IRS Notice To Levy: How To Protect Your Assets From Seizure

Understanding The IRS Notice To Levy Process

Receiving an IRS notice to levy can be a stressful event. Many taxpayers are surprised by this notice, believing it appears without warning.

However, it's the final step in a formal legal process. This process offers several chances to resolve outstanding tax debt before asset seizure.

It's designed to be fair and provide ample time for taxpayers to address their liabilities. Understanding this process is key to taking control and avoiding further complications.

Distinguishing Between Collection Notices and a Notice to Levy

It's crucial to understand the difference between standard collection notices and a notice to levy. Initial collection notices are reminders and requests for payment.

They offer several resolution options, such as setting up payment plans or submitting an offer in compromise. A notice to levy, however, signifies that the IRS is ready to seize assets to cover the debt.

This significant difference emphasizes the importance of responding to earlier notices. Ignoring these preliminary communications can have serious financial repercussions.

The IRS typically sends multiple notices before resorting to a levy. While the agency often sends about five notices, only three are legally required.

These mandatory notices are the CP14 (Notice and Demand), CP504 (Notice of Intent to Levy), and LT11 (Final Notice of Intent to Levy and Notice of Right to a CDP Hearing).

This sequence allows taxpayers multiple opportunities to address their tax debt and avoid more drastic actions. The IRS also generally issues a Collection Due Process (CDP) notice.

This notice informs taxpayers of their right to a hearing before a levy occurs, allowing them to challenge the levy or suggest alternative solutions.

Learn more about this here: Understanding Notice of Levy: The Ultimate Guide for Taxpayers Facing the IRS

Recognizing the Warning Signs

Missed warning signs often lead to an IRS notice to levy. These include ignoring initial collection notices, failing to communicate with the IRS, and not exploring available payment options.

For example, if you receive a CP14 notice and don't respond or make payment arrangements, the IRS will likely escalate collection activities, eventually issuing a notice to levy.

The IRS typically sends a series of notices before levying assets, though only some are legally mandated. Tax professionals estimate the agency sends around five notices before implementing a levy.

However, only three are required by law:

The CP14 (Notice and Demand),

CP504 (Notice of Intent to Levy),

LT11 (Final Notice of Intent to Levy and Notice of Right to a CDP Hearing).

Understanding your position in the collection timeline is vital. By recognizing the various notices and deadlines, you can take proactive steps to resolve your tax debt and protect your assets.

This knowledge helps you navigate the process effectively and seek professional guidance when needed.

Decoding Your IRS Notice To Levy Type And Timing

Understanding the type of IRS notice to levy you receive, and its associated timeframe, is crucial. Knowing this information dictates how much time you have to respond and what actions you can take.

These notices aren't random; they follow a specific order, each designed to give you a chance to address your tax debt before the IRS takes more serious action. Recognizing where you are in this process helps you make informed decisions.

Understanding the Notice Sequence

➲ The IRS notice to levy process isn’t a sudden occurrence. It's a structured series of steps, usually starting with the CP14 Notice and Demand. This notice officially states how much you owe and demands payment.

➲ If you don't respond appropriately, you'll likely receive the CP504 Notice of Intent to Levy. This notice is a serious step-up, warning you that the IRS plans to seize your assets.

➲ Finally, the LT11, Final Notice of Intent to Levy and Notice of Your Right to a CDP Hearing, arrives. This notice is your last chance to avoid levy action by requesting a Collection Due Process (CDP) hearing.

To help clarify these notices, their legal basis, and the typical timeframe for each, the table below provides a detailed comparison.

IRS Levy Notice Types and Timeframes: A Comparison of the three statutorily required IRS notices, their legal basis, and typical timing.

| Notice Type | Legal Basis | Purpose | Typical Timing | Next Steps Available |

|---|---|---|---|---|

| CP14 Notice and Demand | Internal Revenue Code Section 6303 | Officially demands payment of outstanding tax debt | Typically issued 30 days after the tax filing deadline or assessment of tax | Pay the balance, set up a payment plan, submit an offer in compromise |

| CP504 Notice of Intent to Levy | Internal Revenue Code Section 6331(d) | Informs the taxpayer of the IRS’s intent to levy assets | Typically issued 10–30 days after the CP14 notice if no response or payment is received | Pay the balance, set up a payment plan, submit an offer in compromise |

| LT11 Final Notice of Intent to Levy and Notice of Right to a CDP Hearing | Internal Revenue Code Sections 6330 and 6331(i) | Final notice before levy action, informing the taxpayer of their right to a CDP hearing | Typically issued at least 30 days after the CP504 notice | Request a CDP hearing within 30 days of the notice date, explore alternative payment options, seek professional tax advice |

As you can see, each notice offers a window of opportunity to resolve your tax debt. Taking swift action at each stage is essential to protect your assets and financial well-being.

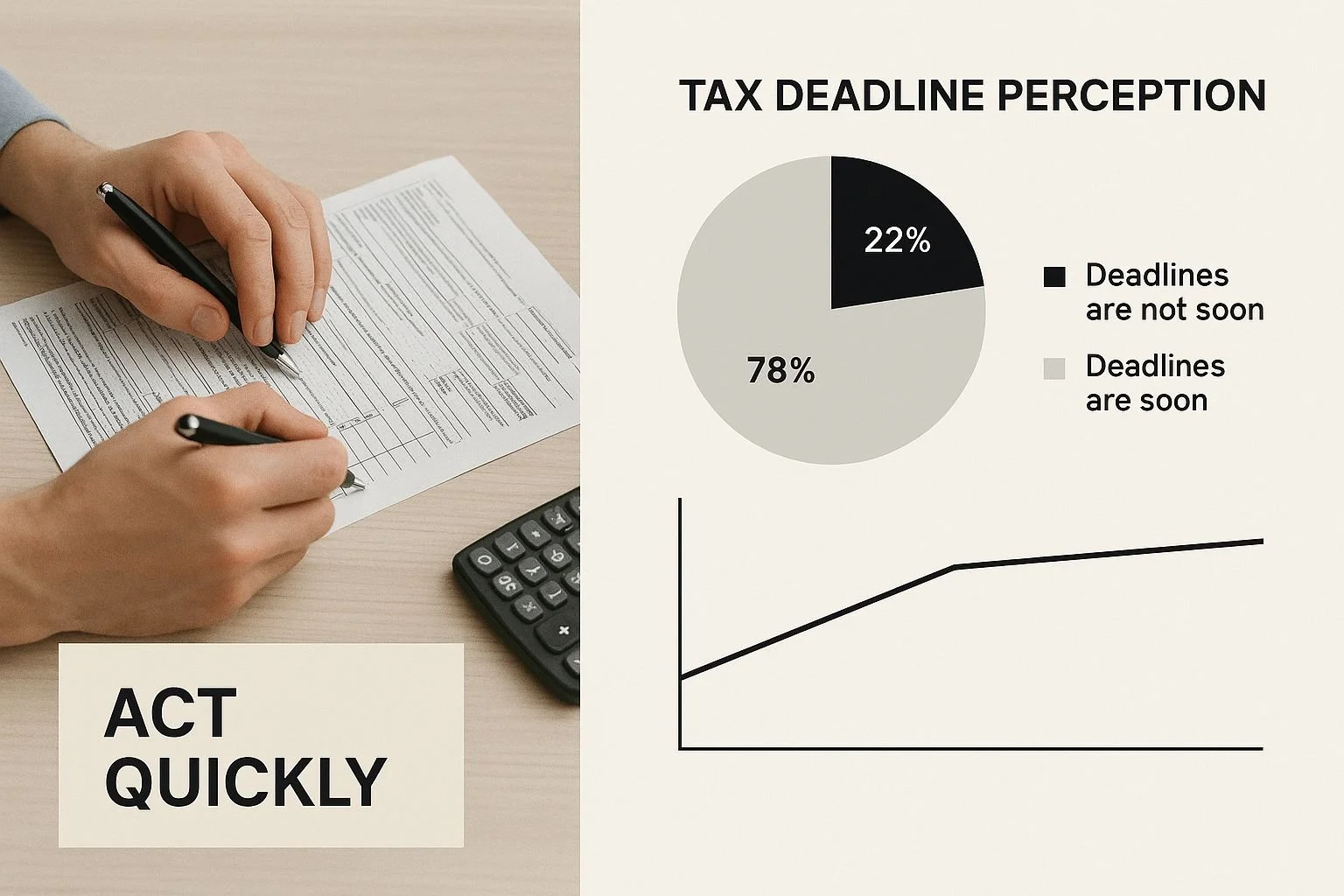

This image highlights the importance of responding promptly to IRS notices. Delaying action can have severe consequences, including the seizure of your assets.

Misconceptions About IRS Notices

One common misconception is that receiving an IRS notice automatically means your assets are about to be seized.

This isn’t true. Each notice, particularly the CP14 and CP504, offers opportunities to negotiate with the IRS and explore alternative payment options.

Another misconception is that ignoring the notices will make the problem disappear. In reality, this can accelerate the levy process.

Ignoring notices leads to escalating collection activities, increased penalties and interest, and ultimately, a quicker path to asset seizure.

Understanding the purpose and timeline of each notice allows you to take control of the situation. You can then decide on the best course of action.

This might involve negotiating a payment plan, getting professional help, or requesting a CDP hearing to protect your rights and explore all available options.

How IRS Wage Garnishment And Asset Seizure Actually Works

When the IRS transitions from sending notices to taking action, the financial repercussions can be significant. However, it's important to understand the key differences between wage garnishment, bank levies, and property seizures. Knowing these distinctions can help you protect your financial stability.

Wage Garnishment: A Continuous Levy

Wage garnishment is a continuous levy, meaning your employer is instructed by the IRS to withhold a portion of your earnings each pay period until your tax debt is settled.

The percentage withheld is determined by your filing status and the number of dependents you claim. Think of it like a recurring bill, but instead of paying a creditor, the money goes directly to the IRS.

For practical steps to address this, you might find this resource helpful: How to stop IRS wage garnishment.

Bank Levies: A One-Time Seizure

Unlike the ongoing nature of wage garnishment, a bank levy is usually a one-time event. The IRS issues a levy to your bank, freezing the funds in your account up to the total amount of your tax debt.

This can happen quickly, sometimes within 24 hours of the IRS contacting your bank. The key difference here is that the IRS takes the available funds at that specific time and doesn't continue to take from future deposits.

Property Seizures: The Last Resort

Seizing property is typically a last resort for the IRS when collecting unpaid taxes. This involves the IRS seizing and selling assets such as vehicles, real estate, or other valuable possessions to cover the outstanding debt.

The IRS generally starts with more liquid assets, like bank accounts and wages, before resorting to property seizures. This is a more complex and lengthy process compared to wage garnishment or bank levies.

Understanding the Continuous Levy

The IRS has broad authority for continuous levies, especially on wages and salaries. According to IRS policy, a wage levy is considered continuous, remaining in effect until the debt is fully paid or other specific conditions are met.

Levies on other assets, like bank accounts or property, apply only to what’s available at the time the levy is received. This critical distinction highlights the importance of understanding the type of levy you're facing. It’s a crucial factor in developing an effective response strategy.

Knowing the procedures for each type of levy can help you anticipate the potential impact on your finances and allows you to take appropriate action.

This knowledge empowers you to make informed decisions about managing your tax debt and protecting your assets.

Facing an IRS levy notice can be intimidating, but understanding the process is the first step toward regaining control.

Your Rights And Real Options When Facing An IRS Levy

Receiving an IRS notice to levy can be a stressful experience. However, it's crucial to remember you have rights and options available to you.

The Taxpayer Bill of Rights offers legal protections, ensuring your right to representation, the ability to appeal, and the possibility of alternative payment arrangements. Understanding these provisions can be crucial for protecting your financial well-being.

Understanding Your Rights

The Taxpayer Bill of Rights is more than just a document; it's your safeguard. It guarantees fair treatment by the IRS, the right to representation, and the opportunity to appeal decisions.

You have the right to a clear explanation of IRS procedures and your rights within those procedures. This transparency is essential when navigating the complexities of the tax system.

You may find this helpful: How to master appealing an IRS decision.

Collection Due Process Hearings: Your Best Weapon

A Collection Due Process (CDP) hearing is often the most effective tool for challenging an IRS levy. This hearing provides a platform to present your case before an independent appeals officer.

You can explain your financial situation and explore alternatives, such as a payment plan or an Offer in Compromise (OIC). This hearing offers a chance to find a resolution that avoids the seizure of your assets.

Requesting Levy Releases

In certain situations, you can request the IRS to release a levy. This is especially important if the levy causes significant financial hardship, such as preventing you from covering essential living expenses.

Documenting your hardship thoroughly and presenting a strong case to the IRS is vital. This can greatly improve your chances of securing a release.

To help you understand your rights and available options, let's look at the following table:

Taxpayer Rights and Available Relief Options

Overview of key taxpayer protections and resolution options when facing IRS levy action

| Right/Option | Description | Time Limit | Requirements | Best Used When |

|---|---|---|---|---|

| Taxpayer Bill of Rights | Guarantees fair treatment, representation, and appeals. | Ongoing | N/A | Always applicable |

| Collection Due Process Hearing (CDP) | Opportunity to challenge a levy before an appeals officer. | 30 days after notice | Must file Form 12153 | Facing an IRS levy |

| Levy Release | Request to remove a levy causing hardship. | Varies | Proof of hardship | Levy creates significant financial difficulty |

| Installment Agreement | Payment plan for tax debt. | Varies | Agreement with IRS | Unable to pay full amount immediately |

| Offer in Compromise (OIC) | Settle tax debt for less than the full amount. | Varies | Meets specific criteria | Unable to pay full amount due to financial hardship |

This table summarizes key taxpayer rights and relief options available when facing an IRS levy. Understanding these options is the first step towards resolving your tax issues.

Exploring Payment Alternatives

The IRS offers several payment alternatives to avoid a full levy. Installment agreements allow you to pay your tax debt through monthly payments.

Offers in compromise (OIC) allow you to settle for a lower amount than what you owe. These alternatives provide flexibility and can help prevent the severe consequences of a full levy. The best option depends on your unique financial situation.

Special Protections and Unique Circumstances

The IRS offers specific protections for certain taxpayers, including innocent spouse relief. If you face a levy due to your spouse’s tax liability, you might qualify for relief.

The IRS also considers special circumstances such as severe illness or unemployment. These protections demonstrate the IRS’s commitment to fairness and recognizing individual circumstances. Exploring these avenues can offer vital relief when dealing with a notice to levy.

Step-By-Step Actions To Stop An IRS Levy Before It Starts

Time is critical when you receive an IRS notice to levy. Taking the right steps, in the right order, can protect your assets and help you avoid financial hardship. This guide provides a practical, step-by-step approach to navigate this challenging situation.

1. Gather Essential Documentation

Before contacting the IRS, gather your important financial documents. This includes tax returns, notices from the IRS, bank statements, pay stubs, and any other relevant financial records. Having this information organized and readily available will streamline the process and demonstrate your proactive approach.

2. Contact the IRS Immediately

Act quickly when you receive an IRS notice to levy. Research shows that taxpayers who respond within the first 30 days have a 73% higher success rate in negotiating payment plans or getting levies released. Learn more about IRS response timing This initial contact is crucial for understanding the details of your situation and your options.

3. Understand Your Levy Notice and Options

Different levy notices have different meanings. Identify the specific notice you received – CP14, CP504, or LT11 – to understand the severity and urgency.

Each notice represents a different stage in the levy process. Knowing which notice you have received helps you determine the right course of action and available timeframe.

Check out our guide on: IRS Take 401k: Understanding Your Rights & Protections

4. Explore Payment Plan Options

The IRS offers several payment plans, including Installment Agreements and Offers in Compromise (OIC). An Installment Agreement allows you to pay your tax debt over time. An OIC allows you to settle your debt for less than the full amount you owe. Determining your eligibility for these plans is a crucial step in avoiding a levy.

5. Consider a Collection Due Process Hearing

A Collection Due Process (CDP) Hearing allows you to challenge the levy before an independent appeals officer. This hearing provides an opportunity to present your case, explain any financial hardship, and potentially negotiate a better solution. It's a valuable tool for protecting your assets.

6. Seek Professional Assistance

If you feel overwhelmed or uncertain about the best course of action, consider seeking professional help from a tax attorney or enrolled agent. They have specialized knowledge of tax law and IRS procedures.

Their expertise can guide you through the complexities, negotiate on your behalf, and improve the likelihood of a favorable outcome.

7. Honest Communication and Realistic Promises

Be honest and upfront with the IRS about your finances. Making promises you can't keep will harm your credibility and reduce your chances of resolving the issue. Open communication and accurate information can help build trust and facilitate a productive discussion.

8. Monitor Your Progress

After taking action, stay engaged with the process. Regularly monitor your account, confirm payment arrangements, and promptly respond to any communication from the IRS. This proactive approach is essential for ensuring the levy process is stopped and preventing future problems.

Working With Tax Professionals And Long-Term Protection

Navigating an IRS notice to levy can be a daunting experience. While some tax situations are easily handled on your own, levy proceedings often require professional expertise to achieve the best possible result. Understanding when to seek professional guidance and what different tax professionals offer is key to effectively resolving an IRS levy.

Choosing The Right Tax Professional

Several types of tax professionals can help with IRS levy issues. Enrolled Agents (EAs) are federally-authorized tax practitioners specializing in representing taxpayers before the IRS.

They possess in-depth knowledge of tax law and IRS procedures, particularly concerning collection matters. Tax Attorneys have the legal expertise to represent you in court if needed, and they can advise you on your rights and legal options.

Certified Public Accountants (CPAs) specializing in tax can also provide valuable assistance, particularly in complex financial situations.

Choosing the right professional depends on your individual needs and the specifics of your situation. If you are dealing with a relatively straightforward levy issue, an EA might be sufficient.

However, if your case involves complicated legal questions or potential litigation, a tax attorney is likely a better choice. If your financial situation is complex or you require assistance with broader tax planning, a CPA specializing in tax could be essential.

Evaluating Potential Representatives

When choosing a tax professional, carefully consider their experience, qualifications, and communication style. Seek professionals with a proven track record of successfully handling IRS levy cases. Also, consider their fees and ensure they fit within your budget. Similar to choosing a doctor, selecting a tax professional requires careful vetting.

Experience: How many levy cases have they handled? What were the typical outcomes?

Qualifications: Are they an EA, tax attorney, or a CPA specializing in tax? Are they licensed in your state?

Communication: Are they responsive and easy to communicate with? Do they explain complex topics clearly?

Fees: Are their fees transparent and reasonable? Do they offer different fee structures?

The Benefits of Professional Intervention

Professional intervention can significantly improve the outcome of an IRS levy case. Tax professionals understand the intricacies of tax law and IRS procedures.

They can effectively negotiate on your behalf, handle complex paperwork, and represent you in a CDP hearing. This expertise often leads to better resolutions, including reduced penalties, more manageable payment plans, or even the release of the levy.

Cost Vs. Benefit: Weighing Your Options

The cost of hiring a tax professional is understandably a major concern for taxpayers facing an IRS levy. However, it's important to weigh the potential cost of professional fees against the potential savings and peace of mind they offer.

A professional might save you money in the long run by negotiating lower penalties, setting up a more manageable payment plan, or preventing the seizure of your assets. These potential benefits often outweigh the initial cost of their services.

Long-Term Tax Protection: Preventing Future Problems

Beyond addressing the immediate issue of an IRS levy, long-term tax planning is crucial for preventing future tax problems.

This includes keeping accurate records, making estimated tax payments if necessary, and staying compliant with tax laws.

A tax professional can help create a sustainable tax plan tailored to your specific financial situation.

Tax Planning: Develop a proactive strategy to manage your taxes year-round.

Estimated Payments: Make regular estimated tax payments to avoid penalties for underpayment.

Compliance: Stay informed about changes in tax laws and maintain accurate records.

By taking these steps, you can regain control of your finances, avoid future issues with the IRS, and achieve long-term financial stability. Just as regular maintenance prevents car trouble, ongoing tax planning helps keep your finances healthy.

Key Takeaways For IRS Levy Protection

Facing an IRS levy notice can be stressful. But understanding the process and taking action can protect your assets. This section offers key takeaways to help you navigate this difficult situation.

Prioritize Immediate Action

Respond Promptly: Never ignore an IRS notice. Responding within 30 days significantly improves your chances of a successful resolution. This quick action can be key to negotiating a payment plan or even getting a levy released.

Gather Your Documents: Organize your financial information, including tax returns, IRS notices, bank statements, and pay stubs. Having these ready streamlines communication with the IRS, making discussions about your finances more efficient.

Contact the IRS: Reach out to the IRS directly. This allows you to understand your debt, confirm its accuracy, and discuss possible solutions. Open communication is a crucial first step.

Understand Your Situation and Rights

Decode the Notice: Determine the notice type (CP14, CP504, or LT11). This clarifies the urgency and your options. Each notice represents a different stage in the levy process, and knowing where you stand helps you plan.

Know Your Rights: Familiarize yourself with the Taxpayer Bill of Rights. This document outlines your rights, including representation and the ability to appeal IRS decisions. Understanding your rights helps you navigate the process.

Explore Payment Alternatives: The IRS offers several payment options, such as installment agreements and offers in compromise. Researching these helps you find the best fit for your finances.

Measure Your Progress and Seek Help When Needed

Track Your Communications: Keep records of all letters and phone calls with the IRS. This documentation is vital if disputes arise. A detailed log ensures clarity on the steps taken and agreements made.

Seek Professional Guidance: If you're feeling lost or unsure, consult a tax professional like an Enrolled Agent or Tax Attorney. They can offer expert advice, negotiate with the IRS, and represent you in a CDP hearing.

Set Realistic Expectations: Resolving an IRS levy takes time and effort. There’s no quick fix. Realistic expectations help manage stress and promote a proactive approach.

Long-Term Tax Compliance

Plan for the Future: After resolving the levy, create a long-term tax plan. This includes accurate record-keeping, timely payments, and staying informed about tax law changes. This helps maintain financial stability.

Consistent Compliance: Accurately file your taxes, pay on time, and keep organized financial records. This builds good habits and reduces future tax problems.

Regular Check-ins: Periodically review your tax situation. Check for outstanding balances, verify payment schedules, and ensure you’re following current tax laws. Regular check-ins help you stay on track.

Taking control begins with understanding your rights and options. Don’t face the IRS alone. Contact Attorney Stephen A. Weisberg today for a free Tax Debt Analysis and begin resolving your tax issues.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034