Currently Not Collectible

Formal Hardship Status

Currently Not Collectible Status - Who Qualifies?

Key Takeaways

Currently Not Collectible (CNC) status provides temporary relief from IRS collection actions for taxpayers facing genuine financial hardship, but it's not debt forgiveness—it's a pause button with important ongoing obligations.

• CNC status temporarily stops IRS collection actions but doesn't eliminate debt; interest and penalties continue accumulating throughout the relief period.

• Qualification requires proving genuine financial hardship where tax payments would prevent covering basic necessities like food, housing, and medical care.

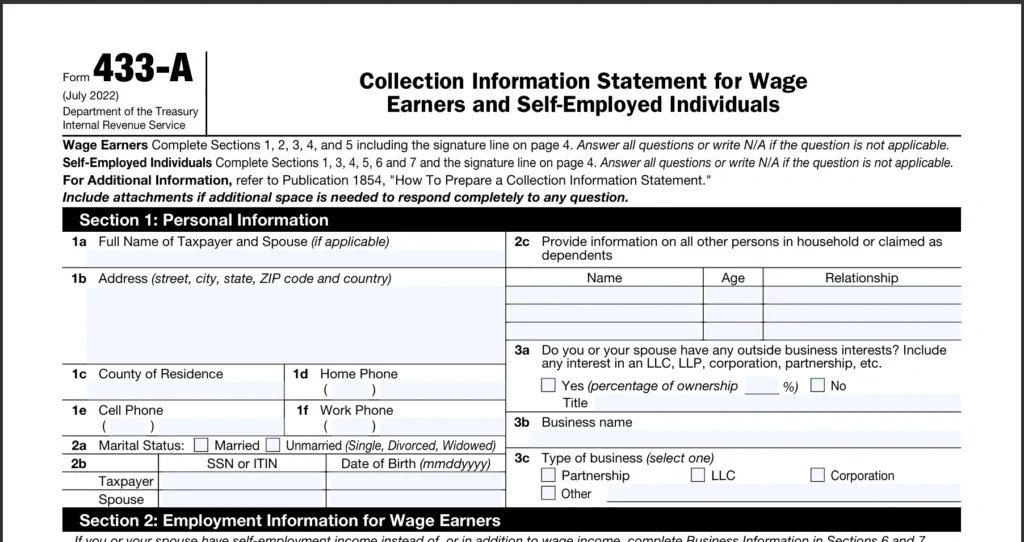

• Apply using Form 433-F (most individuals) or 433-A/433-B with comprehensive financial documentation proving inability to pay even minimal amounts.

• The IRS conducts annual reviews to reassess your financial situation and may revoke CNC status if income increases or circumstances improve.

• Future tax refunds are automatically applied to outstanding balances, and tax liens may still be filed for debts exceeding $10,000.

Remember: CNC status is a temporary solution that provides breathing room during financial crisis, but staying current on new tax obligations and responding promptly to IRS reviews is essential for maintaining this relief.

What is Currently Not Collectible Status?

Currently Not Collectible (CNC) status lets taxpayers temporarily pause their IRS collections. The IRS grants this status when taxpayers prove they can't pay without facing serious financial hardship. This status shows the IRS understands that forcing payment would put too much strain on the taxpayer's finances. The IRS approves this payment pause after seeing that taxpayers can't pay while covering their basic living costs.

The IRS stops all active collection efforts once they put an account in CNC status. This means no bank account levies, wage garnishments, or collection notices while the status stays active. This break usually lasts six months to two years, based on the taxpayer's money situation.

The tax debt doesn't go away just because collections stop. The original amount stays on the books, and interest and penalties keep adding up during the CNC period. So the total debt might grow larger the longer an account stays in CNC status.

The IRS looks at CNC cases each year. They check if the taxpayer's finances have gotten better enough to start paying again. The IRS will end the CNC status and restart collections if they see the taxpayer's situation has improved.

Several key points matter during CNC status:

The IRS usually files a public federal tax lien if you owe more than $10,000 to protect their interests

Any future tax refunds will go toward your outstanding balance

You'll get yearly bills because the law requires it

The IRS can collect the tax debt up to ten years from when it was assessed

The IRS looks at specific money factors rather than just how much you owe to grant CNC status. They have strict rules to assess which expenses count as necessary. You need solid financial records to get approved. The IRS requires you to file any missing tax returns before they'll consider CNC status.

CNC status helps when financial problems make payment impossible right now. While it gives you breathing room from collection pressure, remember that your tax debt stays active and might need attention once your finances improve.

Who Qualifies for Currently Not Collectible IRS Status?

You need to prove financial hardship to qualify for Currently Not Collectible IRS status. The IRS wants to see that paying your tax debt would stop you from covering simple living needs. They will grant this status after they check that even small payments toward tax obligations would create serious money problems.

Taxpayers must show they don't make enough monthly income to pay for living expenses. The IRS reviews financial hardship by getting a full picture of income, assets, and essential expenses. They want to know if making tax payments would stop you from affording basic needs like food, housing, utilities, or medical care.

These common situations often help taxpayers get CNC status:

Limited income sources - People who depend only on Social Security, disability benefits, SNAP (food stamps), or public housing often qualify since these income sources are usually limited

Unemployment recipients - Those who get only unemployment money might qualify, especially if using that money for taxes would stop them from covering basic needs

Medical hardships - Serious illness or disability that affects earning power or creates big medical bills

Business essentials - Self-employed people who can't keep their business running if they pay taxes

The IRS looks at the time left to collect. They might give CNC status more easily if the 10-year collection statute expiration date (CSED) is close and payments would cause money problems.

You must file all required tax returns before applying, even if you can't pay what you owe. On top of that, the IRS usually needs you to fill out financial disclosure forms (Form 433-A, 433-B, or 433-F) with documents to prove your hardship claims.

The IRS does a detailed review to qualify you. A tight budget alone won't work - you must prove you really can't make even tiny payments (about $25 monthly) without serious hardship.

The IRS uses closing codes 24-32 to mark accounts as CNC due to hardship. Your status stays until your money situation gets better. The IRS checks eligibility each year to see if anything has changed. If your finances improve, they might take away the CNC status and start collecting again.

How to Apply for Currently Not Collectible Status

The IRS has a well-laid-out process to apply for Currently Not Collectible status. You need detailed documentation and proof of financial hardship to show you cannot pay your tax debt.

1. Choose the correct IRS form (433-A, 433-B, or 433-F)

Your first step in the CNC application process is picking the right form. Form 433-F is the simplest option—a two-page document that works for most individual taxpayers. You'll need Form 433-A if you're a wage earner, self-employed, or have tax balances over $50,000. Business owners must use Form 433-B for business-related tax debts. The IRS looks at your situation and tax liability type to determine which form you need.

2. Gather financial documents (income, expenses, assets)

You need to put together detailed financial documentation to verify your situation. Here's what you typically need:

Last three months of bank statements and pay stubs

Documentation of all monthly expenses including housing, utilities, and medical costs

Asset information regarding vehicles, property, and investments

Retirement and investment account statements

Profit and loss statements (for business owners)

3. Prove financial hardship

You must show that your living expenses use up all your available income, leaving nothing for tax payments. The IRS compares your financial information to their allowable expense standards. Note that the IRS might limit certain expenses—they might cap a $1,200 monthly car payment at $497 in their calculations. Your goal is to show that paying taxes would prevent you from covering basic necessities.

4. Submit your request to the IRS

You can start your CNC request by calling the IRS directly. Call 800-829-1040 if you're an individual, or 800-829-4933 for businesses. You can also use the phone number on any IRS notice you have. During the call, you can fax your completed Form 433 and supporting documentation, and often get a preliminary decision right away.

5. Wait for IRS review and decision

The IRS will review your documentation to verify your financial situation. Simple cases take four to six weeks, while more complex ones might need one to three months. You might need to provide more information during their assessment. Once approved, you'll get confirmation of your CNC status, usually through IRS Letter 4624C. Note that you must keep filing required tax returns even if you can't pay the amounts owed.

What Happens After You’re Approved?

The IRS approval of Currently Not Collectible status brings several key changes to your tax situation. You should know how these changes work to direct you through this temporary relief period.

IRS stops collection actions

After the IRS approves your CNC status, they immediately stop all active collection efforts. You'll no longer receive threatening letters or calls from revenue officers. The IRS can't garnish your wages or levy your bank accounts. They also can't seize your assets or property while this status remains active. This gives you breathing room to get your finances back on track without constant collection pressure.

Interest and penalties continue

Getting CNC status won't stop interest or penalties on your tax debt. Your penalties and interest keep adding up during your CNC designation. This means your total tax bill grows bigger over time - something to remember if your finances improve. The IRS interest rate (usually 3-5% per year) compounds daily. On top of that, it includes extra penalties that might apply.

Tax liens may still be filed

The IRS usually files a Notice of Federal Tax Lien when your tax debt is over $10,000, even with CNC status. This lien sticks to all your property and shows up on your credit report. It could affect your chances to get loans or credit. The government uses this lien to protect their interest in your assets if your financial situation gets better before the collection statute runs out. The IRS usually won't file liens for debts under $10,000 unless special cases come up.

Future refunds may be taken

The IRS will automatically use any tax refunds to pay down your outstanding balance during your CNC period. This happens whatever the length of your CNC status. They also check your financial situation every 1-2 years to see if you can start making payments again.

How the IRS Reviews and Reassesses Your CNC Status

The IRS keeps track of accounts in Currently Not Collectible status through regular reviews. These reviews help decide if taxpayers should stay in CNC status or start paying their tax debts again.

Annual or biannual financial reviews

The IRS conducts financial reviews every 1-2 years for accounts in CNC status. Some reviews happen every 2-3 years, based on each taxpayer's situation. The IRS looks at updated financial information to see if a taxpayer's ability to pay has changed. They review recent tax returns, income statements, and expense documents. The IRS might also ask taxpayers to fill out new financial statements using Form 433-A, 433-B, or 433-F to get a fresh look at their finances.

What triggers a status change

Your CNC status could change for several reasons:

The IRS spots higher income on your tax returns

Income shows up on W-2 or 1099 forms, even without filed returns

You buy valuable assets or property

You don't file required tax returns while in CNC status

The 10-year collection statute is about to expire

The IRS uses both manual checks and automated systems to spot these changes. You'll usually get a notice from them when your CNC status might change.

How to stay compliant during CNC

You need to take specific steps to stay compliant in CNC status. File all required tax returns on time, even if you can't pay what you owe. Self-employed? Make your quarterly estimated tax payments to avoid more tax debt. Keep appropriate tax withholdings from your wages or retirement distributions. Always respond quickly when the IRS asks for updated financial information. Let the IRS know if your finances improve instead of waiting for them to find out.

FAQs

Q1. How long does Currently Not Collectible (CNC) status typically last? CNC status usually lasts between one to two years, providing temporary relief from IRS collection actions. However, it's important to note that this status is not permanent, and the IRS conducts regular reviews of your financial situation to reassess your eligibility.

Q2. What are the main qualifications for obtaining Currently Not Collectible status? To qualify for CNC status, you must demonstrate that paying your tax debt would prevent you from covering basic living expenses. This typically involves proving financial hardship through detailed documentation of your income, expenses, and assets.

Q3. Does CNC status mean my tax debt is forgiven? No, CNC status does not forgive your tax debt. It simply means the IRS has temporarily suspended collection efforts due to your current financial hardship. The underlying tax liability remains, and interest and penalties continue to accrue during the CNC period.

Q4. Will the IRS still file a tax lien if I'm granted CNC status? For tax debts exceeding $10,000, the IRS will likely file a Notice of Federal Tax Lien even if you're in CNC status. This lien protects the government's interest in your assets and may appear on your credit report.

Q5. How often does the IRS review CNC status, and what can trigger a status change? The IRS typically reviews CNC status annually or biannually. Factors that can trigger a status change include significant increases in income, acquisition of valuable assets, failure to file required tax returns, or approaching the end of the 10-year collection statute expiration date.