Stop IRS Levy Now: 7 Proven Ways to Protect Your Assets

Understanding IRS Levies: What's Really at Stake

Receiving an IRS levy notice can be a stressful experience. It's important to understand what a levy means and how it can affect your finances. Knowing the difference between key terms like lien and levy is the first step toward taking control of the situation.

Lien Vs. Levy: Two Different Beasts

A lien is a legal claim the IRS places against your property, such as a house or car, to secure payment of your tax debt. It's essentially a public record that alerts potential creditors to your tax liability.

The IRS doesn't immediately seize your assets when a lien is filed, but it does impact your ability to sell or refinance the property.

A levy, on the other hand, is the actual seizure of your assets. This can include funds from your bank accounts, wages, or even personal property.

The levy is how the IRS enforces the lien and collects the debt.

The Scope of IRS Authority

The IRS has broad authority to collect unpaid taxes. This power includes levying bank accounts, garnishing wages, and seizing property. However, this process doesn't happen overnight.

The IRS typically begins with a notice of tax due, followed by several attempts to collect before issuing a Final Notice of Intent to Levy.

Importantly, there are limits to the IRS’s power. Understanding these limitations is crucial for protecting your finances and stopping an IRS levy. The process, while designed to collect delinquent taxes, can cause significant financial hardship.

The IRS has recognized this and offers programs to mitigate these impacts. Installment agreements, for example, allow taxpayers to pay their debt over time.

In some cases, the IRS may reconsider a levy if it creates undue hardship, such as preventing the taxpayer from paying basic living expenses.

This demonstrates a balance between efficient debt collection and taxpayer welfare. Learn more about IRS levy programs.

Types of IRS Levies

The IRS uses several types of levies to collect outstanding tax debt. These include:

Bank Levy: This involves freezing and seizing funds directly from your bank account.

Wage Garnishment: A portion of your earnings is withheld from each paycheck and sent directly to the IRS.

Levy on Property: The IRS can seize and sell your assets, including vehicles, real estate, and other personal property.

Understanding the specific type of levy you're facing is essential for developing an effective response. Knowing the IRS’s collection methods and what’s at stake can help you protect your assets and navigate the complexities of stopping an IRS levy.

You might be interested in: How to navigate IRS identity theft.

7 Powerful Ways to Stop an IRS Levy Immediately

Facing an IRS levy can be a stressful experience. Swift action is key to protecting your assets and regaining control of your finances. Here are seven proven strategies to help you stop an IRS levy.

Request a Collection Due Process (CDP) Hearing

A Collection Due Process (CDP) Hearing gives you the chance to challenge the levy before the Independent Office of Appeals.

This can temporarily pause collection efforts while you work towards a resolution. During the hearing, you can present your case, question the levy's validity, and explore alternative payment arrangements.

File for Currently Not Collectible (CNC) Status

If you're facing genuine financial hardship and simply can't afford to pay your tax debt, filing for Currently Not Collectible (CNC) status can offer temporary relief.

While interest and penalties will still accumulate, the IRS will generally halt levies and other collection activities while your CNC status is active.

Be prepared to provide thorough documentation of your financial situation to support your application.

Negotiate an Installment Agreement

An Installment Agreement allows you to pay your tax debt through a series of manageable monthly payments.

This agreement can stop a current levy and help you avoid future collection actions, as long as you stick to the agreed-upon payment schedule.

The IRS offers several installment agreement options, so it’s wise to explore which one best fits your budget.

Submit an Offer in Compromise (OIC)

An Offer in Compromise (OIC) presents the possibility of settling your tax debt for less than the full amount you owe. This can be a valuable option if you're unable to pay your full tax liability.

However, OIC acceptance rates are generally lower than other resolution methods, requiring careful preparation and comprehensive documentation.

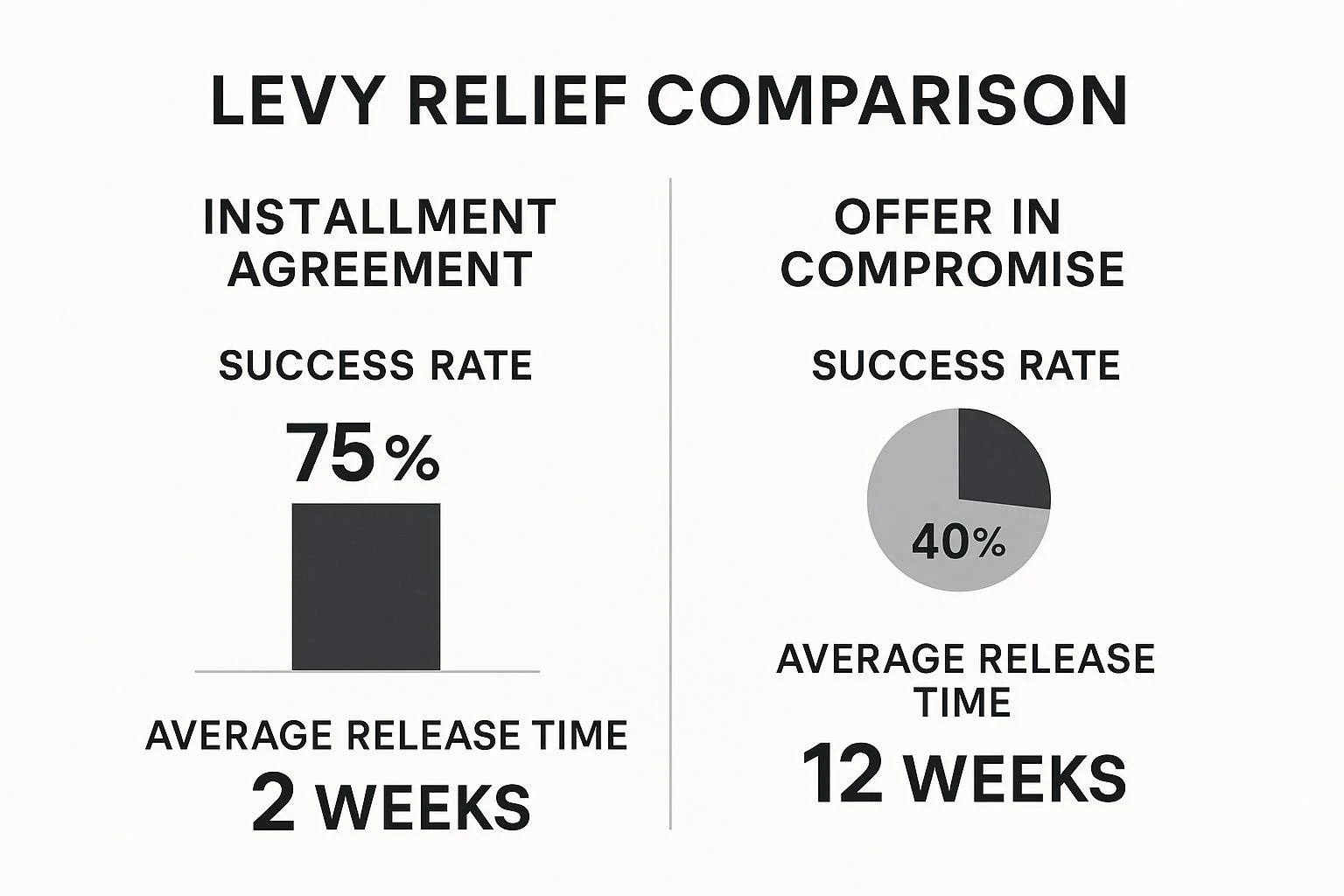

The infographic above illustrates the success rate and average processing time for Installment Agreements and Offers in Compromise.

Installment Agreements boast a higher success rate (75%) and a quicker turnaround time (2 weeks). Offers in Compromise have a lower success rate (40%) and a longer processing time (12 weeks). Choosing the right method depends on your individual financial circumstances.

Engage Taxpayer Advocate Service (TAS)

The Taxpayer Advocate Service (TAS) is an independent organization within the IRS. They provide assistance to taxpayers facing significant hardship due to tax problems.

TAS can help you navigate the complexities of the IRS and advocate for your rights. Their support can be crucial in stopping a levy and resolving underlying tax issues.

For more information on levies, check out our guide on understanding notice of levy.

Consider Bankruptcy (In Specific Circumstances)

While bankruptcy doesn't eliminate all tax debts, it can offer relief from certain tax liabilities and stop levies in some cases. This option has significant long-term financial implications, including impacting your credit score. Consult with a bankruptcy attorney to determine if bankruptcy is a suitable solution for your situation.

Understand IRS Levy Exemptions and Legal Procedures

Understanding IRS levy exemptions and legal procedures can be essential to protecting your finances. In 2025, the IRS offers exemptions from levies based on income and dependents.

For example, a single taxpayer claiming three dependents might have $582.70 exempt per pay period. This increases to $621.16 for taxpayers over 65.

Learning about these exemptions and other legal procedures is crucial. You can find more information on levy exemptions.

Understanding IRD Compliance Crackdown can also be helpful.

To help you choose the best option, here's a comparison table summarizing the key differences between the various IRS Levy Resolution Options:

IRS Levy Resolution Options Comparison

| Resolution Method | Speed of Relief | Requirements | Long-term Benefits | Drawbacks |

|---|---|---|---|---|

| Collection Due Process (CDP) Hearing | Temporary suspension of collection activity | Must file within 30 days of levy notice | Opportunity to negotiate and potentially resolve the levy | No guarantee of success |

| Currently Not Collectible (CNC) Status | Immediate suspension of collection activity | Proof of significant financial hardship | Provides time to improve financial situation | Interest and penalties continue to accrue |

| Installment Agreement | Stops levy upon agreement | Ability to make regular monthly payments | Manageable payment plan | Must adhere to payment terms |

| Offer in Compromise (OIC) | Significant reduction of tax debt if accepted | Meeting specific criteria and demonstrating inability to pay full amount | Potentially settles debt for less than owed | Low acceptance rate and lengthy processing time |

| Taxpayer Advocate Service (TAS) | Varies depending on the case | Experiencing significant hardship due to tax problems | Assistance navigating IRS procedures and advocating for taxpayer rights | No guarantee of a specific outcome |

| Bankruptcy | Can discharge certain tax debts and stop levies | Meeting bankruptcy eligibility requirements | Potential relief from some tax liabilities | Significant long-term financial implication |

These seven strategies offer various paths to stopping an IRS levy. Each situation is unique, so carefully evaluate which approach aligns best with your individual circumstances. By taking proactive steps, you can safeguard your assets and begin your journey towards financial recovery.

Negotiating With the IRS: Insider Strategies That Work

Successfully negotiating with the IRS to stop a levy requires a strategic approach. It's not enough to simply explain your situation.

You must understand the IRS's perspective and present a persuasive case. This involves having proper documentation and communicating effectively with IRS representatives.

Preparing For Negotiation: Essential First Steps

Before contacting the IRS, gather all necessary financial documents. This includes recent tax returns, pay stubs, bank statements, and any documentation that supports hardship claims.

Organize these materials clearly and concisely to demonstrate your current financial situation. This preparation shows the IRS that you are taking the matter seriously and are ready to find a solution.

Additionally, familiarize yourself with common IRS terms. Understanding terms like "Offer in Compromise," "Installment Agreement," and "Currently Not Collectible" is crucial. This knowledge will enable you to understand the available options and communicate effectively.

Learn more about how to negotiate with the IRS. Being prepared will boost your confidence and lead to more productive discussions.

Effective Communication Tactics

When communicating with the IRS, maintain a respectful and professional demeanor. Clearly explain your situation, highlighting any hardships you are facing. However, avoid emotional appeals. Instead, focus on presenting factual information and proposing practical solutions.

For example, if suggesting an installment agreement, specify how much you can realistically pay each month. Provide supporting documentation to validate your claim.

This demonstrates your willingness to cooperate and your commitment to resolving your tax debt. This practical approach encourages cooperation and increases the chances of a positive outcome.

Understanding IRS Guidelines and Reasonable Compromises

Effective negotiation involves understanding what the IRS considers a reasonable compromise.

The IRS aims to collect taxes owed, but they also understand that taxpayers can experience genuine financial difficulties.

They have guidelines for evaluating hardship claims and determining acceptable payment plans.

IRS levies can significantly impact taxpayers, both financially and emotionally. Federal and state tax structures also play a role in negotiating a levy release.

Federal income tax rates, ranging from 10% to 37% in 2025, affect disposable income available for negotiation.

Furthermore, state tax rates vary; some states, like New Hampshire, have eliminated certain income taxes altogether. This means taxpayers in lower-tax states might have more resources to negotiate with the IRS.

Understanding these guidelines helps you create a proposal that aligns with IRS expectations and increases your chances of stopping the levy.

Taxpayer Rights: The Legal Shield Against IRS Levies

Many taxpayers facing an IRS levy feel lost and helpless. Knowing your rights, however, can provide a strong defense against these actions. The Taxpayer Bill of Rights outlines these protections and provides avenues to challenge, and potentially stop, an IRS levy.

Understanding Your Rights Under the Taxpayer Bill of Rights

The Taxpayer Bill of Rights lays out fundamental protections for taxpayers during tax collection. These rights provide a framework for fair treatment and due process.

The Right to Be Informed: The IRS is obligated to clearly explain your rights and responsibilities in a way you can understand.

The Right to Quality Service: You can expect respectful and professional treatment from the IRS.

The Right to Pay No More Than the Correct Amount of Tax: You are responsible for paying what you legally owe, and no more.

The Right to Challenge the IRS’s Position and Be Heard: You have the right to disagree with the IRS and appeal their decisions.

The Right to Appeal an IRS Decision in an Independent Forum: If you're not satisfied with the initial appeal, you can take your case further to an independent review.

The Right to Finality: The IRS should complete audits and collections promptly and efficiently.

The Right to Privacy: Your tax information is kept confidential.

The Right to Confidentiality: The IRS is responsible for protecting your data from unauthorized disclosure.

The Right to Retain Representation: You have the right to hire a tax professional, such as an enrolled agent or attorney, to represent you.

The Right to a Fair and Just Tax System: The tax laws should be administered fairly and equitably.

These rights offer substantial power when dealing with an IRS levy. For instance, the right to be informed ensures you understand the reasons for the levy and that the IRS is following proper procedures.

Utilizing Appeal Processes to Stop a Levy

There are established appeal processes that can put a halt to IRS collection actions. These processes offer a chance to present your case and potentially reach a more favorable outcome.

Collection Due Process (CDP) Hearings: A CDP hearing allows you to challenge the levy before the Independent Office of Appeals. This hearing can temporarily suspend the levy while you negotiate a resolution. It's crucial to request a CDP hearing within 30 days of receiving the levy notice.

Collection Appeals Program (CAP): If you miss the 30-day window for a CDP hearing, the CAP provides another opportunity to challenge the levy. However, CAP hearings generally don't offer the same option for subsequent Tax Court review.

These appeals can help you negotiate alternative payment options, like an Offer in Compromise or an Installment Agreement.

Identifying Levy Exemptions and Statute of Limitations

Not all income and property are subject to IRS levies. Certain exemptions exist to protect basic living expenses. There is also a statute of limitations on tax collection. If the IRS exceeds this time limit, their collection efforts could be invalid.

Understanding these exemptions and the statute of limitations is essential. This knowledge helps identify improper levies and successfully challenge them. By understanding your rights and the available appeal processes, you can effectively fight IRS levies and safeguard your assets.

Beyond Levy Release: Rebuilding Your Financial Foundation

Stopping an IRS levy is a big win. But it’s only the first step in getting your finances back on track. Think of it like this: a cast stabilizes a broken bone, but you still need rehabilitation to regain full strength.

This section provides a guide for rebuilding your financial health after a levy, avoiding future tax issues, and creating a better relationship with your money.

Repairing Your Credit Score

An IRS levy can hurt your credit score. This can make it harder to get loans, rent an apartment, or even get certain jobs. Rebuilding your credit should be a top priority. Start by checking your credit reports for any mistakes. Dispute any inaccuracies you find.

Focus on building responsible financial habits. Pay your bills on time and keep your credit card balances low. Building an emergency fund and working with credit counseling agencies can also help you recover.

Rebuilding Emergency Funds With Tax Obligations in Mind

A financial safety net is crucial for preventing future tax problems. When building your emergency fund, consider your ongoing tax obligations. A good rule of thumb is to set aside a portion of each paycheck just for taxes. Treat it like any other essential bill.

This keeps you from falling behind on tax payments and lowers the risk of future levies. For instance, if you anticipate owing $5,000 in taxes next year, aim to save $417 each month ($5,000 / 12 months). This method makes tax payments easier to handle and less likely to strain your budget.

Implementing Sustainable Tax Planning Practices

Effective tax planning is essential for long-term financial stability. This includes understanding your tax responsibilities, using available deductions and credits, and keeping accurate records. You might find this helpful: How to master an Offer in Compromise.

Planning consistently throughout the year makes tax season less stressful. It helps you stay on top of your tax responsibilities. It's also important to understand the details of your agreements. These contract review tips can help.

Recognizing Warning Signs and Seeking Professional Help

Even with the best planning, financial difficulties can still pop up. Learn to recognize early warning signs of potential tax problems. These might include consistently growing debt or trouble paying bills. Addressing these early allows you to take action before things get worse.

Don't hesitate to get professional help from a qualified tax advisor if you need it. They can offer personalized guidance, negotiate with the IRS for you, and help you create a long-term financial plan.

Their expertise can be invaluable in handling complicated tax situations and protecting your financial well-being. Taking these steps can turn a levy experience from a setback into an opportunity for lasting financial health.

Financial Recovery Timeline After Levy Release

This table outlines key milestones in financial recovery following an IRS levy release.

| Recovery Phase | Key Actions | Timeline | Expected Outcomes |

|---|---|---|---|

| Stabilization | Contact the IRS, stop the levy, understand the cause. | Immediate - 1 week | Levy halted, financial breathing room created. |

| Short-Term Recovery (3-6 months) | Create a budget, prioritize debts, explore payment options with the IRS. | 3-6 months | Reduced debt, agreement with the IRS, improved credit score. |

| Long-Term Recovery (6-12+ months) | Rebuild credit, establish an emergency fund, implement tax planning strategies. | 6-12+ months | Financial stability, reduced risk of future levies, improved financial health. |

The table above provides a general framework. Individual timelines can vary based on your specific circumstances. Remember, consistent effort and professional guidance can significantly accelerate your financial recovery.

When to Call in the Professionals: Getting Expert Help

Dealing with an IRS levy can be stressful. While you can handle some situations on your own, sometimes professional help is essential. This section will help you determine when it’s time to bring in an expert.

We’ll cover situations where self-help isn't enough, discuss the different types of tax professionals available, and provide guidance on finding the right one for your specific needs. This information will empower you to make informed decisions about your financial well-being.

Recognizing When You Need Professional Help

Knowing when to seek professional help is a crucial first step. While self-help strategies can be effective for simpler tax issues, more complex situations often require expert guidance.

For instance, if you're dealing with a substantial tax debt but have limited assets or income, negotiating an Offer in Compromise (OIC) might be your best option.

This complex process greatly benefits from the expertise of a tax attorney or Enrolled Agent. They can navigate the intricate requirements and effectively present your case to the IRS.

If you disagree with the assessed tax amount or if you've been hit with the Trust Fund Recovery Penalty, a tax professional can be invaluable.

They can represent you during audits, appeals, and tax collection disputes, ensuring your voice is heard. Also, consider professional help if you believe the IRS hasn't followed proper procedures or if you're unsure of your rights.

Choosing the Right Tax Professional: Attorneys, Enrolled Agents, and CPAs

Three primary types of tax professionals can assist with IRS levy issues: tax attorneys, Enrolled Agents (EAs), and Certified Public Accountants (CPAs).

Tax Attorneys: These professionals specialize in tax law and can represent you in Tax Court. They provide comprehensive legal advice and representation.

Enrolled Agents (EAs): EAs are federally authorized tax practitioners specializing in IRS matters. They represent taxpayers before the IRS during audits, collections, and appeals.

Certified Public Accountants (CPAs): CPAs are licensed accountants providing various tax services. While not all CPAs specialize in IRS representation, some possess significant experience in tax resolution.

Understanding these distinctions will help you select the right professional. A Tax Attorney might be ideal if your case necessitates legal representation in Tax Court. An Enrolled Agent could be a better fit for navigating IRS procedures and negotiating a resolution.

Evaluating Credentials, Fee Structures, and Avoiding Scams

When choosing a tax professional, carefully assess their credentials and experience. Look for online reviews and confirm their licensing or certification. Beware of professionals guaranteeing specific outcomes, as no one can guarantee IRS decisions.

Inquire about fee structures upfront. Some charge hourly rates, while others offer flat fees. Understanding the cost allows for effective budgeting. Be wary of unusually low fees or pressure to sign up quickly, potential signs of a scam.

Calculating the Return on Investment of Professional Help

Hiring a tax professional requires an investment. Weigh this cost against the potential benefits. A professional can help reduce your tax debt, stop levies, and prevent future issues, resulting in substantial long-term financial savings.

Consider the time and stress involved in handling the situation yourself. A professional can shoulder this burden, allowing you to focus on other priorities. This can significantly improve your outcome and ultimately provide a considerable return on your investment.

Are you ready to stop the IRS levy and regain control of your finances? Contact Attorney Stephen A. Weisberg today for a free Tax Debt Analysis. We'll assess your situation and help you explore your best options moving forward.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034