Fill Out the Innocent Spouse Relief Form with Ease

Navigating Innocent Spouse Relief: Your Path To Tax Justice

Discovering you owe taxes because of your spouse's mistakes can be incredibly stressful. Fortunately, innocent spouse relief may offer a solution.

This form of relief can help taxpayers who are burdened by a spouse's errors or omissions on a jointly filed tax return.

This relief can provide a crucial financial lifeline. It offers a way to separate your tax responsibility from your spouse's. This means you may not be held liable for the full amount, or even any, of the shared tax debt.

You might be interested in this article: Your Spouse Is Shady and Now You’re Stuck With the Tax Debt? Enter Innocent Spouse Relief.

Understanding The Basics Of Innocent Spouse Relief

Innocent spouse relief isn't a simple fix. It's a complex legal process with specific requirements. To qualify, you must have filed a joint return. You also need to prove you didn't know about the errors or omissions that led to the debt.

These errors could include unreported income, incorrect deductions, or other misrepresentations by your spouse. Understanding the history of this provision is important. It helps to grasp the full scope of its impact. Find more detailed statistics here.

Historically, innocent spouse relief has broadened to offer more protection. Initially, it helped spouses affected by simple errors on joint returns.

However, the law expanded in 1998 to include various forms of relief under section 6015. This introduced options like limited equitable relief, allocation of liability for separated spouses, and general equitable relief.

Who Qualifies For Innocent Spouse Relief?

Several factors determine eligibility for innocent spouse relief. The IRS examines each case individually. They consider your knowledge of the tax issues, your financial situation, and the overall fairness of holding you responsible.

For instance, if you were unaware of your spouse's gambling debts and the resulting unreported income, you might qualify. Each situation is unique, and the IRS carefully reviews all the provided information.

Taking The First Steps Towards Relief

If you think you qualify, start by completing Form 8857, the official innocent spouse relief form. This form requires detailed information about your finances, your relationship with your spouse, and the specific tax issues. Accuracy and thoroughness are vital.

This form is your official request to the IRS. It asks them to review your case and potentially grant you relief from the tax debt. Completing it carefully is the first step toward resolving your tax issues.

Breaking Down the Three Relief Types: Which Path Is Yours?

Dealing with tax debt from a joint return can be stressful. Choosing the right type of relief from the IRS is crucial for a successful resolution.

The IRS offers three distinct options: innocent spouse relief, separation of liability relief, and equitable relief. Each is designed for specific situations and has its own eligibility requirements.

Innocent Spouse Relief

Innocent spouse relief is specifically for taxpayers who were genuinely unaware of errors on their joint tax return. These errors might include unreported income or incorrect deductions. The key is proving you had no reason to know about the inaccuracies.

If granted innocent spouse relief, you won't be held responsible for the additional tax, interest, or penalties related to those errors. For example, if your spouse hid gambling winnings and didn't report them, you might qualify.

This is especially true if you weren't involved in or aware of the gambling. The IRS looks at various factors, like your finances and the fairness of holding you responsible.

Separation of Liability Relief

This option is designed for taxpayers who are divorced, widowed, or legally separated. Separation of liability relief divides the tax debt based on each spouse's income and assets at the time of filing.

You're then responsible only for the portion of the tax debt linked to your income and assets.

It's important to note that this relief type doesn't offer refunds for taxes already paid. Instead, it prevents future collections related to your former spouse's share of the debt.

For instance, if you were married, filed jointly, and later divorced, this relief might be applicable. This can be especially helpful if the tax issues mainly stemmed from your former spouse's actions.

You might be interested in: When Love Fades and the IRS Comes Knocking: Three Ways to Innocent Spouse Relief.

It helps you separate your tax obligations from those of your ex-spouse.

Equitable Relief

Equitable relief is a broader category. It's for situations where neither innocent spouse relief nor separation of liability relief applies.

It provides relief if holding you responsible for the tax debt would be unfair, even if you knew about some of the issues.

Factors such as financial hardship, domestic abuse, or your spouse’s financial control often play a role in qualifying for equitable relief.

It can address both unpaid and understated taxes, offering flexibility for those facing difficult circumstances.

This acts as a safety net for taxpayers who may not fully meet the requirements of other relief options. Understanding the specific criteria for each type is key to choosing the best fit for your situation.

These three relief options offer different ways to address tax debt from joint returns. Knowing their specifics is important for navigating the complexities of innocent spouse relief.

Seeking professional advice can be very helpful in choosing the right path and accurately completing the innocent spouse relief form.

Mastering Form 8857: Your Step-by-Step Roadmap

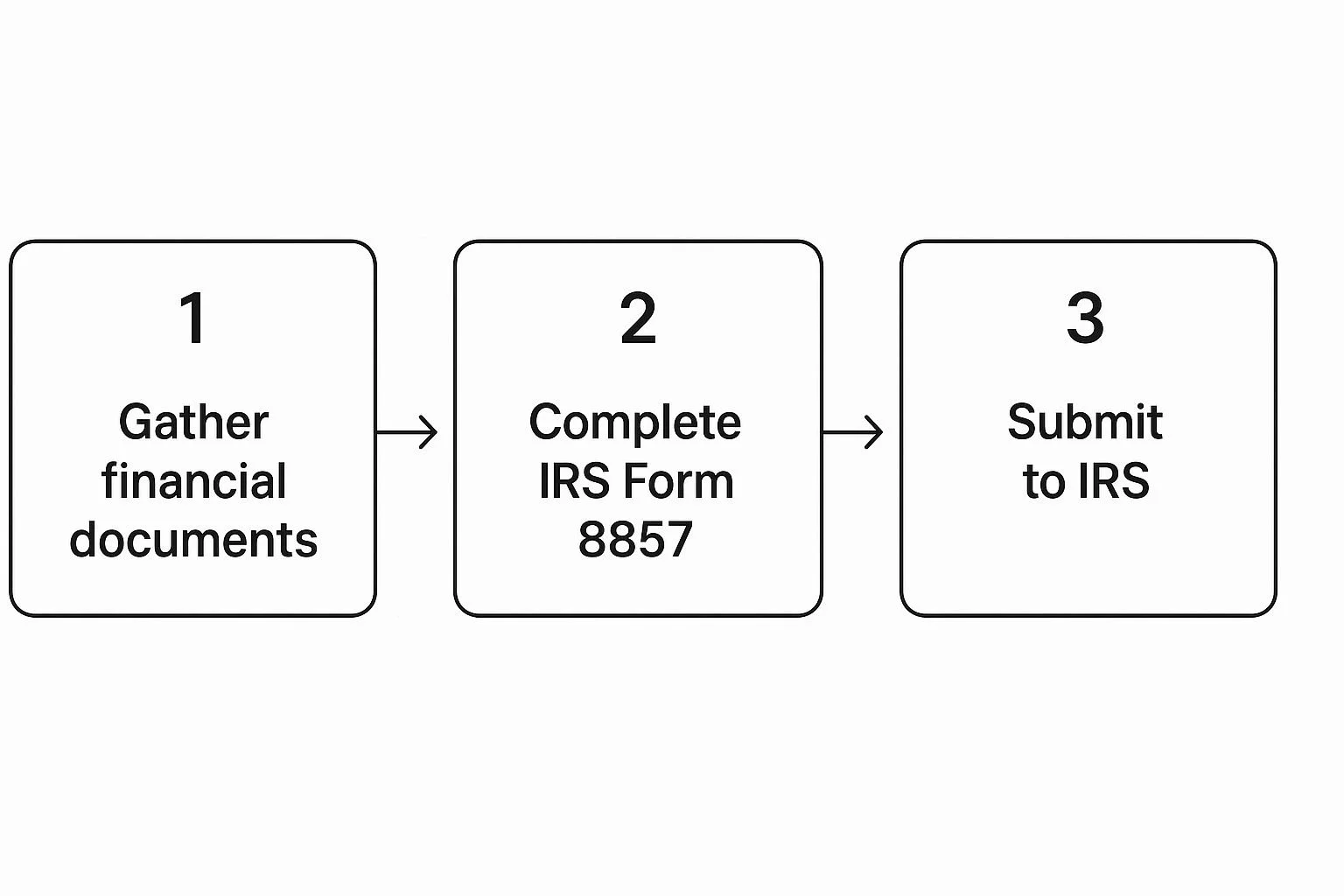

This infographic illustrates the three key steps in applying for innocent spouse relief: gathering financial documents, completing Form 8857, and submitting it to the IRS.

While each step may seem simple, attention to detail is crucial. Successfully completing these steps can make the application process smoother and strengthen your request.

Completing Form 8857, the innocent spouse relief form, can be a daunting task. Breaking it down into smaller sections, however, makes the entire process more manageable.

This guide will walk you through each section of the form, explaining the required information and offering helpful tips.

Understanding The Purpose of Form 8857

Form 8857 is your official request to the IRS for innocent spouse relief. It's your chance to explain why you shouldn't be held responsible for the tax debt on a joint return. Think of it as an opportunity to tell your story and present a persuasive case.

Section-by-Section Breakdown

Form 8857 requires detailed information about your finances, your relationship with your spouse, and the specific tax issues at hand. Accuracy and thoroughness in each section are essential.

To help you further, we've compiled a detailed table outlining the key sections of Form 8857:

Here’s a breakdown of the most important sections of Form 8857, what information to include, and common mistakes to avoid.

| Form Section | Required Information | Tips for Completion | Common Mistakes |

|---|---|---|---|

| Part I: Your Information | Your basic identifying information (name, social security number, and contact details) | Ensure this information matches your tax records exactly. | Incorrectly entering your SSN or using a previous address. |

| Part II: Your Spouse's Information | Your spouse's basic identifying information. | Provide accurate information even if you are separated or divorced. | Omitting information or providing outdated details. |

| Part III: Tax Return Information | The specific tax year(s) for which you are seeking relief and the tax return details. | Double-check that the information matches official IRS records. | Listing the incorrect tax year or return details. |

| Part IV: Reason for Relief | An explanation of why you believe you qualify for innocent spouse relief. | Clearly and concisely explain your reasons, providing a compelling narrative of your situation. | Providing vague or insufficient explanations. |

| Part V: Supporting Information | Evidence that supports your claim of innocence or hardship. | Include all relevant documentation such as bank statements, pay stubs, or other proof of your financial situation. | Failing to provide sufficient documentation or omitting key evidence. |

This table provides a clear overview of the different sections and what needs to be included for successful completion. Remember, each piece of information contributes to building a strong case for your relief application.

The outcome of innocent spouse relief applications can vary. Between Fiscal Years 2019 and 2021, the IRS made 47,892 full scope determinations.

Of those, 48% were denied, 36% were granted full relief, and 13% received partial relief. This data underscores the importance of a well-prepared Form 8857.

You can learn more about innocent spouse relief forms on the IRS website.

Additional Tips For Success

Gather Supporting Documentation: Tax professionals often recommend compiling strong supporting documentation, such as bank statements, pay stubs, or any other evidence that supports your financial situation or demonstrates your lack of knowledge regarding the tax debt.

Be Honest and Transparent: Provide accurate and consistent information. Discrepancies can delay processing or raise red flags.

Seek Professional Advice: While you can complete the form yourself, consulting a tax professional can significantly improve your chances of a successful outcome. They can provide expert guidance, ensure accuracy, and help present the strongest possible case.

By following this guide, gathering the necessary documentation, and understanding the purpose of each section, you can navigate Form 8857 with greater confidence and increase your chances of obtaining innocent spouse relief.

This methodical approach can help you avoid common mistakes and present a compelling case to the IRS.

Critical Timing: When and How to File for Maximum Impact

Applying for innocent spouse relief is a time-sensitive matter. Submitting the innocent spouse relief form at the right moment can significantly affect your chances of a successful outcome. This means understanding deadlines and how life events can influence your application.

The Two-Year Window and Its Exceptions

You generally have two years from the date the IRS began collection efforts to file for innocent spouse relief. This two-year timeframe is important. However, there are exceptions.

Certain circumstances, such as documented financial hardship or spousal abuse, may extend this period. So, even if you think you've missed the deadline, it's worth investigating further. You might still be eligible for relief.

How Divorce and Separation Affect Your Timeline

Life events like divorce and separation can impact your application timeline. Even if a divorce decree assigns the tax debt to your former spouse, the IRS still holds you responsible.

You must file Form 8857 to officially request relief. Using templates for legal documents can help organize your application.

Additionally, separation alone doesn't automatically qualify you for Separation of Liability relief. Specific IRS criteria must be met.

Expedited Processing and Sequencing Your Application

If the tax debt creates significant financial hardship, you can request expedited processing. This requires demonstrating the immediate and severe financial strain caused by the debt.

The timing of your application alongside other tax proceedings is also crucial. If you're also negotiating an Offer in Compromise or facing an audit, strategically sequencing these processes can be beneficial.

Partially Paid Liabilities and Multi-Year Tax Issues

Dealing with partially paid liabilities or tax issues spanning multiple years adds another layer of complexity. You may need to file separate innocent spouse relief forms for each tax year.

This requires meticulous record-keeping and a clear understanding of each year's liabilities. Successfully handling these complexities highlights the importance of understanding the connection between timing and the different types of innocent spouse relief.

After Submission: Navigating The IRS Review Process

Submitting your innocent spouse relief form (Form 8857) is the first step. Next comes the IRS review process. Understanding this process can reduce anxiety and help you prepare.

How The IRS Evaluates Your Case

The IRS assigns your case to a specific department after receiving it. The assigned officer examines your Form 8857 and supporting documents.

They verify the information, looking for inconsistencies, and confirming your claims. This initial review determines if you meet the basic eligibility requirements.

The IRS often contacts your current or former spouse. This helps them gather information from both sides. Providing clear and accurate information on your innocent spouse relief form is crucial for a fair decision.

Triggers For Additional Information Requests

The IRS might request additional information during the review. This is common and doesn't necessarily mean there's a problem with your application.

It often means the reviewer needs clarification or more evidence.

For example, if you claimed financial hardship, they might request financial records. Responding promptly to these requests can speed up the process.

Monitoring Your Application Status And Responding To Inquiries

The IRS will notify you of their decision by mail. You can also monitor your application status online or by phone. This allows you to stay informed and address any issues quickly.

Effective communication with the IRS is essential. Respond to inquiries promptly and provide any requested information without delay.

You might find this helpful: How to master your IRS collection case with Form 433-F.

Realistic Timelines And Appeals

The IRS review process can take several months. Factors like the complexity of your case and the IRS workload can affect processing times. Patience is key during this waiting period.

The following table shows potential outcomes and processing times:

Innocent Spouse Relief Application Outcomes

Statistical breakdown of innocent spouse relief application outcomes and processing times based on recent IRS data.

| Outcome Type | Percentage of Applications | Average Processing Time | Key Factors |

|---|---|---|---|

| Granted in Full | Data not available | Data not available | Meeting all requirements, strong supporting documentation |

| Granted in Part | Data not available | Data not available | Partially meeting requirements, some supporting documentation discrepancies |

| Denied | Data not available | Data not available | Not meeting requirements, insufficient or inconsistent documentation |

Note: This table represents hypothetical data as specific IRS statistics are not publicly available.

It's important to remember that individual cases can vary. Consulting a tax professional can provide personalized guidance based on your situation.

If your application is denied, you can appeal. Understanding the appeals process and preparing a strong case is important.

Consider developing a contingency plan before the initial decision. This may involve consulting with a tax attorney. Preparing for all outcomes ensures you're ready for the next steps.

Building Your Strongest Case: Insider Strategies

Beyond correctly completing the innocent spouse relief form, strategic approaches can significantly improve your chances of approval. A compelling narrative and the right documentation are key to a successful outcome.

Crafting A Compelling Narrative

The innocent spouse relief form is more than just a form; it's your opportunity to tell your story. Explain why you shouldn't be held responsible for the tax debt. Clearly articulate your lack of knowledge about the errors or omissions and the resulting hardship.

For example, if your spouse hid income from a side business, explain your unawareness of these activities. Detail how the tax debt impacts your financial stability. This personal narrative adds context, helping reviewers understand your unique situation.

Documentation: The Backbone Of Your Case

Supporting documentation is critical. It substantiates your claims and validates your request. Include financial records, bank statements, and any communication proving your lack of awareness regarding the tax issue.

Gather evidence supporting your narrative. If you claim no access to joint accounts, provide bank statements showing separate accounts. This reinforces your claim, strengthening your overall case.

Framing Financial Hardship Effectively

If the tax debt causes financial hardship, clearly explain the situation and provide supporting evidence. Quantify the debt's impact on essential expenses like housing, food, and healthcare.

Go beyond general statements. Instead of saying "the debt is causing hardship," be specific. For example, "The $10,000 tax debt prevents me from making my $1,500 monthly mortgage payment, putting my family at risk of foreclosure." This detail adds weight to your claim.

Addressing Potential Weaknesses Proactively

Identify and address any potential weaknesses in your application. If there are inconsistencies or gaps in documentation, acknowledge them and provide reasonable explanations. This demonstrates transparency and builds trust.

If you were aware of some aspects of the tax issue but not the full extent, explain your limited understanding. This proactive approach promotes honesty and prevents misunderstandings.

You might be interested in: How to master your offer in compromise with the IRS. This resource offers additional strategies for managing tax debt.

The Value Of Professional Representation

While completing the innocent spouse relief form yourself is possible, a tax professional can be invaluable. They understand the process, identify potential pitfalls, and present your case favorably.

They can also help gather and organize supporting documentation, ensuring a strong case for the IRS. Their expertise can significantly increase your approval chances.

A tax professional's guidance is especially beneficial in complex cases or with significant tax debt. Their experience navigating the IRS system can streamline the process and maximize your chances of success.

Avoiding Fatal Mistakes: Lessons From Denied Applications

When seeking innocent spouse relief, it's crucial to understand common pitfalls that lead to denied applications.

Learning from others' mistakes can significantly improve your chances of a successful outcome.

This involves recognizing subtle contradictions, addressing documentation gaps, and understanding how seemingly minor omissions can undermine your case.

Common Misconceptions About Eligibility

One frequent mistake is misunderstanding eligibility requirements. Many applicants mistakenly believe that simply being unaware of their spouse's financial misdeeds guarantees approval.

However, the IRS scrutinizes applications for evidence of willful blindness or a deliberate avoidance of knowledge.

This means even if you didn't directly participate in the tax evasion, the IRS might still deny your application. This can happen if they find you should have reasonably known about the discrepancies.

Additionally, inconsistencies between tax years can raise red flags. For example, claiming ignorance of your spouse's unreported income one year but benefiting from it in subsequent years can raise suspicion.

These inconsistencies create a perception of dishonesty, potentially jeopardizing your entire claim.

The Importance of Consistent Documentation

Another significant reason for denials is insufficient or inconsistent documentation. The IRS requires substantial proof to corroborate your claims.

This might include bank statements, pay stubs, emails, or any other evidence demonstrating your lack of knowledge or involvement in the tax issue.

When building your strongest case for innocent spouse relief, consider efficient methods to collect documents from clients.

Failing to provide adequate documentation can quickly derail your application. For example, if you claim financial hardship but don't provide detailed financial records, the IRS might question the validity of your claim.

Furthermore, seemingly minor omissions can have significant consequences. Incorrectly filling out the innocent spouse relief form, omitting key information, or failing to sign the form can lead to automatic rejection.

These oversights, while often unintentional, can undermine your credibility. Therefore, thoroughly reviewing your application for completeness and accuracy before submission is crucial.

Understanding the Psychological Factors at Play

Finally, it's essential to recognize the psychological factors that influence IRS reviewers. Presenting your case clearly and concisely is vital.

A disorganized or emotionally charged narrative can create confusion and lead reviewers to question your reliability.

While conveying the stress and hardship caused by the tax debt is important, focusing on presenting the facts objectively and persuasively is paramount.

By understanding these common mistakes and proactively addressing potential weaknesses, you can significantly increase your chances of securing innocent spouse relief.

Approaching the process with thoroughness, accuracy, and a clear understanding of the IRS's perspective is key to a successful outcome.

For expert guidance, consider consulting with Attorney Stephen A. Weisberg. He can provide personalized support to build the strongest possible case and navigate the often-challenging IRS review process.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034