Can Tax Debt Be Discharged In Bankruptcy? Expert Guide

Understanding When Tax Debt Can Actually Be Discharged

Filing for bankruptcy can feel like a lifeline when facing overwhelming debt. Many people hope it will eliminate all their financial burdens, including taxes.

However, discharging tax debt through bankruptcy isn't always a guarantee. There are specific conditions that must be met before the courts will consider wiping the slate clean.

Dischargeable vs. Non-Dischargeable Tax Debt

Understanding the difference between dischargeable and non-dischargeable tax debt is the first step. Dischargeable debts are those that can be eliminated through bankruptcy. Non-dischargeable debts, on the other hand, stick around even after the bankruptcy process is complete.

Think of it like sorting through old bills. Some, like a forgotten utility bill, can be dealt with and dismissed. Others, like a court-ordered fine, remain a responsibility. Knowing which of your tax debts fall into each category is crucial for managing expectations.

Some older income tax debts might be dischargeable if they meet certain criteria. However, more recent income taxes, along with payroll taxes and penalties for fraud, are usually considered non-dischargeable priority tax debts.

These debts take precedence because they represent obligations to employees and are essential for government operations. This means even if you qualify for bankruptcy, these particular tax debts will likely persist.

Historically, navigating tax debt in bankruptcy has been tricky. While some conditions allow for discharge, the process demands careful attention.

For example, Chapter 7 bankruptcy might eliminate certain tax debts if specific requirements are met. These might include having filed tax returns for the past two years and the return being due within the last three years.

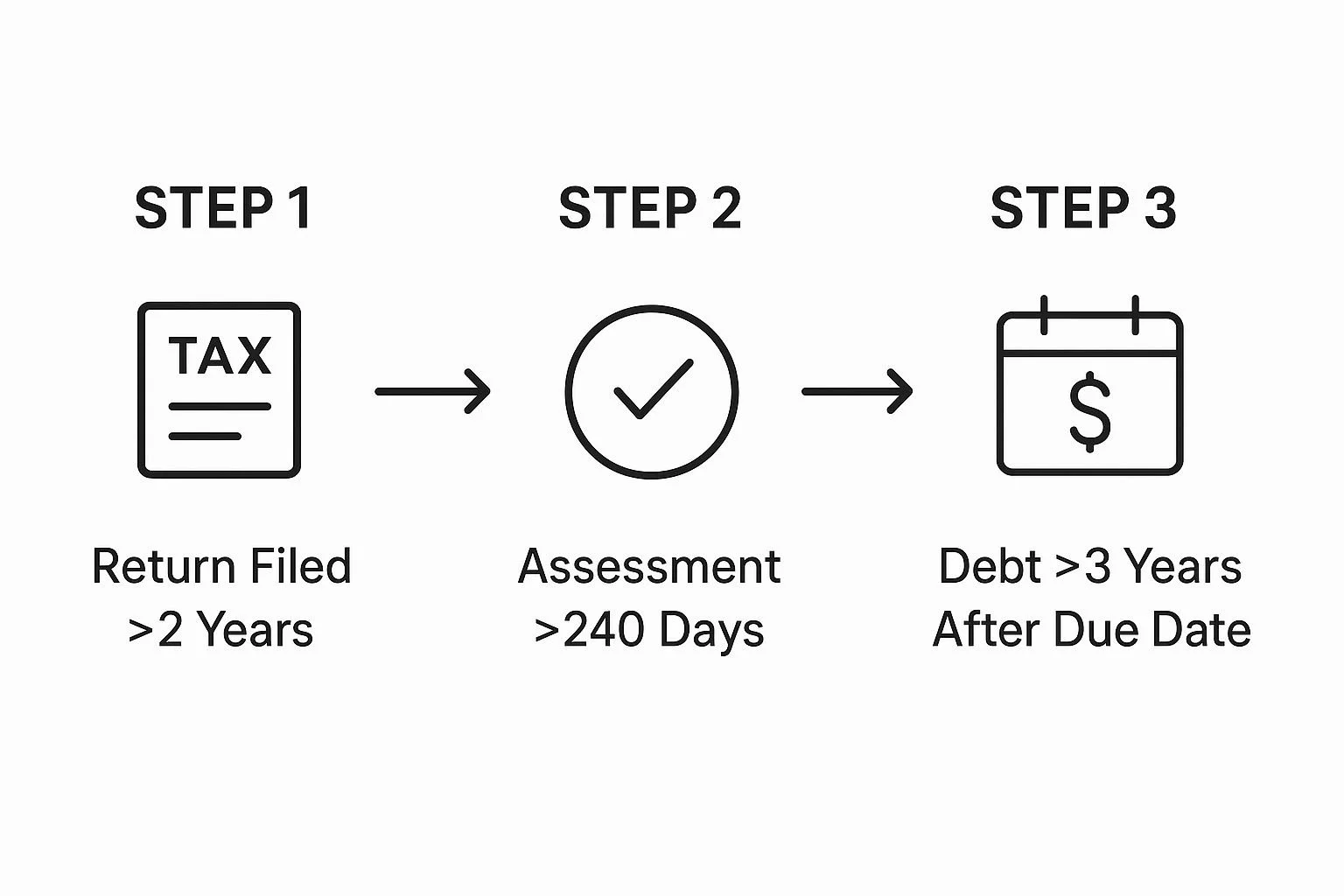

The IRS also needs to have assessed the debt within 240 days of filing for bankruptcy. More information on this complex topic can be found at Bankruptcy and Taxes. You might also find helpful resources on IRS Tax Forgiveness Program.

Types of Taxes and Bankruptcy Courts

Bankruptcy courts handle different types of taxes in different ways. Income taxes, property taxes, sales taxes, and payroll taxes all have their own set of rules regarding dischargeability.

Each case is evaluated individually, with the court considering factors such as the type of tax, how old the debt is, and the taxpayer's history of compliance.

This personalized assessment underscores the importance of understanding your specific financial situation. Seeking professional advice is often essential for successful navigation of this often-complex process, ensuring you meet all the necessary requirements.

The Four Make-Or-Break Requirements You Must Meet

Discharging tax debt through bankruptcy can be a complex undertaking. Success depends on meeting four specific requirements.

Overlooking even one can jeopardize the entire process. These requirements involve strict rules regarding timing, filing procedures, assessment deadlines, and unwavering honesty.

Timing Rules: Is Your Debt Old Enough?

The age of your tax debt is a critical factor in determining its dischargeability. Generally, income tax debts must be at least three years past their due date. This three-year rule discourages taxpayers from accumulating debt with the intention of immediate discharge.

This rule promotes responsible financial management and upholds the fairness of the tax system. It ensures that the system isn't misused for strategic debt avoidance.

Filing Requirements: Staying Ahead of the Game

Discharging tax debt isn't a spontaneous decision. The IRS mandates that you must have filed tax returns for the relevant tax periods. For instance, to discharge a 2020 tax debt, you typically need to have filed your 2020 return at least two years prior to filing for bankruptcy.

This two-year rule underscores the importance of proactive tax compliance. Filing your returns on time is a crucial step toward being considered for debt discharge.

Assessment Timing: When Did the IRS Evaluate Your Debt?

The IRS must assess your tax liability within a defined timeframe. This is generally within 240 days before you file for bankruptcy. The 240-day rule prevents attempts to discharge recently assessed debts.

This timeframe provides the IRS with sufficient time to evaluate your tax situation accurately. It allows them to establish a legitimate claim before any bankruptcy proceedings begin.

Honesty Standards: Playing by the Rules

Transparency and honesty are paramount throughout the discharge process. Submitting fraudulent returns or misrepresenting your finances will disqualify you. This protects the integrity of the bankruptcy system.

This requirement prevents the system from being exploited by dishonest taxpayers. It ensures that bankruptcy remains a legitimate recourse for those genuinely seeking financial relief.

To help visualize these critical timeframes, take a look at the table below:

Tax Debt Discharge Requirements Checklist

A comprehensive comparison of the four key requirements for discharging tax debt in bankruptcy.

| Requirement | Description | Time Frame | Documentation Needed |

|---|---|---|---|

| Tax Return Filed | You must have filed your tax return for the tax year in question. | At least two years before filing for bankruptcy | Copy of filed tax return |

| Tax Debt Age | The tax debt must be sufficiently aged. | At least three years past the due date | Tax assessment notice |

| Tax Assessment Date | The IRS must have assessed the tax liability. | At least 240 days before filing for bankruptcy | Tax assessment notice |

| Honesty and Transparency | You must demonstrate honesty throughout the process. | Throughout the entire bankruptcy process | All relevant financial documentation |

This table summarizes the key timeframes and documentation required for discharging tax debt. Meeting these requirements is essential for a successful discharge.

The infographic reinforces the importance of meeting all three time-based requirements: filing, assessment, and debt age. Missing even one deadline can prevent the discharge of your tax debt in bankruptcy. Understanding these requirements will help you determine your eligibility for discharging your tax debt.

Chapter 7 Vs. Chapter 13: Which Path Actually Works

Choosing the right bankruptcy chapter is a critical step in addressing tax debt. The decision between Chapter 7 and Chapter 13 significantly impacts your tax relief strategy. Each offers different approaches, advantages, and disadvantages. Understanding these nuances is key to making informed decisions.

Chapter 7: The Fresh Start Option

Chapter 7 bankruptcy, often called liquidation bankruptcy, may offer a complete discharge of certain tax debts. This means eligible tax obligations are eliminated, providing a financial fresh start. However, Chapter 7 has strict eligibility requirements and limitations.

One major drawback is that not all tax debts are dischargeable. Priority tax debts, like recent income taxes, payroll taxes, and fraud penalties, usually survive bankruptcy.

Also, Chapter 7 may require selling non-exempt assets to repay creditors. Certain assets, like retirement accounts and some home equity, are often protected. These strict requirements and the possible loss of assets mean Chapter 7 isn't suitable for everyone.

Chapter 13: The Reorganization Route

Chapter 13 bankruptcy, known as reorganization bankruptcy, takes a different approach. Instead of liquidating assets, it involves a structured repayment plan over three to five years. This plan lets you repay a portion of your debts, including eligible tax debts, while keeping your assets.

For example, Chapter 13 provides a structured way to manage tax debt over time. This emphasizes balancing debt recovery with financial stability.

Learn more about declaring bankruptcy

While Chapter 13 doesn't offer the complete debt elimination of Chapter 7, it has significant benefits. It shields you from aggressive IRS collection actions and might even reduce your total repaid tax debt.

However, it requires steady income to maintain the repayment plan and a long-term commitment. You might be interested in: How to master settling IRS debt.

Strategic Considerations and Timeline Differences

Choosing between Chapter 7 and Chapter 13 requires careful thought about your finances, the nature of your tax debt, and your long-term goals. Factors like your income, assets, and the types of taxes owed influence the best path.

The timeline for each also matters. Chapter 7 is generally quicker, while Chapter 13 involves a longer repayment period. Consulting with a bankruptcy attorney can help you evaluate your options and choose the most suitable path.

Making the right choice significantly impacts your ability to effectively manage and resolve your tax debt.

What Tax Debt Survives Bankruptcy (And Why)

While bankruptcy can offer a fresh financial start, it's important to realize that not all tax debt disappears. Assuming all your tax liabilities will vanish can lead to misunderstandings and disappointment. Certain priority tax debts, like recent income taxes, payroll taxes, and fraud penalties, often remain even after bankruptcy, regardless of the chapter or how well you meet other requirements.

Understanding Non-Dischargeable Tax Debts

Why are some tax debts protected under the law? These debts are often considered crucial for government operations and represent obligations to employees or other parties.

For example, payroll taxes, which fund Social Security and Medicare, are typically non-dischargeable. This ensures funding for these important programs continues.

Taxes resulting from fraudulent activities are also rarely forgiven, reflecting the seriousness of such actions. Courts distinguish between dischargeable and non-dischargeable tax obligations based on various factors.

The age of the debt, the type of tax, and filing compliance all play a role. This careful review prevents misuse of the bankruptcy system while providing relief to those experiencing genuine financial hardship. You might be interested in: Understanding Notice of Levy.

Life After Bankruptcy: Managing Surviving Tax Debt

What happens to remaining tax debts after bankruptcy concludes? They don't simply vanish. The IRS can and will pursue collection. However, you have options. Understanding these alternatives is key to navigating your post-bankruptcy finances.

One strategy is negotiating a payment plan with the IRS. This lets you repay the debt over time with manageable installments. You might also qualify for IRS relief programs like an Offer in Compromise (OIC).

An OIC could settle your debt for considerably less than the original amount. Exploring these options can ease your financial burden after bankruptcy. Understanding the rules and limitations is crucial for making informed choices.

Planning for Post-Bankruptcy Obligations

Planning for your continuing tax obligations is vital for long-term financial stability after bankruptcy. This involves developing a realistic budget that includes your remaining tax debt and other expenses.

It also requires understanding the possible long-term consequences of ignoring these debts, such as continued collection efforts and damage to your credit score.

By addressing these matters proactively, you can rebuild your financial health and avoid future problems. Working with a tax professional can provide valuable guidance during this time, ensuring you make informed decisions and create a sound financial plan.

Economic Reality Check: Tax Debt In Today's World

Understanding the bigger picture of tax debt is crucial for making smart decisions about your financial recovery. Current economic conditions, including lingering effects from the pandemic, have greatly changed both taxpayers' ability to pay and bankruptcy filing trends nationwide.

This understanding helps you decide if bankruptcy is truly the best option, or if other strategies better suit your long-term financial goals.

The Scale of The Problem

Tax debt isn't just a personal issue; it's a widespread economic challenge affecting individuals and businesses alike. As of 2019, the OECD reported that tax debt across its member states reached approximately EUR 820 billion, highlighting the global nature of the problem.

In the United States, there were 387,721 bankruptcy filings in 2022. This figure, while lower than pre-pandemic levels, still represents an upward trend.

More detailed statistics can be found here. These numbers show that navigating tax issues in a fluctuating economy requires a well-rounded approach.

How Economic Trends Affect Your Options

Economic shifts can influence court decisions and IRS collection practices. During economic downturns, for instance, courts might show more leniency in hardship cases.

The IRS may also offer more flexible payment plans to taxpayers struggling financially. Understanding current economic trends provides valuable insights into potential outcomes and possible strategies.

Tax Debt in Financial Recovery Strategies

Tax debt plays a major role in financial recovery strategies for both individuals and businesses. For individuals, it can be a huge roadblock to achieving financial stability.

For businesses, unpaid taxes can restrict growth and potentially lead to closure. This emphasizes the importance of proactively addressing tax debt as part of any comprehensive financial plan.

Evaluating Bankruptcy in The Current Climate

Deciding whether to file for bankruptcy requires careful consideration of your unique circumstances within the current economic context. Present economic realities impact the feasibility and effectiveness of different approaches.

For example, if the economic climate suggests a higher probability of increased IRS leniency, alternative strategies like Offer in Compromise programs could be more advantageous than bankruptcy.

Carefully assessing your options and considering the long-term implications is essential before making any major financial decisions.

How The Pandemic Changed Everything About Tax Debt

The COVID-19 pandemic dramatically affected the economy, leaving many individuals and businesses facing financial hardship, including growing tax debt.

This disruption didn't just impact income; it changed the rules around tax debt and how it interacts with bankruptcy strategies. These changes continue to shift, making it critical to understand how they might affect your situation.

The Ripple Effect of Economic Shutdowns

The economic shutdowns during the pandemic triggered job losses and business closures. This sudden drop in income made it difficult for many to meet existing financial obligations, not to mention their taxes.

At the same time, increased dependence on government programs, like unemployment benefits and pandemic relief loans, resulted in surprising tax liabilities for millions. This created a challenging combination of reduced income and increased tax burdens.

Shifting Bankruptcy Landscape and IRS Responses

These pandemic-related financial pressures caused a surge in individuals and businesses considering bankruptcy to manage debt, including tax debt.

Bankruptcy courts saw an influx of new cases, impacting procedures and processing times. The pandemic highlighted the need for efficient tax debt management to ensure confidence in the tax system.

The IRS also implemented several relief measures to help taxpayers. Learn more about declaring bankruptcy and taxes here.

New Relief Programs and Payment Options

The IRS temporarily suspended certain collection actions, giving taxpayers a break. Expanded payment plan options and offers in compromise became available, offering ways to resolve tax debt outside of typical bankruptcy procedures.

These new programs, while sometimes temporary, offered crucial relief for many struggling taxpayers. They also emphasized the changing connection between tax debt, economic hardship, and available relief options.

Understanding Your Options in a Changed World

Managing tax debt post-pandemic requires understanding these significant shifts. Previous strategies may no longer be as effective, and new opportunities for relief might now exist.

Consulting with a tax attorney can help you assess your options and make informed decisions based on your particular situation. Understanding current factors helps you create strategies that consider today's economic realities and potentially utilize relief programs.

Smart Alternatives When Bankruptcy Isn't The Answer

Bankruptcy can feel like a solution to overwhelming tax debt, but it's not always the best approach. Smart financial planning means exploring every option before making such a big decision.

Fortunately, several alternatives can offer relief without the long-term impact of bankruptcy. These alternatives often provide more flexible solutions, and sometimes, even better financial outcomes.

Exploring Options Beyond Bankruptcy

One compelling alternative is the Offer in Compromise (OIC) program. This program lets eligible taxpayers settle their tax debt for much less than the total amount they owe. In some cases, an OIC can resolve debt for pennies on the dollar.

Learn more about OIC in our article about IRS Offer in Compromise. Another option is Innocent Spouse Relief, which can remove responsibility for tax debt incurred by a spouse or former spouse. This is especially helpful for people facing tax liabilities they didn't personally create.

Installment agreements are another way to manage tax debt. These agreements let you make reasonable monthly payments over time, avoiding the immediate financial strain of a lump sum.

Unlike bankruptcy, installment agreements have less of an effect on your credit score, which protects your long-term financial health.

Evaluating Costs, Timelines, and Combination Strategies

Each alternative has its own set of requirements, costs, and timelines. An OIC, for instance, requires proof of financial hardship and detailed documentation.

Installment agreements are usually easier to qualify for but require consistent, on-time payments. Evaluating these factors helps you decide which alternative best fits your circumstances.

Sometimes, combining different approaches creates the most effective strategy. You could combine an installment agreement with an OIC, for example, to lower your total tax burden while keeping payments manageable. Knowing how these options work together lets you create a personalized plan.

To better understand these options, let's compare them side-by-side:

Tax Debt Relief Options Comparison Side-by-side comparison of bankruptcy versus alternative tax debt relief programs

| Relief Option | Eligibility | Timeline | Impact on Credit | Success Rate |

|---|---|---|---|---|

| Bankruptcy | Individuals and businesses with unmanageable debt | Varies, typically several months | Significant negative impact | High, but comes with long-term consequences |

| Offer in Compromise (OIC) | Taxpayers experiencing significant financial hardship | Several months to a year | Less severe than bankruptcy | Depends on individual circumstances |

| Installment Agreement | Taxpayers who can afford to pay their debt over time | Length of agreement depends on amount owed | Less severe than bankruptcy | High if payments are made consistently and on time |

| Innocent Spouse Relief | Taxpayers who can prove they are not responsible for the tax debt | Several months to a year | May have no impact if granted | Depends on individual circumstances |

The table above highlights the key differences and similarities between various tax debt relief options. Notice how each option affects your credit differently and has a unique timeline. Considering these factors is crucial for making the right choice for your financial future.

Working With Tax Professionals and Maintaining Financial Stability

Navigating these alternatives can be complicated. A skilled tax professional can provide helpful guidance, making sure you meet all the requirements and make informed choices.

They can also help you create strategies for staying financially stable throughout the resolution process, protecting your long-term financial health.

Timing is also crucial. Acting early can save you thousands of dollars in penalties and interest. Proactive planning greatly increases your chances of successfully resolving your tax debt.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034