How To Set Up Payment Plan With IRS: Complete Guide

Understanding Your IRS Payment Plan Options

Facing a large tax bill can be stressful, especially if you can't afford to pay it all at once. The IRS understands this and offers several payment plan options to help taxpayers manage their tax debt.

These plans provide a structured approach to paying what you owe over time, helping you avoid more serious collection actions.

Short-Term Payment Plan

A short-term payment plan (STP) gives you up to 180 days to pay your tax balance in full. This includes penalties and interest. This option works best for those who can pay off their debt relatively quickly. It's often ideal for smaller tax debts under $100,000.

For example, if you expect a bonus or other significant income soon, an STP might be a good solution.

Long-Term Payment Plan (Installment Agreement)

If you need more time than an STP allows, a long-term payment plan, also known as an installment agreement, might be a better fit.

This plan lets you make monthly payments for up to 72 months (six years). This provides greater flexibility for managing larger tax debts and structuring payments within your budget.

You might be interested in: Our ultimate guide on IRS back taxes and payment plan strategies.

Installment agreements allow you to pay your tax debt in monthly installments, typically up to 10 years, depending on the collection statute. This is particularly helpful for those unable to pay their tax debt immediately.

The IRS offers various payment methods, including direct debit, which automatically deducts the monthly payment from your bank account.

During the 2025 filing season, the IRS processed over 100 million tax returns, demonstrating the significant number of taxpayers who interact with the agency.

Applying for a payment plan sooner rather than later can help minimize penalties and interest. Learn more about IRS payment options.

Choosing the Right Plan

Choosing between an STP and a long-term installment agreement depends on your individual financial situation.

Key factors to consider:

Total amount of tax debt

Your ability to make consistent payments

The overall cost of each plan (including setup fees and accruing interest)

Understanding your options and taking proactive steps is crucial when managing IRS tax debt. With careful planning, you can find a payment plan that works for your budget and helps you get back on track financially.

Your Step-By-Step Application Process

Setting up an IRS payment plan might seem complicated, but it can be surprisingly straightforward, especially with the IRS Online Payment Agreement tool. This online tool offers a faster and more convenient alternative to traditional mail or phone calls, often providing instant approval.

Let's break down the process, from gathering your financial information to submitting your application.

Gathering Necessary Information

First, you'll need to gather your financial information. This includes details about your income, expenses, and assets. While this might sound like a lot, it's usually a simple process. The IRS uses this information to assess your ability to pay and determine an appropriate monthly payment amount.

Calculating an Affordable Monthly Payment

Next, calculate a monthly payment that aligns with your budget. Consider your essential living expenses and ensure the payment won't create undue financial hardship. This is vital for successfully maintaining your payment plan over the long term.

Check out our guide on calculating your IRS installment agreement.

Presenting Your Financial Situation

Accurately presenting your financial situation is key to increasing your chances of approval. Be honest and transparent about your income and expenses.

This helps the IRS establish a realistic payment plan you can manage. A clear and accurate application can significantly impact the outcome.

Choosing the Right Application Method

The IRS offers several application methods, each designed for different situations. The Online Payment Agreement tool is generally the quickest and most efficient option for many taxpayers.

You can also apply by phone or mail. Understanding the pros and cons of each method can help you choose the best approach. Knowing common mistakes can also prevent processing delays.

Tracking Your Application and Making Adjustments

After submitting your application, track its status through the IRS website or by contacting their customer service. The IRS will notify you of their decision. If your initial application isn't approved, don't worry. You can often revise and resubmit it or explore alternative options.

It's also important to know how to adjust your plan if your financial circumstances change. Staying proactive and informed is key to successfully managing your IRS payment plan.

The Real Cost Of Payment Plans

Before agreeing to an IRS payment plan, it's essential to understand the full costs involved. These costs go beyond the initial tax debt and include setup fees and accumulating interest.

Understanding these additional expenses can help you make informed decisions about managing your tax liability.

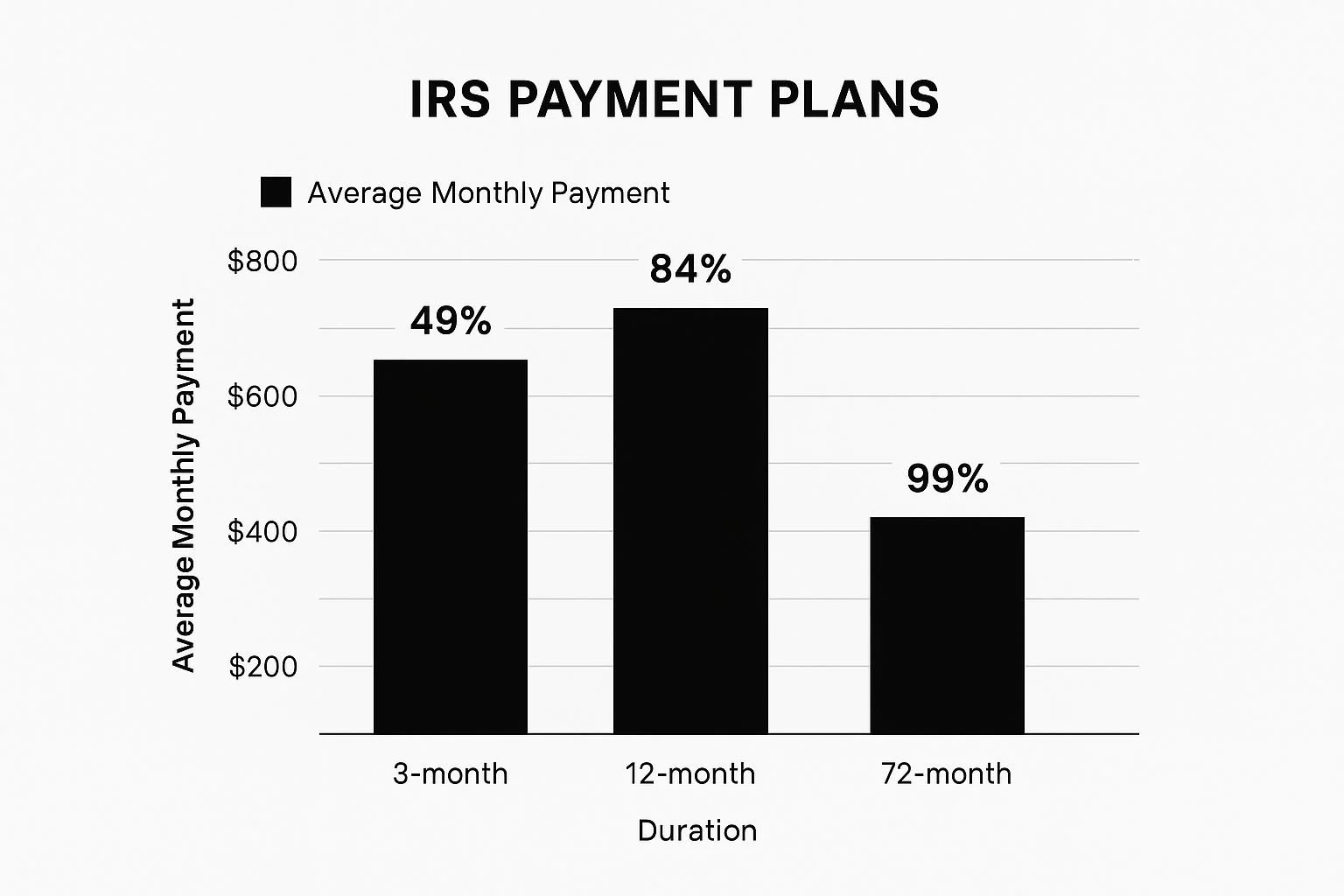

Shorter-term plans, like 3-month or 12-month options, generally have higher monthly payments but often come with higher approval rates.

Longer-term plans, such as a 72-month plan, offer lower monthly payments. However, they can lead to paying significantly more interest over the extended repayment period.

The IRS also charges setup fees for these payment plans, which vary depending on the chosen payment method. Setting up an installment agreement online using direct debit often has a $0 setup fee.

Other payment methods may have associated setup fees. It's important to explore all available options to find the most cost-effective approach. Additionally, interest continues to accrue on the outstanding balance until it's paid in full.

The current annual interest rate for underpayment is 7%, compounded daily (as of the third quarter of 2025). Making timely payments is crucial to minimize these additional interest charges. Carefully consider all factors before deciding how to set up a payment plan with the IRS.

Learn more about IRS payment plans here.

To help you choose the best payment plan for your situation, review the table below comparing various options:

IRS Payment Plan Setup Fees Comparison Compare setup fees and costs for different IRS payment plan options and payment methods to choose the most affordable option.

| Payment Plan Type | Setup Fee | Payment Method | Monthly Fee | Best For |

|---|---|---|---|---|

| Short-Term Payment Plan (up to 180 days) | $31 (online), $107 (phone/mail) | Direct Pay, Debit Card, Check or Money Order | Varies | Taxpayers who can pay off their balance quickly |

| Offer in Compromise (OIC) | $205 application fee | Varies | Varies | Taxpayers who are unable to pay their full tax liability |

| Installment Agreement (IA) | $31 (online), $149 (phone/mail), $225 (in-person) | Direct Debit, Electronic Funds Withdrawal, Check, Money Order | Varies | Taxpayers who need more time to pay their balance (up to 72 months) |

This table provides a general overview of setup fees. Specific fees may vary, so always consult the IRS website or a tax professional for the most up-to-date information.

Minimizing Interest Costs

While interest is a part of most payment plans, strategic payment management can lessen its impact. Whenever possible, paying more than the minimum required payment will reduce your principal balance faster. This, in turn, reduces the total interest paid. This strategy requires careful budgeting and prioritizing your tax debt payments.

Penalty Relief Options

Consistently meeting your payment plan terms can make you eligible for penalty relief. This can significantly reduce your overall costs. Staying current on your plan and future tax obligations is essential for maintaining this relief and avoiding further penalties.

Proactive management of your tax debt can help you regain financial stability.

Choosing Your Payment Method Strategically

The payment method you select for your IRS payment plan significantly affects the total cost, convenience, and even the success of your plan.

While direct debit from your bank account is often presented as the most budget-friendly choice due to its lower setup fees (sometimes free), it's essential to consider if it's the right fit for your circumstances.

This section explores the pros and cons of automated withdrawals (direct debit) versus manual payments. Understanding these differences will help you decide which method best aligns with your financial situation and habits.

Weighing the Pros and Cons of Direct Debit

Direct debit streamlines the payment process. It helps ensure on-time payments and reduces the risk of penalties for missed deadlines. However, this method requires consistently maintaining enough money in your bank account.

Pros:

Automated payments minimize the chance of missing deadlines.

Often involves lower setup fees (or no fees at all).

Simplifies the overall payment process.

Cons:

Requires sufficient funds in your account to avoid overdraft fees.

Offers less control over the timing of your payments.

Considering Alternative Payment Methods

If you prefer more control over your finances or lack consistent access to sufficient funds, alternative payment methods are available. These options include paying by check, money order, or debit/credit card.

However, these methods often come with higher setup fees and require more active management to ensure timely payments. For example, if paying by check, factor in mail delivery times to ensure your payment reaches the IRS before the due date.

Credit cards offer flexibility but come with processing fees and potentially high interest rates, increasing your overall debt. This makes them a less desirable choice for long-term payment plans.

Backup Strategies for Payment Disruptions

Having backup plans for months when your primary payment method isn't feasible is vital for preventing accidental defaults. If you typically use direct debit but anticipate insufficient funds one month, having a check or money order ready can avert a missed payment.

Similarly, if you usually pay manually but will be traveling, scheduling an online payment in advance can ensure you stay on track. The IRS offers a variety of payment options to accommodate different financial situations.

For the 2025 tax year, the IRS offers inflation-adjusted standard deductions, beneficial for taxpayers who have experienced income changes and need to adjust their tax payments.

As of April 2025, over 64 million refunds were issued via direct deposit, indicating a growing trend towards electronic payment methods.

These electronic methods can be more efficient and convenient for managing tax payments and setting up payment plans with the IRS.

Find more detailed statistics here.

Choosing your payment method wisely is a crucial step in successfully managing your IRS payment plan. Consider your financial habits, available resources, and potential challenges to select the method that best supports your ability to stay compliant and minimize costs.

This proactive approach can positively impact your long-term financial well-being.

Maintaining Your Payment Plan Successfully

Getting approved for an IRS payment plan is a big step toward resolving your tax debt. But maintaining that plan requires ongoing effort and a clear understanding of your responsibilities. It's more than just making monthly payments.

By understanding these responsibilities now, you can avoid future problems and maintain financial stability.

Staying Current on Future Tax Obligations

One of the most common mistakes taxpayers on a payment plan make is falling behind on future tax obligations. It's like juggling – you're managing your existing payment plan while also keeping up with new tax responsibilities.

This is where many people struggle. Successfully managing both is vital for maintaining your agreement. Missing future tax payments can put your current payment plan at risk and lead to additional penalties.

Handling Life Changes and Payment Modifications

Life is full of unexpected events. Job loss, unexpected medical bills, or other financial setbacks can affect your ability to make your agreed-upon payments.

When life changes impact your ability to pay, communicating with the IRS is essential. They offer options for modifying your agreement to reflect your current financial situation.

For example, you might be able to temporarily reduce your payments or request a short-term suspension. Proactive communication is key to avoiding default.

Practical Strategies for Payment Management

Successfully managing your payment plan involves implementing practical strategies:

Budgeting: Set aside funds specifically for your tax payments, just like any other necessary expense.

Reminders: Set up calendar reminders or automatic alerts to ensure timely payments and avoid late payment penalties.

Record Keeping: Keep detailed records of all payments made, including dates and amounts. This is crucial for verifying that you're meeting the terms of your agreement.

These simple steps can significantly impact your long-term success.

Benefits of Early Payoff and Effective Communication

While sticking to your payment plan is important, paying off your balance early has significant advantages. This can save you money on interest and penalties, getting you debt-free faster.

Just as important as making payments is communicating effectively with the IRS. If you encounter problems or anticipate difficulties, contacting them proactively can help you find solutions and avoid potential complications.

By understanding the ongoing responsibilities of an IRS payment plan and implementing practical management strategies, you can successfully maintain your agreement, avoid problems, and move toward a more secure financial future.

This proactive approach will help you manage your tax debt effectively and achieve financial peace of mind.

Avoiding Mistakes That Kill Payment Plans

Setting up a payment plan with the IRS can be a real lifesaver when you're facing a tax debt you can't afford to pay all at once. But simply enrolling isn't the end of the story.

Maintaining your agreement takes diligence and a proactive approach to avoid common pitfalls. This section highlights the crucial mistakes to avoid, ensuring your payment plan stays a solution, and doesn't become another source of stress.

The Danger of Missed Payments and Falling Behind

The most obvious mistake is missing a payment. Even one missed payment can put your agreement at risk and trigger collection actions.

A less obvious, but equally dangerous, mistake is falling behind on your estimated tax payments or filing deadlines for future tax years.

The IRS expects continued compliance as a condition of your payment plan. For example, if you’re on a payment plan for 2023 taxes but fail to file or pay your 2024 taxes, the IRS can default your existing agreement. This could lead to levies on your wages or bank accounts.

The Consequences of Defaulting

Defaulting on your payment plan has serious repercussions. The IRS can reinstate the full balance as immediately due, leading to aggressive collection efforts.

These can include wage garnishments, bank levies, and even liens placed on your property. Learn more in our article about how to avoid tax penalties.

You'll also lose the benefit of the reduced penalties you might have received when you entered the agreement, significantly increasing the overall amount you owe.

Staying Organized and Proactive

Staying organized is key to avoiding these issues. Keep detailed records of your payments, due dates, and all communication with the IRS. Set up reminders to ensure timely payments.

This proactive approach minimizes the risk of accidentally missing payments. Just like managing your household budget requires tracking expenses and income, managing your IRS payment plan demands similar diligence.

Communicating With the IRS

Proactive communication with the IRS is essential. If you foresee difficulty making a payment or experience a significant life change impacting your finances, contact the IRS immediately.

They might offer temporary payment adjustments or other solutions. For example, if you lose your job, communicating this proactively could prevent a default and allow you to modify your agreement. The IRS is more likely to work with you if you’re upfront about potential issues.

Seeking Professional Help

If you struggle to manage your payment plan or face complex tax issues, seeking professional help is a smart move. A qualified tax attorney or enrolled agent can provide guidance, represent you before the IRS, and help you navigate the complexities of tax debt resolution.

This expert assistance can be invaluable for protecting your rights and achieving the best possible outcome. It’s like hiring a guide for a challenging hike: a professional can help you navigate the difficult terrain and avoid pitfalls.

By understanding the potential pitfalls and implementing proactive strategies, you can successfully maintain your IRS payment plan, avoid costly mistakes, and resolve your tax debt. This sets the stage for a more secure financial future.

Beyond Payment Plans: Your Complete Tax Relief Guide

Setting up an IRS payment plan is a good first step towards resolving tax debt. But it isn't the only solution. This section explores other strategies and resources to help you manage tax issues and achieve long-term financial well-being. It's important to consider all available options, even those beyond a typical payment plan.

Exploring Alternative IRS Programs

Besides installment agreements, the IRS offers programs for specific financial situations. The Offer in Compromise (OIC) allows eligible taxpayers to settle their tax debt for less than the full amount owed.

This can be a lifesaver for those genuinely unable to afford their full tax liability. The Currently Not Collectible (CNC) status offers temporary relief from collection efforts if the IRS determines you can't currently pay.

However, remember that interest and penalties still accrue under CNC status. Learn more about managing unfiled tax returns: How to master unfiled tax returns and avoid penalties. Understanding program eligibility is crucial for making informed decisions.

To help you compare and choose the right program, we’ve compiled a table summarizing key aspects of each:

IRS Tax Relief Programs Comparison Overview of different IRS relief programs and their eligibility requirements to help you choose the best option for your situation

| Program | Eligibility | Benefits | Drawbacks | Best For |

|---|---|---|---|---|

| Offer in Compromise (OIC) | Doubt as to collectibility, doubt as to liability, or effective tax administration | Reduces the overall tax debt | Requires detailed financial disclosure, may be rejected, can impact credit score | Taxpayers with significant financial hardship who can't afford full tax liability |

| Currently Not Collectible (CNC) | Severe financial hardship where paying any amount would create undue hardship | Temporarily stops collection actions | Doesn’t eliminate the debt, interest and penalties continue to accrue | Taxpayers who are currently unable to pay any amount towards their tax debt |

| Installment Agreement | Taxpayers who owe a combined total of under $50,000, consisting of tax, penalties, and interest | Allows for monthly payments | Interest and penalties continue to accrue, failure to pay can result in levy actions | Taxpayers who can afford to pay their debt over time but not in a lump sum |

This table provides a quick overview of different IRS relief programs. Analyzing your specific situation with a tax professional can help you make the best choice.

When To Seek Professional Guidance

While handling tax issues independently is possible, sometimes professional expertise is beneficial. If your tax situation is complex, involves large sums of money, or you're unsure which action to take, a tax professional can be a valuable resource.

A qualified professional, like a tax attorney or enrolled agent, can offer personalized advice, negotiate with the IRS, and guide you through the complexities of tax law. Just like you’d want a lawyer for a complicated legal issue, a tax professional can provide crucial support.

Finding Affordable Tax Help

Budget concerns can prevent taxpayers from seeking professional help. But, affordable options are available. Low Income Taxpayer Clinics (LITCs) offer free or low-cost assistance to eligible individuals facing tax controversies.

These clinics provide representation during audits, appeals, and collection disputes. The Taxpayer Advocate Service (TAS) also offers free assistance to taxpayers experiencing financial hardship due to tax problems. Both LITCs and TAS ensure that even those with limited resources can access expert advice.

Preventing Future Tax Debt

The best way to avoid future payment plans is to prevent tax debt. This involves careful planning and strategies like making estimated tax payments throughout the year.

This is especially important for self-employed individuals and business owners who don't have taxes automatically withheld.

Think of it like saving for a major purchase; smaller, consistent payments are more manageable than one large sum later. Good financial planning can help you meet your tax obligations and avoid financial stress.

Are you ready to take control of your taxes and build a secure financial future? Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

With over 10 years of experience, Stephen provides expert guidance and tailored solutions to help you navigate tax debt, audits, and other IRS issues.

He works with individuals, businesses, and professionals to achieve the best possible outcomes. Don't let tax problems hold you back; take the first step towards financial peace of mind.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034