How to Appeal Tax Assessment: Simple Steps to Save Money

Why Tax Assessment Appeals Matter to Your Bottom Line

Property tax assessments have a direct impact on your finances, regardless of whether you own a home or a business. Understanding the assessment process and how to appeal can significantly affect your bottom line.

It's not just about reducing your current tax bill. It's about ensuring fair and accurate taxation for the future.

A successful appeal can lead to substantial savings, freeing up funds for other financial priorities.

The Gap Between Market Value and Assessed Value

Many people misunderstand the difference between market value and assessed value. Market value is the estimated price your property could sell for in the current market. Assessed value, however, is the value assigned by your local tax assessor for tax purposes. These two values are often different, sometimes significantly.

Suppose your property’s market value declines due to a local economic downturn, but the assessed value remains high. This means you're paying taxes on a value higher than your property's actual worth. This situation demonstrates the importance of understanding how to appeal a tax assessment.

Common Assessment Errors and Their Impact

Assessment errors can occur for various reasons, ranging from simple data entry mistakes to complex miscalculations of property features.

These errors often result in inflated assessed values and higher tax bills.

Common errors include incorrect calculations of square footage, misclassification of property type, and overlooking existing property damage.

The economic impact of property tax assessments and appeals highlights their importance. In the U.S., property taxes on business property made up 38.8%, or $368.8 billion, of total state and local business tax revenue in FY21. This represents a nearly 12% increase over FY20.

It underscores the considerable financial burden of these taxes and the crucial need to appeal incorrect assessments. Learn more about property tax assessment appeals.

Identifying Red Flags and Calculating Potential Savings

The first step towards a successful appeal is learning to identify red flags in your assessment notice. Check for discrepancies between your property's assessed value and recent sales of comparable properties in your neighborhood.

Carefully review the details of your assessment for any inaccuracies, such as an incorrect lot size or building features.

After identifying potential errors, estimate your potential savings. This involves calculating the difference between your current tax bill (based on the inflated assessment) and the potential tax bill (based on a corrected assessment). This calculation can provide a compelling reason to pursue an appeal.

You might be interested in how to master unfiled tax returns and avoid penalties.

Deciding whether to handle the appeal yourself or hire a professional is important. Many small businesses benefit from specialized services like SEO Services for Small Business.

Understanding the potential financial impact of a successful appeal is key to making informed decisions about your property taxes.

Determining If Your Appeal Has a Fighting Chance

Before appealing your tax assessment, it's essential to evaluate the potential strength of your case.

This involves comparing your assessment with current market values and identifying any discrepancies.

Think of it like a lawyer reviewing a case before going to trial. A solid case requires strong evidence and a clear understanding of the assessment procedures.

Understanding Common Assessment Errors

Tax assessors are human and can make mistakes. Your property tax assessment could contain errors that artificially inflate its value.

These errors might include miscalculated square footage, incorrect property classifications, or overlooked necessary repairs.

Pinpointing these errors is vital to determining a strong case for appeal.

Furthermore, assessments sometimes rely on outdated data that doesn't reflect current market values.

This lag can be especially problematic during times of fluctuating market conditions.

Your property might be assessed at a value significantly higher than its true market worth, providing grounds for an appeal.

The success of property tax appeals can vary depending on market dynamics. In 2022, escalating home prices presented challenges for successful appeals.

The National Association of REALTORS® reported existing-home prices increased by 13.9% in November compared to the previous year.

This rise made proving overassessment—key to a successful appeal—more difficult. However, some homeowners still secured reductions by comparing their properties to similar, lower-priced homes. Learn more about property tax appeals and market conditions.

Researching Comparable Properties

Demonstrating that your property's assessed value exceeds that of comparable properties is crucial for a successful appeal. This requires careful research into recent sales data for similar homes in your area.

This data serves as a valuable benchmark against your assessment. Remember to consider factors like location, size, age, condition, and amenities when selecting comparable properties.

For example, if similar homes in your neighborhood have recently sold for significantly less than your assessed value, it strengthens your case for a reduction.

Conversely, if comparable properties support your assessment, pursuing an appeal might not be the best course of action. You might be interested in: How to settle IRS debt.

Evaluating Your Chances of Success

Before embarking on an appeal, conduct a thorough self-evaluation. Consider the following factors:

Strength of Evidence: Do you have compelling evidence of discrepancies or errors in your assessment?

Potential Savings: Will the potential reduction in your tax bill justify the time and effort required for an appeal?

Complexity of the Appeal Process: Are you comfortable navigating the appeals process, or could you benefit from professional guidance?

The following table outlines key indicators to assess your appeal's strength:

Indicators of a Strong Tax Assessment Appeal Case

| Indicator | Importance Level | Required Evidence | Success Likelihood |

|---|---|---|---|

| Significant difference between assessed value and market value | High | Recent comparable sales data, appraisal report | Higher |

| Errors in property details (e.g., square footage, condition) | Medium | Photos, inspection reports, contractor estimates | Moderate |

| Inconsistent assessment compared to similar properties | Medium | Sales data of comparable properties, assessment records | Moderate |

| Changes in property condition affecting value (e.g., damage) | Medium | Photos, repair bills, insurance reports | Moderate |

This table summarizes key factors and the evidence needed for a strong case, helping you gauge your chances of success.

Effective year-end tax planning can significantly impact your finances. Carefully weigh these factors to make an informed decision about pursuing an appeal.

Building an Evidence Package That Actually Convinces

The success of your tax assessment appeal depends heavily on the evidence you present. A strong evidence package can make the difference between a substantial tax reduction and a denied appeal. This means you need more than just a claim of overvaluation; you need solid proof.

Documenting Property Issues

Start by carefully documenting any problems with your property that lower its value. This could include necessary repairs, outdated features, or functional issues.

Clear photographs, detailed descriptions, and supporting documents like contractor estimates or inspection reports can greatly strengthen your case.

For example, if your property has foundation issues, include photographs of the damage and repair estimates to support your argument for a reduced assessment.

Gathering Comparable Sales Data

Next, gather comparable sales data. This means researching recent sales of similar properties in your neighborhood. This information provides a benchmark for comparing your property's assessment.

The key is to choose truly similar properties – consider size, age, condition, location, and amenities. This data helps the appeal board see how your assessed value stacks up against actual market values.

The Role of Professional Appraisals

While not always required, a professional appraisal can significantly bolster your appeal. An appraisal offers an independent, expert opinion of your property's worth.

Appraisals can be expensive. Weigh the potential tax savings against the appraisal cost to determine if it's a good investment. When the assessed value is significantly higher than market value, an appraisal can often be worth the expense.

Remember, errors in property assessments can occur, and valuations and assessments can sometimes differ greatly, leading to more appeals.

For instance, San Francisco saw property tax appeals more than triple in 2023, underscoring the increasing importance of accurate valuations.

Creating a Persuasive Evidence Hierarchy

Organize your evidence logically. Start with the most compelling information, like a professional appraisal or strong comparable sales data.

Then, present supporting documentation, such as photographs and repair estimates. This structured approach helps the appeal board understand your argument and evaluate your claims.

Think of it like building a legal case—strong evidence forms the base, while supporting details add weight and credibility.

Documentation Formats and Credibility

The format of your documents matters. Appeal boards often prefer clear, concise, and professionally presented materials.

Organized binders, labeled exhibits, and summaries of key findings can make your evidence more credible.

This demonstrates that you've taken the process seriously. Ensure all documents are legible and easy for the board to access.

You might find it helpful to learn more about settling IRS debt. This offers broader insight into financial dealings with government agencies.

Navigating the Appeal Process Without Missing Critical Steps

The tax appeal process can feel overwhelming, with its many deadlines and specific procedures. Even a strong case can be derailed by a missed step. This section offers a guide to navigate this process, from identifying initial deadlines to preparing for potential appeals at different levels.

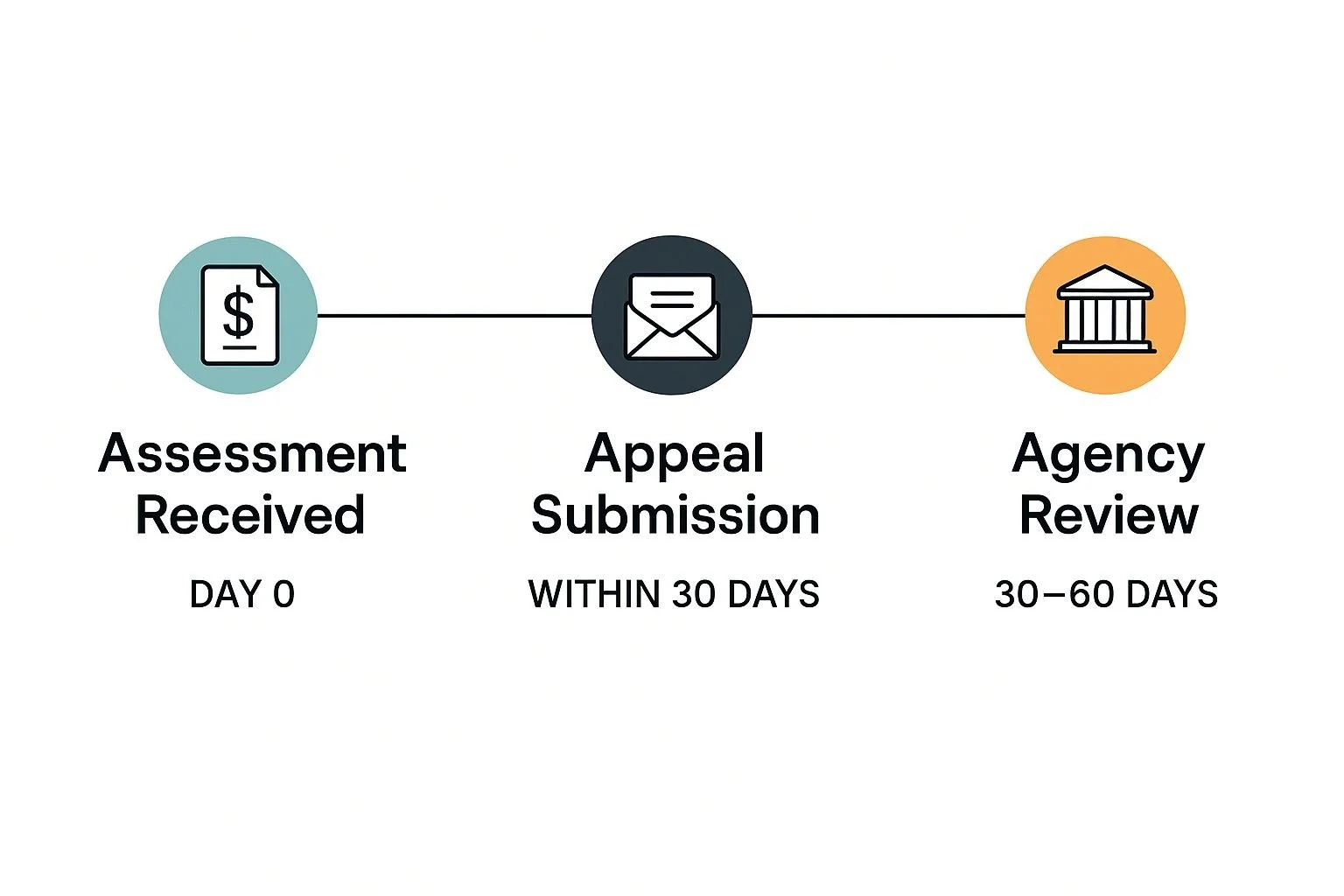

Understanding the Timeline and Key Milestones

A successful tax assessment appeal often depends on understanding the timeline and meeting all deadlines. This means knowing when to file the initial appeal, how much time you have to gather supporting evidence, and when to expect a decision.

Some jurisdictions require appeals to be filed within 30 days of receiving the assessment notice. Missing this initial deadline could impact your chances of success.

The timeline below illustrates the typical appeals process. It highlights key milestones and deadlines to help you stay on track.

The timeline infographic visually represents the stages of a typical tax assessment appeal, from receiving the assessment notice to the final decision and potential further appeals.

Each stage is marked with estimated timeframes, showcasing the overall duration and the critical moments within the process. Understanding this progression is crucial for managing the appeal effectively.

Assessment Notice Received: This is the starting point. Your jurisdiction sets the timeframe for filing an appeal.

Informal Review (Optional): Some jurisdictions allow for an informal review with the assessor before a formal appeal is filed. This can sometimes lead to a quick resolution.

Formal Appeal Filed: This involves submitting a written appeal with supporting evidence to the appropriate appeals board.

Hearing Scheduled: The board schedules a hearing to review your appeal and hear your case.

Board Decision: The board issues a decision on your appeal, usually within a set timeframe.

Further Appeals (If Necessary): If you disagree with the board's decision, you may have options for further appeals.

This process moves from less formal to more formal stages, involving progressively higher levels of authority. The informal review, if available, provides a quicker resolution path.

The formal appeal and hearing are crucial for presenting your case. The board’s decision is the culmination of this process, but it can be challenged if necessary.

Completing Appeal Forms and Gathering Documentation

Accuracy is essential when completing appeal forms. All information should be correct and complete. Clearly explain why you believe the assessment is inaccurate.

Your documentation must also meet specific requirements, which vary by jurisdiction.

This usually means gathering evidence such as comparable sales data, photos of property damage, or professional appraisals.

This documentation supports your appeal – the stronger it is, the better your chances.

Tracking Your Appeal and Staying Organized

After filing your appeal, actively track its progress. Communicate regularly with the appeals board for updates and required actions. Respond promptly if they request more information.

Keep organized records of all communication, documents, and deadlines throughout the process. This helps you stay prepared and avoid missing critical deadlines.

You might find helpful information in this article: How to master IRS back taxes payment plans. It offers guidance on managing tax-related issues.

Adapting Your Approach for Different Taxing Authorities

Appeal processes and the preferences of taxing authorities can differ. Research the specific procedures and requirements of your jurisdiction.

Some boards may favor certain types of evidence or have stricter rules.

For example, some might prioritize recent comparable sales data, while others might emphasize professional appraisals.

Tailoring your approach to the specific expectations of the taxing authority can increase your chances of a successful appeal.

This shows your understanding of their process and your preparation. By following these steps and adapting your strategy, you can improve your odds of success and potentially reduce your tax burden.

| Appeal Stage | Typical Timeline | Required Documentation | Key Actions | Common Pitfalls |

|---|---|---|---|---|

| Assessment Notice Received | Day 0 | Property tax assessment notice | Review the assessment carefully. | Not understanding the assessment details. |

| Informal Review (Optional) | Within 30 days of assessment notice | Evidence supporting your claim (e.g., comparable sales data) | Contact the assessor's office to schedule a review. Present your case clearly and concisely. | Missing the deadline for requesting an informal review. Not adequately preparing for the review. |

| Formal Appeal Filed | Within 30–90 days of assessment notice (varies by jurisdiction) | Formal appeal form, all supporting documentation (e.g., appraisal, photos) | Complete the appeal form accurately and thoroughly. Submit all required documentation by the deadline. | Incorrectly completing the appeal form. Missing the filing deadline. Insufficient supporting documentation. |

| Hearing Scheduled | Several weeks to months after filing the appeal | All original supporting documentation plus any additional evidence requested by the board. | Prepare your presentation for the hearing. Organize your evidence. Be prepared to answer questions from the board. | Not preparing adequately for the hearing. Failing to organize evidence effectively. |

| Board Decision | Several weeks after the hearing | N/A | Review the board's decision. | Misinterpreting the board's decision. |

| Further Appeals (If Necessary) | Varies by jurisdiction and appeal level | Specific documentation as required by the higher appeals authority | File the necessary paperwork within the specified timeframe. | Missing deadlines for filing further appeals. Not understanding the requirements of the next appeal level. |

This table, "Tax Assessment Appeal Timeline and Requirements," summarizes the typical stages of a property tax assessment appeal. It highlights the timeline, necessary documentation, and key actions for each stage, along with potential pitfalls to avoid.

Understanding these elements is crucial for navigating the appeal process successfully. By being aware of potential challenges and preparing accordingly, you can strengthen your appeal and improve your chances of a favorable outcome.

Making Your Case: Presentation Strategies That Work

A successful tax assessment appeal depends not only on the evidence, but also on how well you present it. A strong presentation can make the difference between winning and losing a borderline case. This isn't about putting on a show; it's about communicating clearly and persuasively to the appeal board.

Structuring Your Presentation for Maximum Impact

Think of your presentation as a story. Begin by clearly stating the problem – why you believe your assessment is incorrect. Then, logically present your evidence, connecting each piece to your central argument. Finally, summarize your key points and restate the desired outcome – a lower assessed value.

Imagine explaining why a price is too high. You wouldn't just say, "It's too much!" You would provide reasons, comparing it to similar items and noting any flaws. The same logic applies to a tax assessment appeal.

Simplifying Complex Valuation Concepts

Valuation can be complicated. Avoid using overly technical terms that the board might not understand. Instead, use clear, concise explanations, analogies, and examples.

For example, when discussing depreciation, compare it to a car losing value over time due to wear and tear. This helps the board understand the concept without minimizing its significance.

Responding Effectively to Challenging Questions

Anticipate the board's potential questions. Prepare clear, concise answers supported by evidence. If you don’t know the answer, it's better to admit it than to guess.

Think of it like a job interview. You prepare for typical questions to demonstrate your knowledge and skills. In a tax appeal, you’re demonstrating the validity of your argument.

Neutralizing Assessor Counterarguments

The assessor will likely present arguments against your appeal. Anticipate their points and prepare rebuttals backed by evidence. This demonstrates that you’ve considered all aspects of the issue.

For instance, if the assessor claims your comparable properties aren't truly comparable, be ready to explain why they are, highlighting similarities and addressing any differences. This strengthens your position and builds credibility.

Presenting Different Types of Evidence Persuasively

Different types of evidence require different presentation methods. Market analysis should be presented clearly and concisely, highlighting comparable sales data and explaining any adjustments.

Property condition documentation, like photographs and repair estimates, should visually reinforce how the issues impact the property’s value.

Think about selling a used item online. You provide clear pictures of its condition and compare its price to similar items. In a tax appeal, presenting different types of evidence effectively bolsters your case.

You may also want to explore additional resources, like this guide on tax debt relief companies, which offers information about finding professional assistance.

By mastering these presentation strategies, you significantly increase your chances of a successful appeal and a reduced tax burden.

DIY vs. Professional Help: Making the Right Choice

Appealing your property tax assessment can be daunting. One of the first big decisions? Whether to handle the appeal yourself or hire a professional.

This section will help you decide, weighing the pros and cons of each approach. We'll explore how to analyze your situation and find the best path forward.

Cost-Benefit Analysis: DIY vs. Professional

A cost-benefit analysis is key. Compare potential tax savings against the cost of professional help. For smaller assessments with potentially minimal savings, a DIY approach might be suitable.

But for larger assessments, especially on commercial properties, or complex situations involving unusual property features, a tax professional's expertise becomes invaluable. Think of it like car repairs: you might change the oil yourself, but a complex engine problem needs a mechanic.

Evaluating Tax Professionals: Expertise and Fees

If you choose professional help, select a tax consultant, attorney, or appraiser experienced in property tax appeals.

Review their track record, success rates, and knowledge of your local area. Understand their fees. Some charge hourly, others take a percentage of your savings.

For help finding professional assistance, check our guide on tax debt relief companies. Remember, finding the right professional can significantly impact your appeal's success.

DIY Resources and Support Options

If you’re handling the appeal yourself, many resources can help. Online databases offer comparable sales data for your neighborhood.

Local government websites provide information on assessment procedures and appeal forms. Some organizations even offer free or low-cost assistance to taxpayers. These resources can provide valuable support without the expense of a professional.

Hybrid Approaches: Targeted Professional Help

Consider a hybrid approach: handle some aspects yourself and get expert help for others. For example, you could gather initial evidence and comparable sales data, then consult a professional for advice on presenting your case at the hearing.

This approach balances cost savings with targeted expert support. Like hiring a business consultant for a specific problem, you get professional guidance where it's needed most.

Making the Right Choice for Your Situation

The best approach depends on your circumstances. Consider your case’s complexity, the assessment amount, your comfort level with the appeal process, and your available resources. There's no single right answer.

For some, DIY is a cost-effective way to potentially lower their taxes. For others, professional help offers the best chance of maximizing savings and minimizing stress. A hybrid approach offers a middle ground for those needing specific support.

Are you ready to take control of your property taxes and potentially save thousands?

Contact Attorney Stephen A. Weisberg today for a free consultation.

We have over 10 years of experience helping individuals and businesses navigate complex tax issues.

Don't wait—take the first step towards a fairer tax assessment.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034