Certified Letter from IRS: What You Need to Know

Decoding Your Certified Letter From the IRS: What It Really Means

Receiving a certified letter from the IRS can be unsettling. It's perfectly normal to feel anxious when you see that official envelope.

However, understanding why the IRS uses certified mail can ease some of your initial worries. The IRS uses this method to ensure important documents reach the intended recipient.

This process isn't just about efficiency. It creates a documented communication trail, offering legal protection for both the IRS and you, the taxpayer.

This meticulous tracking ensures the IRS can verify you received the letter. This is especially crucial for time-sensitive notices.

For instance, a Final Notice of Intent to Levy is often sent via certified mail. This establishes a clear starting point for the 30-day response period before the IRS takes action.

The certified mail process removes any doubt about when this countdown begins. Receiving a certified letter is often a serious matter, such as a notice of an audit or a tax debt notification.

The IRS handles a significant volume of paperwork. They processed nearly 271.5 million tax returns and other forms in Fiscal Year 2023 alone. For more detailed statistics, visit the IRS Data Book.

Common Reasons for Certified IRS Mail

What usually triggers a certified letter from the IRS? While not always a sign of major problems, it usually requires your prompt attention.

Notification of an Audit: This is a common reason for a certified letter, indicating the IRS is reviewing your tax return for accuracy.

Collection Actions: If you have unpaid taxes, a certified letter may outline collection steps, such as levies on bank accounts or wages.

Installment Agreement Termination: If you have an installment agreement with the IRS, a certified letter might notify you of its termination, often due to missed payments.

Penalty Assessments: Certified mail is used to notify taxpayers of penalties. One example is the Trust Fund Recovery Penalty for unpaid payroll taxes.

Identity Verification: The IRS may send a certified letter to verify your identity in cases of suspected identity theft before issuing a refund.

Notice Types and Their Significance

The type of notice you receive offers clues about the issue. Understanding these different notices can help you prepare a more effective response. The table below summarizes common certified letter types.

To help you understand these notices, we've compiled the following table:

Common Types of Certified Letters from the IRS This table outlines the most frequent types of certified letters sent by the IRS, their purpose, and typical response timeframes

| Notice Type | Purpose | Typical Response Timeline | Potential Consequences of Non-Response |

|---|---|---|---|

| CP Notice | Relates to unpaid taxes, penalties, or interest. | Generally 30 days. | Liens, levies, or other collection actions. |

| LTR Notice (Letter) | Covers a wider range of issues, from audit notifications to identity verification requests. | Varies depending on the specific notice. | Consequences vary widely, depending on the issue addressed. |

| Notice of Deficiency | Officially informs you of the IRS's intent to assess additional tax. | 90 days to file a petition in Tax Court. | The IRS will assess the tax and begin collection actions. |

This table provides a general overview, and specific response times may vary. It's always essential to carefully review the notice itself for precise details. For more information on resolving disagreements with the IRS, you can learn how to appeal an IRS decision.

Responding promptly and appropriately to any certified IRS letter is critical. Ignoring the letter will likely worsen the situation.

Cracking the Code: Understanding IRS Notice Numbers

That certified letter from the IRS probably has a confusing combination of letters and numbers—a CP or LTR followed by more digits. This isn't random. It's a code that tells you what the IRS is trying to communicate.

Understanding this code is the first step to addressing the issue. This section will explain the IRS notice numbering system and help you understand what the IRS wants.

Deciphering CP and LTR Notices

The letters "CP" stand for Computer Paragraph, while "LTR" means Letter. These prefixes categorize the notice type. CP notices usually deal with tax balances due, penalties, or interest. LTR notices cover a wider range of topics, from audit notifications to identity verification requests.

For example, a CP2000 explains a proposed adjustment to your tax. An LTR 4159 requests additional documentation. This distinction helps you quickly figure out the general topic.

The Number Holds the Key

The numbers after the CP or LTR are even more specific. Each number corresponds to a particular issue or request. For instance, CP90 signals a notice about the Alternative Minimum Tax (AMT). A CP75 relates to an Installment Agreement.

Knowing this helps you quickly understand why you received the certified letter. This understanding helps determine if you can handle the issue yourself or need professional help.

Using IRS Resources to Your Advantage

The IRS offers resources to decipher these codes. Their website has a searchable database of notice numbers with detailed explanations.

Understanding supporting documentation, similar to what's needed for VA disability letters, can also be helpful with IRS notices. For an example, see this VA Disability Letter Example.

However, keep in mind that the IRS constantly updates its systems. The IRS has been modernizing its mail processing, including projects like the Submission Processing Modernization. This aims to improve how mail is received, sorted, and digitized. Learn more about IRS modernization efforts.

Identifying Urgent Issues

Some notice numbers signal serious problems needing immediate action. For example, a CP290 means your Offer in Compromise (OIC) has been rejected. An LTR 12C informs you of math errors on your return.

Quickly identifying these critical notices is crucial to avoid further problems. Not every certified letter from the IRS is a reason to panic. But knowing what the notice number means helps you prioritize your response and take the right action.

Your First 48 Hours: Critical Steps After Receiving IRS Mail

Receiving a certified letter from the IRS can be unsettling. It's normal to feel anxious. However, a methodical approach can help you manage the situation effectively. The first 48 hours are especially important for taking control and setting the right course of action.

Hour 1: Breathe and Assess

Before opening the envelope, take a moment to breathe. Panicking won't help. Instead, approach the situation calmly, like reviewing a medical bill. Once you're composed, open the letter and read it thoroughly. Take note of the notice number (CP or LTR) and the reason for the correspondence.

Hours 2-24: Decipher the Code

Begin deciphering the IRS notice. The IRS website provides information on various notice numbers. Looking up your specific number will give you a better understanding of the issue.

For example, a CP90 notice refers to the Alternative Minimum Tax, while an LTR 4159 indicates a request for more documentation. This research will help you assess the situation's severity.

The IRS offers resources to help taxpayers understand these notices. In Fiscal Year 2023, the IRS assisted nearly 60.3 million taxpayers through calls and visits. More detailed statistics are available here. You can also find helpful information in our certified mail from IRS success guide.

Hours 25-48: Gather Your Allies and Documents

Once you understand the notice, gather relevant documents, such as tax returns, receipts, and bank statements. Organize these materials methodically, as you would for a presentation. This organized approach will save you time and provide a sense of control.

If the issue seems complex, consider consulting a tax professional. A qualified advisor can offer valuable guidance and insights.

Assessing the Situation: Emergency or Manageable?

Not all IRS notices indicate a crisis. Understanding the difference between a serious issue and a manageable one can alleviate unnecessary stress. A simple request for information differs significantly from a notice of intent to levy.

Look for key phrases in the letter. Terms like "final notice," "intent to levy," or "criminal investigation" suggest a more urgent situation.

Understanding Deadlines and Dates

Pay close attention to the dates in the letter. The mailing date and receipt date are important for determining your response window. The IRS typically provides a deadline for your response.

Mark these deadlines on your calendar. Missing them can have significant consequences. Just like a court date, failing to respond can have repercussions.

By taking prompt action within the initial 48 hours, you'll be better prepared to manage the situation and avoid potential problems.

This proactive approach can minimize stress and increase your chances of a positive outcome.

Crafting Your Response: Tailored Strategies By Notice Type

Not all certified letters from the IRS are created equal. Different notices require different responses. This section offers proven response strategies for common IRS notices, based on the experience of tax professionals.

We'll explore what supporting documentation is most effective for various notice types, from audit responses to collection alternatives.

Understanding The Nuances of IRS Notices

The first step in crafting an effective response is understanding the specific notice you received. The notice number (CP or LTR) and its explanation provide valuable clues about the IRS's concerns.

For example, a CP2000 notice, indicating a proposed tax adjustment, requires different documentation than an LTR 4159, which requests additional information. Understanding these nuances is crucial for a successful resolution.

This careful analysis helps you tailor your response to the specific issue. For example, if the notice concerns unpaid taxes, gathering documentation of your payment history, financial hardship, or efforts to establish an installment agreement could be crucial.

An audit notice, however, may require producing records related to specific deductions or income sources.

Effective Communication Strategies

Beyond documentation, the language you use in your response significantly impacts the outcome. Cooperation is essential, but clearly and respectfully advocating for your position is equally important.

Avoid confrontational language. Instead, present your case logically and factually, supporting your arguments with clear evidence.

Successful taxpayers often acknowledge the IRS's concerns and then present their side of the story with supporting documentation.

For instance, if the IRS questions a claimed deduction, explain the nature of the expense and its relevance to your business or income. Then, provide receipts or other proof of payment.

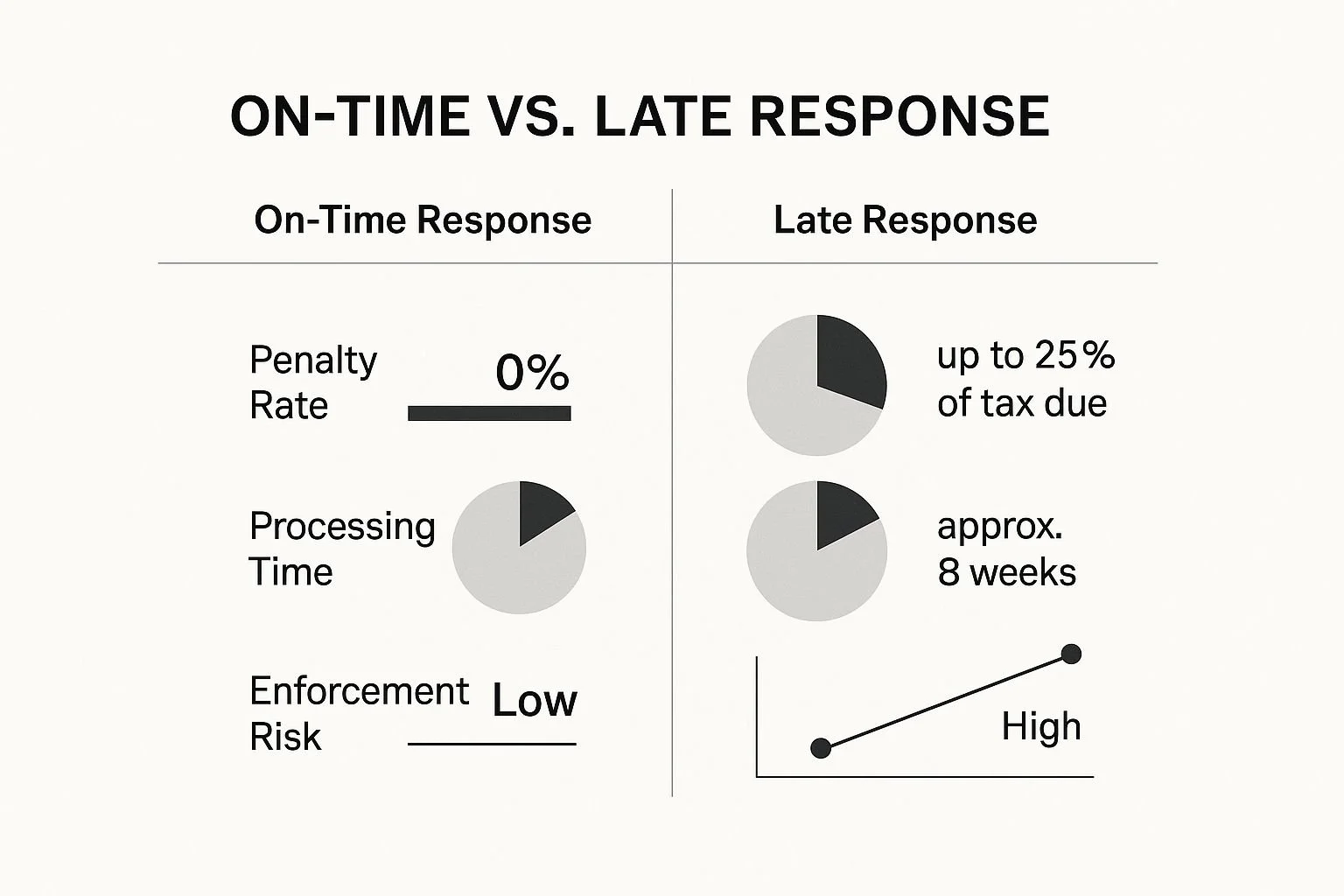

The infographic above highlights the importance of a timely response. Responding promptly can reduce penalties, shorten processing times, and minimize the risk of enforcement actions.

A late response can lead to penalties of up to 25% of the tax due, double the processing time, and a significantly higher enforcement risk. This underscores the importance of taking swift action. You might be interested in: IRS Tax Debt Forgiveness Program.

Adapting To Different Notice Types

Different notice types demand specific strategies. A notice about a math error might simply require pointing out the correct calculation. A Notice of Deficiency, however, indicating the IRS intends to assess additional tax, warrants a more comprehensive response and potentially professional assistance.

CP Notices (Balance Due, Penalties, Interest): Focus on proving payment, establishing inability to pay, or negotiating an installment agreement.

LTR Notices (Various Issues): Tailor your response to the specific request, providing relevant documentation and clear explanations.

Notice of Deficiency: This is a serious matter, often requiring professional tax advice and potentially legal action.

The following table provides a summary of response strategies for different IRS notices:

Response Strategies for Different IRS Notices

| Notice Type | Recommended Response | Required Documentation | Professional Help Needed? | Typical Resolution Timeframe |

|---|---|---|---|---|

| CP2000 (Proposed Tax Adjustment) | Provide documentation supporting the original tax filing | Bank statements, receipts, payment records | Potentially, if complex | 2–4 months |

| LTR 4159 (Request for Information) | Gather and submit requested documentation | Varies depending on request | Possibly, if unclear or complex | 1–3 months |

| CP501 (Balance Due) | Pay balance due or set up payment plan | Proof of payment or financial hardship documentation | Potentially, for negotiating a payment plan | Varies depending on payment arrangement |

| Notice of Deficiency | Consult with a tax professional and consider legal options | Tax returns, supporting documentation, legal arguments | Highly recommended | Varies, potentially lengthy |

This table summarizes the various approaches needed for different IRS notices, ranging from simple documentation requests to complex legal challenges. Understanding these differences is crucial for effective resolution.

Real-World Examples and Case Studies

Examining real-world scenarios provides valuable insights. One taxpayer successfully resolved a CP2000 notice by providing bank statements showing the disputed income was a loan repayment.

Another taxpayer negotiated an Offer in Compromise after receiving a collection notice, significantly reducing their tax liability. These cases highlight the importance of understanding the specific issue and tailoring your response.

By understanding these strategies, you can effectively navigate the complexities of IRS notices and achieve the best possible outcome. Remember, cooperation is key, but effectively advocating for yourself is equally important.

When to Call in the Cavalry: Working With Tax Professionals

While you can handle some certified letters from the IRS on your own, others require the help of an expert. This section offers guidance on when getting professional tax help isn't just a good idea, but essential.

We'll explore the costs and benefits of professional assistance for different types of notices, using insights from experienced CPAs, Enrolled Agents, and tax attorneys.

Recognizing When You Need Professional Help

Figuring out if you need professional help takes careful thought. A simple CP notice about a small adjustment might be something you can handle yourself.

However, a certified letter about an audit, a collection action like a levy, or a complicated tax issue such as the Trust Fund Recovery Penalty often calls for expert guidance.

For example, if your certified letter is about a disallowed Employee Retention Credit (ERC) refund claim, things can get complicated fast.

Navigating the appeals process, gathering the right documents, and understanding the IRS’s risk-scoring filters requires specific tax knowledge.

You might be interested in: IRS Innocent Spouse Relief.

Choosing the Right Professional

Not all tax professionals are the same. CPAs are usually well-versed in tax preparation and planning. Enrolled Agents specialize in representing people before the IRS.

Tax attorneys bring legal expertise, which is essential for complex tax disputes or litigation. Choosing the right professional depends on the specific issue raised in your certified letter from the IRS.

For instance, if your certified letter is about an audit, an Enrolled Agent or a tax attorney specializing in audit defense could be a good choice.

If you're facing a collection action, a tax attorney experienced in negotiating and settling with the IRS can be incredibly helpful.

Credentials and Red Flags

When choosing a tax professional, always check their credentials. Look for licensing, certifications, and memberships in professional organizations. Be wary of unrealistic promises or aggressive sales tactics.

A trustworthy professional will clearly explain their fees and services without guaranteeing specific results.

A qualified professional should also understand the IRS’s internal procedures and resources. The IRS Independent Office of Appeals offers administrative reviews of IRS decisions. Knowing how this process works is crucial for effective representation.

Preparing for Your Consultation

To get the most out of your consultation, be prepared. Gather all the important documents related to the certified letter from the IRS, including tax returns, correspondence, and supporting evidence.

Make a list of questions about their experience with similar cases, their proposed strategy, and how they charge for their services.

Being prepared shows you’re actively involved and helps ensure a productive discussion. Just like making a list of your symptoms before a doctor’s appointment, organizing your tax documents helps your professional quickly assess your situation.

Cost vs. Benefit Analysis

Professional help does have a cost, but the potential benefits often outweigh the expense. A skilled professional can navigate the complicated IRS procedures, negotiate on your behalf, and potentially reduce your tax liability. They can also give you peace of mind and reduce the stress that comes with IRS issues.

For example, if you have significant tax debt, a tax professional might be able to negotiate an Offer in Compromise (OIC), which could significantly lower the amount you owe.

They can also help you set up an Installment Agreement to make your debt more manageable. This expertise can save you much more money than their fees. Investing in professional tax help is often an investment in your financial future.

Beyond the Response: Building Your Tax Compliance Shield

Responding to a certified letter from the IRS can be stressful. The best approach? Prevent them entirely. This means building a robust tax compliance shield to minimize your audit risk and the likelihood of receiving such notices.

Think of it like a business meticulously tracking inventory to prevent shortages and losses – it's about proactive strategies for record-keeping, documentation, and filing.

Proactive Tax Strategies: Staying Off the IRS Radar

Just as regular maintenance keeps a car running smoothly, proactive tax planning can significantly reduce IRS scrutiny. This involves understanding which tax positions truly save money and which ones, while technically legal, might draw unwanted attention.

For instance, claiming excessively high business expenses compared to your income can be a red flag. Focus on legitimate deductions supported by solid documentation.

Meticulous Record-Keeping: Organized records of income and expenses are essential. They’re the foundation of your tax strategy, supporting everything else you build. Keep receipts, invoices, and bank statements.

Detailed Documentation: Don't just keep records; explain them. Document the why behind each transaction. This added context can be invaluable in an audit. A simple note explaining a business trip's purpose, attached to the related receipts, can prevent confusion.

Strategic Filing: File accurately and on time. Late filing, like a delayed flight, can disrupt everything and trigger penalties and interest, increasing your chances of an IRS notice.

Utilizing Technology for Streamlined Compliance

Technology can be a huge help with tax compliance. Software and apps can automate record-keeping, track expenses, and even estimate your tax liability throughout the year. These tools simplify ongoing compliance.

Expense Tracking Apps: These apps categorize expenses and digitally capture receipts, eliminating shoeboxes full of paper.

Cloud-Based Accounting Software: QuickBooks and Xero are examples of cloud-based solutions allowing access to your financial data from anywhere, making tax preparation much more efficient.

Tax Planning Software: This software helps project your tax liability and explore different scenarios to optimize your tax strategy.

Navigating Life Transitions: Maintaining Compliance During Change

Big life changes—marriage, divorce, retirement, or business changes—can disrupt even the most organized tax systems. These transitions are often when compliance slips, leading to IRS correspondence. Simple systems can help you stay on track. Navigating complex tax issues arising from these changes may require expert help, like from a real estate agency for related financial matters.

Updating Your Filing Status: Ensure your filing status is always current. Marriage or divorce requires updating your W-4 and possibly changing your filing status on your tax return.

Adjusting Your Withholding: Life changes often impact your income and therefore your tax liability. Adjust your withholding to avoid underpaying or overpaying taxes.

Seeking Professional Advice: During significant life transitions, consulting a tax professional can offer valuable guidance and ensure you're making informed decisions. This proactive step can prevent future issues and minimize the risk of IRS notices.

For expert help navigating IRS compliance and resolving tax issues, contact Attorney Stephen A. Weisberg. With over 10 years of experience, he offers a free tax debt analysis to help you understand your options and create a personalized strategy for the best possible outcome. Don't face tax challenges alone; get the expert advice you need to protect your financial future.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034