IRS Levies Bank Accounts: How to Protect Your Money

Inside the IRS Bank Levy Process: What You Need to Know

When the IRS levies a bank account, it signifies a serious escalation in their collection efforts. It means they're legally authorized to seize funds directly from your account to settle a tax debt.

Understanding this process can help you take the right steps and potentially safeguard your finances.

How Does a Bank Levy Work?

The IRS follows a structured procedure, initiating the process with multiple notices. These notices become increasingly serious, starting with a simple payment demand. If ignored, the IRS will then issue a Final Notice of Intent to Levy, serving as your last warning.

This final notice is critical. The IRS follows a specific procedure, which includes a 21-day waiting period after the notice is served.

Your funds are frozen during this period, giving you a final chance to contact the IRS. You can resolve your tax debt or address any errors before the levy occurs.

This waiting period offers taxpayers an opportunity to negotiate with the IRS or provide evidence of fund ownership discrepancies.

Learn more from this information about bank levies. After this period, the bank is legally required to send the levied amount to the IRS.

Which Accounts Are Vulnerable?

Checking accounts are often the primary target, but the IRS can levy other account types as well. Savings accounts, money market accounts, and even brokerage accounts are potentially at risk.

Understanding the scope of their reach helps you assess your possible exposure. After a levy, understanding the tax implications is essential for financial recovery. You may want to consider the tax implications of selling a business.

What Triggers a Levy?

Unpaid tax debts are the primary reason for a bank levy. These debts may include income tax, payroll tax, or other types of tax liabilities.

However, simply owing taxes doesn't automatically trigger a levy. The IRS usually resorts to this action only after repeated collection attempts have been unsuccessful.

Protecting Your Funds: What You Can Do

An IRS bank levy is serious, but there are options to protect your money. These options include setting up a payment plan, negotiating an Offer in Compromise, or claiming financial hardship.

Understanding these options is crucial for navigating the complexities of a levy. Acting quickly and strategically is key to minimizing the financial impact.

The Levy Timeline: From Warning Signs to Frozen Accounts

The IRS doesn't immediately seize your bank accounts. There's a specific process, a timeline with steps that offer chances to act.

Knowing this timeline is vital for protecting your finances.

Many people miss crucial opportunities simply because they don't understand where they are in the process.

You might be interested in: When the IRS Freezes Your Client's Bank Account.

Initial Notices and Demands

The process starts with notices. The IRS sends a series of increasingly urgent letters, beginning with a Notice and Demand for Payment.

This notice outlines how much you owe and starts the collection process. More notices will arrive if payment isn't made. These initial notices are your first warnings.

IRS Bank Levy Timeline and Required Notices

A chronological breakdown of the notices and waiting periods required before the IRS can levy a bank account

| Notice Type | Timing | Taxpayer Rights | Next Steps |

|---|---|---|---|

| Notice and Demand for Payment | Initial contact | Request clarification, dispute the amount | Pay the balance, set up a payment plan, or explore other resolution options |

| Subsequent Notices | Following non-payment of initial notice | Same as above | Same as above |

| Final Notice of Intent to Levy | At least 30 days before levy | Request a Collection Due Process (CDP) hearing | Negotiate a payment plan, offer in compromise, or make other arrangements |

| Bank Levy | After the 30-day notice period | Contact the IRS to discuss release options | Attempt to secure the release of funds, potentially through an offer in compromise or installment agreement |

This table summarizes the key steps the IRS takes before levying a bank account, highlighting taxpayer rights and potential next steps at each stage. Understanding these stages can help taxpayers navigate the process and potentially avoid levy action altogether.

The Final Notice of Intent to Levy

A crucial moment arrives with the Final Notice of Intent to Levy. This document is more than just a reminder.

It's a legal requirement before the IRS can levy. It's the clearest sign that a levy is coming.

The IRS must send this notice at least 30 days before acting. This 30-day window offers a crucial chance to negotiate or arrange a payment plan.

The IRS follows a defined process for bank levies. Learn more about IRS collections.

These include assessing the taxes, sending a Notice and Demand for Payment, and issuing a Notice of Intent to Levy and a Final Notice of Intent to Levy at least 30 days before the levy occurs.

The 21-Day Holding Period

After the 30-day notice period, the IRS sends the levy to your bank. Your bank then freezes your accounts, starting the 21-day holding period. Your funds are unavailable during this time, but they haven't been sent to the IRS yet.

This 21-day period is your last chance to negotiate a solution, possibly preventing the seizure of your money.

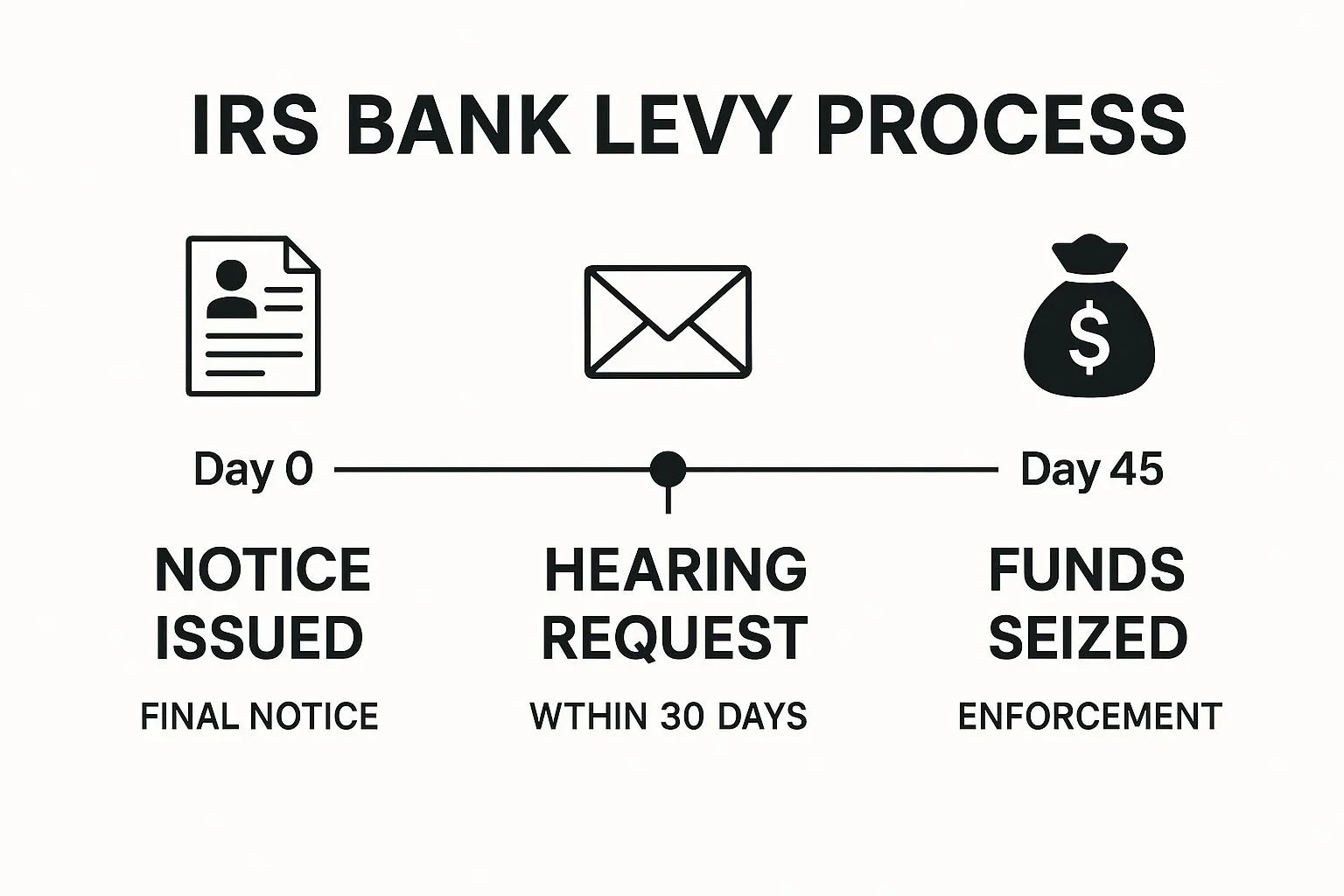

This infographic shows the key timeline of an IRS bank levy, from the final notice to the seizure:

The process takes about 45 days, from the final notice to the seizure of funds. Each stage presents a decreasing window of opportunity to act and possibly protect your assets.

Seizure of Funds

If there's no resolution within the 21-day hold, your bank sends the levied amount to the IRS. This is the final step. Getting your funds back becomes much harder now, requiring appeals or legal action.

Understanding Your Position

Knowing where you are in the timeline helps determine your best approach. If you’ve received early notices, you have time to explore options and potentially prevent a levy. During the 21-day hold, focus on securing a release.

After seizure, your priority is damage control and preventing future levies. Understanding your situation empowers you to make informed choices and protect your finances.

Your Taxpayer Rights When the IRS Freezes Your Accounts

Facing an IRS levy on your bank accounts can be a stressful experience. But you have significant rights that can protect your funds.

The Taxpayer Bill of Rights offers specific protections you can use to navigate this difficult situation. Understanding these rights is the first step toward resolving this issue.

Understanding Your Right to Appeal

Many people mistakenly believe an IRS levy is final. This isn't the case. You have the right to appeal before and after a levy occurs.

This provides multiple chances to challenge the IRS and safeguard your money. If you suspect a procedural error by the IRS, filing an appeal can be a powerful tool.

Leveraging Collection Due Process Hearings

A Collection Due Process (CDP) hearing is a key avenue for appealing an IRS levy. This formal proceeding lets you challenge the levy's legality before an independent IRS office.

It’s more than just a conversation with a collections agent. You can present evidence and argue your case. You can also explore alternative solutions, like an Installment Agreement, to pay your debt over time instead of a lump sum.

Utilizing the Collection Appeals Program

The Collection Appeals Program (CAP) offers another way to challenge the levy. While similar to a CDP hearing, there are key differences. One major distinction is the timing. You can request a CAP hearing even after the 30-day CDP hearing deadline.

However, choosing this route usually means forfeiting the right to further judicial review by the Tax Court.

You might be interested in: Your Spouse Is Shady and Now You're Stuck With the Tax Debt? Enter Innocent Spouse Relief.

Documenting Economic Hardship

If the IRS levy causes significant financial difficulty, you might qualify for levy release or modification. Gather comprehensive financial records, including proof of income, expenses, and assets, to effectively document your hardship.

The IRS determines hardship based on whether the levy prevents you from meeting basic living expenses. For example, inability to pay rent or essential medical expenses qualifies as economic hardship. This documentation is vital to demonstrating your need for relief.

Identifying Procedural Errors

The IRS must adhere to strict procedures when levying bank accounts. A levy might be invalid if these procedures aren't followed.

The IRS must send a Final Notice of Intent to Levy at least 30 days before the levy. Failure to receive this notice could invalidate the levy.

Identifying and documenting these procedural errors is crucial for getting a levy released.

Protecting Your Privacy Rights

You have privacy rights throughout the levy process. The IRS must handle your financial information confidentially and can't disclose it without your permission, except in specific legal situations.

The IRS cannot publicly share details about your tax debt or levy. Protecting these privacy rights is a key aspect of navigating the IRS levy process.

These rights provide a way to regain control of your finances and protect your livelihood. By understanding and using these rights, you can better manage the IRS levy process and potentially avoid serious financial hardship.

Preventing a Levy: Strategic Moves Before the IRS Acts

The most effective way to handle an IRS levy on your bank accounts is to prevent it. Proactive taxpayers understand this and take steps to manage their tax obligations.

This section explores resolution options available to stop levies before they occur, drawing on insights from tax resolution professionals who negotiate with the IRS.

Understanding Your Options

Several strategies can help you avoid an IRS levy on bank accounts. These range from payment plans to negotiating a settlement for less than the full amount owed. Choosing the right strategy depends on your finances and the specifics of your tax debt.

Installment Agreement: This allows you to pay your tax debt in monthly installments. Negotiating a manageable payment is crucial. This involves demonstrating your financial situation to the IRS, ensuring payments fit your budget.

Offer in Compromise (OIC): An OIC lets you settle your tax debt for less than the full amount. This is available only under specific circumstances, typically when demonstrating significant financial hardship or doubt about the liability's validity. Understanding the eligibility requirements is important before pursuing an OIC.

Currently Not Collectible (CNC) Status: If you are unable to pay anything toward your tax debt due to severe financial hardship, you might qualify for CNC status. The IRS temporarily suspends collection efforts during CNC status. However, interest and penalties continue to accrue, making it a short-term solution.

You might be interested in: How to stop IRS levy.

Documenting Financial Hardship: The Key to Success

Whether pursuing an Installment Agreement, an OIC, or CNC status, documenting your financial hardship is essential.

This involves providing the IRS with a complete picture of your income, expenses, and assets. Organized, detailed documentation increases your chances of successful negotiation.

Detailed Records: Gather relevant financial documents, including bank statements, pay stubs, and bills. Detailed records are key.

Clear Explanation: Provide a written explanation of your hardship, explaining how the tax debt affects your ability to meet basic living expenses. Use clear, concise language and focus on the facts.

Professional Assistance: Consider help from a tax attorney or CPA. They can guide you through documentation and represent you in IRS negotiations.

The following table summarizes the various IRS tax resolution options:

IRS Tax Resolution Options Comparison

| Resolution Option | Eligibility Requirements | Benefits | Limitations | Processing Time |

|---|---|---|---|---|

| Installment Agreement | Demonstrated ability to pay agreed-upon monthly installments | Avoids immediate levy, allows manageable payments | Interest and penalties continue to accrue | Varies, generally a few months |

| Offer in Compromise (OIC) | Significant financial hardship, doubt as to liability, or effective tax administration | Reduces total tax debt owed | Strict eligibility requirements, requires detailed financial disclosure | Several months to a year |

| Currently Not Collectible (CNC) | Severe financial hardship preventing any tax payments | Temporarily suspends collection activity | Interest and penalties continue to accrue, not a long-term solution | A few months |

This table provides a quick overview of the different options available. Each situation is unique, so consulting with a tax professional is recommended.

The Importance of Timing

Responding promptly to IRS notices is critical. Ignoring notices escalates the situation and makes avoiding a levy harder. The sooner you act, the more options you have. The 21-day waiting period after a levy notice is your last chance to prevent seized funds, so don’t delay.

When Professional Representation Makes a Difference

Navigating IRS tax resolution can be challenging. A tax professional can provide expert guidance, represent you in IRS negotiations, and help you achieve the best possible outcome.

While professional representation has a cost, it can provide a significant return by protecting your assets and minimizing the financial impact of tax debt.

Consider professional help if facing a potential bank levy, unsure which resolution option is best, or struggling to communicate with the IRS. They can navigate the process, ensure proper documentation submission, and protect your taxpayer rights.

Getting Your Money Back: Releasing An Active Bank Levy

When the IRS levies your bank account, quick action is essential. This guide outlines the steps you can take to potentially release the levy and regain control of your funds. Time is of the essence when your money is frozen.

Understanding The Urgency

The IRS gives you a 21-day window to act after they levy your bank account. During this time, your funds are frozen. After this period, the bank sends the money to the IRS, making retrieval much more difficult. Therefore, you need to act swiftly and decisively.

Immediate Steps To Take

Contact the IRS: The first step is to contact the IRS Collections department. Explain your situation and explore possible solutions. Be prepared to provide any requested documentation.

Gather Hardship Documentation: If the levy causes significant financial hardship, gather documentation to support your case. This could include proof of income, expenses, and assets demonstrating how the levy impacts your ability to meet basic needs like rent, utilities, and medical bills.

Explore Emergency Release Procedures: Many taxpayers are unaware of emergency release procedures available through the IRS. Ask the IRS representative about these options, particularly if the levy creates a severe and immediate hardship.

Strategies For Partial Releases

A full release may not always be immediately achievable. In these cases, a partial release might be an option. This allows access to some of your funds while you work out a longer-term payment arrangement with the IRS.

For instance, if the levy seized more than your tax liability, a partial release of the excess might be possible.

Protecting Payroll For Business Owners

Business owners face unique challenges when dealing with an IRS bank levy. Protecting payroll is often critical. Contact the IRS immediately and explain how the levy affects your ability to pay employees.

You might be able to negotiate a release or modification to protect payroll. Prevention is always the best strategy. Staying compliant with IRD requirements can help avoid levies in the first place. Learn more about how to navigate an IRD Compliance Crackdown.

The Taxpayer Advocate Service

The Taxpayer Advocate Service (TAS) provides assistance to taxpayers facing significant hardship. As an independent organization within the IRS, TAS can help expedite the levy release process and negotiate with the IRS on your behalf.

Consider contacting TAS if you are having difficulty resolving the issue with the Collections department.

Effective Communication With The IRS

When communicating with the IRS, remain calm, polite, and professional. Provide a clear explanation of your situation and supporting documentation.

Maintain detailed records of all interactions, including dates, times, and the names of the representatives you speak with.

Developing a plan for managing your tax debt can help you avoid future issues. Explore IRS back taxes payment plan strategies for more information.

Planning For The Future

Releasing a bank levy is the first step. Creating a long-term plan to prevent future levies is crucial. This includes staying compliant with tax regulations, establishing a budget, and exploring options like Installment Agreements to manage your tax debt.

Proactive planning helps protect your finances and avoid the stress of another levy.

Rebuilding After a Levy: Your Financial Recovery Roadmap

Recovering from an IRS levy on bank accounts requires proactive steps. It's not just about getting your funds released. You need to rebuild your financial stability and prevent future levies.

This involves rebuilding trust with your bank, establishing sound financial practices, and keeping open communication with the IRS. This guide will help you create a robust financial recovery plan.

Rebuilding Trust With Financial Institutions

An IRS levy can impact your relationship with your bank. While banks are legally required to comply with the IRS, a levy creates a record in their system.

Open communication is crucial for repairing this relationship. Contact your bank to discuss the levy and how to rebuild trust.

This might include regular meetings to review your account or exploring new account options.

Establishing Sound Financial Practices

Rebuilding after a levy requires establishing sound financial practices. This includes creating a realistic budget, tracking your spending, and paying your taxes on time. Think of this as building a strong financial foundation.

Budgeting: Create a detailed budget that outlines your income and expenses. Find areas to reduce spending and allocate funds for tax obligations. A good budget acts as a roadmap for your finances.

Tax Compliance System: Set up a system to manage your taxes. This might include automatic payments, working with a tax professional, or using tax software like TurboTax to track deadlines and payments. This helps minimize future IRS issues.

Maintaining Open Communication With the IRS

Staying in contact with the IRS after a levy is essential. This shows you’re committed to resolving your tax issues and can prevent further collection actions. Consistent communication builds trust and avoids misunderstandings.

Regular Updates: Keep the IRS informed about any changes to your finances. If you foresee trouble making a payment, contact them before the deadline to discuss options. This can help avoid additional levies.

Professional Representation: Consider working with a tax professional to communicate with the IRS. They can offer expert advice and represent you in negotiations, ensuring you understand your rights.

Monitoring Your Financial Health

Regularly checking your financial health is vital after a levy. This includes reviewing your credit report, monitoring your bank balances, and staying on top of your tax obligations. Consider it a regular check-up for your financial well-being.

Rebuilding Your Emergency Fund

After a levy, rebuilding your emergency fund is crucial. This safety net covers unexpected costs, helping you avoid high-interest debt. It also provides financial security. Start small and gradually increase your savings.

Rebuilding Your Credit

An IRS levy can indirectly impact your credit. While the levy isn’t reported to credit bureaus, the tax lien that caused it can be.

Rebuild your credit by paying bills on time, reducing existing debt, and checking your credit report for errors. A good credit score provides access to better loan terms and financial opportunities.

Rebuilding after an IRS levy takes time and dedication. With a proactive and strategic approach, you can regain financial stability and avoid future levies. Staying informed, organized, and committed to a stronger financial future is key.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034