Find a Good Tax Attorney: Expert Tips for Your Search

Why Finding a Good Tax Attorney Truly Matters

Navigating the complexities of the tax code can be daunting. One wrong step can lead to significant financial consequences, including substantial penalties and lengthy legal battles.

Finding a good tax attorney isn’t about avoiding taxes altogether. It’s about ensuring you pay only what you’re legally obligated to while taking advantage of available deductions and credits. This proactive strategy protects your finances and provides peace of mind.

The Stakes Are High: Protecting Your Assets and Peace of Mind

Consider the implications of an IRS audit. Even small discrepancies can escalate into major problems, consuming valuable time and resources.

A skilled tax attorney acts as your advocate during an audit, ensuring your rights are protected. They can also negotiate with tax authorities, potentially reducing penalties or setting up manageable payment plans.

This professional intervention can prevent a stressful situation from becoming a financial disaster.

For example, imagine a small business owner facing an audit for misclassified employee expenses. Without proper representation, they might be required to pay back taxes plus substantial penalties, potentially jeopardizing their business's financial stability.

A good tax attorney, however, could negotiate a lower penalty or even demonstrate that the expenses were correctly categorized, saving the business owner thousands of dollars and significant stress.

Strategic Planning: More Than Just Compliance

Finding a good tax attorney isn't just about reacting to problems; it's about proactive planning. A qualified attorney can help you structure your finances in a tax-efficient way, minimizing your tax burden legally.

This forward-thinking approach can save you significant money over time, letting you focus on growing your assets rather than constantly worrying about tax liabilities.

This strategic planning can include everything from selecting the right business structure to optimizing investment strategies for maximum tax benefits.

The process of finding a good tax attorney is increasingly complex given the changing global tax landscape, and the stakes are high given the costs involved.

According to the 2025 Report on the State of the US Legal Market by Thomson Reuters, law firms experienced solid growth in legal demand and rates through 2024, with many firms increasing overhead spending to boost future competitiveness amid economic uncertainty.

This means hiring a skilled tax attorney may involve higher fees, with average legal rates rising along with demand.

When DIY Isn’t Enough: Recognizing the Need for Professional Guidance

Handling simple tax matters yourself might be sufficient, but complex situations often demand professional expertise. This includes issues involving international taxation, estate planning, or significant tax disputes.

Trying to navigate these intricate areas without proper legal guidance can be risky and potentially more expensive than seeking professional help immediately.

Finding a good tax attorney is an investment in your financial future, providing the expertise and advocacy you need to navigate the complexities of the tax system and protect your assets.

The Non-Negotiable Qualifications That Set Elite Tax Attorneys Apart

Finding the right tax attorney takes more than a quick online search. It requires careful evaluation of their qualifications to identify genuine expertise.

This means looking beyond basic credentials and digging deeper into their specific experience and knowledge. A general legal license is essential, of course, but specialized certifications truly set the experts apart.

Decoding the Alphabet Soup of Certifications

The field of tax law is full of acronyms, and understanding them is crucial to finding a qualified tax attorney. A Certified Public Accountant (CPA) designation indicates expertise in accounting and financial matters, a valuable asset in many tax situations.

An LL.M. in Taxation, a Master of Laws degree specializing in tax law, signals advanced knowledge and a strong commitment to the field. This specialized training can prove invaluable in complex tax cases.

Knowing when to involve a tax attorney is essential, much like understanding when to hire an accountant. A good resource can offer helpful guidance on such decisions.

However, certifications alone are not enough. Practical experience is equally important. Look for an attorney with a proven track record in the specific tax law area relevant to your needs.

For instance, a tax attorney specializing in international taxation may not be the best fit for someone with estate planning questions. This is where focused research becomes paramount.

Verifying Credentials and Assessing Continued Learning

In addition to checking certifications, you should verify an attorney's credentials through your state's bar association. This confirms their license is active and in good standing.

Reviewing disciplinary records can also uncover any past ethical violations or malpractice issues. This due diligence safeguards you from potentially problematic legal representation.

A commitment to continuing education is also essential in the constantly evolving field of tax law. Tax policy is undergoing significant change globally, making it even more important to find a tax attorney with up-to-date knowledge across multiple jurisdictions.

Deloitte's 2025 Global Tax Policy Survey, involving over 1,100 tax and finance executives from multinational corporations, highlights transparency, the digitalization of tax, and international tax reform as major themes shaping global tax policy.

This emphasizes the importance of finding an attorney who keeps abreast of the latest developments. Asking about an attorney's ongoing education and professional memberships can help you assess their commitment to staying at the forefront of tax law.

By carefully evaluating these qualifications, you can find a tax attorney well-equipped to effectively address your unique challenges.

Uncovering Hidden Gems: Where Exceptional Tax Attorneys Are Found

Finding the right tax attorney isn't as simple as a quick Google search. It requires a more thoughtful, strategic approach. You need to know where to look and how to connect with the best professionals for your unique tax situation.

Tapping Into Professional Networks

Referrals are often the most reliable way to find a great tax attorney. Start with your existing network of financial professionals.

Your CPA, financial advisor, or even your estate planning attorney likely have connections with tax attorneys and can offer recommendations. These referrals often come from firsthand experience and established professional trust.

Another excellent resource is bar association directories. These directories often categorize attorneys by their practice areas, making it easy to find specialists in tax law.

Many state bar associations even have specific tax law sections, narrowing your search even further. This allows you to find attorneys actively involved in the tax law community.

Navigating Online Resources Strategically

Online platforms can be helpful, but it's crucial to be discerning. Some websites prioritize paid advertisements over genuine recommendations.

Look for reputable sites like Avvo and Martindale-Hubbell which offer attorney directories with peer reviews and client ratings. These resources provide valuable insight into an attorney's reputation and client satisfaction.

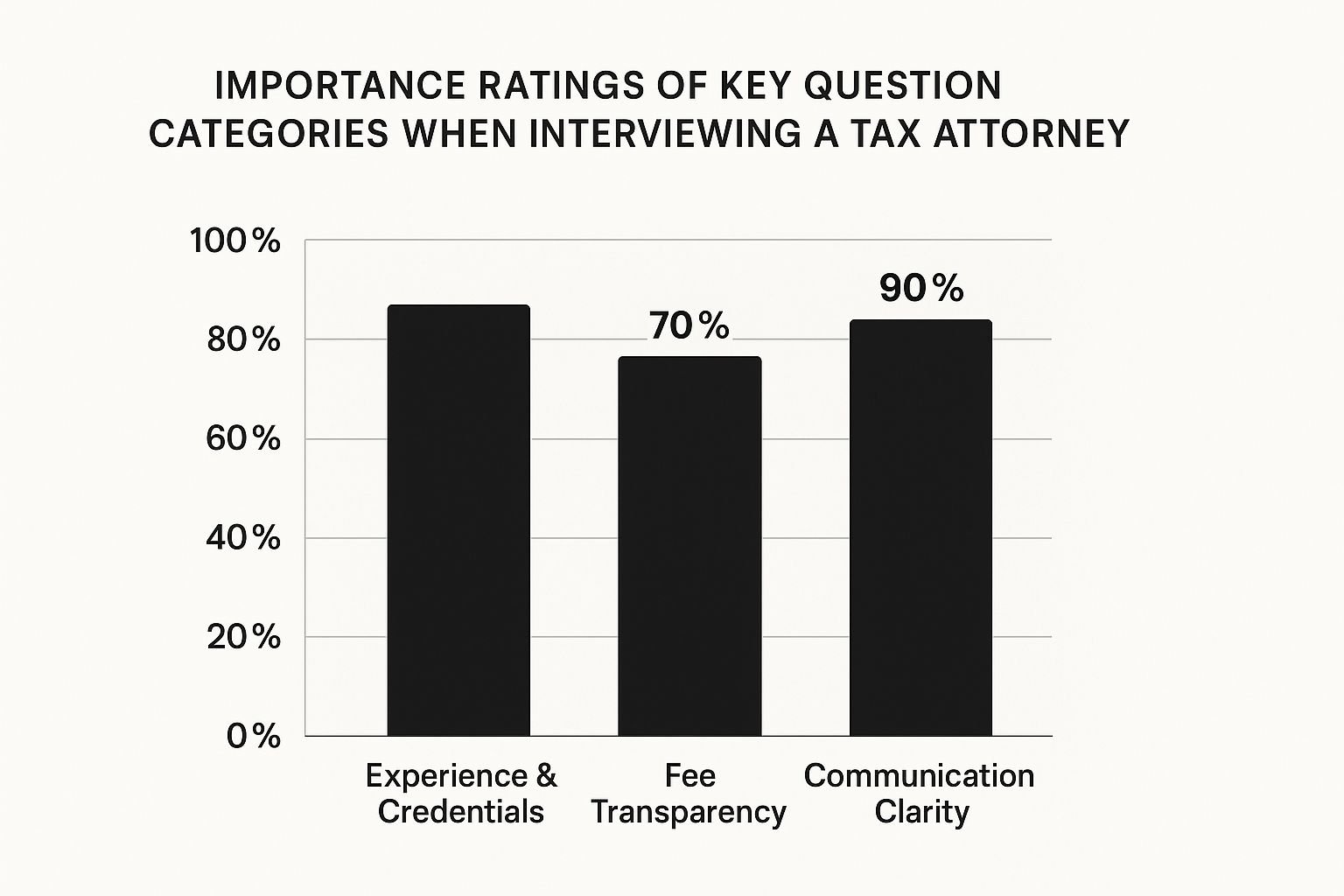

The infographic above illustrates the importance of asking the right questions when interviewing a potential tax attorney. Clear communication is key, followed closely by experience, credentials, and fee transparency.

This emphasizes the importance of open dialogue, a proven track record, and clear financial agreements for a strong attorney-client relationship.

For more guidance, check out this helpful guide on tax debt relief companies.

Understanding Market Dynamics

The availability of qualified tax attorneys is also influenced by market trends. Employment projections and economic factors play a significant role.

The U.S. Bureau of Labor Statistics projects 5% growth in lawyer employment from 2023 to 2033. This indicates a steady demand. However, tax law remains a specialized and competitive field within the legal market.

This moderate growth suggests a balance between supply and demand. While more tax attorneys will enter the field, the demand for specialists in complex areas like international tax law or technology-enhanced tax practice will likely remain high.

For more detailed statistics, see this resource. This reinforces the importance of a proactive and informed approach to finding the right tax attorney for your needs.

To further assist you in your search, we've compiled a comparison of different resources:

Top Sources for Finding Tax Attorneys

This table compares different channels for locating qualified tax attorneys, highlighting the benefits and considerations of each source.

| Source | Best For | Pros | Cons | Verification Tips |

|---|---|---|---|---|

| Referrals (CPAs, Financial Advisors) | Individuals with existing financial networks | Personalized recommendations based on trust and experience | Limited scope based on your network | Discuss the attorney’s specific experience with your referring professional |

| State Bar Association Directories | Finding specialists in your area | Comprehensive listings of licensed attorneys, searchable by specialty | Can be overwhelming to navigate; not all attorneys are equally qualified | Check the attorney’s profile for board certifications and disciplinary actions |

| Online Legal Directories (Avvo, Martindale-Hubbell) | Accessing client reviews and peer ratings | Offers insights into attorney reputation and client satisfaction | Potentially influenced by paid placements; requires careful evaluation of reviews | Cross-reference reviews with other sources and look for detailed feedback |

This table summarizes key resources and strategies for finding a tax attorney. By leveraging referrals, professional directories, and reputable online resources, you can connect with the right expertise for your specific tax needs. Remember to thoroughly vet any potential attorney to ensure they are a good fit for your situation.

The Interview Playbook: Questions That Reveal True Expertise

Finding a good tax attorney hinges on more than just a polished resume. The interview process is your chance to dig deeper, to uncover the qualities that truly distinguish exceptional legal representation.

This means asking strategic questions designed to reveal an attorney’s problem-solving abilities, communication style, and overall client philosophy.

Beyond the Basics: Probing for Deeper Insights

Verifying qualifications is important, of course, but the interview should go further. Focus on scenario-based questions that expose genuine expertise.

For instance, instead of asking, "Do you handle IRS audits?", present a hypothetical audit scenario relevant to your circumstances. Ask how they would approach it. This unveils their practical problem-solving skills, not just rehearsed answers.

Additionally, inquire about their experience with cases similar to yours. Have they effectively represented clients with comparable tax challenges? What were the results? These targeted questions provide valuable insight into their track record and relevant expertise.

Communication Is Key: Evaluating Style and Approach

Effective communication is vital for a successful attorney-client relationship. During the interview, assess the attorney’s communication style.

Do they explain complex tax concepts clearly and concisely? Do they listen attentively to your concerns and provide thorough answers? These factors will be critical throughout your representation.

Furthermore, ask about their preferred methods and frequency of communication. How often will they provide updates on your case? Do they prefer communication via email, phone calls, or in-person meetings?

Clarifying these expectations upfront ensures a smoother, more productive working relationship. Finding the right tax attorney isn't just about technical skills; it's also about finding someone you can communicate with easily.

The Fee Conversation: Transparency and Value

Openly discussing fees is essential. Don’t hesitate to ask detailed questions about their fee structure. Do they charge hourly rates, flat fees, or a blend of both?

Are there any additional costs to consider? Understanding their billing practices upfront prevents unexpected expenses and allows for informed decisions.

Moreover, don’t be afraid to negotiate. While higher rates can reflect specialized knowledge, it’s crucial to evaluate whether the value aligns with the cost. Explore payment plans or alternative fee arrangements, if necessary.

This helps ensure you're securing the best representation within your budget. When interviewing potential tax attorneys, remember to ask pointed questions.

This resource on Top Interview Questions for Call Centers offers a helpful model for developing key questions when evaluating a professional. Use these conversations to assess not only the cost but the overall value the attorney brings to your specific tax situation.

Objective Comparisons: Creating Your Scoring System

To effectively compare candidates, create a scoring system. This system should consider multiple dimensions. Assign weights to factors like experience, communication style, and fees, based on their importance to your specific needs.

For example, if clear communication is paramount, give that category a higher weight. This objective framework supports informed decision-making and helps you select the attorney best suited for your individual requirements.

Finding the right tax attorney requires a careful, thoughtful approach to interviewing and evaluation. By asking the right questions, you can uncover the true expertise and compatibility that will result in successful representation.

For more resources on navigating tax issues, explore articles on tax debt relief. With careful planning and insightful questions, you can find an attorney who is both highly qualified and a good fit for your individual needs.

Decoding Fee Structures: What You’re Really Paying For

Understanding a tax attorney's fee structure is crucial before signing any agreements. It's not just about the hourly rate; it's about understanding what that rate covers and what additional costs might arise. Open communication about fees is key to a productive attorney-client relationship.

Common Fee Arrangements: Hourly, Flat Fee, and Value-Based

Most tax attorneys use one of three main fee structures: hourly billing, flat fees, or value-based pricing. Hourly billing is common for ongoing representation or complex cases with uncertain time commitments.

Flat fees are often used for specific services like preparing tax returns or handling simple audits. Value-based pricing ties the fee to the potential tax savings the attorney achieves.

This approach can incentivize attorneys to secure the best possible outcome. Each structure has its pros and cons, and the best option depends on the nature and complexity of your tax issue.

Hidden Costs: Uncovering the Fine Print

Be aware of potential hidden costs that can significantly impact your total expense. Some attorneys charge for expenses like photocopying, postage, or travel time. Others may bill for paralegal or administrative support. These seemingly small expenses can add up quickly.

When interviewing potential tax attorneys, remember to ask pointed questions. This resource on Top Interview Questions for Call Centers provides a helpful model for formulating key questions to assess a professional. Understanding all potential costs upfront is vital.

Negotiation Strategies: Securing Favorable Terms

Don't hesitate to negotiate fee arrangements. Experienced clients often discuss alternative billing options or payment plans.

You might find this helpful: How to master your IRS payment plan. For example, for long-term engagements, you could negotiate a lower hourly rate or a capped fee.

This allows you to secure quality representation while managing costs effectively. Negotiating effectively empowers you to control your legal expenses.

Premium Rates vs. Superior Value: Assessing the ROI of Your Legal Spend

While premium rates can sometimes reflect greater expertise, it's essential to determine if they truly represent superior value.

Does the attorney's experience and track record justify the higher cost? Consider the potential tax savings or other benefits you might gain through their representation.

Conducting a cost-benefit analysis based on your specific situation helps determine if a premium rate is worthwhile. This analysis helps you make informed decisions based on the potential return on investment. Careful evaluation ensures you are paying for actual value, not just prestige.

The following table summarizes key differences between common fee structures for tax attorneys:

Tax Attorney Fee Structure Comparison

Detailed comparison of different fee arrangements with typical costs and scenarios where each is most appropriate

| Fee Structure | Typical Cost Range | Best For | Considerations | Negotiation Tips |

|---|---|---|---|---|

| Hourly | $200–$500+/hour | Complex cases, ongoing representation, unpredictable time commitment | Tracks actual time spent, can be expensive if the case drags on | Negotiate a lower hourly rate, agree on a maximum number of billable hours, request regular updates on time spent |

| Flat Fee | $500–$10,000+ | Simple, straightforward tasks like tax preparation or simple audits | Predictable cost, good for clients on a budget | Clearly define the scope of work included, ask about potential additional charges |

| Value-Based | Percentage of tax savings or other achieved outcome | Cases with significant potential tax savings or financial recovery | Aligns the attorney’s incentives with the client’s goals, can be very cost-effective if successful | Clearly define the metrics used to measure value, negotiate the percentage of savings or recovery |

Knowing the various fee structures and being prepared to negotiate will help you make informed decisions when choosing a tax attorney. Understanding the fine print and potential hidden costs allows you to control your legal spending and achieve the best possible outcome.

Beyond Expertise: Finding Your Tax Attorney Match

Finding the right tax attorney involves more than just a stellar resume. It's also about finding someone you can connect with personally, building a relationship based on trust and open communication. This crucial aspect of the attorney-client relationship can significantly influence case outcomes and your overall experience.

The Human Element: Compatibility and Communication

Choosing a tax attorney is similar to choosing a doctor. You want someone highly qualified, but also someone you feel comfortable talking to and trust.

This means considering compatibility and communication styles. Do you prefer frequent updates or a less involved approach? Can the attorney explain complex tax concepts in a way you understand?

These seemingly minor details can significantly impact your experience. For example, a client dealing with a complex audit can easily feel overwhelmed if their attorney doesn't clearly explain the process and provide regular updates.

On the other hand, constant communication might frustrate a client who prefers less frequent contact. Finding the right balance is essential.

Evaluating the Intangibles: Red Flags and Green Lights

During initial consultations, pay attention to both verbal and nonverbal cues. Does the attorney actively listen to your concerns? Do they appear genuinely invested in helping you achieve the best possible result? These subtle indicators can reveal a lot about their approach to client representation.

Red flags might include being dismissive, evasive, or communicating unclearly. Green lights, however, include active listening, empathetic responses, and a willingness to thoroughly answer your questions. These initial interactions can often predict the long-term dynamic of the attorney-client relationship.

Setting Expectations: Building a Strong Foundation

From the beginning, establish clear expectations for communication, decision-making, and overall case management. Discuss preferred communication methods, how often you'd like updates, and how you'll be involved in key decisions. This initial clarity creates a foundation for a productive and collaborative partnership.

For example, decide whether updates will be weekly or bi-weekly. Identify your main point of contact at the firm. Clarify how you'll be notified about important deadlines or case developments.

You might be interested in: How to master an Offer in Compromise with the IRS. Addressing these logistical details proactively can minimize misunderstandings and strengthen your working relationship.

Balancing Boundaries and Rapport: The Ideal Partnership

A successful attorney-client relationship balances professional boundaries with personal rapport. While maintaining professionalism is crucial, a degree of personal connection fosters trust and open communication.

This balance creates a collaborative environment where you feel comfortable sharing information and working together toward a shared goal.

Finding a good tax attorney is about finding the right blend of expertise and compatibility. By considering these "human elements," you can select an attorney with the required legal skills who also understands your needs and communicates effectively, ensuring a smoother and more successful experience.

Making the Call: Your Decision Framework for Finding a Good Tax Attorney

After researching, interviewing, and deliberating, the final decision of hiring a tax attorney requires careful thought. This involves evaluating qualifications, cost, compatibility, and case-specific nuances. It also includes essential due diligence steps that many clients miss.

Final Due Diligence: Beyond the Surface

While qualifications and experience matter, speaking with references is vital. Ask potential attorneys for references from clients with similar situations to yours.

This provides valuable practical insights into their approach and effectiveness. These conversations offer a realistic view of the attorney’s communication style, responsiveness, and ability to achieve positive results.

For example, if you're facing an IRS audit for business expenses, speaking with someone who has been through a similar audit offers invaluable firsthand knowledge. This real-world perspective can significantly shape your decision.

The Engagement Letter: Protecting Your Interests

The engagement letter formalizes the attorney-client relationship and details the terms of representation. Carefully review its provisions, especially those about scope limitations, termination rights, and confidentiality guarantees. Understanding these terms protects your interests and ensures a smooth working relationship.

Scope limitations define the specific services the attorney will provide. This prevents confusion about what's included. Termination rights outline how either party can end the agreement, providing needed flexibility.

Confidentiality guarantees are crucial, protecting your sensitive financial data. You might be interested in: How to master settling your IRS debt. Understanding these elements is critical before signing.

Communication and Accountability: Setting the Stage for Success

Clear communication from the start is essential for a productive attorney-client relationship. Discuss preferred communication methods, how often you want updates, and how you'll be involved in key decisions. This sets clear expectations and fosters collaboration.

Also, put accountability measures in place. Agree on deadlines for tasks and deliverables. This ensures progress and provides a framework for monitoring the attorney’s performance.

For example, set deadlines for document submissions, responses to questions, and case updates. This keeps everything on track and addresses potential delays proactively.

Onboarding Your Attorney: A Smooth Start for Efficient Representation

Efficient onboarding ensures a seamless transition and lets your attorney address your tax matters quickly. Provide all relevant documents upfront, including tax returns, correspondence with tax authorities, and supporting documentation. This allows your attorney to assess your situation rapidly and develop a strategic plan.

Furthermore, schedule an initial meeting to discuss your goals, concerns, and desired outcomes. This establishes a shared understanding of your objectives and sets the stage for effective teamwork. A well-defined onboarding process avoids delays and allows your attorney to focus on achieving the best possible outcome.

Ready to navigate your tax challenges with confidence? Contact Attorney Stephen A. Weisberg for a free consultation. With over 10 years of experience representing individuals and businesses, Attorney Weisberg offers personalized strategies to address your unique tax needs. Don't let tax issues weigh you down. Take control of your financial future and get the expert guidance you deserve.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034