How to Get Reasonable Cause Penalty Abatement From the IRS

Understanding When You Actually Qualify for Reasonable Cause Relief

Let's be real, "reasonable cause" isn't some magic IRS loophole. It's a specific legal term, and understanding its nuances can make or break your penalty abatement request. Over the years, I've seen how knowing this can mean a quick resolution or a long, drawn-out fight with the IRS.

What the IRS Considers "Reasonable Cause"

The IRS doesn't expect you to be perfect, but they do expect ordinary business care and prudence. Did you act like a responsible person would in the same situation? That's the heart of a good reasonable cause penalty abatement argument.

Think a fire destroying your records, or a major illness keeping you from filing. Those are things the IRS gets. Just forgetting? Not so much.

The IRS also understands life happens. They want to see that you tried to be careful and responsible, even if something unexpected stopped you from meeting your tax obligations. You might find this helpful: Penalty Abatement - IRS Reasonable Cause.

Why "I Forgot" Isn't Enough

Saying "I forgot" almost never works as reasonable cause. The IRS expects you to have a system – calendar reminders, a tax pro, something – to manage your taxes.

But if your CPA landed in the hospital during tax season? Different story. That shows you were trying to be responsible but couldn't control what happened.

Showing ordinary business care is key. It means showing you acted responsibly within your situation and means.

A small business owner doesn't have the same resources as a corporation, and the IRS knows that. The important thing is to document what you did.

So, how does this all work in practice? You can ask for penalty abatement by showing a reasonable cause for not meeting your tax obligations.

This often means showing you practiced ordinary business care and prudence.

This might start with a protest letter, and maybe even an appeal. Got a CP15 Notice? You can protest. Rejected? Appeal, or even file a Collection Due Process Hearing Request.

The IRS's Large Business and International Division handles a lot of these, especially for penalties on late-filed forms like Form 5471.

Learn more about reasonable cause to abate IRS penalties. Understanding reasonable cause will completely change how you approach your abatement request. It's about showing responsibility, not just making excuses.

Gathering Documentation That Actually Convinces the IRS

Let's be honest: a simple letter explaining your situation rarely cuts it when you're trying to get a reasonable cause penalty abatement from the IRS.

I've been through this process with countless clients, and believe me, solid documentation is key. Think of it like building a court case – you need hard evidence to support your claims.

What the IRS is Looking For

The IRS isn't interested in excuses; they want proof. Think along the lines of medical records, death certificates, business contracts, bank statements, or even things like fire reports and police reports. Official correspondence with the IRS itself can also be incredibly valuable. These documents tell a story that goes beyond your words.

A letter from a third-party professional, like a doctor or CPA, can add even more weight to your argument. These professionals lend credibility and an unbiased perspective.

Also, don't forget to document any attempts you made to comply. Did you reach out to the IRS for an extension? Did you try to file, even if it was late? Showing you made an effort helps your case significantly.

Organizing Your Documentation: A Case for Reasonable Cause

Imagine presenting your case to a judge. You wouldn't just hand over a messy pile of papers, would you? You’d organize it meticulously, creating a clear, easy-to-follow narrative. Do the same with your abatement request.

Here are some tips to organize your documentation effectively:

Chronological Order: Present your documents in the order they occurred, painting a clear picture of the timeline.

Clear Labeling: Use tabs or labels to identify each document and its relevance to your case.

Cover Letter Summary: Write a concise cover letter highlighting the key documents and how they connect to your argument for reasonable cause.

Index (For Larger Packages): If you have a lot of documentation, an index makes it even easier for the IRS to navigate.

This organized approach demonstrates your seriousness and helps the IRS understand your situation quickly.

Before we move on, let's look at a handy table to further illustrate what kind of documentation you might need for your specific situation:

Essential Documentation Types for Common Reasonable Cause Scenarios

| Scenario | Primary Documentation | Supporting Evidence | Timeline Requirements |

|---|---|---|---|

| Serious Illness | Medical records, hospitalization records | Doctor's statements, prescription records | Dates of illness corresponding to tax deadline |

| Death of a Family Member | Death certificate | Obituary, estate documents | Date of death in relation to tax deadline |

| Natural Disaster | Insurance claim, photos of damage | Police reports, government disaster declarations | Dates of disaster impact & tax deadline |

| Fire or Theft | Police report, insurance claim | Photos of damage, repair bills | Dates of incident & tax deadline |

This table offers a snapshot of how you might approach documentation. Remember to tailor it to your specific circumstances.

Common Mistakes That Can Hurt Your Case

One common mistake is overwhelming the IRS with irrelevant paperwork. They don't need your entire life story. Stick to documents directly related to the penalty and your reason for requesting abatement.

Another pitfall is failing to connect your circumstances to the specific tax obligation you missed. Explain exactly how your documented circumstances prevented you from meeting that particular requirement.

For example, if it's about a late filing penalty, demonstrate how your reasonable cause prevented you from filing on time.

Finally, avoid vague statements. "I was sick" isn't convincing. "I was hospitalized with pneumonia for three weeks, as shown in these medical records, preventing me from accessing my tax documents," is much stronger. Be specific.

The right documentation, presented effectively, significantly increases your chances of success. It's about building a compelling, evidence-based case for reasonable cause penalty abatement.

Why the IRS Actually Wants to Abate Your Penalties

I know this might sound crazy, but the IRS isn't out to get you with penalties. They actually want to remove legitimate ones. Seriously. It seems counterintuitive, but their own internal data shows it's true.

Once you get how this whole system works, you’ll feel much better about requesting reasonable cause penalty abatement. You might even find this interesting: IRS Tax Forgiveness Program.

Not All Penalties Are Created Equal

The IRS handles penalties in different ways. Think of those annoying late filing penalties. Those are often automatically generated by computers, no human involved.

Other penalties happen after an examination, where someone actually looks at your specific situation. This difference is a big deal.

Why? Automatically generated penalties have a much higher chance of being removed. They’re often applied across the board and then fixed later after someone takes a closer look. This means you’ve got a better shot at success with these kinds of penalties.

For example, penalties for not reporting foreign information often get slapped on automatically, then later removed for reasonable cause.

Between 2018 and 2021, the IRS abated 74% of these penalties (by number) and 84% (by dollar value) under Sections 6038 and 6038A of the Internal Revenue Code.

This tells us something: the IRS’s own policies often lead to too many penalties being assessed, which wastes everyone’s time and resources dealing with abatements.

Back in 2017, the IRS abated about 64% of these penalties, and in the years after, that number jumped as high as 78% of the initial dollar assessments. This high abatement rate shows that many penalties are systematically applied and later corrected.

Discover more insights about foreign information penalties.

Knowing this is key to creating a good strategy for penalty abatement. Understanding which penalties are usually removed at higher rates can really boost your chances of success.

Why This Matters for Your Case

Look, the IRS isn't trying to make your life miserable. They have a system, and sometimes that system messes up. Knowing that the IRS frequently fixes its own mistakes through abatement should make you feel a bit better.

You're not up against an impossible opponent; you're working within a system that knows it's not perfect.

This insider info lets you approach your request strategically, putting your energy into the types of penalties most likely to be removed. Remember, reasonable cause penalty abatement isn't just a long shot; it happens all the time.

Crafting Your Abatement Request Like a Professional

Let's be honest, writing a penalty abatement request to the IRS can feel intimidating. It's not just about stating your case; it's about telling a convincing story.

I've looked at tons of these requests, and I've got a good feel for what gets results. The secret sauce? Blending legal accuracy with a human touch. You need to check all the IRS boxes while making your situation relatable to the person reviewing your case.

Structuring Your Request for Maximum Impact

The way you structure your letter is super important. A powerful opening gets right to the point, establishing the basis of your "reasonable cause" claim right away. Don't make them hunt for it!

For example, start strong with something like, "This letter requests abatement of penalties for the late filing of Form 941 due to the unexpected hospitalization of our CFO during the filing period." Boom. You've set the scene.

Next, tell your story clearly and concisely. Lay out the events that led to the penalty in a chronological timeline, showing exactly how the incident prevented you from fulfilling your tax obligation.

Be precise and stick to the facts. Instead of saying "we had some business problems," explain the specific issues and how they directly stopped you from filing on time.

Remember, you want the reviewer to connect with your situation on a human level while maintaining a professional tone. Let them see the real-world impact of the events. This personal touch can be incredibly powerful.

Supporting Your Narrative with Evidence

A good story needs proof. This is where your documentation comes in. Include copies of medical records, legal documents, or anything else that backs up your claim. A well-organized package of supporting documents strengthens your narrative and gives your request serious credibility.

Here’s a snapshot of the IRS information on Form 843, which you use for claiming refunds of taxes, penalties, and interest:

This screenshot shows the different types of claims you can make using Form 843 and emphasizes the importance of having a valid "reasonable cause" for your claim.

Addressing Potential Objections Proactively

A really smart move is to anticipate any questions the IRS might have and address them directly in your letter. This shows you've thought it through and reinforces your argument.

For example, if you're claiming reasonable cause due to a natural disaster, acknowledge that the IRS might wonder why you didn't file an extension. Explain why that wasn't possible given the circumstances.

Concluding with a Clear Call to Action

Your closing should summarize your request and clearly state what you want: penalty abatement. Make it easy for the reviewer to say yes. Restate your commitment to meeting your tax obligations and express confidence that the IRS will understand your situation.

Dealing with the IRS can be daunting. For more tips on navigating the process, check out this helpful resource: How to Negotiate IRS Debt.

By writing a professional, well-supported request, you dramatically improve your chances of success. It’s all about presenting a convincing narrative, backed by solid evidence, that clearly demonstrates why you deserve relief.

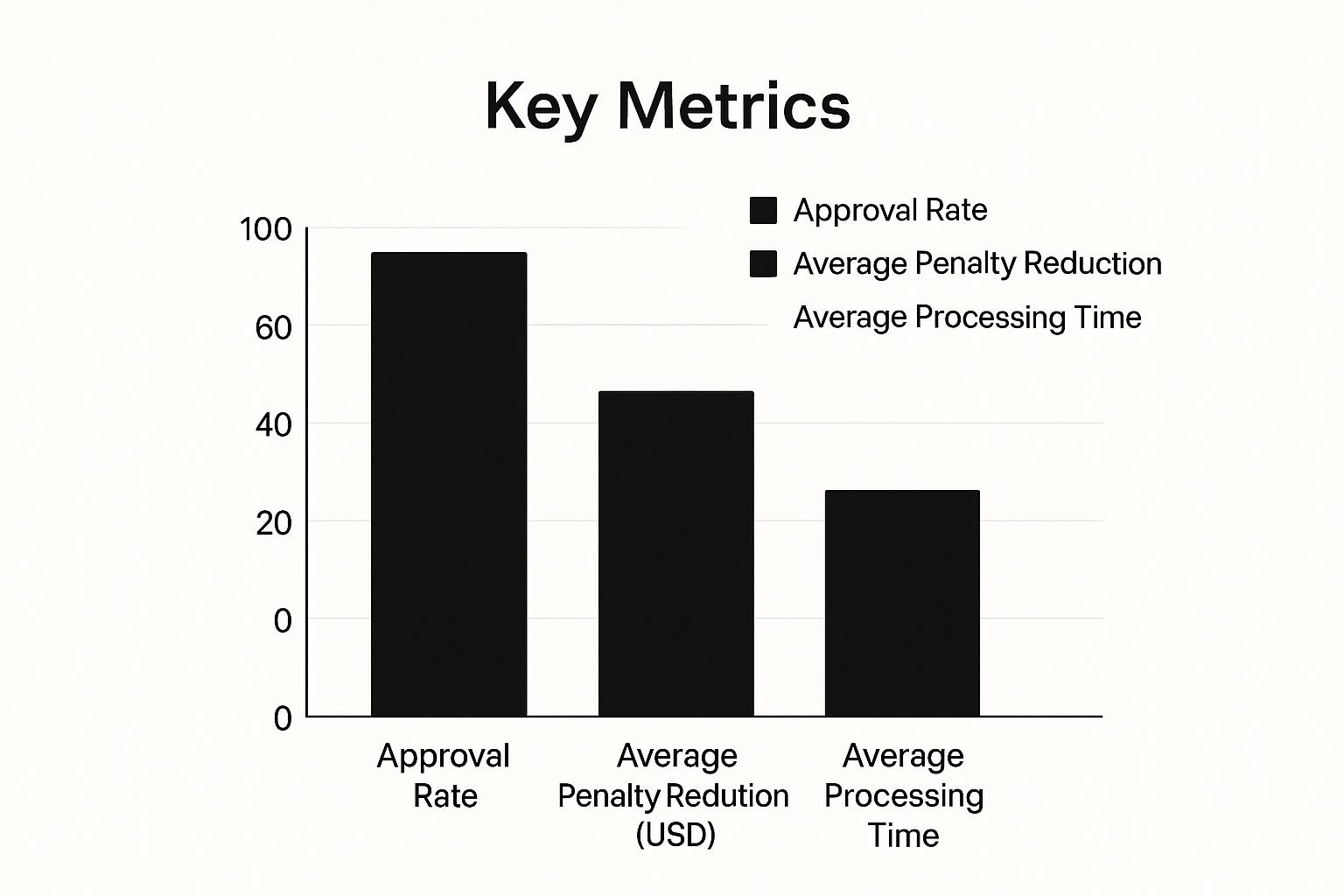

Decoding IRS Penalty Assessment Patterns

The infographic above gives you a visual snapshot of key data in reasonable cause penalty abatement. It shows things like approval rates, average penalty reductions, and how long the process typically takes.

Notice how the timing and the type of penalty can really affect your chances. For instance, automatically generated penalties tend to be processed quicker and often have better approval odds.

Manually reviewed penalties, while slower, can lead to bigger dollar reductions if you win.

Not all IRS penalties are the same. Some are like a robot—automatically triggered by the system, such as many late filing penalties. Others involve a human actually reviewing your case, usually during an audit.

This is a crucial piece of the puzzle when you're going for reasonable cause penalty abatement. Different penalties call for different strategies.

Automated vs. Manual Penalty Assessments

Penalties slapped on during audits are tougher to get rid of than those automatically generated. This makes sense. If a human has already looked at your situation and decided a penalty is justified, it's a harder battle.

On the other hand, automatically generated penalties are often applied broadly and later reversed if you can show reasonable cause. Knowing this helps you focus your efforts where they’ll likely have the biggest impact.

Let's talk about the reasonable cause abatement process. The outcomes can vary dramatically based on whether penalties are systemic (automatic) or manual. Systemic penalties tend to have higher abatement rates.

For example, systemic penalties under IRC §§ 6038 and 6038A have abatement rates between 55% and 72% by number and around 40% by dollar value.

Now, compare that to penalties assessed manually during examinations, which have significantly lower abatement rates. This difference highlights the need for a more nuanced approach to penalty assessments, one that's less automated and fairer to taxpayers.

The Taxpayer Advocate Service has pointed out these high abatement rates, suggesting they point to flawed policies that lead to too many penalties being assessed in the first place.

The following table provides a clearer view of these differences:

| Assessment Type | Abatement Rate (by Number) | Abatement Rate (by Dollar) | Best Strategy |

|---|---|---|---|

| Automated (e.g., late filing) | Higher (e.g., 70%) | Moderate (e.g., 40%) | Prompt response, clear documentation |

| Manual (e.g., audit penalties) | Lower (e.g., 30%) | Potentially Higher (case-by-case) | Strong justification, legal representation |

This table summarizes the key differences in abatement rates and suggests optimal strategies based on the assessment type. As you can see, understanding the type of penalty you’re facing is critical for determining the best approach.

Timing is Everything

Even the IRS has busy and slow periods. Understanding these cycles can significantly improve your chances of a successful abatement. Submitting your request during peak times could mean a long wait.

Filing during the off-season might result in faster processing. Knowing when to submit and follow up is just as important as what you submit.

People often overlook this timing aspect, but it's crucial for effectively navigating the reasonable cause penalty abatement process. Knowing the IRS's internal patterns can give you a real advantage.

Following Up Without Being a Pest (But Getting Results)

Submitting your reasonable cause penalty abatement request is like sending a message in a bottle. You’re hoping it reaches its destination, but you don’t want to just toss it in the ocean and forget about it.

I’ve helped plenty of people navigate this process, and a good follow-up strategy can really make a difference.

Understanding the IRS's Internal Processes

The IRS isn't one giant machine. It’s more like a collection of different teams, each handling specific parts of the penalty abatement process. Knowing this helps you focus your follow-up efforts.

For example, a penalty from an automated assessment might go to a different department than one from an audit. This inside baseball can have a big impact on how quickly your case moves.

The Art of the Follow-Up

When you follow up, be prepared. Have your taxpayer identification number, the penalty details, and your submission date handy. This helps the IRS representative quickly find your file and give you an update. It’s like calling customer service – they need your account number to help you efficiently.

Here are some tips from my experience:

Initial Contact: Give the IRS at least 30 days to process your request before you reach out.

Be Polite and Professional: IRS agents are people too! A little courtesy goes a long way.

Document Everything: Keep a record of every conversation – who you spoke with, when, and what was discussed. This creates a helpful history if things get complicated.

When to Escalate (and How to Do It Right)

If your initial follow-up doesn't get you anywhere, it might be time to escalate. The Taxpayer Advocate Service can be a great resource for tricky tax issues. They can step in on your behalf and help you navigate the system.

But don’t jump to escalation too quickly. Give the normal process a fair chance. Escalation is a useful tool, but it’s not always the first step.

Preparing for Appeals

Sometimes, even with the best follow-up, your penalty abatement request might be denied. Don’t give up! You can appeal the decision.

Appealing takes careful preparation. Read the denial letter closely and understand why the IRS rejected your request. Gather any additional supporting documents that address their concerns. A strong appeal can often turn things around.

Effective follow-up for reasonable cause penalty abatement isn't about being annoying; it’s about being proactive. It's about keeping your case on track, getting updates, and working constructively with the IRS. Doing so can significantly improve your chances of success.

Your Reasonable Cause Success Roadmap

So, we've covered a lot of ground. Now, let's map out how to actually use all this info. This isn't just a summary; think of it as your personalized game plan for tackling reasonable cause penalty abatement.

I'll give you realistic timelines, important milestones, and even point out some common traps to avoid. Plus, we’ll discuss when calling in a pro might be a good idea.

Building Your Action Plan

I like to break this whole process down into manageable phases. Here's what that looks like:

Assessment: First, a gut check. Do you really have reasonable cause? Be brutally honest. "I forgot" just won't fly with the IRS. If you legitimately fit the IRS definition of reasonable cause, then you’re heading in the right direction. Here's a helpful resource: How to Qualify for Tax Forgiveness.

Documentation: Now, gather your supporting evidence. Think medical records, legal documents, emails – anything that backs up your story. Organize it clearly and chronologically. Make it easy for the IRS reviewer to connect the dots.

Crafting Your Request: Write a clear, concise letter explaining your situation. Directly link your reasonable cause to the penalty. Keep your tone professional and respectful, and address any potential IRS pushback before they raise it.

Submission and Follow-Up: Send your request via certified mail (always keep a copy!). Follow up after 30 days. Be persistent, but don’t be a nuisance.

Pitfalls to Avoid

I've seen a lot of reasonable cause requests, and trust me, these are the most common mistakes people make:

Insufficient Documentation: A simple letter explaining your situation isn't enough. You need hard evidence. Think receipts, bills, medical records - whatever substantiates your claim.

Unclear Narrative: Don’t just present the facts; tell a story. Clearly explain how your reasonable cause directly resulted in the penalty.

Ignoring IRS Procedures: Follow the IRS guidelines exactly. Using the wrong forms or sending your request to the wrong address can cause major delays.

Giving Up Too Easily: If your initial request is denied, don't give up! You can appeal the decision. Persistence can pay off.

When to Seek Professional Help

Sometimes, these situations get complicated fast. If you're dealing with a significant penalty, a complex tax issue, or a particularly difficult IRS agent, professional help might be your best bet. A tax attorney specializing in penalty abatement knows the ins and outs of the system and can advocate for you effectively.

What Happens If Your Request is Denied?

If you get a denial, don't panic! It’s not the end of the world. Read the denial letter carefully to understand the IRS's reasoning. You might just need to provide more documentation or tweak your argument. Sometimes, a second request, or even an appeal (especially with a pro on your side), can turn things around.

Remember, reasonable cause penalty abatement is possible. With a solid plan, good documentation, and a bit of persistence, you can successfully navigate the IRS penalty process. Contact Attorney Stephen A. Weisberg today for a free tax debt analysis and learn how he can help you navigate the complexities of IRS penalty abatement.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034