Certified Mail From The IRS: Your Complete Response Guide

Why The IRS Uses Certified Mail (And What It Means For You)

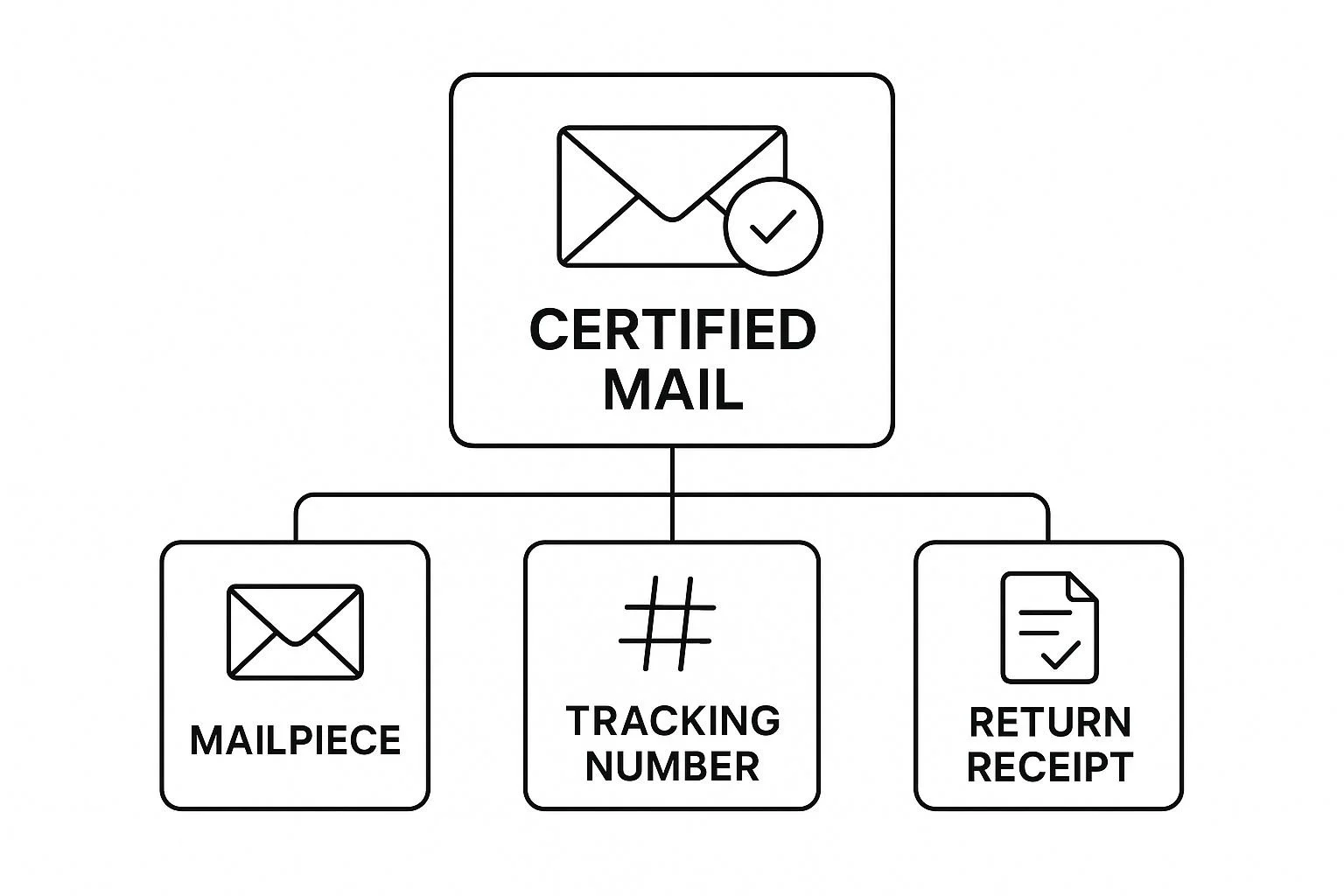

This infographic breaks down certified mail into its key parts: the letter itself, the tracking number, and the all-important return receipt. Think of it like a chain of custody, ensuring everything is accounted for and transparent between you and the IRS.

Imagine receiving a registered letter. That's the kind of weight certified mail carries. It underscores the communication's significance and creates a clear record of delivery. This is especially important for time-sensitive IRS documents with deadlines and potential legal ramifications.

Understanding the Importance of Certified Mail

Notices about audits, collection efforts, or outstanding balances often arrive via certified mail. This ensures the IRS meets its legal obligation to notify taxpayers properly while protecting their rights.

Certified mail isn't just about informing you—it's about proving you received the information. This shifts the burden of proof. Instead of the IRS having to prove they told you something, you would need to prove you didn't receive it.

This is crucial for documents like the CP504 notice, a serious heads-up about potential collection actions. Certified mail creates a documented paper trail that protects both the IRS and you. You might find this helpful: our certified mail IRS success guide.

The Legal Weight of Certified Mail

Why is all this so important? Because certified mail from the IRS often involves critical communications with legal implications and strict rules about delivery and receipt tracking.

The IRS often uses certified mail for notices like the CP504, which warns of impending levies or other serious collection actions.

This practice is actually required by law. Section 6331(d) of the Internal Revenue Code mandates that the IRS give taxpayers at least 30 days' notice before seizing property or assets to satisfy tax debts. Discover more insights. This gives you time to respond and take action.

The table below outlines some common IRS notices sent by certified mail and what they mean for you. It explains the purpose of each notice, the typical timeframe for receiving it, and what kind of response you might need to make.

Common IRS Notices Sent Via Certified Mail

| Notice Type | Purpose | Typical Timeline | Required Response |

|---|---|---|---|

| CP504 | Final notice before levy action for unpaid taxes | 30 days prior | Pay the balance due, set up a payment plan, or appeal |

| CP90 | Final notice of intent to levy (seize) state income tax refund | 30 days prior | Pay the balance due, set up a payment plan, or appeal |

| CP297 | Notice of intent to levy certain federal payments (like Social Security) | 30 days prior | Pay the balance due, set up a payment plan, or appeal |

| CP14 | Notice of balance due | Varies | Pay the balance due |

| LT11 | Final notice of intent to levy and Notice of Your Right to a Hearing | 30 days prior | Pay the balance due, request a hearing, or appeal |

This table helps illustrate how the IRS uses certified mail for important communications that require your attention and potentially a timely response. Understanding these notices and their implications can help you navigate the tax process effectively.

The Legal Weight Of Your Signature (More Important Than You Think)

Signing for certified mail from the IRS isn't just about acknowledging a delivery. It carries a significant legal weight, establishing what's called constructive receipt.

Imagine a courtroom drama where a witness is handed a key piece of evidence and asked, "Do you recognize this exhibit?" That's similar to signing for certified mail. You're confirming you received something, not necessarily agreeing with its contents.

That signature starts a clock ticking. The IRS considers you officially notified from that moment, regardless of whether you open the envelope immediately or let it gather dust for a week. This differs drastically from regular mail, which lacks verifiable proof of delivery.

Why Your Signature Matters

This process, though formal, is designed to protect both parties. Imagine the IRS claiming they sent a vital notice, but you swear you never saw it. Your signature on that certified mail receipt becomes crucial evidence, safeguarding you from penalties based on a missed communication.

On the flip side, this same signature strengthens the IRS’s position if someone tries to avoid their tax responsibilities. Dodging delivery or refusing to sign can backfire spectacularly. It can create an impression of willful ignorance and escalate a simple matter into a much bigger problem.

Understanding constructive receipt is key. It essentially means you're deemed to have received a notice even if you haven't actually read it. This reinforces the importance of acting promptly after signing for certified mail from the IRS.

This principle is a cornerstone of tax law. It's about accountability and transparency for both you and the IRS. It sets a clear process, ensuring everyone is on the same page (pun intended!).

Certified mail also plays a critical role in resolving tax disputes. Sometimes, the question of whether a tax return or petition was filed on time hinges on the "timely-mailing, timely-filing" rule.

This often leads to debates about whether the certified mail tracking data can be used as a postmark. Read more insights regarding tax disputes.

Understanding certified mail's legal weight is crucial for protecting yourself and navigating IRS procedures. This knowledge empowers you to address tax issues quickly and avoid potentially larger headaches down the road.

Decoding The Most Serious IRS Certified Mail Notices

Let's talk about some of the most common – and often most concerning – certified mail notices you might receive from the IRS. Think of these notices as different kinds of signals. Some are like a yellow caution light, while others are more like a red stop sign.

CP504 Notice: The Final Warning

One of the most serious notices is the CP504 notice. This is often the last warning you'll receive before the IRS begins collection activity. This notice tells you that you have a significantly overdue tax balance.

It also means the IRS may start levying your assets. A levy allows the IRS to seize property or funds to cover your tax debt. Receiving a CP504 requires immediate action.

CP90 and CP297: Levies on Refunds and Payments

Similar to the CP504, the CP90 and CP297 notices indicate the IRS intends to levy specific funds. The CP90 notice targets your state income tax refunds.

The CP297 notice, on the other hand, focuses on federal payments, such as Social Security. Both of these certified mail notices demand your prompt attention to avoid having critical income sources disrupted.

LT11: The Levy and Hearing Notice

The LT11 notice is a combined notice. It informs you of an impending levy and your right to a hearing with the IRS. This hearing is your chance to explain your situation and potentially work out a payment plan or other solutions before the levy takes effect.

It’s essential to understand your rights when you receive an LT11, which is typically sent by certified mail. This hearing can be a valuable opportunity to resolve your tax issues.

Other Key Notices: CP14 and Audit Notifications

The CP14 notice is a more general notice of balance due. While not as urgent as a levy notice, it still requires your attention. Ignoring it could lead to further penalties and collection actions.

Audit notifications, often sent by certified mail, represent a different kind of concern. They require you to gather detailed documentation and potentially seek professional tax advice.

Understanding the different types of IRS certified mail and what they mean allows you to respond effectively and manage your tax obligations proactively. Explore how to handle IRS debt.

Your Critical Response Window (And What Happens When You Miss It)

Receiving certified mail from the IRS can feel like a shot clock starting in a basketball game. You have a limited time – a 30-day window – to respond, and every second counts. This isn't a suggestion; it's a crucial deadline that can significantly impact your tax situation.

This screenshot shows the homepage of the IRS website, your go-to resource for all things tax-related. Think of it as your official guidebook, offering information on everything from payment options to filing requirements.

Direct access to this information is key for effectively responding to any IRS communication.

Calculating Your Response Period

Figuring out exactly how much time you have can be tricky. Weekends and holidays unfortunately do count towards that 30-day limit. And postal service delays? Those can eat into your response window, too. It’s a bit like planning a road trip and realizing some roads are closed – you have to adjust your route and timing.

Also, different notices have different deadlines. A CP504 notice, for example, which warns about potential levies (seizure of assets), carries a strict 30-day deadline. Other notices, like those related to audits, might offer a bit more breathing room.

The Consequences of Missing the Deadline

Missing the deadline can have serious repercussions. Imagine missing a court date – the results are rarely in your favor. Similarly, ignoring certified mail from the IRS could lead to bank levies, wage garnishments, or other enforcement actions. These are situations that a timely response could potentially prevent.

However, if you do miss the initial deadline, don't panic just yet. You may still have options, like requesting an abatement (a reduction or cancellation of a tax assessment) or filing an appeal.

Think of it like asking for a retake on an exam – it’s not guaranteed, but it’s worth exploring. These options tend to be more complex and have a lower success rate than responding within the initial 30-day window.

What Constitutes an Adequate Response

Just sending any letter to the IRS doesn't automatically count as an adequate response. Your response needs to be thorough and directly address the specific issues in the notice.

For instance, if you receive a CP14 notice stating you have a balance due, simply disagreeing with the amount without providing supporting documentation won’t halt collection efforts.

It's like telling a mechanic your car is making a strange noise but not explaining what the noise sounds like or when it happens.

Your response should be clear, concise, and backed by evidence. Include relevant tax forms, financial records, or legal arguments to support your position.

Think of it as building a case – the more supporting evidence, the stronger your position becomes. Understanding these details can make the difference between a quick resolution and a long, drawn-out process with the IRS.

How Common Is IRS Certified Mail Really?

Getting a certified letter from the IRS can feel like a gut punch. You might think you're being singled out, but the truth is, dealing with the IRS is a pretty common experience for many Americans.

Our tax system is complicated, and sometimes things go wrong, even with the best intentions. This section will unpack just how common IRS correspondence is and help you see where your experience fits into the bigger picture.

Understanding the Scope of IRS Correspondence

The IRS handles a mountain of mail every year, from simple questions to complex audit notifications. Not all of this arrives by certified mail, of course.

However, the IRS often uses certified mail for important matters that require a documented response from you. Think of it like sending a registered letter – it’s a way for them to make sure you’ve received the information.

This is especially true for notices about collections or levies, which almost always come via certified mail due to their legal weight.

Another common reason for IRS correspondence? Honest mistakes on tax returns. It happens more than you think. In fact, CNBC reports that roughly 80% of Americans have made errors on their tax returns at some point.

These errors, while often unintentional, can trigger IRS notices, and sometimes, those notices arrive by certified mail. Learn more about common tax errors and how they impact taxpayers.

This underscores just how widespread tax filing errors are and why receiving an IRS notice, while unnerving, isn't necessarily cause for panic.

Factors Influencing Certified Mail Volume

A few different things influence how much certified mail the IRS sends out. Changes in tax laws, IRS enforcement priorities, and even the overall economic climate can all play a role.

Certain types of taxpayers might also be more likely to receive certified mail. This isn’t about the IRS targeting anyone; it simply reflects the different levels of complexity in different tax situations.

For example, if you're self-employed or a small business owner, you’re often dealing with more complicated tax regulations than someone who receives a regular salary.

This complexity can unfortunately lead to more errors or overlooked items, potentially attracting IRS attention and resulting in a certified letter. Understanding these factors can take some of the mystery—and anxiety—out of receiving IRS mail.

Let's take a look at some data to illustrate the scope of IRS correspondence and its impact on taxpayers.

To understand the volume and common reasons behind IRS certified mail, take a look at this table:

| Year | Total Notices Sent | Most Common Notice Types | Resolution Rate |

|---|---|---|---|

| 2021 | Hypothetical Data - 15 million | Hypothetical Data - CP2000 (Underreported Income), CP501 (Balance Due), CP504 (Notice of Intent to Levy) | Hypothetical Data - 85% |

| 2022 | Hypothetical Data - 16 million | Hypothetical Data - CP2000 (Underreported Income), CP501 (Balance Due), CP14 (Past Due Taxes) | Hypothetical Data - 82% |

| 2023 | Hypothetical Data - 17 million | Hypothetical Data - CP2000 (Underreported Income), CP501 (Balance Due), CP75 (Proposed Penalty) | Hypothetical Data - 80% |

(Please note: The data in this table is hypothetical for illustrative purposes only. Real IRS statistics are not publicly available in this format.)

The table above, while using hypothetical data, illustrates the kinds of information the IRS might track and analyze. Understanding trends in notice types could help taxpayers better prepare and perhaps even avoid certain issues altogether.

It’s all about seeing the bigger picture. These interactions are a relatively common part of navigating the U.S. tax system. Knowing this can help you approach IRS correspondence with confidence, understanding your rights and responsibilities, and ultimately making the process less stressful.

Your Step-By-Step Action Plan Starting Right Now

Receiving certified mail from the IRS can feel like a punch to the gut. But instead of panicking, take a deep breath. Having a clear plan is your best defense. Think of this guide as your roadmap for navigating this often-stressful process.

Before You Open It: Document Everything

Before you even tear open that envelope, pause. This is like the opening scene of a detective movie – preserving the evidence is crucial. Jot down the date you received it and snap a photo of the unopened envelope. This creates a valuable timestamp and documents its condition upon arrival.

Opening the Envelope: Careful Documentation Continues

Now, carefully open the envelope. Imagine you’re an archaeologist uncovering a precious artifact. Take photos of everything inside. Note the documents included, their dates, and any instructions. If anything seems amiss – like a missing page or a damaged document – document that too.

Understanding the Notice: Deciphering the IRS Language

Let’s be honest, IRS notices are notorious for their confusing jargon. Don’t let it intimidate you. Take your time to read through the notice carefully.

What's its purpose?

What amounts are involved?

What deadlines do you need to be aware of?

Highlight key phrases and jot down notes in the margins as you go. Need help with an Offer in Compromise?

Check out our guide: IRS Offer in Compromise for a complete guide to tax debt settlement.

Responding to the Notice: Organize for Maximum Effectiveness

When responding to the IRS, clarity and organization are your best allies. Keep copies of everything you send. And always send your response via certified mail with return receipt requested. This creates a verifiable paper trail, protecting you down the line should any disputes arise.

Knowing Your Options and Choosing the Right Path

Once you understand the notice, it's time to explore your options. Do you need to pay the balance? Can you set up a payment plan? Should you request an abatement or file an appeal? The best course of action will depend on your individual circumstances.

Seeking Professional Help: When to Call in the Experts

While many IRS notices can be handled independently, sometimes it's best to call in reinforcements. If the notice involves complex issues, significant sums of money, or potential legal ramifications, consider consulting with a tax attorney, enrolled agent, or CPA. This is especially crucial if you’re facing an audit or collection actions.

Example Scenarios and Action Plans

Let's walk through a couple of examples to illustrate these steps in action:

Scenario 1: You receive a CP14 notice for a balance due that you believe is incorrect. Action Plan: Gather your supporting documents like tax returns, payment records, and any related correspondence. Write a clear letter to the IRS explaining the discrepancy and include copies of your supporting documents.

Scenario 2: You receive a CP504 notice warning of a levy. Action Plan: This requires immediate action. Contact the IRS right away to discuss your options. These may include paying the balance, setting up a payment plan, or requesting a hearing. If you can't resolve the issue yourself, seek professional help immediately.

These step-by-step plans provide a framework for effectively responding to certified mail from the IRS. By taking a proactive and organized approach, you can transform a potentially overwhelming situation into a manageable process.

When To Handle It Yourself Versus Getting Professional Help

That dreaded feeling – you’ve just received certified mail from the IRS. Your heart sinks. Do you need to lawyer up? Not necessarily. While getting professional help is sometimes essential, understanding the situation can save you stress and money. Knowing when to DIY and when to call in the experts is key.

Simple Issues You Can Likely Handle Alone

Some IRS notices are pretty straightforward. Think of it like getting a friendly reminder to renew your car registration. A CP14 notice saying you have a balance due might just mean making a payment or setting up a payment plan.

Or maybe the IRS needs some extra documents. In cases like these, you can probably handle things yourself. Check out our guide on how to negotiate IRS debt for more information on managing payment plans.

When Professional Help Becomes Essential

However, some situations are more complex. You wouldn't try to fix a major plumbing issue yourself if you had no experience, right? You'd call a plumber. The same applies to taxes. Issues like audits, levies, or large tax debts often require the specialized skills of a tax professional.

Types of Tax Professionals and What to Expect

Just like there are different types of doctors for different health needs, there are different types of tax professionals. Tax attorneys are the legal experts of the tax world, specializing in tax law and representing you in court if needed.

Enrolled agents are federally authorized to represent taxpayers before the IRS, handling a wide range of tax issues. CPAs, or Certified Public Accountants, can offer tax advice and prepare your returns.

Choosing the right professional depends on your specific situation. Facing an audit? A tax attorney or enrolled agent might be your best bet. Need help negotiating a payment plan or an offer in compromise? An enrolled agent or CPA could be a good fit.

Avoiding Common Misconceptions

Many people overreact when they get a letter from the IRS, spending a lot of money on professional help for simple issues they could have resolved themselves. Others try to tackle complicated situations solo when they really need expert advice.

The first step is to understand what the IRS notice is about. If it mentions potential levies, substantial tax debts, or complex legal issues, seeking professional help is crucial. But if it’s a simple request for information, you can likely handle it yourself.

Finding Qualified Help When You Need It

Finding the right tax professional might seem daunting. Start by asking for recommendations from trusted sources like friends, family, or your financial advisor. You can also check online directories like the IRS directory of enrolled agents or your state’s bar association website.

Getting a certified letter from the IRS doesn’t have to be a disaster. By understanding the situation, knowing your options, and seeking professional help when needed, you can navigate the process effectively and protect your finances.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034