This table outlines the chronological steps in the IRS levy process and the requirements that must be met before a levy can be executed.

| Stage | IRS Action | Taxpayer Rights | Timeframe |

|---|---|---|---|

| Assessment | IRS determines the amount of tax owed | Right to appeal the assessment | Varies |

| Notice and Demand | IRS sends a notice demanding payment | Right to pay the tax or set up a payment plan | Typically within 60 days of assessment |

| Final Notice of Intent to Levy | IRS sends a final notice before seizing assets | Right to request a CDP hearing within 30 days of the notice | At least 30 days before the levy |

| Levy | IRS seizes assets to satisfy the tax debt | Right to appeal the levy | Varies |

This table summarizes the key stages and rights taxpayers have during the IRS levy process. Understanding these steps and timelines can help you protect your assets.

As the infographic shows, timely action is crucial at each stage. Delaying payment past the due date can result in enforced collection action, highlighting the importance of prompt communication and exploring resolution options.

Vulnerable Assets: What's at Risk

Knowing which assets are vulnerable to a levy is essential for planning and response. While bank accounts are a common target, other assets can be seized:

Wages: A portion of your paycheck can be garnished.

Retirement Funds: Certain retirement accounts may be subject to levy.

Pending Payments: Funds owed to you, such as accounts receivable, are vulnerable.

Property: Real estate and personal property, like vehicles, can be seized and sold.

Understanding what's at stake allows you to prioritize and protect your financial well-being. Ignoring a levy notice can have severe consequences, emphasizing the importance of proactive engagement with the taxing authority.

Remember, each stage offers opportunities to negotiate and potentially lessen the financial impact.

Beyond the IRS: How Levy Notices Work Worldwide

A levy notice is often associated with the IRS here in the United States. However, these notices aren't exclusively American. They're used around the world as powerful financial tools by governments and international organizations.

Let's explore the global landscape of levy notices and see how they're applied and implemented in different jurisdictions.

International Variations in Levy Practices

From the UK to Singapore, countries use levy notices with different procedures and regulations. The core principle remains the same—seizing assets to satisfy a debt—but the details can vary significantly.

For instance, the types of assets considered vulnerable, the notification timelines, and the taxpayer's rights can change drastically depending on the location.

Understanding local levy laws is crucial for anyone involved in international finance. Some countries also prioritize certain debts over others, impacting which assets are seized first.

Beyond Tax Collection: Specialized Applications of Levies

Levy notices aren't just for tax collection. They also play a significant role in labor markets, particularly concerning foreign worker levies. Countries like Singapore, the UAE, and Malaysia use these levies.

These foreign worker levies are fees imposed on employers for hiring foreign workers. They act as a regulatory tool, managing labor market dynamics and encouraging the hiring of local talent.

Learn more about foreign worker levies here. This shows how levies can be instruments of economic policy, not just debt collection tools.

The Global Reach of Levy Notices: International Organizations

International organizations, like the UN, also use levy mechanisms. These operate under different rules than national systems.

Often, these levies support specific programs or administrative costs, demonstrating a wider application beyond traditional debt recovery. This highlights the adaptability of the levy concept in diverse global financial situations.

Understanding the nuances of international levy notices is crucial for businesses operating globally and for expats. The varying regulations can significantly impact financial planning and business strategies.

By recognizing these global differences, individuals and businesses can better protect their assets and successfully navigate the complexities of international finance. Ignoring these differences could result in expensive legal issues or unforeseen financial burdens.

Your Levy Notice Arrived: Exact Steps To Take Now

Receiving a levy notice can be a stressful experience. But taking a proactive and informed approach can significantly influence the outcome. This guide outlines a clear action plan, detailing the steps to take when you're facing a levy notice.

Review and Verify The Levy Notice

Your first step is to carefully review the notice itself. Verify the accuracy of all the information, including the amount owed, the tax period, and your identifying details. Any discrepancies should be immediately addressed with the issuing authority.

This initial review is crucial. It confirms you're dealing with a legitimate claim and forms the basis for your response. For example, compare the notice against your own tax records. For more insights into levies, you can review this helpful guide on when the IRS freezes your client's bank account.

Understand Your Rights and Options

Tax authorities must follow specific procedures. Understanding your rights, including the right to a Collection Due Process (CDP) hearing, is essential. A CDP hearing allows you to challenge the levy, present your case, and potentially negotiate a resolution.

Don't hesitate to exercise these rights. They can have a major impact on the levy process. Also, explore all available resolution options. These can range from installment agreements to offers in compromise, each with its own requirements and advantages.

Evaluate Resolution Options

The best resolution strategy depends on your individual financial situation. Installment agreements let you pay the debt over time, often protecting your credit and preventing further collection actions.

Offers in compromise, on the other hand, allow you to settle for less than the full amount. However, these are generally reserved for situations involving significant financial hardship. Selecting the right path is crucial. It will impact your financial future and the overall effect of the levy.

Documentation and Timeline Considerations

Each resolution option has specific documentation requirements. Gathering necessary paperwork, like financial statements and tax returns, strengthens your position.

Also, pay close attention to deadlines. Responding promptly is critical to protecting your rights and achieving a favorable result. Missing deadlines can severely hinder your chances of a successful resolution. This underscores the importance of organized record-keeping and proactive communication with the taxing authority.

Navigating Special Circumstances

Certain situations, such as innocent spouse relief, might apply to your case. Innocent spouse relief can release a taxpayer from liability if their spouse or former spouse incorrectly reported income or claimed deductions. Understanding these provisions can substantially reduce your tax burden.

Effectively presenting hardship cases requires clear documentation and a compelling explanation of your circumstances.

Highlighting your financial struggles and demonstrating your inability to pay can lead to more flexible payment terms or even a temporary suspension of collection efforts.

Identifying potential procedural violations by the tax authority can also invalidate a levy. If the IRS failed to send required notices within the specified timeframe, for instance, the levy could be deemed invalid.

These specific scenarios often benefit from expert advice. A tax professional can help navigate these complexities and protect your interests.

The following table summarizes the various response options available to you:

Response Options for Levy Notices: Comparison of different response strategies to a levy notice, including their requirements, timeline, and potential outcomes

| Response Option | When to Consider | Required Documentation | Potential Outcome | Timeline |

|---|---|---|---|---|

| Installment Agreement | Unable to pay the full amount immediately | Financial statements, Tax returns | Payment plan, Prevents further collection action | Varies, typically months |

| Offer in Compromise | Significant financial hardship, Unable to pay full amount | Financial statements, Tax returns, Offer amount justification | Reduced tax liability | Varies, typically months |

| Collection Due Process Hearing | Dispute the levy, Present your case | Relevant documentation supporting your position | Levy release, Alternative collection methods | Varies, typically weeks to months |

This table provides a quick overview of the key considerations for each response. Choosing the right option is crucial for an effective resolution.

By taking these steps, you can confidently navigate the levy process and work toward a resolution that minimizes the financial impact and safeguards your future. Remember, proactive engagement and a clear understanding of your options are key to a successful outcome.

The Real Financial Impact of Levy Notices

A levy notice signifies a serious financial situation with both immediate and long-term effects. Understanding the full scope of these implications is vital for making sound decisions and minimizing potential harm. It's about looking beyond the initial debt and considering the ripple effects on your overall financial well-being.

Immediate Impacts: Disruptions to Daily Finances

The most immediate impact of a levy notice is often the disruption to your daily finances. A bank levy, for instance, can freeze your accounts, restricting access to funds needed for essential expenses.

Wage garnishment reduces your take-home pay, creating difficulties in meeting regular financial obligations. These sudden changes can make managing everyday expenses, such as rent, mortgage payments, and utilities, a real struggle.

For businesses, the repercussions can be even more dire. Levies can disrupt cash flow, put a strain on vendor relationships, and damage customer confidence.

This can lead to operational challenges, affecting the ability to pay employees, buy inventory, and fulfill contractual agreements. Planning for these scenarios is crucial for business owners facing a levy notice. You might be interested in: IRS Collection Notices.

Long-Term Consequences: Credit and Borrowing Power

Beyond the immediate disruption, levy notices can have lasting consequences on your credit score and borrowing ability. A levy can show up on your credit report, indicating to lenders a history of financial problems.

This can make it harder to secure loans, get credit cards, or even rent an apartment. These long-term effects can extend well beyond the initial tax debt, impacting your financial future for years.

In addition, the accumulation of penalties, interest, and collection fees can greatly increase the overall financial burden. The longer a tax debt goes unresolved, the more these added costs compound, increasing the total amount owed.

This makes addressing a levy notice promptly crucial for minimizing the long-term financial damage.

The Complete Cost Picture: Beyond the Initial Debt

The true cost of a levy notice goes beyond the initial tax debt. Penalties for non-payment can accumulate quickly, adding a substantial percentage to the original amount.

Interest charges continue to accrue until the debt is fully paid, further inflating the overall balance. Furthermore, collection fees charged by agencies or legal professionals add to the total cost. In some cases, legal representation becomes essential, resulting in additional legal expenses.

Moreover, international organizations also employ levy mechanisms. For example, the UN uses a 'coordination levy' on project funds exceeding $100,000 to cover administrative costs. Explore this topic further here. This highlights the broad use of levies beyond national tax collection.

Understanding the complete cost picture is essential for making informed decisions about resolution priorities.

By evaluating the potential for extra costs, you can better assess different resolution options and select the most effective approach for your individual financial situation.

This comprehensive understanding enables you to take control of your finances and reduce the long-term impact of a levy notice.

Preventing Future Levy Notices: Proactive Protection

The best way to handle a levy notice is to prevent it from ever happening. This section explores proactive strategies to help you stay off the collection radar and maintain financial control. These are the same practices tax professionals recommend to their most successful clients.

Building a Strong Financial Foundation: Record-Keeping and Communication

Meticulous record-keeping is one of the most effective ways to avoid levy notices. A well-organized system for tracking income, expenses, and tax-related documents allows you to accurately assess your tax liability and make timely payments.

This also simplifies responding to any inquiries from tax authorities. Keeping digital copies of receipts, invoices, and tax returns, for example, can save you significant time and stress if questions arise.

Open communication with tax authorities is equally important. Promptly addressing initial notices and thoroughly responding to inquiries demonstrates a willingness to cooperate and can often prevent issues from escalating.

This proactive approach builds trust and can lead to more flexible payment options if needed. Consider signing up for electronic notifications from tax authorities to receive timely updates and reduce the risk of missing critical deadlines.

Early Warning Signs and Proactive Interventions

Recognizing the early warning signs of a potential levy situation is crucial. These include consistently missing tax deadlines, accumulating tax debt, and receiving multiple notices from tax authorities. Understanding how levy notices impact your finances is critical.

For tips on improving your financial health, check out this resource on improving cash flow.

If you notice these signs, proactive intervention is essential. Voluntary disclosure programs can help rectify past non-compliance and minimize penalties.

These programs often offer reduced penalties for taxpayers who voluntarily disclose unreported income or unpaid taxes. Setting up a pre-emptive installment agreement with tax authorities is another proactive measure.

This demonstrates your commitment to paying your debt and can prevent more aggressive collection actions.

High-Risk Scenarios and Targeted Compliance

Certain situations, such as self-employment, business ownership, or owning international assets, carry a higher risk of triggering collection actions.

These scenarios often involve complex tax regulations and require specialized knowledge to ensure compliance.

Self-employed individuals, for instance, are responsible for calculating and paying their own estimated taxes, which can be challenging without proper guidance.

Understanding the specific compliance requirements for your situation is paramount. Consulting with a tax professional can ensure you meet all obligations and avoid potential pitfalls.

Staying informed about changes in tax laws and regulations can also help you adapt your strategies and maintain compliance.

For business owners, this might involve implementing robust accounting software like QuickBooks and seeking professional advice on tax planning and compliance.

By taking these proactive steps, you can significantly reduce your risk of encountering a levy notice and build a more secure financial future.

When to Call the Experts: Professional Help for Levy Notices

Receiving a levy notice can be a stressful experience. The complexities of tax regulations and the potential financial consequences can feel overwhelming.

While some situations can be managed independently, others necessitate the guidance of a professional. Understanding when to seek expert assistance is crucial for safeguarding your assets and achieving the best possible resolution.

Recognizing the Need for Professional Intervention

Several key indicators suggest that professional help is advisable. A complex tax situation, such as one involving multiple tax years or a substantial amount owed, often necessitates expert analysis and strategic planning.

If the levy notice pertains to a business, engaging professional representation can help minimize operational disruptions and protect the company's financial well-being.

Additionally, if you are experiencing financial hardship, a tax professional can assist you in exploring available options. These could include strategies like offers in compromise or currently not collectible status.

Protecting your assets is paramount. One way to achieve this is by limiting access to only active users. Learn more about managing user access: deactivating inactive users.

Finally, if you are unsure about your rights or the most appropriate course of action, consulting a professional can offer clarity and instill confidence.

For example, challenging the levy's validity due to procedural errors made by the taxing authority necessitates expertise in tax law.

Choosing the Right Professional: Tax Attorneys, CPAs, and Enrolled Agents

Various types of professionals can offer assistance with levy notices. Tax attorneys specialize in tax law and can offer legal representation in court or during negotiations with taxing authorities.

Certified Public Accountants (CPAs) possess a broad range of financial expertise, including tax preparation, planning, and representation during audits.

Enrolled Agents (EAs) are federally authorized tax practitioners who specialize in representing taxpayers before the IRS.

The selection of the right professional depends on your specific circumstances. If your situation involves legal disputes or intricate tax issues, a tax attorney is likely the best choice.

For financial planning and tax compliance assistance, a CPA can provide valuable support. If your levy notice originates from the IRS, an EA is a suitable option. Aligning the professional's expertise with your individual needs will ensure you receive the most effective representation.

Evaluating Expertise and Fee Structures

When selecting a professional, it's essential to assess both their expertise and their fee structures. Inquire about their experience handling similar levy cases and their track record of achieving positive outcomes for clients.

Discuss their fee structure, including hourly rates, flat fees, or any contingency arrangements. Understanding the costs upfront helps with budgeting and avoids unexpected expenses.

Reasonable fee structures can vary depending on the professional's experience and the complexity of the case. Tax attorneys typically command higher hourly rates than CPAs or EAs.

However, the potential return on investment (ROI) from professional representation can be significant.

A skilled professional can negotiate penalty abatements, potentially reduce the overall tax liability through offers in compromise, or even identify procedural errors that could invalidate the levy altogether.

Preparing for Your Consultation: Essential Documents and Communication

Proper preparation for your initial consultation will maximize the effectiveness of your meeting. Gather all relevant documents, including the levy notice itself, tax returns, financial statements, and any correspondence with the taxing authority.

Organizing these documents in advance allows the professional to quickly evaluate your situation and formulate a tailored strategy.

Establishing clear communication channels with your chosen professional is crucial. Discuss your objectives, concerns, and preferred methods of communication.

Regular updates and open dialogue will ensure you stay informed throughout the entire process and can make well-informed decisions. This collaborative approach cultivates a strong working relationship and increases the probability of a successful resolution.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034