How to Stop Wage Garnishment: Proven Steps to Protect Income

Understanding What You're Really Up Against

Wage garnishment can be a frightening experience. The thought of a creditor taking money directly from your paycheck is understandably stressful.

But understanding the garnishment process can empower you to take control.

Creditors must adhere to specific legal procedures before they can access your earnings. Many attempts fail when challenged effectively.

For instance, creditors usually must first secure a judgment against you in court.

This means proving you owe the debt and haven't paid. This process typically involves being served with legal documents and attending court hearings.

If the creditor overlooks a step or makes an error, the entire garnishment attempt might be invalid.

Certain types of debt have special rules. Some government debts, like student loans and taxes, may be garnished through administrative wage garnishment (AWG).

This means a court order isn't always necessary. Even with AWG, limits exist on how much can be taken. You may find this resource helpful: How to master IRS wage garnishment.

Understanding the types of debt subject to garnishment is essential. While credit card debt, medical bills, and personal loans are frequent causes, not all debts are treated equally. Some, like child support and alimony, have a higher priority and different garnishment limits.

Globally, wage garnishment is a significant issue. As of 2019, it impacted over one in every 100 workers dealing with delinquent debt.

On average, a garnished worker faces garnishment for around five months, with approximately 11% of gross earnings deducted to repay creditors. This underscores the importance of understanding your particular situation.

Knowing Your Rights Is Key

Knowing your rights can shift you from feeling like a victim to someone who can actively protect their income. This means understanding the federal and state laws that safeguard portions of your paycheck.

It also involves understanding how to claim exemptions based on your financial situation. This isn't about avoiding legitimate debts; it's about ensuring creditors follow proper procedures and that you have enough income to cover your essential needs.

Emergency Actions When Your Paycheck Is Already Hit

Discovering a garnishment on your wages demands immediate action. Developing a plan to protect your earnings and address the underlying issue is critical. This section outlines the first steps you should take, including potential legal challenges to stop wage garnishment.

Understanding Your Options for Immediate Action

Begin by understanding the reason behind the wage garnishment. Carefully review the legal documents you received. Identify the creditor, the total amount owed, and the court order authorizing the garnishment. This information is essential to determine your next steps.

Once you have these key details, explore your legal options. One possibility is an improper notice objection.

If the creditor didn't follow the correct notification procedures, the garnishment might be invalid. You can also explore hardship exemptions.

These exemptions demonstrate that the garnishment creates an undue financial burden, preventing you from meeting basic living expenses.

Interestingly, before the pandemic, wage garnishment rates were on the rise, reaching 3.9% in March 2020. This trend shifted, dropping to 2.8% by January 2024 due to the economic impact of the pandemic.

Calculating Your Protected Income and Gathering Documentation

When claiming a hardship exemption, calculating the portion of your income protected by federal and state law is crucial.

This involves understanding the Consumer Credit Protection Act (CCPA), which limits the garnishment percentage of your disposable earnings.

Accurately calculating your disposable earnings after legally required deductions is essential.

Gather supporting documentation for your claim. This includes pay stubs, bank statements, rent/mortgage agreements, and proof of other necessary expenses.

This documentation provides concrete evidence of your financial hardship. Thorough records also demonstrate your proactive approach to resolving the situation.

Effective Court Filings and Timeline Expectations

Presenting a clear and compelling argument in your court filings is essential. Use concise language, cite relevant laws, and clearly present your financial hardship.

Explain how the garnishment prevents you from meeting basic necessities like housing and food. For instance, detail the percentage of your income being garnished and its impact on your ability to afford essential expenses.

Be prepared for the court process. Understand the associated timelines, including deadlines for filing responses and scheduling hearings. This preparation helps you manage expectations and avoid potential delays.

Anticipate potential questions from the judge. Prepare clear, concise answers supported by your gathered documentation. A well-prepared case significantly increases your chances of successfully stopping the wage garnishment.

Your Legal Shield - Rights Creditors Hope You Don't Know

Creditors may try to make you think your paycheck is entirely vulnerable. However, several federal and state laws offer significant protection.

These safeguards shield a portion of your earnings from garnishment. Understanding these protections is the first step toward effectively stopping wage garnishment.

This involves knowing precisely how much of your income is legally protected and how to demonstrate your exempt status.

Federal Protections Under The CCPA

The Consumer Credit Protection Act (CCPA) sets federal limitations on the garnishment of your disposable earnings. For most workers, the CCPA caps the garnishment amount at the lesser of 25% of disposable earnings or the amount by which your disposable earnings exceed 30 times the federal minimum wage.

Disposable earnings are your income after legally required deductions, like taxes. This means a substantial part of your income remains protected, even if facing a garnishment order.

Head-Of-Household Exemptions

Many states offer additional exemptions beyond the CCPA, particularly for heads of households. These head-of-household exemptions acknowledge the added financial strain of supporting dependents. They often offer greater garnishment protection for individuals caring for children, elderly parents, or other dependents.

This often overlooked protection can significantly reduce the portion of your wages subject to garnishment.

You may find this article helpful: Understanding your rights regarding 401ks.

Untouchable Income Sources

Some income sources receive complete protection from wage garnishment. Federal benefits, such as Social Security, disability, and Supplemental Security Income (SSI) are generally exempt.

Similarly, TANF, SNAP, unemployment benefits, and veterans' benefits are typically untouchable. This ensures these vital safety nets remain in place, offering essential support regardless of debt. Furthermore, some retirement accounts like 401(k)s and IRAs may also have some level of protection under federal law.

Enforcing Your Rights

Simply knowing your rights isn't enough. You must actively assert these rights to stop or lessen wage garnishment. This means correctly claiming exemptions, submitting accurate documentation, and understanding your state's specific procedures.

Also, be prepared to challenge creditors or employers who violate these legal protections. For instance, if your employer withholds more than legally permitted, you have the right to formally dispute the action. This knowledge allows you to protect your income and ensure your financial well-being.

Negotiating Your Way Out Before Court Gets Involved

Negotiating with creditors before wage garnishment begins can often prevent the process altogether. This proactive approach can save you significant stress and financial hardship, demonstrating your willingness to address the debt and potentially leading to more manageable repayment terms.

Often, creditors prefer negotiated settlements to the expense and time involved in wage garnishment. Reaching out to them before legal action is taken shows initiative and a sincere desire to resolve the debt.

This proactive communication can encourage a more cooperative and flexible approach from the creditor. For example, they might be willing to suspend late fees or interest charges if you commit to a regular payment plan.

This initial contact is crucial for establishing a foundation for a mutually beneficial agreement. You might find this helpful: How to master IRS debt negotiations.

Crafting Effective Payment Plans and Settlement Offers

When proposing a payment plan, research what the creditor typically accepts. Some creditors are open to lower monthly payments over an extended period, while others prefer a lump-sum settlement.

Consider debt settlement as another strategy. This involves negotiating a reduced payoff amount, which can be substantially less than the total debt. It can be an effective tool for managing overwhelming debt.

Understanding Wage Garnishment Trends

Wage garnishment disproportionately affects certain demographics. Workers between 35 and 44 experience the highest rates, with approximately 10.5% facing this issue.

This is often attributed to increased financial pressures such as raising children and higher divorce rates. Discover more insights about wage garnishment. Understanding these trends highlights the importance of preemptive negotiation.

Documenting Agreements and Seeking Professional Help

Once you and a creditor reach an agreement, document everything in writing. The agreement should clearly outline payment terms, any agreed-upon debt reductions, and the consequences of default. This documented agreement provides legal protection and a clear repayment plan.

Direct negotiation is often successful, but sometimes professional assistance is necessary. A qualified attorney or credit counselor can provide expert advice, negotiate on your behalf, and protect your rights.

They understand the intricacies of debt negotiation and can navigate complex legal procedures.

This professional guidance can be particularly valuable when dealing with multiple creditors or aggressive collection tactics, especially if the creditor has already initiated legal proceedings.

Proactive communication, strategic negotiation, and proper documentation are key to stopping wage garnishment before it starts.

Alternative Solutions When Traditional Approaches Fail

Sometimes, stopping wage garnishment requires thinking outside the box. This means exploring alternative debt relief strategies that can offer a permanent solution to the threat of garnishment.

These strategies include bankruptcy protections, debt consolidation, and even asset protection techniques. Choosing the right path depends on your individual financial situation and the long-term implications of each option.

Exploring Bankruptcy, Debt Consolidation, and Asset Protection

➲ Bankruptcy, despite its negative connotations, can offer significant protection from creditors. Filing for bankruptcy initiates an automatic stay, a legal order that immediately stops most collection efforts, including wage garnishment. This can give you the breathing room you need to reorganize your finances. You might be interested in: Finding expert help with tax debt.

➲ Chapter 7 bankruptcy can sometimes eliminate debts completely, while Chapter 13 bankruptcy allows you to repay debts over a structured timeframe, often at a reduced amount.

➲ Debt consolidation involves securing a new loan to pay off several existing debts. This simplifies your repayment process into a single monthly payment and may lower your overall interest rate. However, qualifying for a consolidation loan with existing garnishments on your wages can be challenging, especially depending on your credit score. This strategy is often most effective when used before garnishment actions begin.

➲ Asset protection focuses on safeguarding certain assets from being seized by creditors. This can involve legally protecting specific assets, such as retirement accounts or home equity, according to state law. Keep in mind, these strategies can be complex and often require professional legal guidance to ensure you remain compliant.

Utilizing Hardship Deferrals and State-Specific Protections

Beyond these common strategies, there are other lesser-known options available.

Hardship deferrals offer a temporary postponement of loan payments during times of financial difficulty, providing temporary relief from garnishment pressures.

These deferrals typically have specific eligibility requirements, so it's important to understand these criteria.

Furthermore, your state may have laws and programs in place offering additional protection. State-specific protections can vary significantly, so researching your state's laws concerning wage garnishment exemptions is crucial.

Even your employer might offer internal policies to assist employees facing financial hardship.

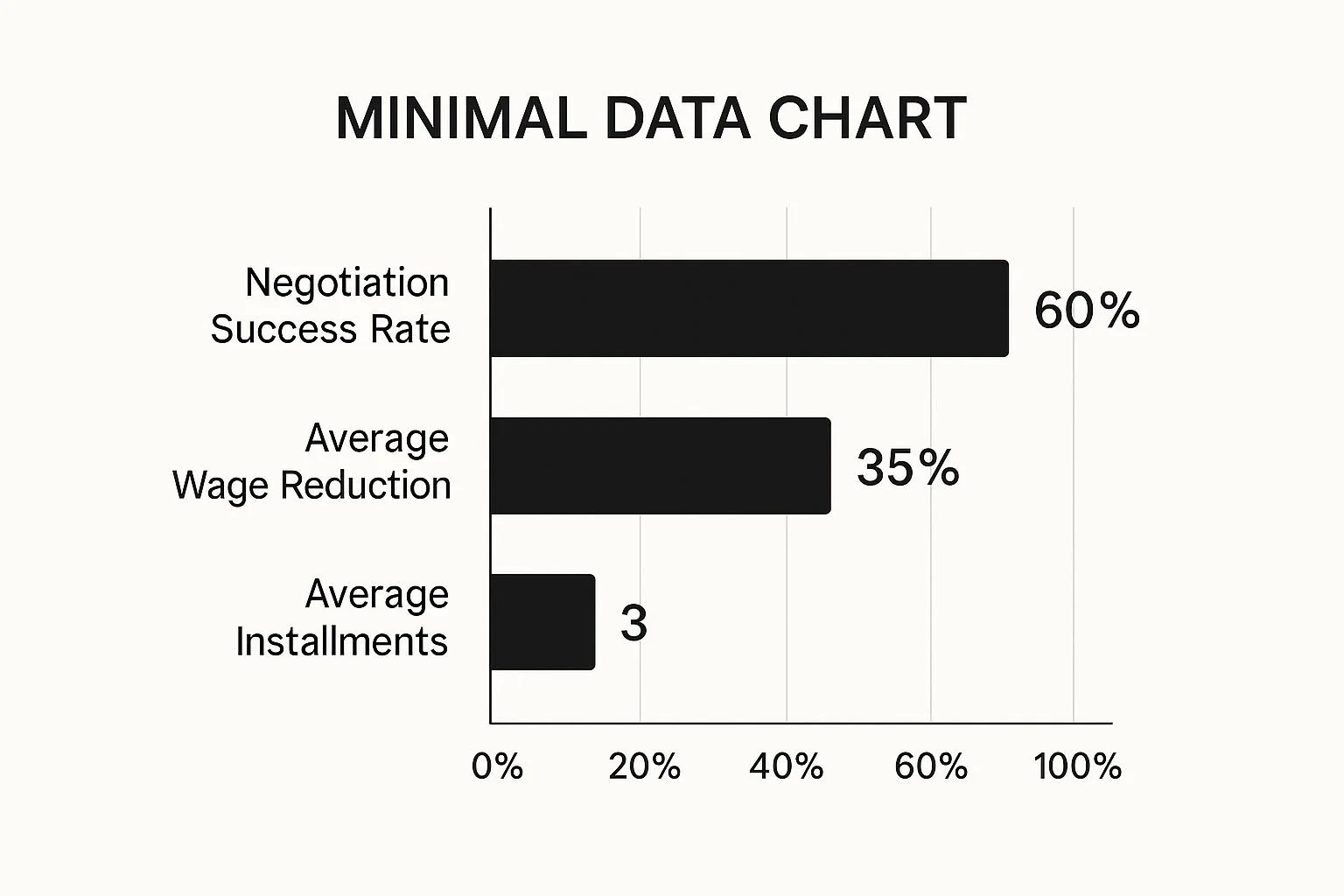

The infographic above presents data related to debt negotiation, including success rates, average wage reductions achieved through negotiation, and the typical number of installments in negotiated agreements.

Successful negotiation, as highlighted in the infographic, can lead to a significant wage reduction, potentially lowering the garnished amount from 35% to a more manageable figure and spreading the repayment over an average of three installments.

This information underscores the potential advantages of exploring negotiation before the situation escalates to wage garnishment.

Understanding all available options, including these alternatives, empowers you to select the most effective approach to stopping wage garnishment.

Debt Relief Options Comparison

A comprehensive comparison of different debt relief strategies showing timeline, costs, credit impact, and effectiveness for stopping wage garnishment.

| Strategy | Timeline | Cost | Credit Impact | Garnishment Protection |

|---|---|---|---|---|

| Bankruptcy (Chapter 7) | Relatively quick (a few months) | Legal and filing fees | Significant negative impact | Immediate and permanent |

| Bankruptcy (Chapter 13) | 3–5 years | Legal and filing fees, plus repayment plan costs | Negative impact, but less severe than Chapter 7 | Immediate and throughout the repayment plan |

| Debt Consolidation | Varies depending on loan terms | Loan origination fees, potential interest rate savings | Minimal impact if managed well; potential improvement over time | Can prevent future garnishments if debt is reduced and managed |

| Asset Protection | Varies greatly depending on strategy | Legal and implementation costs | Minimal direct impact, but could affect future borrowing | Depends on specific assets protected and state laws |

| Hardship Deferrals | Temporary (typically a few months) | Potentially fees, but could avoid interest accrual during deferral | Minimal impact if payments resume after deferral | Temporary |

| Negotiation | Varies depending on creditor and negotiation process | Potential fees for negotiation services | Minimal impact if successful, could even improve credit utilization over time | Can stop current garnishments and prevent future ones |

The table above summarizes the key differences between the various debt relief options available. As you can see, each strategy carries its own set of pros and cons in terms of timeline, cost, impact on credit, and how effectively it stops wage garnishment. Carefully consider each option before deciding what best suits your circumstances.

Working With Your Employer To Your Advantage

Your employer plays a significant role in the wage garnishment process. Understanding this role, including their legal obligations and your rights, can be incredibly helpful. Knowing how to communicate effectively with HR and payroll can also make a difficult situation more manageable.

Understanding Your Employer's Legal Obligations

When a garnishment order arrives, your employer is legally required to comply. This means they must withhold the specified amount from your wages and send it to the creditor.

However, there are limitations to what your employer can do. They are prohibited from firing you for a single wage garnishment, providing crucial job security during this challenging time.

Employers must also adhere to confidentiality rules. They generally cannot disclose information about your wage garnishment to coworkers, protecting your privacy in the workplace.

Communicating Effectively With HR and Payroll

Maintaining open communication with your HR and payroll departments is essential. Promptly inform them of any court orders that modify or stop the garnishment. This ensures they adhere to the most current legal directives and prevents potential complications.

Be proactive in providing any necessary exemption paperwork. Ensure it's completed accurately and submitted through the proper channels within your company. This demonstrates your responsible approach to resolving the situation.

Protecting Yourself From Workplace Retaliation

Federal law provides strong protections against employer retaliation related to wage garnishment. While they can't terminate you for a single instance, they may be able to act based on internal policies and state laws if you have multiple garnishments.

Meticulously document all communications with your employer concerning the garnishment. This creates a valuable record of your interactions should any disputes or misunderstandings arise.

Sample Scripts for Difficult Conversations

Navigating these sensitive conversations can be stressful. Here are some sample scripts to help you initiate productive discussions:

Explaining your situation to HR: "I'm dealing with a wage garnishment and wanted to inform HR and provide the required documentation. I'd appreciate it if you could explain the company's policy on this matter."

Following up on exemption paperwork: "I submitted my exemption paperwork last week. Could I check on its status to make sure it's been processed?"

Addressing a discrepancy in withheld wages: "I think there might be a difference between the garnishment order and the amount deducted from my last paycheck. Could we review this to ensure accuracy?"

These scripts offer a professional and respectful way to address your concerns, protecting your rights while maintaining a positive working relationship.

To better understand how wage garnishment affects different demographics, let's examine the following table:

Wage Garnishment by Demographics and Industry

This table provides a statistical breakdown showing garnishment rates across different age groups, industries, and worker categories to help identify high-risk factors.

| Category | Garnishment Rate | Average Duration | Typical Debt Type |

|---|---|---|---|

| 25–34 years old | 12% | 18 months | Credit Card Debt |

| 35–44 years old | 8% | 12 months | Medical Debt |

| 45–54 years old | 5% | 9 months | Student Loan Debt |

| Construction | 15% | 24 months | Credit Card Debt |

| Manufacturing | 10% | 15 months | Medical Debt |

| Retail | 7% | 12 months | Credit Card Debt |

| Salaried Employees | 6% | 10 months | Student Loan Debt |

| Hourly Employees | 14% | 20 months | Credit Card Debt |

As the table demonstrates, younger age groups and those in certain industries like construction face higher garnishment rates and longer average durations. Credit card debt is a frequent contributor across several categories. This data underscores the importance of financial planning and debt management.

Building Long-Term Financial Protection That Lasts

Stopping wage garnishment is a critical first step. However, true financial stability requires a long-term plan. This means addressing the issues that led to garnishment and adopting sound financial practices. This section will help you build a comprehensive recovery plan, covering budgeting, emergency funds, and credit repair.

Budgeting for a Fresh Start

Creating a realistic budget is essential. Track your income and expenses to see where your money is going. Focus on essential expenses like housing, food, and utilities.

Then, allocate funds to pay down debt, starting with high-interest debts. For instance, if you have a high-interest credit card and a lower-interest student loan, prioritizing the credit card debt might save you more in the long run.

Also, look for ways to reduce non-essential spending. This could mean cutting back on entertainment, dining out, or subscriptions. Small changes add up to significant savings over time, freeing up resources for debt repayment and building a financial safety net.

Building an Emergency Fund

An emergency fund cushions you against unexpected expenses. This prevents future financial crises that could lead to more debt and potential garnishments. Start small, aiming for a few hundred dollars, and gradually increase it to cover three to six months of essential living expenses.

Your emergency fund is like a financial firewall. Just as a firewall protects your computer, your emergency fund protects your finances from unexpected problems.

Having accessible funds prevents relying on high-interest credit cards during emergencies, which helps you avoid accumulating more debt. It also offers peace of mind, knowing you can handle unexpected costs without jeopardizing your recovery.

Repairing Your Credit

Wage garnishment can hurt your credit score. Addressing this is crucial for future borrowing and financial health. Start by checking your credit report for errors. Dispute any inaccuracies with the credit bureaus: Equifax, Experian, and TransUnion.

Next, focus on making consistent, on-time payments on all your debts. This shows responsible financial behavior to lenders and will improve your credit score over time. It's like rebuilding trust; consistent positive actions are key.

Consider seeking help from a reputable credit counseling agency. They offer personalized advice, create debt management plans, and can negotiate with creditors. This expert assistance can speed up your credit repair journey. You can find reputable credit counseling agencies through the National Foundation for Credit Counseling.

Prioritizing Debt and Building Positive Creditor Relationships

Develop a debt repayment strategy, focusing on high-interest debts first. This minimizes interest payments and reduces debt faster. Communicate openly with your creditors about your financial situation and repayment efforts. This builds positive relationships, potentially preventing further collection actions.

Open communication can sometimes lead to better repayment terms. Creditors are often more willing to work with you if they see you're actively managing your debt. Setting up payment reminders or automating payments can help you avoid missed payments, further protecting your financial progress.

Remember, achieving long-term financial health is a marathon, not a sprint. By using these strategies, you can protect your income, rebuild your finances, and avoid future garnishments.

Take the first step toward lasting financial security. Contact Attorney Stephen A. Weisberg today for a free consultation.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034