Small Business Tax Checklist: Simplify Your 2025 Taxes

Navigating the Tax Maze: A Simplified Approach for Small Businesses

Tax season doesn't have to be a headache. This small business tax checklist provides six actionable steps to simplify your tax obligations and minimize your tax liability.

Whether you're a sole proprietor, run an LLC, or manage an S corporation, understanding these key areas will streamline your tax preparation and ensure compliance.

From choosing the right business structure and tracking expenses to planning for estimated taxes and maximizing deductions, this checklist covers essential elements of a successful small business tax strategy.

Use this small business tax checklist to prepare for a stress-free tax filing experience.

1. Business Structure and Tax ID Documentation

A crucial first step in your small business tax checklist is establishing the correct business structure and obtaining the necessary tax identification numbers.

This foundational element determines how your business will be taxed, influences your personal liability, and serves as your official identity with tax authorities like the IRS.

Failing to address this correctly from the outset can lead to significant tax liabilities and legal complications down the road, making it a top priority for any small business owner.

This documentation is essential for small business tax compliance, and its importance earns it a spot at the top of this checklist.

This process involves choosing a structure—sole proprietorship, partnership, LLC, S-Corporation, or C-Corporation—and acquiring the appropriate tax IDs.

Each structure has different tax implications, levels of administrative complexity, and liability protections.

For instance, a sole proprietorship offers simplicity but doesn't separate your personal liability from the business, while an S-Corp can offer potential tax advantages by reducing self-employment taxes but requires more stringent record-keeping.

Your choice will impact everything from how you file your taxes to your legal responsibilities.

Features of this step include:

Securing an EIN (Employer Identification Number) if required (essential for businesses with employees or structured as corporations or partnerships)

Filing the necessary business formation paperwork with your state (like Articles of Organization for LLCs or partnership agreements)

Obtaining state tax IDs and registration certificates, and filing for a DBA (Doing Business As) certificate if your business operates under a name different from its legal name.

Pros of Properly Handling Business Structure and Tax ID Documentation:

Liability Protection: Structures like LLCs and corporations offer a degree of separation between your personal assets and business debts, protecting you from personal liability in case of lawsuits or business failures.

Tax Advantages: Certain structures, such as S-Corps, may reduce self-employment taxes.

Financial Clarity: Establishes a clear legal and financial separation between personal and business finances, simplifying accounting and tax preparation.

Business Legitimacy: Essential for opening business bank accounts, applying for business credit, and contracting with other businesses.

Cons to Consider:

Compliance Costs: Some structures have higher compliance costs, including annual reporting fees and more complex tax filing requirements.

Potential for Higher Tax Liability: An incorrectly chosen structure can lead to a higher overall tax burden.

Complexity: More complex structures require more extensive record-keeping and accounting practices.

Tax Consequences of Changes: Changing structures later can trigger tax consequences, so careful planning is essential.

Examples of Successful Implementation:

A consulting business forming an S-Corporation to potentially reduce self-employment taxes while maintaining pass-through taxation.

A real estate investor using an LLC structure for liability protection while maintaining tax simplicity.

Actionable Tips for Small Business Owners:

Consult Professionals: Consult with both a qualified tax professional and an attorney before selecting a business structure to ensure you choose the best option for your specific situation.

Secure Documentation: Keep your EIN letter, formation documents, and other tax-related paperwork in secure, easily accessible digital and physical locations.

Annual Review: Review your business structure annually to ensure it still aligns with your business goals and tax situation.

Maintain Separate Finances: Maintain strict separation between business and personal finances regardless of your chosen structure to simplify accounting and protect your personal assets.

Learn more about Business Structure and Tax ID Documentation for guidance on potential structure changes.

By prioritizing business structure and tax ID documentation within your small business tax checklist, you lay a solid foundation for compliance, minimize potential liabilities, and position your business for financial success.

This proactive approach is crucial for navigating the complexities of the tax system and ensuring the long-term health of your business.

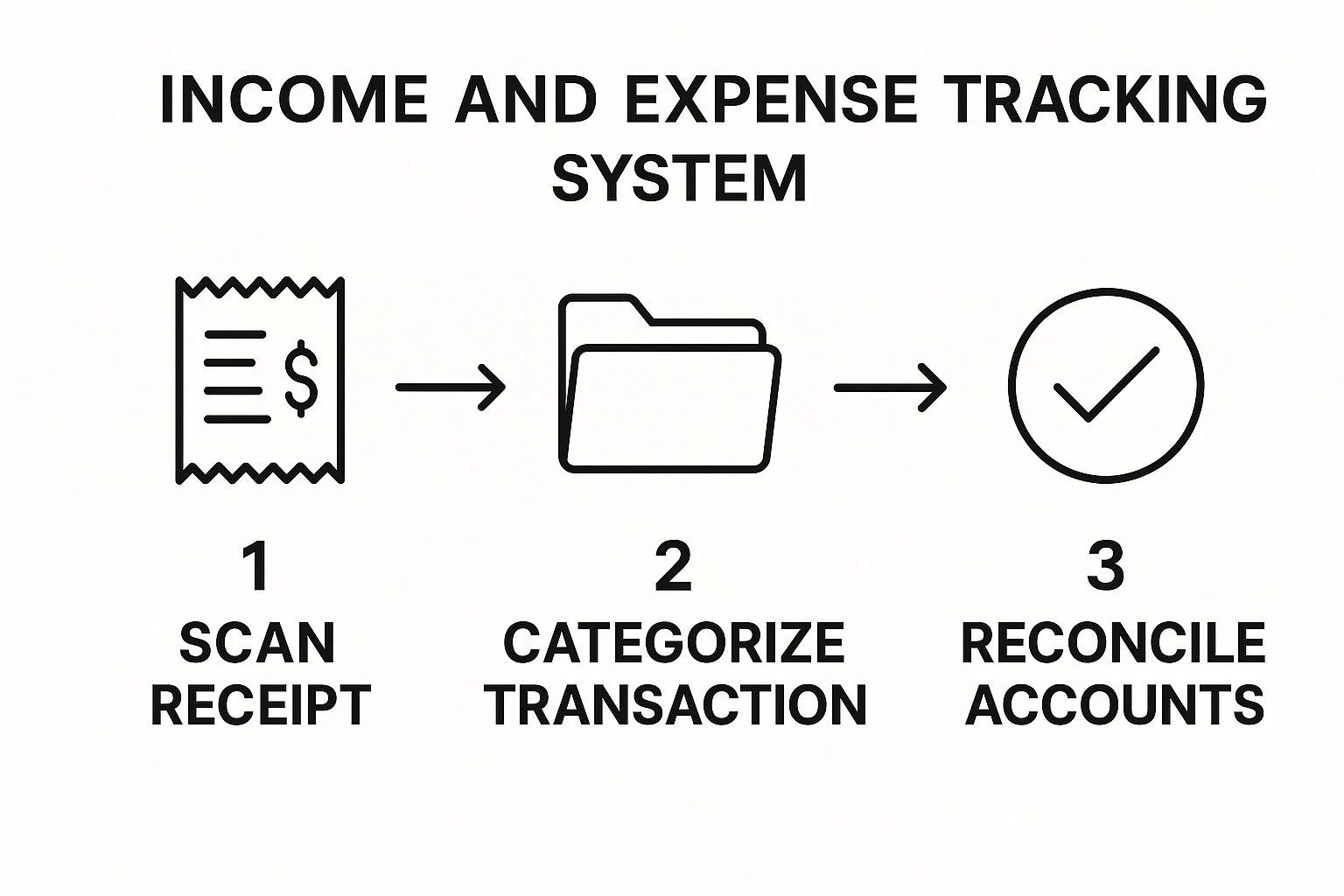

2. Income and Expense Tracking System

A robust income and expense tracking system is paramount for any small business, especially when it comes to navigating the complexities of tax season.

This crucial element of a small business tax checklist ensures accurate tax filing, helps maximize deductions, and provides essential documentation for audit protection.

It involves implementing a structured approach to recording all financial transactions, encompassing software solutions, meticulous receipt management, and a well-defined categorization system.

This comprehensive approach captures the full financial picture of your business, providing you with the necessary data to manage your finances and comply with tax regulations.

The infographic above illustrates the cyclical process of income and expense tracking for small businesses. It begins with choosing a suitable tracking method, encompassing options like spreadsheet software, accounting software, or even dedicated mobile applications.

Next, it emphasizes the importance of diligent daily recording of all income and expenses, followed by categorizing these transactions for tax reporting and analysis purposes.

The cycle concludes with regular reviews and reconciliation, ensuring accuracy and identifying potential tax-saving opportunities.

This continuous process fosters financial awareness and simplifies tax preparation. The visual representation reinforces the importance of each step and how they contribute to a streamlined financial management system.

Features of a comprehensive system include:

Cloud-based accounting software with mobile accessibility

Receipt scanning and digital storage capabilities

Income categorization aligned with tax reporting requirements

And expense categories that correspond to Schedule C or other relevant business tax forms.

Bank and credit card integration for automatic transaction importing further streamlines the process.

Why this is crucial for your small business tax checklist:

This system is fundamental because it directly impacts your ability to accurately calculate your tax liability, claim eligible deductions, and substantiate your financial records in case of an audit.

Without a proper tracking system, you risk overpaying taxes, missing out on valuable deductions, or facing penalties for inaccurate reporting.

Pros:

Real-time financial visibility: Monitor profit and loss status at any time.

Reduced tax preparation stress: Organized records simplify the tax filing process.

Minimized risk of missed deductions: A systematic approach ensures all eligible deductions are identified and claimed.

Audit protection: Provides comprehensive documentation to support your tax filings.

Improved cash flow management: Tracking expenses facilitates better financial planning.

Cons:

Software costs: Quality accounting software often requires subscription fees.

Time investment: Setting up and maintaining the system requires dedication.

Integration challenges: Compatibility issues between different platforms can arise.

Security risks: Digital financial data is susceptible to security breaches.

Examples of Successful Implementation:

A freelance photographer using QuickBooks Online to track income by service type (e.g., weddings, portraits) and expenses by category (e.g., equipment, travel), attaching digital copies of all receipts.

An e-commerce business leveraging specialized inventory management software integrated with their accounting system to accurately track cost of goods sold.

Actionable Tips:

Regularly categorize transactions: Dedicate 15-30 minutes weekly to categorize transactions and process receipts.

Customize expense categories: Create categories aligned with your specific business deductions.

Separate business and personal finances: Use dedicated business bank accounts and credit cards.

Implement a naming convention: Establish a consistent system for naming digital receipts and documents.

Automate recurring transactions: Utilize automation rules within your software to categorize recurring expenses.

Popularized By: Intuit (QuickBooks), Xero, FreshBooks, Wave Accounting

By prioritizing the implementation of a robust income and expense tracking system, small businesses can significantly improve their financial management, simplify tax preparation, and minimize potential tax liabilities.

This proactive approach ultimately contributes to the long-term financial health and success of the business.

3. Quarterly Estimated Tax Payment Schedule

Staying on top of your taxes is crucial for any small business, and a key component of this is understanding and adhering to the quarterly estimated tax payment schedule.

Unlike employees who have taxes withheld from each paycheck, most small business owners, including self-employed individuals, sole proprietors, single-member LLCs, multi-member LLCs, S corporations, and independent contractors, are responsible for paying their income tax and self-employment tax in installments throughout the year.

This system, designed to manage cash flow and prevent large, year-end tax bills, helps avoid underpayment penalties and fosters better budgeting for tax obligations. This is an essential item on any small business tax checklist.

The quarterly estimated tax payment system involves calculating your projected tax liability for the year and dividing it into four equal payments.

These payments are typically due on April 15th, June 15th, September 15th, and January 15th of the following year. This schedule aligns with the typical filing deadlines for individual income tax returns.

To facilitate these payments, the IRS provides Form 1040-ES for federal estimated taxes. Additionally, many states also require estimated tax payments and have their own specific forms and procedures.

It's advisable to consult with a tax professional or refer to your state’s department of revenue website for specific guidelines.

Electronic payment options, available through both the IRS and state tax portals, offer a convenient and efficient method for submitting these payments.

These platforms, such as the Electronic Federal Tax Payment System (EFTPS), provide confirmation receipts for your records.

Examples of Successful Implementation:

Consultant: A consultant might set aside 30% of each client payment into a dedicated tax savings account, then make quarterly payments from this fund. This proactive approach ensures that funds are readily available when tax payments are due.

E-commerce Business: An e-commerce business might work with their accountant after each quarter closes to calculate the appropriate estimated payments based on actual profit. This allows for adjustments based on the business's performance, crucial for seasonal or fluctuating businesses.

Pros:

Improved Cash Flow Management: Distributing the tax burden throughout the year prevents a large, year-end payment, easing cash flow management.

Penalty Mitigation: Making timely estimated tax payments significantly reduces the risk of incurring underpayment penalties.

Regular Profitability Review: The system encourages regular review of business profitability, allowing for adjustments in strategy and budgeting.

Flexibility: Quarterly payments can be adjusted based on the actual performance of the business.

Cons:

Requires Discipline: Setting aside funds regularly requires financial discipline and planning.

Estimation Challenges: Accurately estimating tax liability can be difficult for businesses with seasonal or fluctuating income.

Multiple Deadlines: Keeping track of multiple deadlines throughout the year can be challenging.

Potential Overpayment: Overpaying can result in giving an interest-free loan to the government.

Tips for Success:

Dedicated Savings Account: Create a separate savings account specifically for tax obligations.

Calendar Reminders: Set calendar reminders two weeks before each quarterly due date.

Safe Harbor: Consider using the previous year's tax liability to qualify for safe harbor provisions and avoid penalties.

Adjustments: Adjust estimated payments if your business performance significantly changes mid-year.

Electronic Payments: Use electronic payment methods and retain confirmation receipts.

Learn more about Quarterly Estimated Tax Payment Schedule.

By understanding and implementing a sound quarterly estimated tax payment strategy, small business owners can effectively manage their tax obligations, minimize the risk of penalties, and maintain a healthy financial outlook.

This proactive approach, popularized by the IRS payment system (EFTPS), tax preparation software with estimated payment calculators, and financial advisors like Dave Ramsey who recommend percentage-based saving systems, is essential for long-term success.

4. Deduction Tracking Framework

A crucial element of any small business tax checklist is a robust deduction tracking framework. This systematic approach is designed to identify, document, and maximize legitimate business tax deductions, ultimately reducing your tax liability.

It ensures you're capturing all eligible expenses while maintaining the necessary substantiation for each deduction claimed, a critical component for avoiding issues during tax season or an audit.

This framework is essential for accurate tax filing and can lead to significant savings for your business.

A well-structured deduction tracking framework includes several key features:

A comprehensive deduction checklist customized for your specific industry

Clear documentation standards for each deduction category (ensuring you meet IRS requirements)

A mileage tracking system for business vehicle use

A home office measurement and expense allocation method if applicable

And a system for tracking mixed-use assets and accurately calculating the business percentage.

These features streamline the process and ensure accuracy.

The benefits of implementing a deduction tracking framework are numerous. It can significantly reduce your taxable income legally, providing peace of mind during tax filing and creating audit-ready documentation.

By ensuring your business expenses properly offset business income, you’re maximizing your tax savings.

However, it's crucial to be aware of the potential drawbacks. Some deductions have complex qualification rules, and over-aggressive deduction claims can trigger audits. Recordkeeping requirements vary by deduction type, and tax law changes can affect deduction eligibility.

For example, a web designer could use a standardized system within their deduction tracking framework to document software subscriptions, professional development courses, and home office expenses.

A food truck business might track inventory, vehicle expenses, commissary rental, and permit costs with dedicated tags in their accounting software. These examples illustrate how a framework can be adapted to various business types.

Actionable Tips for Implementing a Deduction Tracking Framework:

Create a Custom Checklist: Develop a deduction checklist specific to your industry with help from a tax professional. This ensures you’re not overlooking any potential deductions.

Utilize Technology: Use a dedicated app for mileage tracking with GPS verification, simplifying recordkeeping and increasing accuracy. Apps like MileIQ and Everlance are popular choices.

Visual Documentation: Take dated photos of your home office and business equipment for additional documentation.

Detailed Receipts: Keep business purpose notes on receipts for entertainment and meal expenses.

Regular Review: Review deduction opportunities quarterly rather than annually to stay on top of your finances and catch any potential issues early.

This approach is particularly beneficial for self-employed individuals, sole proprietors, single-member LLCs, multi-member LLCs, S corporations, and small businesses in general.

Even taxpayers with relatively simple tax situations can benefit from the organization and peace of mind a deduction tracking framework provides. For those facing tax debt or those advising clients with tax issues, understanding and implementing this framework is crucial.

Popularized by tax preparation services like H&R Block and Jackson Hewitt, expense tracking apps like Expensify and Shoeboxed, and experts like Sandy Botkin (Tax Strategies for Business Professionals), the deduction tracking framework has become a cornerstone of sound financial management for small businesses.

Learn more about Deduction Tracking Framework and how it can help your business thrive. Including this framework in your small business tax checklist is a proactive step towards minimizing your tax burden and ensuring long-term financial health.

5. Employee and Contractor Documentation System

A crucial part of any small business tax checklist is a robust employee and contractor documentation system.

This system is essential for managing payroll taxes, contractor payments, and all associated tax forms, helping ensure compliance with employment tax laws and accurate reporting of payments to workers.

This is a vital component of your small business tax checklist because mismanaging this area can lead to significant penalties and financial setbacks.

What it is and How it Works:

An effective employee and contractor documentation system encompasses all aspects of worker compensation and tax reporting.

It begins with proper worker classification (employee vs. independent contractor) and continues through payroll processing, tax deposits, and year-end filing requirements.

The system should be organized and easily accessible for audits and tax preparation.

Features of a Comprehensive System:

Worker classification documentation: This includes documentation proving why a worker is classified as an employee or an independent contractor, based on IRS guidelines and relevant "common law rules."

Payroll tax deposit schedule and processing system: A defined schedule and system for calculating, withholding, and depositing federal and state payroll taxes.

W-2, W-3, 1099-NEC, and 1096 preparation and filing process: Procedures for accurately preparing and filing these crucial year-end tax forms.

State-specific employment tax requirements: Adherence to unique state regulations regarding unemployment insurance, income tax withholding, and other employment-related taxes.

New hire reporting and onboarding procedures: Processes for reporting new hires to relevant state agencies and collecting necessary employee information.

Required employment tax forms (940, 941, etc.): A system for completing and filing quarterly and annual employment tax returns.

Pros:

Reduces risk of worker misclassification penalties: Accurate classification and documentation helps avoid costly penalties associated with misclassifying employees as independent contractors.

Ensures timely tax deposits, avoiding substantial penalties: A structured system helps ensure timely tax deposits, preventing penalties for late payments.

Creates proper documentation for business expense deductions: Accurate record-keeping enables businesses to properly deduct employee wages and contractor payments as business expenses.

Improves worker relationships through professional payment handling: Consistent and organized payment processing demonstrates professionalism and fosters positive relationships with workers.

Cons:

Payroll tax deadlines occur frequently (often monthly or quarterly): Managing payroll taxes requires ongoing attention and adherence to frequent deadlines.

Rules for proper worker classification can be complex: Understanding the nuances of worker classification can be challenging and requires careful consideration of various factors.

Penalties for non-compliance are significant: Failing to comply with employment tax regulations can result in hefty fines and penalties.

Requirements vary by state and locality: Businesses must be aware of and comply with specific employment tax rules in each state and locality where they operate.

Examples:

A marketing agency using a professional payroll service like ADP or Paychex to handle bi-weekly employee payments, tax withholding, and quarterly filings.

A home renovation business maintaining detailed contracts with subcontractors and meticulously tracking payments for accurate 1099-NEC reporting.

Tips for Success:

Consider using a specialized payroll service rather than handling payroll in-house, especially if you are unfamiliar with the complexities of payroll tax.

Collect W-9 forms from all contractors before issuing the first payment.

Create a dedicated calendar with all filing and deposit deadlines clearly visible.

Conduct periodic reviews of worker classification decisions to ensure ongoing compliance.

Maintain detailed documentation of all contractor relationship terms, including contracts and payment records.

Why This Item Deserves Its Place on the Small Business Tax Checklist:

Proper handling of employee and contractor documentation is crucial for avoiding legal and financial repercussions. It ensures compliance, streamlines tax preparation, and promotes positive worker relationships.

Ignoring this aspect can lead to substantial penalties and damage your business's reputation.

Incorporating this into your small business tax checklist is a non-negotiable step towards financial health and legal compliance.

6. Tax Planning and Strategy Review Protocol

A crucial element of any successful small business tax checklist is a Tax Planning and Strategy Review Protocol. This formalized approach moves beyond reactive tax preparation and embraces proactive tax planning.

Instead of scrambling to gather information and minimize your tax burden at year-end, a Tax Planning and Strategy Review Protocol allows you to anticipate tax liabilities and optimize your financial decisions throughout the year.

This is particularly important for self-employed individuals, sole proprietors, single-member LLCs, multi-member LLCs, S corporations, and other small business entities included in this small business tax checklist.

How it Works:

This protocol involves establishing a structured system for reviewing your business's tax situation regularly, typically with the help of a qualified tax professional. This system incorporates several key features:

Mid-year and Year-end Tax Projection Calculations: Projecting your tax liability at various points throughout the year allows you to anticipate potential issues and adjust your strategy accordingly.

Structured Meeting Schedule with Tax Professionals: Regular meetings, ideally quarterly, provide opportunities to discuss potential tax-saving strategies and address any emerging concerns.

Business Decision Tax Impact Analysis Framework: Before making significant business decisions, such as hiring employees, purchasing equipment, or changing your business structure, you analyze the potential tax implications.

Retirement Plan and Tax-Advantaged Benefit Evaluation: This ensures you're maximizing tax-advantaged savings opportunities through retirement plans and other benefits.

Multi-year Tax Strategy Planning Tools: Thinking beyond the current tax year allows you to develop a long-term tax strategy aligned with your overall business goals.

Examples of Successful Implementation:

A growing service business holds quarterly strategy sessions with their CPA to evaluate the tax implications of hiring employees versus using independent contractors. This helps them make informed decisions about workforce management while minimizing their tax burden.

A manufacturing business collaborates with their tax advisor to strategically time equipment purchases to maximize depreciation benefits and leverage Section 179 deductions. This proactive approach minimizes their tax liability and improves cash flow.

Pros:

Significantly Reduce Lifetime Tax Burden: Proactive planning can identify and leverage tax-saving opportunities that wouldn't be available with a reactive approach.

Informed Business Decisions: Understanding the tax consequences of your decisions allows you to make choices that benefit both your business and your bottom line.

Identify Relevant Tax Law Changes: Staying informed about changes in tax laws ensures compliance and helps you adapt your strategy as needed.

Alignment with Business Goals: A well-defined tax strategy supports your overall business objectives and promotes financial stability.

Cons:

Time Investment: Implementing a Tax Planning and Strategy Review Protocol requires dedicating time away from direct business operations.

Professional Fees: Engaging tax professionals for planning services can incur additional costs.

Tax Law Changes: Changes in tax regulations can sometimes disrupt previously established strategies, requiring adjustments.

Long-Term Benefits: While the benefits of tax planning are significant, they often materialize over longer timeframes.

Actionable Tips for Your Small Business Tax Checklist:

Schedule Quarterly Tax Planning Meetings: Don't wait until year-end to discuss your tax situation.

Consult Before Finalizing Decisions: Bring major business decisions to your tax professional for analysis before making them final.

Consider Tax Impact in Pricing and Structure: Factor in tax implications when setting prices and determining your business structure.

Annual Retirement Plan Evaluation: Review your retirement plan options annually to ensure you are maximizing tax-advantaged savings.

Document Strategies: Keep written records of your tax planning strategies for future reference.

Why This Item Deserves Its Place in the Small Business Tax Checklist:

For businesses of all sizes, and especially those navigating the complexities of self-employment, LLC structures, or S corporations, a Tax Planning and Strategy Review Protocol is essential for long-term financial health.

It empowers business owners to minimize their tax burden, make informed decisions, and achieve their financial goals.

By including this in your small business tax checklist, you are shifting from a reactive to a proactive stance, which is vital for sustained growth and profitability.

Popularized by tax experts like Tom Wheelwright and Diane Kennedy, this approach is becoming increasingly crucial in today’s complex tax environment.

Failing to plan is planning to fail, and this holds especially true when it comes to small business taxes.

Small Business Tax Checklist Comparison

| Checklist Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Business Structure and Tax ID Documentation | Medium – involves legal paperwork & decisions | Moderate – professional consultation recommended | Legal business identity, tax classification, liability protection | New business formation, changing tax structures | Liability protection, tax advantages, financial separation |

| Income and Expense Tracking System | Medium-High – setup and ongoing management | Moderate-High – software subscriptions, time for maintenance | Accurate financial records, maximized deductions, audit readiness | Small businesses needing real-time financial visibility | Minimizes missed deductions, simplifies tax prep |

| Quarterly Estimated Tax Payment Schedule | Low-Medium – routine scheduling and payments | Low – funds management, calendar discipline | Avoidance of penalties, improved cash flow management | Businesses with fluctuating or predictable income streams | Spreads tax payments, reduces year-end burden |

| Deduction Tracking Framework | Medium – requires systematic documentation | Moderate – apps/tools, consistent record-keeping | Reduced taxable income, audit-ready deduction substantiation | Businesses with many deductible expenses | Maximizes deductions, strengthens audit defense |

| Employee and Contractor Documentation System | High – complex classification and compliance | High – payroll services, frequent filings, legal review | Compliance with employment tax laws, penalty avoidance | Businesses with employees or contractors | Avoids misclassification, ensures proper tax filings |

| Tax Planning and Strategy Review Protocol | Medium-High – regular reviews and analysis | Moderate-High – professional fees, time invested | Proactive tax savings, informed decision-making | Growing businesses, those with complex tax situations | Long-term tax reduction, strategic alignment |

Ready to Tackle Tax Season with Confidence?

This small business tax checklist provides six crucial components for navigating tax season effectively:

Verifying your business structure and tax IDs

Establishing income and expense tracking

Understanding quarterly estimated tax payments

Implementing a deduction tracking framework

Organizing employee and contractor documentation

And regularly reviewing your tax planning strategy.

Mastering these areas not only minimizes your tax liability but also provides a clear financial picture of your business, allowing for informed decision-making and sustainable growth.

Proactive planning is paramount; staying organized and maintaining accurate records throughout the year prevents last-minute scrambles and potential penalties.

To further streamline your tax preparation and stay ahead of the curve, explore these expert tips and strategies for the 2025 tax season. This resource offers valuable insights to help you optimize your tax strategy for the upcoming year.

Implementing this small business tax checklist empowers you to take control of your financial future. While this checklist offers a strong foundation, the complexities of tax law can be challenging.

For expert guidance tailored to your specific business needs, consider consulting with Attorney Stephen A Weisberg, a tax professional specializing in assisting businesses like yours navigate these intricate matters. Don't let tax season become a source of stress; start implementing these strategies today and build a more prosperous tomorrow.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034