What Is a Bank Levy? Your Complete Guide to Understanding It

Understanding What a Bank Levy Really Means (Beyond the Jargon)

Think of a bank levy less like a membership fee and more like an insurance premium for the entire financial system. Instead of getting lost in technical terms, let's use a relatable example.

Imagine homeowners all contributing to a shared fund that covers damages if a fire or natural disaster strikes. That’s similar to how bank levies work, creating a financial safety net for the banking industry.

This pooled money helps protect depositors and ensures stability if a crisis hits. It's not just about individual banks; it's about safeguarding the entire financial ecosystem, preventing a domino effect where one bank's failure triggers others.

Why Governments Target Banks

Governments focus on banks with levies due to their vital role in the economy. Banks hold our money, facilitate transactions, and provide loans that power businesses and economic growth. This central position comes with inherent risks, and bank levies act as a buffer against these potential problems.

These levies also generate substantial revenue for governments. This money can fund other essential programs or even help offset the costs of potential future bailouts, should they become necessary.

Let's compare bank levies to regular corporate taxes to highlight their unique characteristics:

To help clarify the differences, the following table breaks down the key distinctions between a bank levy and standard corporate tax:

| Feature | Bank Levy | Corporate Tax |

|---|---|---|

| Basis of Calculation | Liabilities and equity | Profits |

| Purpose | Financial stability, revenue generation | General government revenue |

| Target | Banks and building societies | All profitable corporations |

| Frequency | Annual | Annual |

As you can see, while both contribute to government revenue, they stem from different sources and serve different purposes. Bank levies specifically address the systemic risks associated with the financial sector.

The UK Bank Levy: A Real-World Example

The UK introduced its bank levy in 2011 as an annual charge on specific liabilities and equity held by banks and building societies operating within the country. The initial aim was to encourage banks to reduce risky funding practices. The levy rates have been adjusted over time.

The UK's bank levy is projected to raise £1.3 billion in 2025-26, equivalent to approximately £45 per household. For a deeper dive into the UK bank levy.

This screenshot shows the projected growth of UK bank levy receipts through 2027-28. The main takeaway is the anticipated consistent growth, highlighting their increasing significance as a revenue stream.

These levies are a crucial element of modern financial regulation, acting as both revenue generators and incentives for safer banking practices.

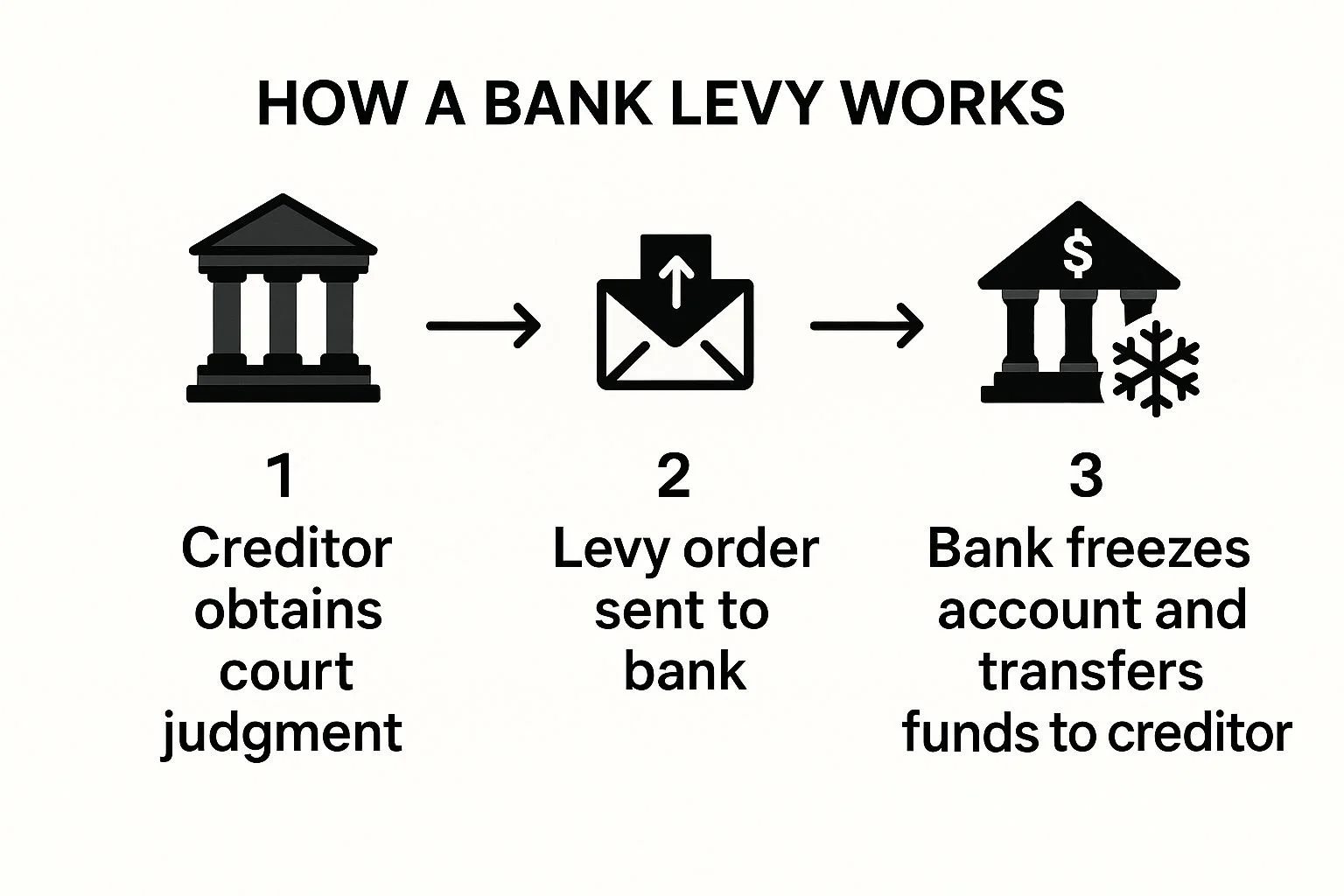

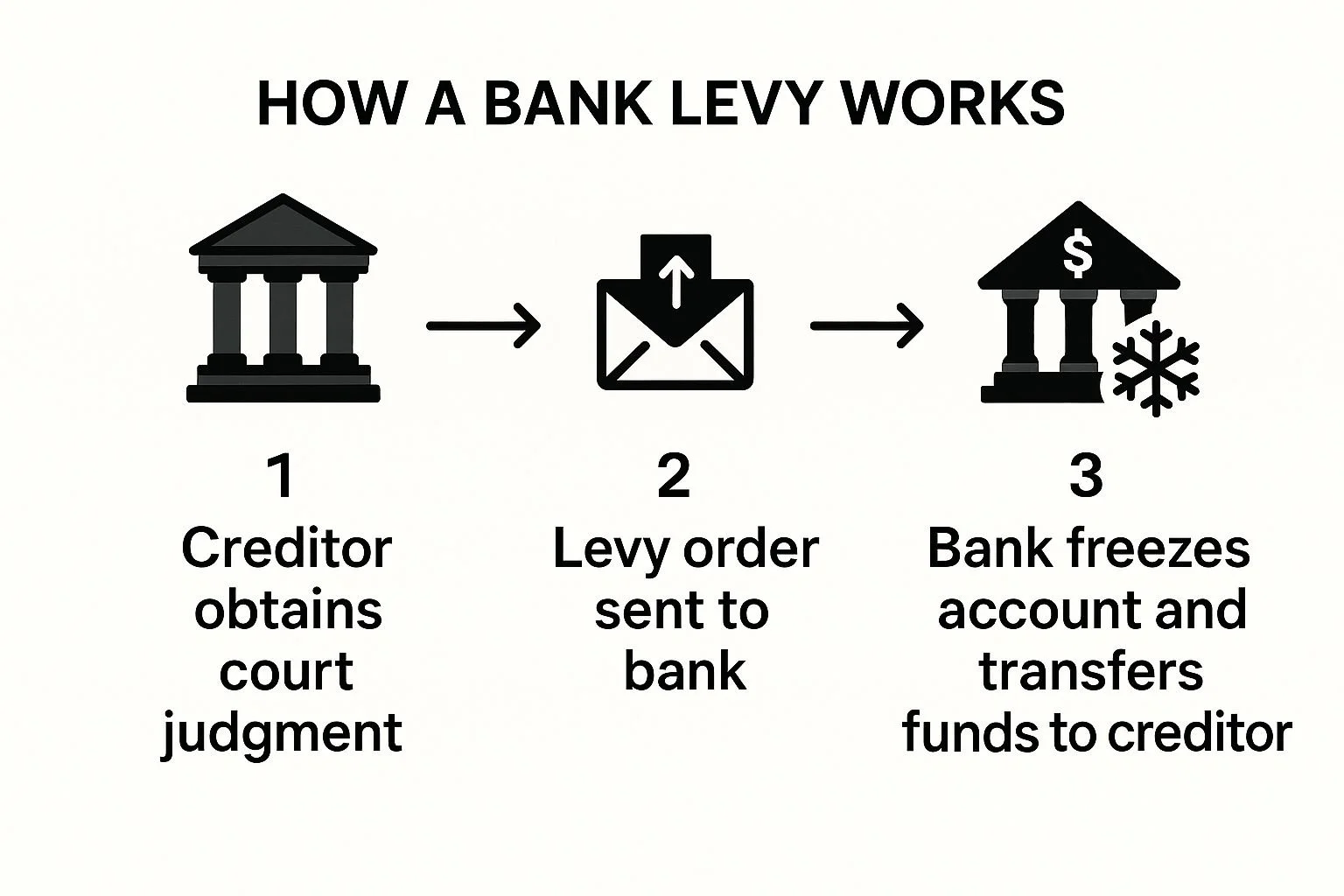

How Bank Levies Work in the Real World (Step by Step)

Let's break down bank levies, step by step. Imagine you're running a bank. A court order arrives. What happens next?

How do you calculate the amount, make the payment, and report everything? We'll use real-world examples to illustrate how different banking activities can actually change how much is levied.

This infographic provides a visual guide to the bank levy process. It shows how the bank acts as a go-between, following the court's instructions. This process emphasizes the legal steps required to start and carry out a levy.

For more information on IRS bank levies specifically, you can check out this resource.

Understanding the Levy Calculation

Now, let’s dive into the specifics of how a levy is calculated. Think of a bank's balance sheet. What factors come into play? Risk-weighted assets (RWAs) are a major one. Imagine them as ingredients in a recipe. Riskier assets, like certain types of loans, carry more "weight," ultimately increasing the levy amount.

Another factor is the bank's capital adequacy ratio. This ratio measures a bank's financial strength – its ability to absorb losses. A higher ratio usually means a lower levy, as it indicates a more stable financial footing. Timing matters too.

The levy is typically based on the bank’s balance at a specific moment. Even small changes on the balance sheet can shift the final levy amount.

Navigating the Payment Process

Once the levy is calculated, the bank typically has a deadline to make the payment. These payments are usually electronic and sent to the relevant authority. In the U.S., that's the Internal Revenue Service (IRS).

This image underscores the legal side of bank levies, highlighting their role in debt collection and legal proceedings. It reinforces that a bank levy is a formal, court-ordered procedure.

Managing Levy Obligations: Strategic Decisions

Banks don't just react to levies; they actively manage them. They might adjust their balance sheets to lower RWAs or boost their capital adequacy ratio. These decisions impact their daily operations and long-term strategy.

Bank levies aren't simply a box to check for compliance. They're a key part of a bank's financial planning and decision-making. Understanding how they work offers valuable insights into the modern banking world.

Bank Levy Approaches Around the World (What Each Country Gets Right)

Bank levies aren't a one-size-fits-all solution. Each country develops its own approach, reflecting its unique banking priorities and regulatory philosophy. Let's explore how different nations tackle the challenge of managing banking risk and generating revenue.

Germany's Risk-Based System vs. France's Capital Focus

Imagine two countries with very different approaches to baking a cake. Germany’s recipe for bank levies is like a carefully calibrated scale. The more ingredients (risks) you add, the higher the levy. This encourages banks to keep their "recipes" simple and manage their risk effectively.

France, on the other hand, focuses on having a strong foundation. They want to make sure you have enough flour and eggs (capital reserves) before you even start mixing. Banks with higher capital reserves pay less, promoting financial stability.

Even smaller countries have unique approaches, like adding a pinch of spice to their recipes. Some target specific risky behaviors, like excessive lending, to address particular vulnerabilities within their banking sectors. This precision aims to avoid specific pitfalls. The variety of approaches shows how different priorities shape these financial tools.

Why Bank Size Matters (Sometimes)

Some countries emphasize bank size. Think of it like this: a larger bakery has the potential to cause a much bigger mess if things go wrong. A levy proportional to size aims to reflect this potential impact.

However, this approach can have unintended consequences. Imagine charging a small bakery the same fees as a huge corporation - it could stifle competition and discourage growth. Other countries focus less on size and more on specific risky activities, regardless of the bank's overall scale. It's about the quality of the bread, not just the size of the oven.

Across Europe, bank levies address financial stability and systemic risk in various ways. Germany, for example, uses a progressive tax rate based on factors like bank size.

France bases taxes on minimum capital requirements, while Hungary uses bank asset size. Between 2009 and 2012, 14 EU member states implemented bank levies, mostly targeting liabilities net of funds and insured deposits.

These levies aim to manage risk and fund recovery mechanisms. For a deeper dive into bank taxes in Europe, check out this resource.

To illustrate the differences, let's look at a comparison of how several countries approach bank levies.

The following table provides a snapshot of bank levy structures across major economies, including levy rates, calculation methods, and revenue generated.

| Country | Levy Rate | Calculation Base | Annual Revenue | Implementation Year |

|---|---|---|---|---|

| Germany | Variable, risk-weighted | Liabilities | Varies | 2011 |

| France | Variable, based on capital requirements | Liabilities | Varies | 2011 |

| Hungary | Fixed rate | Bank assets | Varies | 2010 |

| UK | Fixed rate | Balance sheet total | Varies | 2011 |

| This data is for illustrative purposes and may not reflect the most current figures. |

As this table shows, there's considerable variation in how countries structure their bank levies. Some focus on risk, others on capital, and still others on size. This diversity reflects the differing priorities and regulatory philosophies at play.

Cultural Attitudes and Regulatory Traditions

Cultural attitudes also influence a country's approach to bank levies. Countries with a history of government intervention in the financial sector may favor more complex and targeted levy structures. Those with a more hands-off approach might opt for simpler, broader-based levies.

Regulatory traditions also shape these tools. Countries with established regulatory frameworks can integrate levies more easily. Those with less developed frameworks may face implementation and enforcement challenges.

These diverse global approaches offer valuable lessons for the future of banking regulation. They show how different contexts and philosophies influence the design and effectiveness of bank levies.

This global perspective helps us understand not only how these levies work but why they differ around the world.

What Bank Levies Actually Mean for You and Your Bank

Think of bank levies as a kind of tax specifically aimed at financial institutions. But unlike taxes paid directly by individuals, the effects of a bank levy can ripple outwards, influencing the services banks offer and even the overall financial landscape.

This isn't just abstract policy; it's something that can impact your daily banking experience. So, whether you're a banker, a business owner, or simply someone with a checking account, it pays to understand how these levies work.

How Banks Adapt to Levy Requirements

When a bank gets hit with a levy, they have to adjust. Imagine balancing a scale – if one side suddenly gets heavier, you need to add weight to the other to keep things even. Banks use several strategies to offset the weight of a levy.

Raising Fees: Sometimes, banks increase fees on services like checking accounts or wire transfers.

Adjusting Interest Rates: They might tweak the interest rates offered on loans or savings accounts.

Cutting Back Services: In some cases, banks might reduce services offered or prioritize attracting larger deposits.

Developing New Products: Some banks get creative, introducing new products and services aimed at specific customer groups to generate additional revenue.

However, not all of these adjustments are customer-friendly. Tighter lending standards, for example, could make it harder for individuals and small businesses to secure loans.

Increased fees can also frustrate customers, potentially driving them to seek alternatives. Banks have a tough balancing act: meeting their regulatory obligations while staying competitive and keeping their customers happy.

Real-World Examples of Levy Impacts

Let's say a bank faces a large levy based on its risk-weighted assets (basically, how risky its loans are). To lighten that burden, the bank might reduce lending to higher-risk borrowers. While this directly lowers the levy, it could also limit access to credit for small businesses who rely on such loans.

On the flip side, imagine a levy tied to a bank's liabilities (like the amount of money they hold in customer deposits). The bank might encourage larger deposits by offering higher interest rates. This demonstrates how levies indirectly shape the kinds of financial products and services offered.

Bank levies have a serious impact on the financial sector, affecting both how banks operate and how well they perform. The specific effects depend on things like market competition and the levy's design.

Research shows that in markets with only a few major players (oligopolistic markets), the effects of levies can be substantial. They can reshape competition and even influence how much risk banks are willing to take.

Studies in Europe have shown that levies can increase bank costs, which may get passed on to consumers through higher fees or reduced lending.

The goal, though, is to strengthen the entire financial system by discouraging risky behavior. To learn more about regulatory bank levies and their effects, check out this resource: Assessing the Effects of Regulatory Bank Levies.

Intended and Unintended Consequences

The main goal of a bank levy is to improve financial stability. It's like creating a safety net, building a pool of funds to deal with potential future crises. By making excessive risk-taking less appealing, levies aim to prevent widespread financial failures.

However, there can be unintended side effects. Changes in lending practices, increased fees, and restricted access to credit can all affect individuals and businesses. Policymakers need to consider these potential downsides carefully when creating and applying bank levies.

Understanding all sides of bank levies provides a clearer picture of their role in the financial system. It helps create more informed discussions about balancing regulatory oversight with the real-world impacts on both banks and their customers.

Why Governments Really Use Bank Levies (The Strategy Behind the Policy)

Bank levies aren't simply about collecting money. They're more like multi-purpose tools governments use to achieve several policy goals, often all at once. Let's explore the main reasons behind these levies, from addressing the "too big to fail" dilemma to promoting responsible banking practices.

Beyond Revenue: The Behavioral Nudge

One primary goal is to use levies as a behavioral nudge. Imagine a gentle tap on the shoulder, guiding banks toward safer choices. By making risky practices more expensive, governments encourage banks to carefully consider the potential consequences before taking on excessive risk.

This nudge helps create a more stable financial system, which benefits everyone. At the same time, these levies contribute to financial stability funds. Think of these funds as a safety net, designed to soften the impact of economic downturns.

This proactive approach aims to prevent future bailouts and ultimately save taxpayers money. For more on protecting your income, you might find this helpful: How to Stop IRS Wage Garnishment.

Targeting Banks: A Strategic Choice

Why focus specifically on banks? They hold a unique position in the economy. They are essential but also potentially fragile. They safeguard our money, provide loans to businesses, and enable our everyday transactions.

This interconnectedness makes their stability paramount for overall economic health. However, this same central role also makes them potential points of systemic failure. A problem in one bank could quickly spread to others.

Bank levies aim to reduce this risk, acting as a safeguard against cascading failures. This approach is especially important now, given how interconnected global financial systems have become.

Preventing Future Crises: A Proactive Approach

Bank levies aren’t just a reaction to past crises; they're a proactive measure designed to prevent future ones. They are part of a larger regulatory framework aimed at strengthening the financial system.

These frameworks often include things like capital requirements (making sure banks have enough money on hand), stress tests (simulating tough economic times), and increased oversight (more careful monitoring). All of these measures are designed to prevent another financial meltdown.

By adding a cost to risky behavior, levies discourage actions that could destabilize the entire system. This long-term strategy aims to promote sustainable growth and build a more resilient financial future. It's not about punishing banks; it's about aligning their incentives with the broader public good.

Balancing Competing Interests: A Delicate Dance

Implementing bank levies requires a delicate balance. Governments must carefully weigh financial stability against economic growth. A levy that's too high could stifle lending and slow down economic activity. A levy that's too low might not be effective in deterring risky behavior.

Governments also need to consider public accountability and maintain a competitive industry. The goal is to foster a healthy and dynamic banking sector that serves both the economy and its citizens.

This involves ongoing evaluation and adjustment of levy policies to adapt to changing economic conditions. This constant refinement is essential for successfully managing the complexities of the modern financial landscape.

Common Myths About Bank Levies (And What's Actually True)

Let's chat about bank levies and clear up some common misconceptions. These misunderstandings can really cloud our judgment about how they work within the larger financial system. You might have heard that bank levies are just a way to punish banks or that they're simply another form of corporate tax. We're going to debunk these myths and separate fact from fiction.

Myth 1: Bank Levies Are Just Punishment

Some people see bank levies as purely punitive, a penalty for past mistakes. It's true that past actions might influence how levies are applied – for instance, higher levies might be imposed on riskier activities.

However, the core purpose isn't retribution. Think of bank levies more like an insurance premium for the entire financial system. They're there to protect depositors and maintain overall stability. It's a proactive approach aimed at preventing future crises, not just punishing past ones.

Myth 2: Bank Levies Equal Corporate Taxes

It's easy to confuse bank levies with corporate taxes, but they're actually quite different. Corporate taxes are based on a company’s profits. Bank levies, on the other hand, target specific liabilities and equity.

This distinction is key. Corporate taxes contribute to general government revenue, while bank levies have a more focused purpose: bolstering the stability of the financial system. They serve as both a revenue stream and an incentive for safer banking practices.

You might find this interesting: IRS Tax Forgiveness Program.

Myth 3: Levies Make Banking More Expensive for Everyone

A common worry is that bank levies inevitably lead to higher fees for everyday customers. While banks could pass on some of these costs, it doesn't always happen that way.

Banks often adjust their internal practices, manage their balance sheets more efficiently, and find ways to streamline operations. Some even develop new products and services that benefit customers while offsetting the costs of the levy.

Myth 4: Levies Are a Guaranteed Fix for Financial Crises

Bank levies certainly contribute to a more stable financial system, but they're not a magic solution on their own. They're one component of a larger regulatory framework that includes things like capital requirements, stress tests, and increased oversight. These tools work in concert to build a more resilient financial system, but no single measure can entirely eliminate risk.

Understanding the Nuances

The reality of bank levies is far more complex than these common myths suggest. They're not simply punishment, nor are they just another tax. They're strategic tools used to strengthen the financial system, encourage responsible banking practices, and ultimately, protect depositors and the economy. Understanding these nuances is crucial for navigating today’s complex financial world.

The Future of Bank Levies (Where This Is All Heading)

Bank levies aren't set in stone. They're constantly changing as the financial world gets more complex and interconnected. This creates both new headaches and new possibilities for those setting the rules.

Let's explore some emerging trends and how these tools are being refined to deal with the realities of modern banking. Think about the rise of online banking and the increasing focus on climate-related financial risks – things regulators weren't even considering ten years ago.

Adapting to Modern Banking Realities

Digital banking presents a whole new set of challenges for bank levies. If a bank primarily operates online, with assets spread across different digital platforms, how do you even begin to assess its liabilities? This is a question regulators are actively wrestling with.

Climate change is another curveball, creating new financial risks. For example, banks heavily invested in fossil fuels might face higher levies as those assets become riskier. These are just two examples of how today’s realities are reshaping how we think about bank levies.

The Debate Over Optimal Levy Structures

Policymakers are constantly discussing the best way to structure these levies. One key debate centers around creating a more unified international approach. Right now, bank levy structures are wildly different from country to country.

Some countries focus on the size of the bank, others on the level of risk, and still others on capital adequacy. More international cooperation could create a more level playing field.

You might be interested in: Complete Guide to Small Business Tax Deductions. However, getting everyone on the same page presents significant political and economic hurdles.

Cross-Border Banking and its Complexity

Another tricky issue is cross-border banking. How do you levy a bank that operates in multiple countries, each with its own set of rules? This is becoming increasingly important as financial institutions become more global.

Finding solutions that are both effective and fair requires careful consideration of international law and cooperation among regulators.

Looking Ahead: What to Expect

The future of bank levies will likely involve more targeted and precise approaches. Expect to see more use of data analytics and risk modeling to figure out the appropriate levy amounts.

There will also be more emphasis on aligning bank levies with bigger policy goals, like promoting sustainable finance and addressing systemic risk. Understanding these evolving trends is crucial for anyone involved in finance, from bankers to policymakers.

Staying informed will help you navigate this changing landscape and understand the implications for the future of banking.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034