How to Remove a Tax Lien: Complete Recovery Playbook

Understanding What You're Really Up Against

A tax lien can feel overwhelming. But understanding what it is is the first step toward resolving it. Essentially, it's a legal claim the government puts on your property when you haven't paid your taxes. This claim acts as security for the debt.

Think of it as a "hold" on your assets. This hold prevents you from selling or refinancing without first addressing the tax issue. It doesn't mean the government immediately takes your property.

The lien simply establishes their right to do so if the debt remains unpaid. This can be especially problematic if you're trying to sell property, as the lien must be resolved before the sale can go through.

Different Types of Liens and Their Impact

Tax liens come in different forms, each with specific consequences. Federal tax liens, issued by the IRS, cover unpaid federal income taxes. State tax liens are issued by individual state governments for unpaid state taxes. There are also property tax liens for unpaid property taxes.

Each type of lien affects your credit and finances. Knowing which kind you have is crucial for figuring out how to remove it. For example, a federal tax lien means working with the IRS, while a state tax lien involves your state's tax agency.

The IRS files hundreds of thousands of federal tax liens every year to secure overdue tax payments. In fiscal year 2003 alone, over 548,000 tax liens were filed.

Timeline and Resolution Strategies

How long it takes to resolve a tax lien depends on the situation and how you choose to address it. The process starts with the taxing authority filing the lien, followed by notification to the taxpayer. Then, the taxpayer has several options: full payment, payment plans, or negotiated settlements.

The lien stays until the debt is paid or another solution is found. This whole process, from filing to resolution, can take months or even years if not handled properly. But with a proactive and strategic approach, it can be much faster.

Immediate and Long-Term Effects

The immediate effects of a tax lien are often the most worrying. These include trouble selling or refinancing property, potential credit problems, and the stress of having a government claim on your assets. But these effects aren't all permanent.

While a lien can complicate your short-term financial plans, it doesn't have to be a lifelong setback. Once the lien is removed, you can manage your assets freely again. With a solid plan and consistent effort, the long-term impact can be minimized.

By choosing the right approach and understanding the process, you can regain control of your financial future.

The Full Payment Route That Actually Works

Paying off your tax debt is the most direct way to remove a tax lien. However, there's a right way and several wrong ways to approach this. Success requires careful planning and execution. This means understanding your total debt, contacting the correct IRS departments, and ensuring proper documentation at every step.

Calculate Your Total Debt

Before making any payments, determine exactly how much you owe. This includes not only the original tax amount but also any accrued interest and penalties. An accurate calculation prevents future issues and ensures the lien is fully satisfied. The IRS website provides tools and resources to help you determine your total balance.

Contact the Right Department

The IRS is a large organization, and contacting the right department is crucial for efficient processing. Don't just send a check and hope for the best. Instead, contact the specific department handling your lien. This direct communication clarifies any questions about your payment and confirms it's applied correctly to your account.

Ensure Proper Documentation

Throughout the process, meticulous record-keeping is essential. Maintain copies of all correspondence, payment confirmations, and other relevant documents. This documentation provides proof of payment and helps resolve any discrepancies that might arise later. For example, if your payment isn't correctly applied, your records will be crucial in rectifying the issue.

Understanding Payment and Release Timelines

Once you've made your full payment, the IRS is legally obligated to release the lien within 30 days.

However, delays can occur. In the first nine months of fiscal year 2004, about 22%—nearly 23,000—of taxpayers who had satisfied their tax liability didn't have their liens released on time.

Explore this topic further. This highlights the importance of following up after 30 days if you haven't received confirmation.

Check out our guide on How to qualify for tax forgiveness.

Payment Plans and Lien Withdrawal

Even if full payment isn't immediately possible, payment plans can lead to lien withdrawal. A withdrawal is different from a release. A release acknowledges the debt is paid but leaves a record of the lien.

A withdrawal removes the lien entirely from public records. This distinction is important for your credit and financial future. Negotiating a payment plan with the IRS may involve specific requirements for lien withdrawal.

Crucial Follow-Up Steps

After your lien is released or withdrawn, take final steps to ensure its complete removal from public records. This involves requesting confirmation from the IRS and checking with credit reporting agencies. This verification provides peace of mind and confirms the lien no longer affects your finances.

You might be interested in: How to master. By following these steps, you can successfully navigate the full payment route and remove a tax lien.

Smart Alternatives When Full Payment Isn't Possible

Dealing with a tax lien can be stressful, especially when paying the full amount upfront seems impossible. The good news is that other options exist to help you manage your lien and regain control of your finances. These options involve exploring solutions like installment agreements and settlements.

Installment Agreements: A Path to Lien Withdrawal

An installment agreement lets you pay off your tax debt in monthly payments. This offers a manageable approach to handling the lien without the pressure of immediate full payment. Successfully completing your installment agreement can even result in a lien withdrawal.

This means the lien is completely erased from public records. It's as if it never happened. This is a much better outcome than a lien release, which simply acknowledges the debt was paid but still leaves a public record of the lien.

You may also want to consider Currently Not Collectible status with the IRS. This status can offer temporary relief from payments if you’re experiencing significant financial hardship.

Offers in Compromise: Settling for Less

An Offer in Compromise (OIC) allows you to settle your tax debt for less than what you originally owed. This option is available under specific circumstances, usually when there are questions about whether the full debt can be collected. An accepted OIC resolves the lien and gives you a chance for a fresh financial start.

However, understanding the qualifications and the process involved is crucial. The IRS often collects a significant portion of tax debts from taxpayers whose income is greater than their allowable living expenses or who have assets that can satisfy the debt.

A study of roughly 13,000 taxpayers, each generally owing between $10,000 and $25,000, revealed that about 93% of collected funds came from these taxpayers. Read the full research here. This underscores the importance of demonstrating real financial hardship when pursuing an OIC.

Subordination and Discharge: Managing Your Lien

Even if a lien remains active, options like subordination and discharge can provide some financial flexibility. Subordination allows other creditors to take priority over the IRS lien. This can be beneficial when refinancing or securing new loans.

Discharge, on the other hand, removes the lien from specific assets. This allows you to sell or refinance those assets while still working to resolve your overall tax debt.

These options offer strategic ways to manage your financial situation as you work towards a full resolution. For instance, if selling a property would improve your financial standing, discharging the lien on that property can make the sale possible.

This can help you generate funds to address your tax debt and move closer to your financial goals. Understanding these alternatives can help you navigate the complexities of a tax lien and find the best solution for your situation.

Withdrawal Vs. Release: The Difference That Changes Everything

When dealing with a tax lien, understanding the difference between a withdrawal and a release is essential. This seemingly minor difference can have a major effect on your financial health. Making the right choice is vital for true financial recovery.

Defining Withdrawal and Release

A tax lien release acknowledges that you’ve fully paid your tax debt. It's essentially a receipt. While a release removes the legal claim against your assets, the lien itself may still appear on public records. This can create obstacles when you apply for loans or credit.

A tax lien withdrawal, on the other hand, completely removes the lien from public records. It's as if the lien never existed. This clean slate is the best possible outcome for your financial history. It's not just about paying off a debt; it's about erasing it from your record.

When To Pursue Withdrawal

Full payment often leads to a release. However, specific situations might qualify you for a withdrawal. These typically involve cases where the lien was filed incorrectly, or if you've entered and successfully maintained an IRS-approved payment plan.

A withdrawal might also be an option if it benefits both you and the IRS in collecting any remaining tax liability. For more insights into resolving tax debt, consider reading Settling IRS Debt: A Smart Guide to Tax Relief Success.

Criteria For Withdrawal Approval

The IRS uses specific criteria to evaluate withdrawal requests. These often include demonstrating that the initial lien filing was a mistake, showing a consistent history of complying with tax regulations, and proving you can manage your finances responsibly.

Understanding these criteria is crucial for a successful application.

Strengthening Your Application

A carefully prepared application significantly increases your chances of approval. This involves providing thorough documentation of your tax history, including payment records and any communication with the IRS.

Clear, concise, and accurate information is essential to show your commitment to resolving the tax issue.

Processing Timelines and Denied Requests

Withdrawal requests typically take longer to process than releases. A release is often processed within 30 days of full payment, while withdrawals can take several months. If your request is denied, don't be discouraged.

Understanding the reason for the denial allows you to address the issue and resubmit a stronger application.

By April 2018, tax liens were removed from U.S. consumer credit reports, reflecting a trend to minimize their impact. However, for liens filed before this change, the difference between 'withdrawal' and 'release' was critical.

A release simply noted payment but left a record for up to seven years, while a withdrawal erased the lien from credit history entirely.

Learn more about the impact of tax liens on credit reports. This highlights the long-term advantages of pursuing a withdrawal whenever possible.

Avoiding The Mistakes That Cost You Time And Money

Dealing with tax liens can be a stressful and complex process. Even with the best intentions, taxpayers can make mistakes that lead to additional costs and delays.

These errors can range from simple paperwork problems to more complex communication issues with the IRS. This section will help you understand the common pitfalls and how to avoid them.

Timing Is Everything: Act Promptly

Addressing a tax lien quickly is crucial. The longer you wait, the more penalties and interest will accumulate, increasing your overall debt. Acting promptly minimizes the total amount owed and speeds up the removal process.

Addressing a lien within the first few months can significantly impact your final cost compared to waiting a year or more. Learn more about potential options in our article about IRS tax forgiveness programs.

Maintain Meticulous Records

Keeping organized records is essential throughout the tax lien process. Maintain copies of all correspondence with the IRS, including payment confirmations and any other related documents.

These records will help you track your progress, verify payments, and resolve any discrepancies that might arise. Having readily available documentation will also demonstrate your proactive engagement with the issue.

Strategic Communication: Knowing When to Follow Up

Communicating with the IRS is important, but knowing when to follow up is key. Too many inquiries can actually slow down the process. Strategic follow-ups, such as checking in 30 days after a payment, are more effective than daily contact. This balanced approach keeps you informed without being overly persistent.

Dealing With Errors and Disagreements

If you find errors in the lien or disagree with the debt amount, address these issues promptly and professionally. Provide supporting documentation to back up your claims. This might involve contacting the IRS directly or consulting with a tax professional to help navigate the process.

Knowing When to Seek Professional Help

While some tax lien situations can be handled independently, others benefit from professional expertise.

Complex tax situations, significant debt amounts, or difficulty communicating with the IRS are all indicators that seeking professional guidance might be beneficial.

A tax professional can help save you time, money, and reduce stress in the long run.

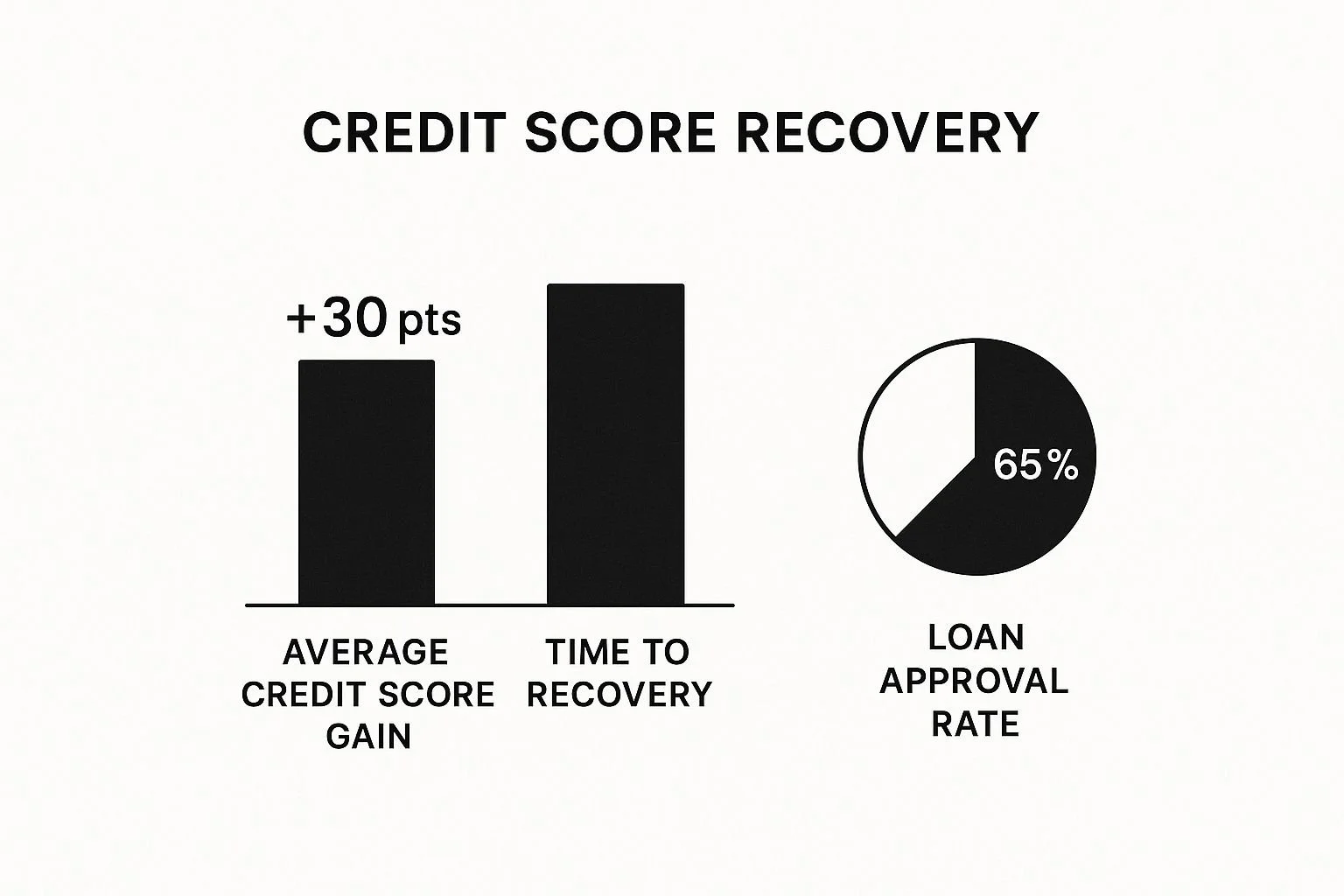

To help visualize the impact of successful lien removal, we've included the following infographic:

As the infographic shows, removing a tax lien can improve your credit score by an average of +30 points, shorten recovery time to around 6 months, and increase loan approval rates to 65%. These improvements highlight the long-term financial advantages of successfully resolving a tax lien.

The following table further details different lien removal methods:

Lien Removal Methods Comparison: A comprehensive comparison of different tax lien removal methods, their requirements, timelines, and credit impact

| Removal Method | Requirements | Typical Timeline | Credit Impact | Best For |

|---|---|---|---|---|

| Withdrawal | Proof of error in the lien filing | Varies, typically a few weeks to a few months | Positive, removes the lien from credit report | Situations where the lien was filed in error |

| Release | Full payment of the tax debt | Immediate upon payment | Positive, demonstrates resolution of the debt | Taxpayers who can afford to pay the full amount |

| Offer in Compromise (OIC) | Demonstrated inability to pay the full amount | Several months to a year | Positive, but may still reflect a negotiated settlement | Taxpayers who cannot afford to pay the full amount |

| Subordination | Demonstrating that the lien is hindering the sale of a property | Varies, typically a few weeks | Can be positive, allows for property sale despite the lien | Taxpayers needing to sell property to address the debt |

By avoiding common mistakes and using the strategies outlined above, you can greatly improve your chances of a positive outcome and get back on the path to financial stability.

Key Takeaways For Your Lien Removal Success

Successfully removing a tax lien requires a strategic approach. This involves understanding your options, careful planning, and consistent effort. This guide offers practical advice, drawing from the experiences of taxpayers who have successfully resolved their lien issues.

Checklists For Each Removal Method

A clear checklist keeps you organized and ensures you don't miss any crucial steps. Here's a breakdown:

Full Payment: Calculate the total debt (including interest and penalties). Gather the necessary funds. Contact the appropriate IRS department. Make the payment. Request confirmation. Verify the lien release within 30 days.

Payment Plan: Determine your eligibility. Gather financial documents. Contact the IRS to propose a plan. Obtain a written agreement. Adhere to the payment schedule. Request lien withdrawal upon completion.

Offer in Compromise (OIC): Assess your eligibility. Gather financial information. Complete the OIC application. Submit all required documentation. Follow up with the IRS. Adhere to the agreement terms if accepted.

Subordination/Discharge: Determine which option best suits your needs. Gather relevant property and financial documents. Submit a request to the IRS. Follow up on the decision. Proceed with the sale or refinance.

Realistic Timelines and Expectations

Understanding realistic timeframes helps manage expectations and avoid frustration.

Full Payment: Lien release typically occurs within 30 days of payment. However, delays can occur. Be prepared to follow up.

Payment Plan: Negotiating and approving a payment plan can take several weeks or months. The overall timeline for completing the plan depends on the agreed-upon terms.

OIC: The OIC process can take several months or even up to a year. Be patient and persistent throughout the process.

Subordination/Discharge: Processing these requests typically takes several weeks. The timeline can vary depending on the complexity of the case.

When to Seek Professional Help

Knowing when to handle lien removal yourself and when to seek professional help can save you time and money.

DIY: If your tax debt is relatively small, the lien is straightforward, and you're comfortable communicating with the IRS, you might be able to handle the process yourself.

Professional Help: Consider consulting a tax attorney if your tax debt is substantial, the lien is complex, you're facing multiple liens, or you're having difficulty communicating with the IRS. A tax professional can navigate the complexities and represent your best interests.

Maintaining Momentum and Handling Setbacks

Staying motivated and handling setbacks effectively are essential for success.

Track Your Progress: Use your checklists and timelines to monitor your progress. Celebrate milestones, both big and small.

Stay Organized: Maintain a dedicated file for all lien-related documents. This helps you stay on top of deadlines and requirements.

Don't Give Up: Setbacks can occur. Be persistent and don't get discouraged. Seek professional advice if you encounter unexpected challenges.

Long-Term Tax Compliance

Removing a tax lien is a significant accomplishment, but it's important to ensure you don't encounter these challenges again.

Understand Your Tax Obligations: Familiarize yourself with tax laws and regulations to prevent future issues.

File and Pay on Time: Set reminders and create a system for timely filing and payments.

Seek Professional Advice When Needed: Don't hesitate to consult a tax professional if you have any questions or concerns.

These takeaways provide a practical guide for your lien removal journey. By understanding the process, staying organized, and seeking help when needed, you can achieve a successful resolution and maintain long-term tax compliance.

For expert guidance and personalized support, contact Attorney Stephen A. Weisberg. Our team has over 10 years of experience helping individuals and businesses resolve their tax issues and regain financial stability.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034