How to Fight the IRS: Top Strategies to Protect Yourself

Understanding IRS Priorities: Where You Stand in the Crosshairs

When considering how to approach potential issues with the IRS, understanding their priorities is crucial. The IRS doesn't have the resources to audit everyone. They use a targeted approach, focusing on areas where they believe they can have the biggest impact.

This means certain taxpayers and return types are more likely to be scrutinized. Knowing where you stand relative to these priorities can help you prepare and possibly avoid an audit.

Decoding the IRS's Strategic Operating Plan

The IRS's Strategic Operating Plan offers insights into their enforcement focus. This plan reveals a recent shift toward prioritizing high-income earners and large corporations, areas where the IRS believes significant revenue recovery is possible. This targeted strategy allows for more effective resource allocation.

High-Income Earners and Large Corporations: Under the Microscope

For example, individuals with incomes over $10 million face increasing audit rates. Large corporations with assets exceeding $250 million are also experiencing increased IRS scrutiny.

The IRS audit strategy has shifted to prioritize these groups. For individuals earning over $10 million, audit rates are projected to rise from 11% in 2019 to 16.5% by 2026. Large corporations with assets over $250 million could see audit rates jump from 8.8% in 2019 to 22.6% by 2026.

This represents a substantial increase in scrutiny on wealthy taxpayers and large businesses, reflecting a strategic focus on maximizing revenue recovery.

Meanwhile, audit rates for individuals and small businesses earning under $400,000 annually are not expected to increase. This signals the IRS’s intent to target audits more selectively.

These changes are part of the IRS’s Strategic Operating Plan, which prioritizes audits of complex, high-dollar returns over smaller, standard filings. Find more detailed statistics here.

Assessing Your Own Audit Risk

So, how can you determine your own risk? Several factors contribute. Your income level is a key indicator. However, the complexity of your return also matters.

Businesses with multiple income streams, international transactions, or complex deductions are more likely to be flagged. Your filing history also plays a role. Past audits, discrepancies, or late filings can increase the likelihood of future scrutiny.

Understanding these factors is the first step in preparing. By assessing your risk profile, you can tailor your approach to interacting with the IRS and be prepared for potential challenges.

Surviving The Audit: What To Do When The IRS Comes Knocking

Receiving an IRS notice can be incredibly stressful. But understanding the audit process and taking the right steps can significantly improve your outcome. This guide will walk you through the different types of audits and offer strategies for navigating this challenging experience.

Understanding The Different Types Of Audits

The IRS conducts audits in several ways, each with its own distinct approach. Knowing which type you're facing is the first step in creating a solid plan.

Correspondence Audits: These are the most common type. Typically handled through mail, they focus on specific questions or documentation related to your tax return. They often involve relatively minor issues.

Office Audits: These are more formal. They require you to meet with an IRS agent at their office. Be prepared to present documentation and answer questions about specific parts of your tax return.

Field Audits: These are the most complex. They involve IRS agents visiting your home or business. They are usually reserved for more complicated cases or suspected fraud.

Your strategy will differ significantly depending on the audit's complexity and nature.

Communicating With Auditors and Organizing Documentation

Effective communication and organized documentation are essential during an audit. Always maintain a respectful and professional demeanor with IRS agents.

Respond to their requests promptly and provide clear, concise answers. Understanding the tax implications of selling a business is also important for financial planning. Be aware of the selling business tax implications.

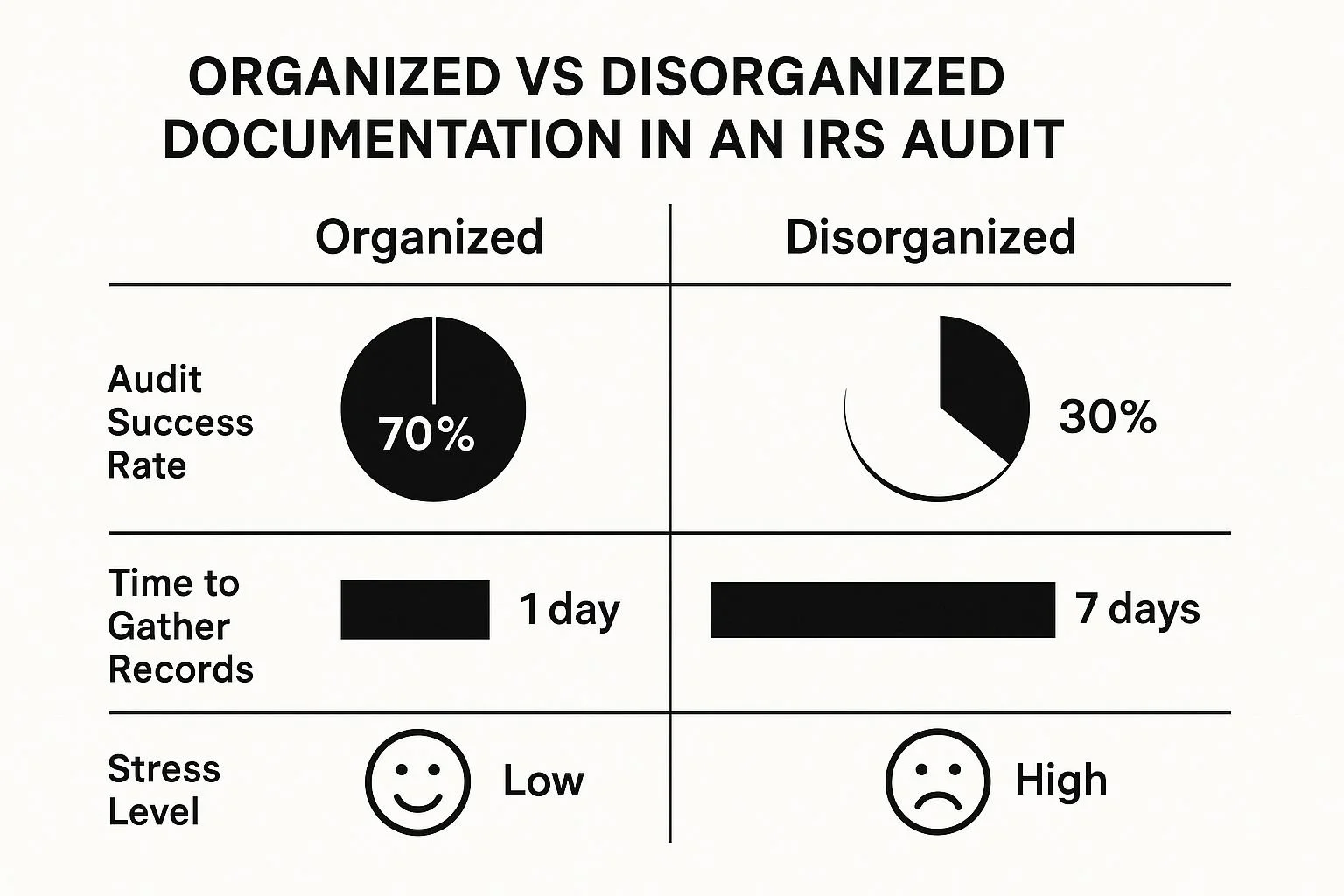

Meticulous record-keeping is crucial for effectively navigating an IRS audit. The following infographic highlights the importance of organized documentation:

Organized documentation dramatically increases audit success (70% vs. 30%), reduces time spent gathering records (1 day vs. 7 days), and significantly lowers stress levels.

The table below summarizes the key differences between the three main types of IRS audits.

To understand the different types of audits, review the following table:

| Audit Type |

|---|

| Correspondence Audit |

| Office Audit |

| Field Audit |

This table helps illustrate the varying levels of complexity and required responses for each audit type. Being prepared and understanding your specific situation is key.

IRS Audit Triggers and Timeframes

Several factors can trigger an IRS audit. These can include unusually high deductions, discrepancies between reported income and IRS records, or involvement in certain businesses known for higher audit rates.

Audit processes and IRS enforcement also face staffing challenges, while compliance demands remain high. The IRS has recently been reducing personnel, which impacts audit capacity. Despite this, 77.3% of audits in the 2023 fiscal year were correspondence audits.

The IRS generally has three years to audit a tax return. This extends to six years if gross income is understated by more than 25%.

If fraud is suspected, there's no time limit. Learn more about audit risk here. Understanding these factors is crucial for preparing for a potential audit and mitigating its impact.

Leveraging Your Rights: The Taxpayer's Secret Weapon

Many taxpayers are unaware of the significant legal rights available to them when dealing with the IRS. This section explains how to use the Taxpayer Bill of Rights—not just as theoretical concepts, but as practical tools for protection. These rights empower you to challenge IRS determinations and ensure you pay only what is legally required.

Understanding the Taxpayer Bill of Rights

The Taxpayer Bill of Rights outlines fundamental rights designed to protect you during interactions with the IRS. These are legally-backed protections you should utilize. For example, you have the right to professional representation.

This allows you to seek expert help from a tax professional in navigating complex tax issues. You might be interested in: Understanding Rights and Protections Related to Your 401k and the IRS.

You also have the right to appeal unfavorable decisions, ensuring you’re not bound by an initial determination you believe is incorrect.

Protecting Your Privacy and Paying What You Owe

Your rights also extend to protecting your privacy during IRS interactions. The IRS is obligated to respect your confidentiality and handle your information responsibly. This means your financial data should be treated with care.

A core principle of the Taxpayer Bill of Rights is ensuring you pay only what you legally owe. You are not required to pay inflated amounts or unjustified penalties.

Asserting Your Rights in IRS Interactions

Knowing your rights is important, but actively using them is crucial. This means understanding when to question aggressive collection efforts. It also means knowing the necessary documentation during disputes and how to confidently assert your rights in every interaction.

Examples of Leveraging Your Rights

Challenging Penalties: If you believe a penalty was applied unfairly, you can use your right to appeal. Provide evidence to support your case.

Requesting a Collection Due Process Hearing: If you disagree with a collection action, you can request a hearing. This allows you to present your case to an independent appeals officer.

These are just a few examples of how understanding and using your rights can significantly impact the outcome of your interactions with the IRS.

By being proactive and informed, you become an active participant in protecting your financial well-being, rather than a passive recipient of IRS notices.

These rights are your secret weapon in effectively interacting with the IRS and achieving a fair resolution.

Building Your Defense: Documentation That Wins Cases

Facing an IRS audit can be intimidating. But proper preparation can make all the difference. A solid documentation strategy is key to navigating this process successfully. This section explains how meticulous record-keeping can significantly impact the outcome of an IRS audit.

Why Documentation Matters in IRS Disputes

Your financial records tell a story. If that story is incomplete or unclear, the IRS may interpret the situation unfavorably. This can lead to costly consequences.

Comprehensive, well-organized records, however, offer clear proof of your financial activities and support your tax filings. This clarity can minimize misunderstandings, reduce the risk of penalties, and help resolve disputes efficiently.

Essential Records to Keep and How Long to Keep Them

What records should you prioritize? Begin with income documentation: pay stubs, W-2s, 1099s, and records of other income. Next, compile expense documentation: receipts, invoices, bank statements, and credit card statements supporting your deductions.

For instance, if you claim a home office deduction, meticulous records of those expenses are crucial. Also, keep records of all communication with the IRS, including notices, letters, and emails. For more information on resolving tax debt, check out our guide on Offer in Compromise.

How long should you retain these records? The standard recommendation is three years from the filing date or the tax return's due date, whichever is later. However, some exceptions exist.

Certain deductions or credits may require longer retention periods. If you understate your income by 25% or more, the IRS has a six-year window to audit your return.

Organizing Your Documentation: Systems That Work

Knowing what to keep is only half the battle; how you keep it is equally important. Two primary approaches exist: physical and digital. A physical system typically uses filing cabinets, folders, and labeled dividers.

A digital system often involves scanning documents and storing them securely in the cloud or on an external hard drive. A hybrid approach, combining physical storage for originals and digital backups for accessibility, can be particularly effective. The key is choosing a system you can maintain consistently.

Reconstructing Missing Documents: Proven Strategies

If you discover missing records, don't despair. Several options exist for reconstruction. You can contact banks, credit card companies, or vendors for copies of statements or invoices.

Alternative evidence, like canceled checks or bank statements, can also corroborate expenses. While reconstructing documents requires effort, it's essential preparation for a potential audit.

The IRS processed over 100 million individual tax returns during the 2025 tax filing season, highlighting the importance of accurate records. Explore this topic further.

Real-World Examples and Case Studies

Real-world examples demonstrate the significance of thorough documentation. In one instance, a taxpayer facing an audit for business expenses successfully defended their deductions with detailed receipts and invoices arranged chronologically.

Conversely, another taxpayer lacking adequate documentation incurred penalties and back taxes. These scenarios underscore the critical difference between a robust defense and a costly outcome.

By establishing and maintaining a comprehensive record-keeping system, you transform your documentation into a valuable asset, protecting you from potential IRS challenges.

Mastering the Appeals Process: Your Path to Victory

An unfavorable IRS decision isn’t the final word. It’s simply the start of your appeals journey. This section explains the steps you can take to challenge an IRS determination, from informal conversations to formal court proceedings.

Understanding Your Appeal Options

Several options exist for appealing an IRS decision. These range from simple reconsideration requests to complex litigation. Each option has its own procedures and potential advantages.

Reconsideration: This informal process involves asking the IRS to review its decision. It's often effective for resolving minor issues.

Formal Appeals: If reconsideration doesn't work, you can file a formal appeal with the IRS Independent Office of Appeals. This provides a more structured process with stronger legal protections. For additional guidance, you might find this article helpful: How to master appealing an IRS decision.

Tax Court: As a final option, you can take your case to the U.S. Tax Court. This involves presenting your case before a judge.

The best path forward depends on the details of your specific situation.

To help you understand the various appeal options, we've provided the following table:

IRS Appeal Options and Success Rates This table presents different appeal options available to taxpayers, their applicable situations, typical timeframes, and estimated success rates.

| Appeal Option | When to Use | Deadline to File | Typical Resolution Time | Estimated Success Rate |

|---|---|---|---|---|

| Reconsideration | Minor discrepancies or errors | Varies, generally 30–60 days from the date of the IRS notice | A few weeks to several months | Relatively high, as it addresses simple errors |

| Formal Appeals (IRS Independent Office of Appeals) | Disagreements over tax liability or other IRS determinations after reconsideration | 30 days from the date of the reconsideration decision or within the time specified in the original IRS notice | Several months to a year | Moderate, depending on the complexity of the case |

| U.S. Tax Court | When all other appeal options have been exhausted or the disputed amount is substantial | 90 days from the date of the Notice of Deficiency | One to two years or longer | Lower than other appeal options, but still possible with strong evidence and legal representation |

As you can see, each appeal option has its pros and cons. Be sure to weigh your options carefully.

Navigating the Appeals Process: Deadlines and Strategies

Successfully navigating the appeals process requires understanding key deadlines and using strong strategies. Each stage has specific timeframes for filing and responding. Missing these deadlines could impact your appeal.

Effective strategies are essential for making a compelling argument. This includes gathering strong evidence, creating logical arguments, and presenting your case clearly and professionally.

Collection Due Process Hearings and Offers in Compromise

Two powerful tools in your appeals process are Collection Due Process (CDP) hearings and Offers in Compromise (OICs). CDP hearings allow you to challenge IRS collection actions. They offer a platform to discuss payment options and dispute the amount you owe.

An OIC lets you settle your tax debt for less than the total amount. It's a possible solution in certain situations, particularly if you're experiencing serious financial difficulties.

Practical Templates and Negotiation Tactics

This process can be difficult, but resources are available to help. Practical templates for appeal letters can guide your writing and ensure you include all necessary details.

Strong documentation practices and expert-backed negotiation tactics can significantly improve your position. These resources provide you with the tools and strategies to effectively navigate the appeals process.

When to Escalate to Tax Court

Knowing when to escalate to Tax Court is critical. This is a significant step, often requiring legal counsel. It's usually pursued when other appeal options have been exhausted or when the disputed amount is significant. Careful thought and professional guidance are essential in deciding whether to take this step.

By understanding your options and using effective strategies, you can greatly improve your chances of a successful appeal. While this doesn't guarantee a win, it does provide the foundation for a solid defense and a potentially positive outcome.

Bringing In the Pros: When and How to Get Expert Help

Dealing with the IRS can be a daunting task. Sometimes, facing this challenge alone isn't just tough—it can seriously impact your financial well-being. This section will guide you in deciding when and how to seek expert assistance in your dealings with the IRS.

Recognizing When You Need Professional Help

While straightforward tax matters can often be resolved independently, more complicated situations often require professional guidance. Several signs indicate you should consider getting professional help:

Complex Tax Issues: If your tax situation involves intricate business structures, offshore accounts, or sophisticated investment strategies, professional expertise can be essential.

Significant Amounts of Money: When large sums of money are involved, the potential repercussions of mistakes or misinterpretations increase. Professional representation can help mitigate these risks.

Criminal Investigations: If the IRS suspects criminal activity, hiring a tax attorney is crucial. They can safeguard your rights and offer expert legal counsel.

You Feel Overwhelmed: The stress of an IRS dispute can be substantial. If you feel overwhelmed or unable to manage the situation alone, seeking professional support is a good idea.

These situations, among others, suggest that getting professional help might be your best course of action.

Choosing the Right Professional: Tax Attorneys, CPAs, and Enrolled Agents

Several types of tax professionals can assist you with IRS issues. Each one offers distinct expertise. Tax attorneys specialize in tax law and can represent you in court if needed.

Certified Public Accountants (CPAs) manage a broader spectrum of financial matters, including tax preparation and planning. Enrolled Agents (EAs) are federally-authorized tax practitioners focused on IRS representation. The best type of professional for your situation depends on the specifics of your tax issue.

For instance, a complicated tax fraud case would benefit from the expertise of a tax attorney, while a disagreement over deductions might be effectively resolved by a CPA or EA.

Key Questions to Ask and Red Flags to Watch For

When interviewing potential representatives, asking the right questions is important. Inquire about their experience with similar cases, their success rate, and their fee structure.

Reasonable fee structures are usually tied to the complexity of the case and the time required. Watch out for red flags like unusually high upfront fees or guarantees of specific results.

Also, establishing a clear and productive working relationship is key. Make sure you understand the process and maintain open communication with your chosen professional. This collaborative approach will maximize your chances of a successful outcome.

Learn more in our article about How to Master Settling Your IRS Debt.

Understanding Power of Attorney and Representation Impact

Power of attorney allows your representative to act on your behalf with the IRS. This enables them to access your records, communicate with agents, and negotiate for you.

Professional representation can substantially influence audit and appeal outcomes. Experts understand IRS procedures and can use this knowledge to your advantage. They can present your case effectively, challenge IRS findings, and negotiate favorable settlements.

If you disagree with an IRS decision, the next step is to understand your appeal options, including learning how to appeal a VA decision.

While a VA decision may not be directly related to the IRS, it offers valuable insights into the general appeals process, especially concerning documentation and strategic arguments.

Warning Signs That Demand Immediate Professional Help

Some warning signs indicate that you absolutely need to seek professional help immediately. These include receiving a notice of criminal investigation, facing asset seizure, or being unable to comprehend IRS communications. In these situations, delaying professional help can lead to severe repercussions.

By understanding these key aspects of engaging professional help, you can navigate your interactions with the IRS with confidence, ensuring you have the best possible support to protect your financial interests.

Key Takeaways: Your IRS Battle Plan

This section offers a practical guide to navigating IRS disputes. It provides actionable steps and checklists for audit preparation, necessary documentation, and effective appeal strategies. This advice emphasizes realistic solutions and the most impactful approaches in tax disagreements.

Preparing For An Audit: A Step-by-Step Checklist

Gather Your Records: Collect all essential financial documents, such as income statements, expense receipts, and bank records. Organize these chronologically and by category.

Review Your Return: Carefully examine your tax return for any mistakes or inconsistencies. Proactively addressing these can strengthen your position.

Understand Your Rights: Familiarize yourself with the Taxpayer Bill of Rights. This knowledge empowers you in interactions with the IRS.

Consult a Professional (If Necessary): For complex situations, consider seeking guidance from a tax attorney, CPA, or Enrolled Agent. Their expertise can be a significant advantage.

Documentation: Your Strongest Defense

Maintain Meticulous Records: Keep detailed records of all income and expenses. This should include receipts, invoices, bank statements, and canceled checks.

Organize Your Files: Use a reliable filing system, whether physical or digital. A well-organized system simplifies the audit process and projects a professional image.

Preserve Key Communications: Retain copies of all correspondence with the IRS. This includes notices, letters, and emails, providing a clear record of your interactions.

Mastering The Appeals Process: Key Strategies

Know Your Options: Understand the various levels of appeal available, including reconsideration and Tax Court. Each level has specific procedures and deadlines.

Craft Persuasive Appeals: Compose clear and concise appeal letters, outlining your arguments and providing supporting evidence. Well-reasoned arguments are crucial for a successful appeal.

Consider Professional Representation: Hiring a tax professional can significantly improve your chances of a successful appeal, especially in complex cases.

Timelines and Success Indicators: Staying on Track

Respond Promptly: Meet all IRS deadlines. Timely responses demonstrate your commitment to resolving the matter.

Track Your Progress: Monitor the status of your audit or appeal. Stay informed about upcoming steps and potential outcomes.

Measure Your Success: Assess the effectiveness of your chosen strategies. Adjust your approach as needed based on the results.

This practical guidance focuses on proven methods to help you effectively manage IRS challenges. By following these key takeaways, you can build a solid defense, protect your rights, and navigate the tax dispute process with confidence.

Remember, an IRS challenge can be stressful, but thorough preparation and a clear strategy are your greatest assets.

Are you facing an IRS challenge and feeling lost? Don't face this complex situation alone. Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

We can help you understand your available options and develop a strategy to protect your financial well-being. We have years of experience helping individuals and businesses resolve tax issues with the IRS. Don't delay – take charge of your tax situation today.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034