How To Get Rid Of Tax Debt: Your Complete Freedom Guide

Understanding Your Tax Debt Reality

Dealing with tax debt can be a stressful experience. The positive news is that getting a clear picture of your situation is the essential first move toward finding a solution for how to get rid of tax debt.

This section aims to clarify what you are truly facing, so you can get ready to address the issue directly.

Decoding Those Intimidating IRS Notices

Receiving an official envelope from the IRS often causes unease, but these letters are your primary source for understanding your predicament.

IRS notices typically explain their reason for contacting you, whether it's about an adjustment to your tax return, a balance you owe, or other tax-related matters.

It's very important to understand the specific language and penalty calculations detailed in these communications. Don't simply put them aside; they contain critical information regarding your debt.

Many find these notices confusing, but breaking them down can help. For example, a CP14 notice usually means you have unpaid taxes. Knowing the specific notice type helps you understand the urgency and the necessary next steps.

What Kind of Tax Debt Do You Owe?

Not all tax debts are identical, and figuring out the specific type you carry is a fundamental step. Is it income tax debt from a previous year, or if you're a business owner, could it be payroll tax debt?

Perhaps it's related to the Trust Fund Recovery Penalty. Each type of debt might require a different approach for resolution.

Clearly identifying the source and nature of your debt helps you look into the most appropriate relief options. This initial evaluation prevents you from spending time and energy on strategies that don't fit your particular circumstances.

Calculating Your True Debt and Spotting Errors

Before you can effectively manage your tax burden, you need an accurate understanding of what you actually owe, including any accrued penalties and interest.

It’s also surprisingly common for errors to occur in IRS calculations. Carefully reviewing all the figures could potentially save you a considerable sum of money.

The broader economic picture shows increasing pressure on financial obligations. For instance, global public debt is projected to approach 100% of GDP by the end of the decade, making it more challenging for nations to manage their finances, including tax collection.

Explore global debt trends further on the IMF blog. This wider economic context really highlights why meticulously checking your own tax debt details is so vital for finding a path forward.

Gathering Your Documents and Knowing Your Rights

Understanding your taxpayer rights is empowering. The IRS offers a Taxpayer Bill of Rights, which includes the right to be informed, the right to quality service, and the right to challenge the IRS's position, among others. Knowing these rights can make the entire process feel less overwhelming.

To prepare for any resolution strategy, begin by collecting essential documents:

Copies of your tax returns that are in question.

All IRS notices and any correspondence you've received.

Proof of your income and expenses.

Bank statements.

Having this information organized will be extremely valuable as you explore how to get rid of tax debt. This preparatory work establishes a solid foundation for the journey ahead.

IRS Payment Plans That Actually Work For You

Once you've got a clear handle on what you owe, the journey to get rid of tax debt involves looking into payment methods you can actually manage.

It’s a common misconception that the IRS only wants full payment right away. In reality, their main aim is to collect the taxes owed, so they provide several structured plans.

This means you’ve got choices, and knowing what they are is crucial for getting your finances back on track.

Understanding Your IRS Payment Options

The IRS offers a number of payment arrangements to help taxpayers settle their debts without causing excessive financial hardship. Many people are pleasantly surprised by the amount of flexibility available.

The goal is to find a repayment schedule that fits your financial situation, making it easier to resolve your tax debt. The IRS is keen to recover outstanding taxes, which contributed to an estimated tax gap of $688 billion for 2021, so they have a good reason to work with taxpayers.

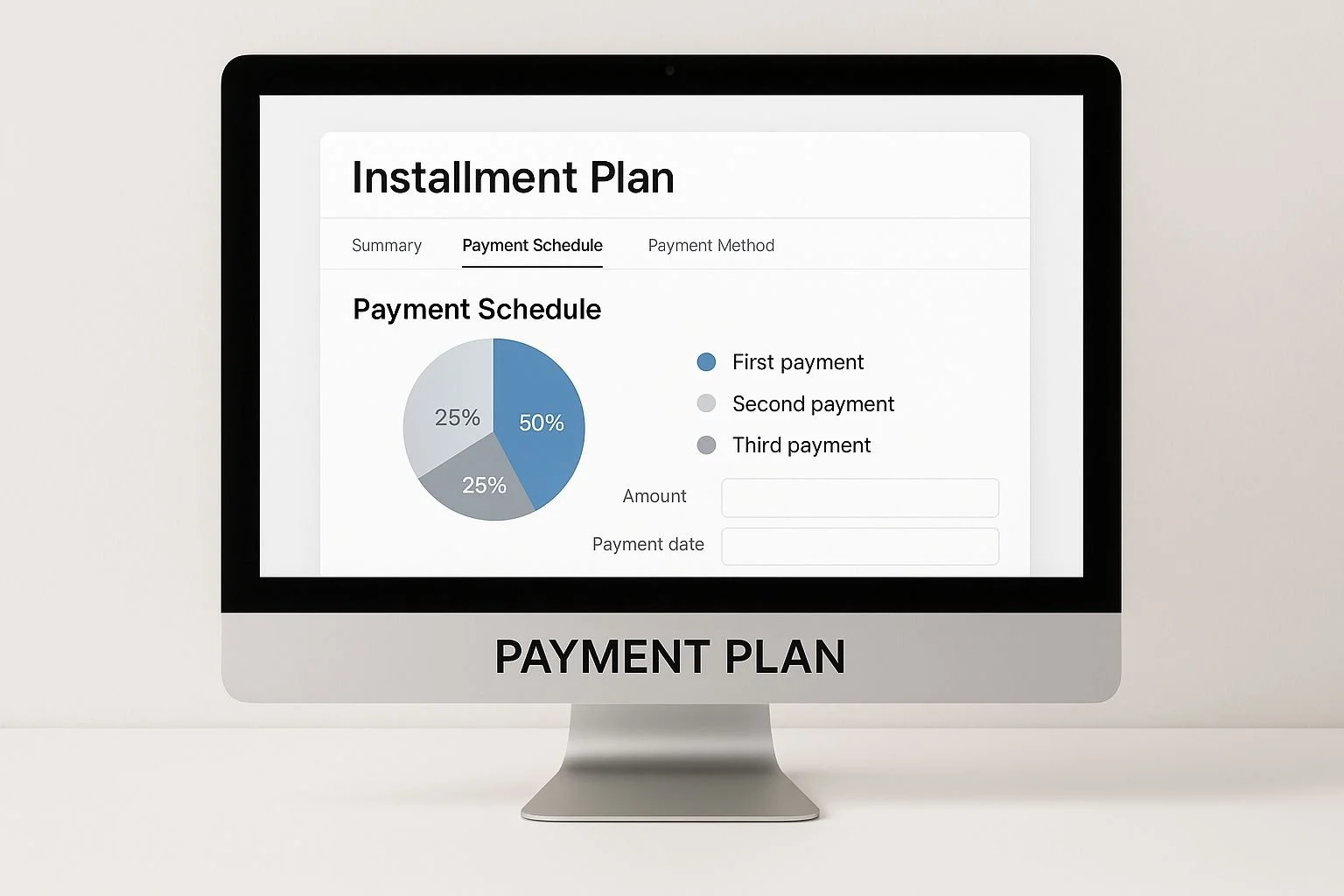

Seeing the process visually can make it feel less daunting. For example, the image below shows a typical online screen for setting up an IRS Installment Plan.

This shows that the IRS provides easy-to-use digital tools to help taxpayers arrange payments, which signals their willingness to help people comply.

Key Types of IRS Payment Agreements

The IRS has a few main ways you can structure your payments. A popular option is the Short-Term Payment Plan (STPP). This plan gives you up to 180 additional days to pay your full tax bill, including any penalties and interest that have built up.

This option often has very low or no setup fees, particularly if you set it up online, making it a good choice if you can pay off your debt fairly quickly.

For individuals who need more time, an Installment Agreement (IA) allows for monthly payments over a period of up to 72 months. This is better suited for larger debts, although interest and penalties will continue to add up until the debt is fully paid.

A very useful version is the Streamlined Installment Agreement, which is available if your total tax, penalties, and interest are under $50,000. This often comes with a simpler approval process.

To help you understand these options better, here's a table comparing the different IRS payment plans. It outlines the maximum term, setup fees, debt limits, and key requirements for each.

IRS Payment Plan Options Comparison

A detailed comparison of different IRS payment plan types, eligibility requirements, fees, and maximum terms

| Plan Type | Maximum Term | Setup Fee | Debt Limit | Requirements |

|---|---|---|---|---|

| Short-Term Payment Plan | Up to 180 days | $0 (Online) | < $100,000 (tax, penalties, interest) | Filed all required returns; Agree to pay in full within 180 days. |

| Installment Agreement | Up to 72 months | $31 (Online, Direct Debit) / $130 (Online) | Varies; > $50,000 may need financial statement | Filed all required returns; Monthly payments; Interest/penalties continue to accrue. |

| Streamlined IA | Up to 72 months | $31 (Online, Direct Debit) / $130 (Online) | < $50,000 (tax, penalties, interest) | Filed all required returns; Can pay within 72 months or collection statute end date. |

This table shows that the Short-Term Payment Plan is best for smaller debts you can clear quickly, while Installment Agreements, especially the Streamlined version, offer longer repayment periods for larger amounts, though with associated fees and ongoing interest.

Navigating Eligibility and Application

To be eligible for most payment plans, you must have filed all your necessary tax returns. You can usually start the application process online through the IRS website, over the phone, or by mail.

Before you apply, it's really important to figure out a realistic monthly payment that you can consistently make, because if you default on an agreement, it could lead to more serious collection efforts.

Setup fees can differ; for instance, applying for an IA online and choosing direct debit can notably lower these costs. While some fees are hard to avoid, knowing the fee structure helps you make better decisions.

For more detailed information on these strategies, you might find The Ultimate Guide to IRS Back Taxes Payment Plan Strategies helpful.

Tips for Managing Your Payment Plan

Once your plan is up and running, being consistent is very important. Standard IRS payment plans don't offer much room for negotiating terms upfront like an Offer in Compromise might, so making sure your payments are on time is key to avoiding extra penalties and staying in good standing.

However, unexpected things can happen in life. If your financial circumstances change and you find you can't keep up with the agreed payments, you should contact the IRS straight away.

Ignoring the issue will only make things more difficult. The IRS can often work with you to adjust your payment plan or look into other solutions if you communicate with them proactively.

Settling Tax Debt For Pennies On The Dollar

Paying much less than your total tax bill might seem like a long shot. However, the IRS Offer in Compromise (OIC) program can make this happen for certain taxpayers.

This is not a sneaky trick; it's an official program for people who genuinely can't pay their full tax debt. Figuring out if you qualify for this option is an important step in learning how to get rid of tax debt.

Legitimate Grounds For An Offer In Compromise

The IRS carefully reviews OIC requests, and you'll need to satisfy certain conditions. Generally, the IRS might approve an OIC for one of these three reasons:

Doubt as to Liability: This applies if you have good reason to believe the amount of tax assessed is wrong. For instance, you might have proof the IRS made a calculation mistake.

Doubt as to Collectibility: You acknowledge the debt is correct, but you lack the financial means (income or assets) to pay the full sum, either now or down the road. This is the most frequent basis for an OIC approval.

Effective Tax Administration (ETA): You could technically pay the entire debt, but doing so would cause unusual problems or severe financial strain. An example is if paying the tax would prevent you from covering essential living costs.

Realistically Assessing Your Chances And Preparing Your Offer

Before you start an OIC application, it's important to honestly evaluate your situation. The IRS will ask for extensive financial documentation, which means providing thorough details about your earnings, spending, property, and debts.

For more on this, you might find this resource helpful: A Smart Guide to Tax Relief Success and Settling IRS Debt.

Several common errors can cause your OIC to be turned down. These include sending in an incomplete application, not keeping up with all your tax filing and payment duties (such as estimated taxes while your OIC is being reviewed), or offering an amount that doesn't match what the IRS figures you can afford. Ultimately, your success often depends on clearly showing you cannot pay the full amount.

How The IRS Calculates An Acceptable Offer

To decide on an acceptable OIC amount, the IRS uses a figure called your Reasonable Collection Potential (RCP).

This calculation takes into account the net value of your assets that could be sold, plus your expected future income after necessary living expenses are subtracted.

In simple terms, they determine what they believe they can reasonably get from you.

Governments worldwide are always managing their finances. For instance, in OECD countries, the amount of sovereign bonds issued is expected to hit $17 trillion in 2025, an increase from $14 trillion in 2023.

This reflects how governments fund public services and handle debt. This broader financial picture helps explain why the IRS tries to collect owed taxes but also offers programs like the OIC when getting the full amount isn't practical.

You can Discover more insights about global debt and government financing from the OECD.

The OIC Journey: Timeline, Review, And Backup Plans

Submitting an OIC application is not a fast solution to your tax problems. The IRS review period can last from 6 months up to 2 years.

During this time, they will conduct a detailed examination of your finances. If your first offer is turned down, you might be able to appeal that outcome.

It's also a good idea to think about alternative plans. If an OIC doesn't seem like the right fit or if your application is denied, other avenues like an Installment Agreement or being placed in Currently Not Collectible status could be better ways to handle your tax debt.

When You Simply Can't Pay Right Now

A large tax bill can feel like an overwhelming weight, particularly when your current finances just don't stretch to cover it. Recognizing that you might need some space to regain your financial footing is often a practical first step in understanding how to get rid of tax debt.

Understanding Currently Not Collectible (CNC) Status

If paying your tax debt would mean you couldn't afford basic living essentials, the IRS has a provision called Currently Not Collectible (CNC) status. This isn't about ignoring your tax duties; think of it as a strategic pause.

When the IRS designates your account as CNC, they temporarily halt active collection methods, like seizing bank funds or garnishing wages. This break can give you crucial time to work on your financial stability without the immediate stress of IRS enforcement.

Qualifying for Genuine Financial Hardship

To be approved for CNC, you need to show the IRS that you are facing genuine financial hardship. This involves proving that your income isn't enough to cover your necessary living expenses, let alone the tax amount you owe.

The IRS uses established national and local standards to determine what counts as reasonable living costs.

Solid documentation is key to this process. You will need to supply detailed information regarding your:

Income from every source

Monthly household expenses (this includes housing, food, utilities, healthcare, and transportation)

Assets and any outstanding debts

Providing a transparent and accurate snapshot of your financial reality is vital for the IRS to grant CNC status. This step is an important part of figuring out how to get rid of tax debt when paying immediately is not feasible.

Benefits and Strategic Use of CNC Status

The most significant advantage of CNC status is the prompt relief it offers from forceful collection activities. While interest and penalties on your tax debt usually keep accumulating, CNC status protects your essential income and assets.

It’s important to remember that CNC is not a permanent fix; the IRS will typically review your financial situation every 1 to 2 years to see if your ability to pay has changed.

Recent global economic conditions have certainly highlighted issues of fiscal policy and debt management.

For example, collective global public debt soared to around $100 trillion, and rising interest rates are making it harder for nations to service their debts, a topic discussed at the World Economic Forum in Davos 2025.

These worldwide challenges can reflect the kinds of pressures individuals experience, making programs like CNC very important. Explore this topic further on the World Economic Forum website.

Make good use of the CNC period. Concentrate on improving your financial situation, perhaps by finding more secure employment or cutting back on non-essential spending.

This period of relief should be seen as an opportunity to plan your move towards a lasting solution, such as an Offer in Compromise or an Installment Agreement, once your finances are more stable.

You can learn more in our article about what Currently Not Collectible IRS status means for you.

Getting Professional Help Without Getting Scammed

Even with various IRS programs available to help manage tax burdens, figuring out how to get rid of tax debt can sometimes feel like a task best left to the experts.

The tax resolution field is home to many very capable professionals, but it's also a place where predatory scammers can operate. Learning to tell the difference is key to protecting your finances.

When to Call in the Experts

The decision to hire a professional often comes when your tax debt situation seems too tangled to unravel on your own, or when the amount you owe is quite large.

If you find IRS notices confusing, or if you're dealing with serious collection efforts like property liens or bank levies, it's a good idea to think about getting expert help. These professionals can offer clear guidance and act on your behalf.

Navigating the Types of Tax Pros

When you start looking for assistance, you'll generally find three main kinds of professionals: tax attorneys, Enrolled Agents (EAs), and Certified Public Accountants (CPAs). Each type comes with different credentials and areas of specialization.

For example, a tax attorney is qualified to handle legal battles and can represent you in Tax Court, something EAs and most CPAs are not typically authorized to do.

Enrolled Agents are tax practitioners licensed at the federal level by the IRS; they specialize in all things tax-related and have broad rights to represent taxpayers.

CPAs hold state licenses, and while many prepare tax returns and give tax advice, their work often covers a wider range of accounting services, not just complex tax debt solutions. To better distinguish their roles and help you choose, the following table outlines their key differences.

Tax Professional Services Comparison Comparison of different types of tax professionals, their qualifications, services offered, and typical costs

| Professional Type | Qualifications | Services | Average Cost | Best For |

|---|---|---|---|---|

| Tax Attorney | Law degree, state bar admission | IRS representation, Tax Court, legal disputes, criminal tax issues | Varies significantly; hourly or project-based fee | Complex legal issues, large debts, Tax Court representation |

| Enrolled Agent | IRS license (passed exam or former IRS employee) | IRS representation (audits, appeals, collections), tax preparation | Varies significantly; hourly or project-based fee | Direct IRS negotiation, tax debt resolution, audit representation |

| CPA | State license, passed Uniform CPA Exam | Tax preparation, planning, accounting, some IRS representation | Varies significantly; hourly or project-based fee | Tax planning, return preparation, general accounting, some IRS interactions |

This table highlights that while all three can assist with tax matters, their core strengths and the situations where they are most effective differ significantly.

Identifying Red Flags and Avoiding Scams

Unfortunately, the field of tax resolution can attract dishonest individuals, especially when large sums of money are at stake.

The IRS reported that the estimated annual gross tax gap—the difference between taxes owed and what's actually paid—was a staggering $688 billion for the 2021 tax year.

Scammers often target the anxiety of people struggling with tax debt. Be cautious of companies making grand promises, like guaranteeing they can resolve your debt for "pennies on the dollar" before they’ve even looked at your financial details.

Watch out for these key warning signs:

Demands for very large upfront fees before any real work is done.

Guarantees that sound too good to be true – because they usually are.

High-pressure tactics to get you to sign a contract immediately.

A lack of clear credentials or a hard-to-verify physical business location.

It’s also important to remember that the IRS will never contact you first through social media, email, or text messages to request personal or financial information or to make threats.

Their initial contact is almost always via traditional U.S. mail. Reputable professionals charge fees that match their level of skill and the complexity of your case, typically starting with a consultation to understand your specific circumstances.

What Genuine Tax Assistance Looks Like

A reliable tax professional will always start by carefully reviewing your tax history and current financial situation.

They will clearly explain the options available to you, discussing the advantages and disadvantages of each, and provide a realistic outlook on potential outcomes and how long the process might take.

Developing a good working relationship means maintaining open lines of communication and providing all the necessary documents in a timely manner.

Remember, their job is to help you figure out how to get rid of tax debt, but your active participation is essential for success. To learn more about choosing the right help, take a look at our guide on Tax Debt Relief Companies: A Guide to Finding Expert Help.

The right expert offers real solutions, not just empty assurances.

Breaking The Tax Debt Cycle For Good

Getting your tax debt sorted out feels great, no doubt. But the real victory, when you figure out how to get rid of tax debt, is making sure it doesn't come back.

Folks who’ve been through it often say that having solid systems to stay on top of taxes is super important, particularly when your income isn't steady or surprise expenses pop up. Think of it as making tax management a regular part of keeping your finances healthy.

Proactive Tax Planning: Your First Line of Defense

The best way to keep tax problems at bay is through proactive tax planning. If you have a job, take a look at your Form W-4 withholdings now and then.

Adjusting them to fit your current financial picture can help you steer clear of an unexpected tax bill later on—a common piece of advice from people who've successfully dealt with tax issues.

If you're self-employed or your income changes a lot, making estimated tax payments is a really smart move. By paying what you owe in quarterly chunks, that big yearly tax bill becomes much easier to handle.

This approach helps you dodge those end-of-year financial frights and possible penalties for not paying enough.

Building a Financial Safety Net for Tax Time

Setting up a financial cushion is another key habit to develop. Make it a practice to put aside a bit of your income into a special tax savings account. This kind of planning means that sudden personal costs won't leave you scrambling when it's time to pay your taxes.

Having this money set aside just for taxes means your other emergency savings can stay put. Being prepared in this way really helps with the next important step in keeping up with your tax duties.

The Power of Organized Record-Keeping

Keeping your paperwork in order, or maintaining organized records, is something people always mention as vital for sidestepping future tax headaches.

Good records make filing your taxes much simpler, help you get all the deductions you're entitled to, and give you solid proof if the IRS has any questions. This can significantly lower your stress levels!

Make sure you have these documents handy:

Proof of all your income sources.

Receipts for any business costs or expenses you can deduct.

Mileage logs, if they apply to you.

Records showing any estimated tax payments you’ve made.

This kind of regular habit is really helpful when your financial situation changes.

Adapting and Staying Informed for Long-Term Success

Your financial life doesn't stay static, and neither should your approach to taxes. Changes in how much you earn or how your business is set up can shift what you owe. It's also a good idea to keep up with relevant tax law updates, especially since the IRS is always working to close the tax gap—which was an estimated $688 billion for 2021.

When you actively manage your tax payments, keep careful records, and make an effort to stay informed, you'll feel much more confident about dealing with your tax responsibilities.

These habits are the bedrock for building lasting financial stability and enjoying the peace of mind that comes with having your tax situation under control.

Your Step-By-Step Action Plan

Now that we've looked at different ways to handle tax problems and steps to prevent them, it's time to bring all that information together. Your next important step is to create a clear, workable plan to tackle how to get rid of tax debt and find your financial peace of mind.

Crafting Your Personalized Roadmap To Tax Freedom

Every tax debt situation is one-of-a-kind, so your solution needs to be specifically for you. This means looking at your particular debt amount, your current financial capacity to pay, and your long-term money goals. A personalized plan can turn what feels like too many confusing options into a clear series of steps, leading you toward a future free from tax debt.

This process starts when you carefully consider the resolution methods available, such as an IRS payment plan or perhaps an Offer in Compromise. Your personal roadmap will lay out the approach that is most suitable for you, helping you to actively manage your way out of tax debt rather than just reacting to it.

Decision Points: Choosing Your Best Strategy

Picking the best resolution strategy involves a few important decision points. Think about the total amount you owe the IRS. Is it a sum you could reasonably pay off within 180 days using a short-term plan? Or does the amount call for a longer-term solution, like an Installment Agreement, which can give you up to 72 months to pay?

Next, honestly assess what you can afford to pay right now. If you're facing serious financial hardship that stops you from making any payments, being placed in Currently Not Collectible (CNC) status might be the first step.

If you believe the amount the IRS says you owe is wrong, or if you truly cannot pay the full amount, then an Offer in Compromise (OIC) could be a possibility. Answering these questions will help you identify the most effective strategy for how to get rid of tax debt in your specific circumstances.

Practical Checklists for Action

To get things moving, good organization is essential. Here are some checklists to help you stay on course:

Gathering Essential Documentation:

All IRS notices and letters.

Copies of the filed tax returns that are in question.

Current proof of your income (like pay stubs or profit and loss statements if you have a business).

A detailed breakdown of your monthly living expenses.

Statements for all your assets (such as bank accounts and property).

Preparing Your Applications:

Make sure all forms are filled out completely and accurately.

Carefully double-check all your calculations.

Include all the necessary supporting documents, and make sure they are clearly labeled.

Always keep copies of everything you submit to the IRS.

Tracking Your Progress:

Keep a log of all your communications with the IRS (note down dates, agent names, and what was discussed).

Stay aware of submission deadlines for applications and payment due dates.

Note any changes in your financial situation, as these might affect your agreed plan.

Setting Realistic Expectations And Timelines

Resolving tax debt is usually not a quick fix. For instance, an Offer in Compromise can take the IRS 6 to 18 months, or even longer, to review and make a decision on. Setting realistic timelines from the beginning can help you maintain your efforts and reduce feelings of frustration.

It's also important to celebrate milestones along your journey. Successfully submitting an application, making your first payment on an agreement, or receiving confirmation of CNC status are all significant achievements.

Recognizing these small victories can provide much-needed encouragement during what can be a demanding period.

Rebuilding Your Financial Future Post-Resolution

Once you've successfully figured out how to get rid of tax debt, your attention should shift to rebuilding and protecting your financial health for the future. This involves continuing good habits like planning for your taxes ahead of time and keeping careful, organized records.

Work on improving your credit score by ensuring all your payments are made on time and by managing any other debts you have in a responsible way. Building an emergency fund will also give you a financial cushion to handle unexpected money problems down the road.

Regaining financial confidence is a step-by-step process, but every positive action you take helps to secure your financial stability for the long term.

Feeling overwhelmed by your tax debt and unsure of the next step? A personalized strategy can make all the difference. Contact Attorney Stephen A. Weisberg for a FREE Tax Debt Analysis and start your journey to financial freedom.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034