Reasonable Cause for Penalty Abatement: Expert Tips

Understanding What Qualifies as Reasonable Cause

Getting penalty relief from the IRS depends on demonstrating reasonable cause. This legal term explains why you didn't follow tax rules. But simply saying you had a good reason isn't enough. You must clearly prove your actions were justified under the IRS's particular definition of reasonable cause.

Defining Reasonable Cause

Reasonable cause generally means you acted with ordinary business care and prudence in handling your taxes, but still couldn't comply. This involves proving two things:

Circumstances Beyond Your Control: These are events truly stopping you from fulfilling your tax duties. Think of a natural disaster destroying your records, or a sudden, serious illness.

Good Faith Effort: Even with problems, you must show you tried to follow tax law. This could involve getting professional tax advice, filing for an extension, or making partial tax payments.

What the IRS Considers

The IRS uses a facts-and-circumstances test to decide on reasonable cause. This means each case is reviewed individually. This can lead to unpredictable results. The burden of proof is on you, the taxpayer, to give strong evidence to support your claim.

➥ You may find this helpful: How to master tax issues with expert help.

Reasonable cause is essential for penalty abatement. It allows taxpayers to avoid or lower penalties by demonstrating good faith and valid reasons for not complying.

Applied case-by-case with the facts-and-circumstances test, it can sometimes lead to inconsistent outcomes due to its subjective nature.

The IRS uses this test not only for international information reporting penalties, but also for other penalties. This includes accuracy-related penalties under Sec. 6662 and civil fraud penalties under Sec. 6663.

Reasonable cause can greatly affect a taxpayer's finances, as it can remove substantial penalties, thus lowering the overall tax bill.

➥ Learn more about reasonable cause here.

Documentation Is Key

The IRS needs more than your word. You need solid documentation. This could include:

Medical records

Police reports

Insurance claims

Communication logs with tax professionals

Postal receipts

This documentation needs to be organized, clear, and connected to the penalty you want removed. Vague excuses or weak evidence will likely get your request denied. Carefully preparing your reasonable cause explanation and supporting documents is crucial for success.

Navigating the World of Abatement-Eligible Penalties

Not all IRS penalties are the same. This means arguing reasonable cause for penalty abatement has different success rates depending on the penalty. Understanding these differences is essential for the best possible outcome. Let's explore how different penalties respond to reasonable cause arguments.

Penalty Types and Abatement Pathways

The IRS levies various penalties, from failure-to-file and failure-to-pay to more complex penalties related to accuracy, fraud, and international reporting. Each penalty has its own rules and abatement criteria.

For example, a failure-to-file penalty, often calculated as 5% of the unpaid taxes for each month or part of a month that a return is late, might be more easily abated with a reasonable cause argument based on a documented medical emergency. This is compared to a penalty related to an alleged tax shelter.

Additionally, penalties from international reporting requirements, such as those related to foreign trusts or gifts, have unique abatement pathways.

These penalties, sometimes reaching substantial amounts, can often be abated if reasonable cause is demonstrated.

The IRS often abates penalties related to foreign information reporting due to the reasonable cause exception.

For penalties under IRC §§ 6038 and 6038A, the abatement rates are high. From 2018-2021, the IRS abated 74% of these penalties by number and 84% by dollar value.

This highlights inefficiency in the penalty assessment process. Many penalties are imposed automatically, only to be later abated.

Find more detailed statistics here. This suggests resources are spent on penalties that shouldn't have been assessed.

Statutory Standards and Documentation

Understanding the specific statutory standards for each penalty is crucial for successful penalty abatement. This includes knowing the typical dollar amounts and the documentation that works best with IRS reviewers.

For instance, a reasonable cause argument for a failure-to-pay penalty might require documentation of a sudden income loss. An accuracy-related penalty might require evidence of reliance on bad advice from a qualified tax professional.

However, some penalties have strict reasonable cause thresholds. Penalties related to tax fraud or intentional disregard of tax rules are rarely abated simply through a reasonable cause argument. Understanding when alternative relief strategies might be necessary is important.

Real-World Examples and Success Rates

Examining real-world examples of successful and unsuccessful abatement requests can offer valuable insights. By analyzing IRS data and case studies, taxpayers can learn which penalties have the highest abatement success rates.

This helps taxpayers make informed decisions about their penalty abatement cases. They can also determine if professional representation is necessary.

The key to navigating penalty abatement lies in understanding the requirements of each penalty, gathering strong documentation, and presenting a persuasive case to the IRS.

Crafting Your Compelling Reasonable Cause Narrative

Successfully resolving tax penalties often depends on more than just presenting the facts. It requires building a convincing reasonable cause narrative. This means framing your situation in a way that resonates with IRS reviewers.

This section explains how to effectively present your case using persuasive language. You might also find this helpful: How to master unfiled tax returns.

Presenting Your Case Effectively

Think of your reasonable cause argument as a persuasive essay. You need to clearly state your main point – why you deserve penalty abatement – and support it with solid evidence. You also need to anticipate and address potential counterarguments. This involves understanding the IRS reviewer's perspective and what they look for in a successful claim.

For example, simply stating "I was sick" isn't enough. You need to detail the severity of your illness, explain how it prevented you from meeting your tax obligations, and describe the steps you took to address the situation despite your illness. This demonstrates not only the circumstance, but also your good faith effort.

Furthermore, anticipating potential IRS objections is key. If your illness lasted for an extended period, explain why you didn't file for an extension or contact the IRS to explain your situation sooner. Addressing these potential concerns head-on strengthens your credibility and shows you took the matter seriously.

Organizing Evidence and Documentation Techniques

Effective organization of your evidence is crucial. A disorganized collection of documents weakens your case. Present your evidence in a clear, chronological order that tells a cohesive story.

Specific documentation requirements will vary based on the reason for your request. For medical reasons, provide detailed doctor's notes, hospital records, and medication lists. For natural disasters, gather insurance claims, police reports, and photographs of the damage. If the issue stemmed from a tax professional's error, include copies of your communication logs and engagement letters. Clear, concise documentation significantly strengthens your narrative.

Addressing Key Elements and Avoiding Pitfalls

Successful narratives address the key elements IRS reviewers consider:

Severity of the circumstance: Was the issue genuinely beyond your control?

Timeliness: Did you act promptly to resolve the problem?

Good faith effort: Did you attempt to comply with tax law despite the difficulty?

Consistency: Does your story align with the provided documentation?

Even seemingly minor oversights can weaken your case. Avoid exaggerating the circumstances or withholding pertinent information. Inconsistencies or missing documentation can raise red flags.

Honesty and transparency are essential for building trust with IRS reviewers, increasing the likelihood of a favorable outcome.

Documentation Requirements by Reasonable Cause Type This table provides specific documentation recommendations based on the type of reasonable cause being claimed for penalty abatement

| Reasonable Cause Type | Required Documentation | Recommended Additional Evidence | Common IRS Objections |

|---|---|---|---|

| Serious Illness | Doctor's notes, hospital records, medication lists | Medical bills, statements from caregivers | Why wasn't an extension filed? Why wasn't the IRS contacted sooner? |

| Natural Disaster | Insurance claims, police reports, photos of damage | Witness statements, repair bills | What steps were taken to mitigate the impact on tax compliance? |

| Tax Professional Error | Communication logs, engagement letters | Corrected tax returns, expert witness testimony | Why wasn't the error discovered and corrected sooner? |

Key insights from this table emphasize the importance of providing not just the required documentation but also additional evidence to strengthen your claim and preemptively address potential IRS objections. This proactive approach can significantly improve your chances of a successful penalty abatement.

Navigating the IRS Abatement Process From Start to Finish

Understanding reasonable cause for penalty abatement is essential. Knowing how the IRS processes these requests is equally important. This guide breaks down the journey of your abatement request from submission to the final decision, drawing on the experience of tax professionals who've successfully navigated the IRS system.

Selecting the Right Submission Method

Your first step is choosing how to submit your request. The IRS offers a few options:

Form 843, Claim for Refund and Request for Abatement: This form is generally preferred for most penalty abatement requests.

Written Correspondence: A detailed letter explaining your reasonable cause argument can also be effective.

Phone Contact: While an option, phone contact is less recommended for complex cases due to the lack of a formal record.

Each method has pros and cons. Form 843 provides structure and a clear record. Written correspondence allows for more detailed explanations and supporting documents. Phone calls can be quicker for simple questions, but lack formality. The best method depends on your situation.

➥ You might find this helpful: How to master IRS back taxes and payment plans.

Understanding IRS Review Procedures

Once submitted, your request enters the IRS review process. Here's a breakdown:

Initial Screening: The IRS checks for completeness and basic eligibility.

Case Assignment: If your request passes screening, it's assigned to an IRS agent.

Evidence Evaluation: The agent reviews the evidence and your reasonable cause arguments.

Determination: The agent decides whether to grant or deny abatement.

This process takes time, varying based on case complexity and IRS workload. Tracking your submission and following up is crucial to avoid delays. Factors like the penalty amount or type can trigger more scrutiny.

Interpreting IRS Responses and Following Up

IRS responses can be difficult to understand. Knowing IRS procedures and language helps interpret them. If your request is denied, don't give up; appeals pathways exist.

A denial for insufficient documentation doesn't mean your argument is invalid. It may mean you need more evidence or clarification. Follow-up is key. This could involve sending more documents, requesting a meeting with the agent, or filing an appeal.

Appeals and Strengthening Your Case

If your initial request is denied, you can appeal. Understanding the appeals process and presenting your case effectively is vital for a successful second review. This might involve gathering more evidence, consulting a tax professional, or refining your argument to address the IRS's concerns.

The IRS has historically struggled with penalty assessments, especially for international information reporting. High abatement rates for penalties under IRC §§ 6038 and 6038A highlight systemic issues.

In 2017, the IRS abated 64% of these penalties. This suggests taxpayers often face penalties later reduced or eliminated for reasonable cause. Explore this topic further.

Successfully navigating IRS abatement requires understanding procedures, attention to detail, and persistence. While complex, understanding each stage, a well-crafted reasonable cause argument, and strong documentation significantly improve your chances of a positive outcome.

Beyond Reasonable Cause: Alternative Penalty Relief Pathways

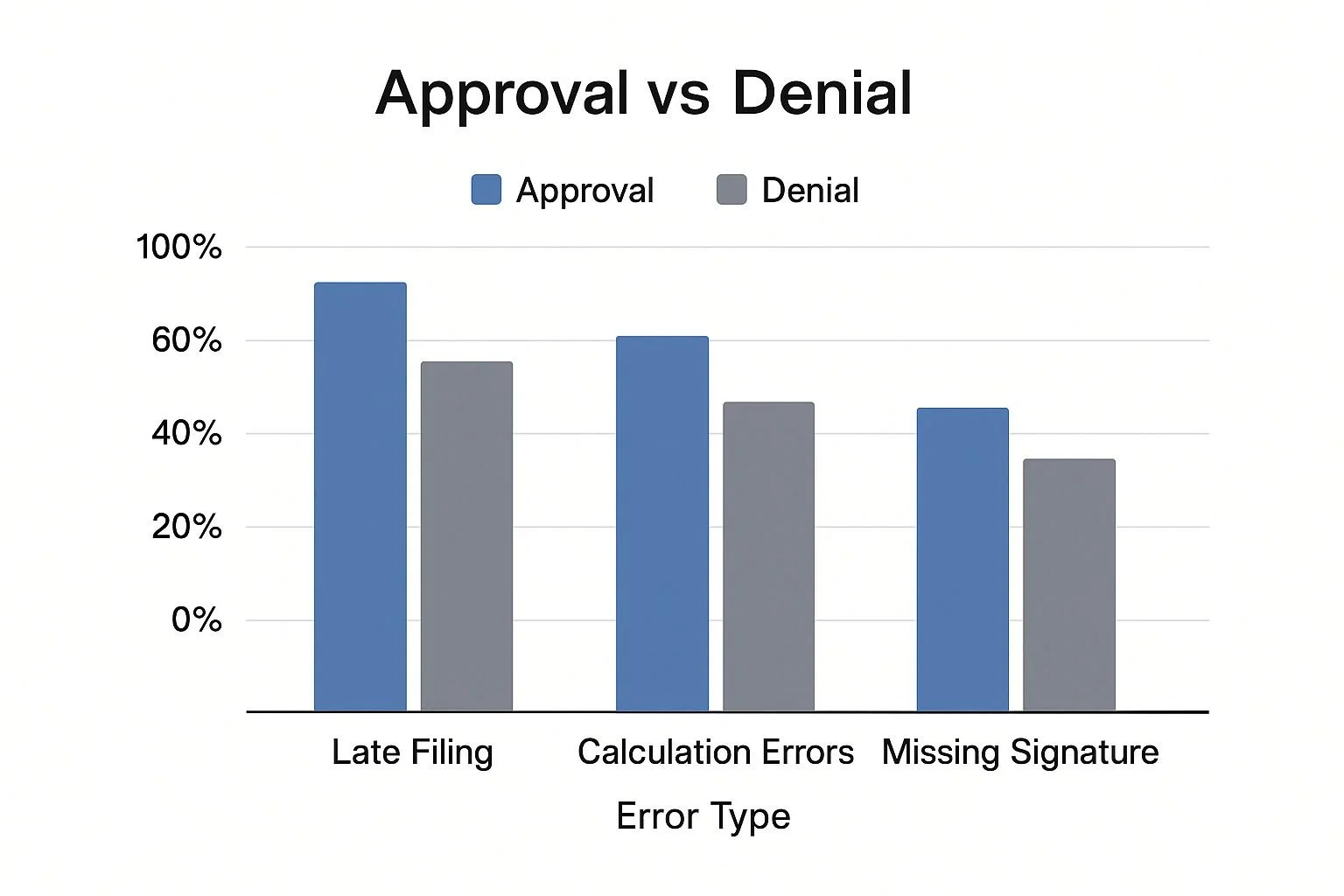

This infographic breaks down approval and denial rates for penalty abatement based on reasonable cause. The categories include Late Filing, Calculation Errors, and Missing Signature. Notice the significantly lower approval rates for issues like Missing Signatures.

This highlights the need for alternative relief options when a reasonable cause argument isn't enough.

Sometimes, claiming reasonable cause isn’t the best strategy for penalty abatement. Understanding other relief strategies can be key to a successful outcome. These strategies may offer better odds depending on your situation.

First-Time Penalty Abatement (FTA)

The First-Time Penalty Abatement (FTA) program is a great option for taxpayers with a clean record. This program waives penalties for a first offense, even without reasonable cause. Using the FTA program strategically can be more effective than arguing reasonable cause, especially for minor issues.

Specialized Programs For International Reporting

International reporting violations often come with unique challenges. The IRS offers specialized programs designed for these situations. These programs acknowledge the intricacies of international tax law and offer targeted relief.

Statutory Exceptions

Some tax laws include statutory exceptions that completely bypass reasonable cause requirements. These exceptions provide a direct path to penalty abatement if you meet specific criteria. Knowing and understanding these exceptions is crucial for maximizing your chances of relief.

➥ You might be interested in: A complete guide to tax debt settlement.

Administrative Waivers

Even seasoned tax professionals sometimes overlook administrative waivers. These waivers, granted at the IRS's discretion, can offer relief when other options are unavailable. Exploring administrative waivers can be a good strategy for those who don't qualify for other programs.

Combining Relief Approaches

Often, the best way to reduce penalties is to combine multiple strategies. For instance, a taxpayer could combine an FTA request with a reasonable cause argument to address different aspects of their penalties. This combined approach can be very effective in complex situations.

To help you choose the best strategy, let's compare the available options:

Comparing Penalty Relief Options: This table compares the different penalty relief options available to taxpayers, their eligibility requirements, and effectiveness for different penalty types.

| Relief Option | Eligibility Criteria | Best For | Success Rate | Documentation Needed |

|---|---|---|---|---|

| First-Time Abatement (FTA) | No prior penalties | First-time offenses | High | Proof of clean compliance history |

| Reasonable Cause | Valid reason for non-compliance | Various penalty types | Moderate | Documentation supporting the reason |

| Statutory Exceptions | Meeting specific legal criteria | Specific situations defined by law | High if criteria met | Proof of meeting the criteria |

| Administrative Waivers | Discretionary review by the IRS | Cases where other options fail | Varies | Supporting documentation for the request |

| Combined Approach | Utilizing multiple strategies | Complex situations | Potentially highest | Documentation for all applicable strategies |

As the table shows, each relief pathway has specific requirements and benefits. Choosing the right approach, or combining several, offers the best chance for significant penalty reduction.

Each pathway has specific eligibility criteria and application procedures. Understanding these frameworks helps ensure you choose the right strategy for your situation. Combining various strategies is often the best way to significantly reduce penalties.

Success Stories: Reasonable Cause Strategies That Worked

Understanding the IRS's definition of reasonable cause is crucial for successful penalty abatement. Real-world examples offer valuable insights into how these principles work in practice. This section explores successful abatement cases, highlighting effective strategies and documentation.

Case Study 1: The Unexpected Inheritance

A taxpayer inherited a large sum from a relative overseas. Unfamiliar with the rules, they didn't file Form 3520 on time for reporting foreign inheritances. They filed late and received a significant penalty.

Key Strategy: The taxpayer documented their lack of awareness regarding the reporting rules. They showed their limited experience with international finance and proved they took immediate action after discovering the error. A clear reasonable cause statement accompanied the late filing, emphasizing their good-faith effort to comply. The IRS abated the penalty.

Case Study 2: Business Disruption Due To Natural Disaster

A small business owner suffered a devastating flood, destroying their business and records. This caused them to miss tax deadlines, resulting in penalties.

Key Strategy: The owner provided extensive documentation of the flood damage, including insurance claims, photos, and official reports.

They also showed their efforts to reconstruct records and comply with tax obligations as quickly as possible.

Maintaining communication with the IRS throughout the process was crucial. This proactive approach resulted in penalty abatement.

Case Study 3: Reliance On Faulty Professional Advice

A taxpayer received incorrect advice from a tax professional, leading to an inaccurate tax filing and penalties.

Key Strategy: The taxpayer documented all communication with the advisor, proving their reliance on professional expertise.

They showed they provided all necessary information to the advisor and acted in good faith based on the received guidance.

The IRS abated the penalties, acknowledging the taxpayer's good-faith reliance on flawed advice. While holding professionals accountable is important, sometimes reasonable cause arguments fail.

Exploring other options, like those found in this overview of regulatory compliance solutions, can offer penalty relief.

Lessons Learned and Adaptable Principles

These cases highlight several key principles:

Thorough Documentation: Solid evidence is essential. Gather all relevant materials, including medical records, legal documents, and communication logs.

Clear and Concise Narrative: Present your case logically, explaining the situation, your actions, and reasons for deserving abatement.

Proactive Communication: Keep the IRS informed about your situation and compliance efforts.

Persistence: If your initial request is denied, don't give up. Explore appeal options and refine your argument.

Each case is unique, but these principles provide a solid base for a compelling reasonable cause argument. Learning from others' success can guide your penalty abatement journey. Understanding the IRS's perspective and presenting your case effectively increases your chances of a positive outcome.

When to DIY vs. When to Call in the Professionals

Knowing when to handle your tax penalty abatement request yourself and when to seek professional help is crucial. This section offers guidance on making that important decision.

Assessing Your Situation

Several factors can help you decide if professional representation might be beneficial:

Penalty Type and Amount: Smaller, less complex penalties, like a first-time failure-to-file, might be manageable on your own. However, larger penalties, especially those involving international reporting or tax fraud allegations, often benefit from professional expertise.

Complexity of the Issue: Straightforward situations with clear documentation, such as a natural disaster preventing a timely filing, could be suitable for a DIY approach. However, complex situations with multiple tax years, numerous penalties, or complicated legal interpretations often require professional guidance.

Your Comfort Level: If you feel overwhelmed by the process or unfamiliar with tax law, a professional can reduce stress and potentially improve your outcome.

Your Available Time: Preparing a strong abatement request requires time and effort. If you're short on time, a professional can handle the process efficiently.

Success in penalty abatement often involves strategic planning. For more on strategic planning, review this guide on developing a digital marketing strategy. While not directly related to abatement, the principles of planning and execution are universally applicable.

Choosing the Right Professional

If you decide to seek professional help, choosing the right representative is essential. Look for a tax attorney or enrolled agent with experience in penalty abatement. Ask about their success rate, fees, and communication style. A good representative will clearly explain the process, answer your questions, and keep you informed.

The DIY Approach: Resources and Guidance

If you choose the DIY route, several resources are available:

IRS Instructions and Publications: The IRS website offers instructions for Form 843 and other relevant publications.

Online Forums and Communities: Connecting with others who have navigated the abatement process can offer valuable insights.

Free Tax Clinics: Low-income taxpayers can often access free assistance through various tax clinics.

Even with these resources, a DIY approach requires dedication. Be prepared to invest time in research, organizing documentation, and writing a persuasive request. Having realistic expectations about the effort involved and potential challenges is crucial.

Need Expert Help With Your Penalty Abatement?

Are you facing IRS penalties and unsure how to proceed? Attorney Stephen A. Weisberg has over 10 years of experience representing individuals and businesses in tax controversies, including penalty abatement. Don't face the IRS alone.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034