Make Payment Arrangements with IRS | Easy Relief Tips

Understanding Your IRS Payment Options: What's Really Available

Dealing with a hefty tax bill you can't pay immediately can be stressful. Thankfully, the IRS provides several payment arrangements to help taxpayers manage their tax debt. Knowing your options is key to making smart decisions and avoiding further collection activity.

Short-Term Payment Plans: A Temporary Solution

If you need immediate relief, a short-term payment plan (STPP) could be a good starting point. This plan gives you up to 180 days to pay your total tax liability, including penalties and interest. A STPP can offer a temporary reprieve, giving you time to gather the necessary funds or reorganize your finances. Keep in mind, though, that interest continues to accrue during this period.

Long-Term Payment Plans (Installment Agreements): Managing Debt Over Time

When you need more than 180 days, a long-term payment plan, also known as an installment agreement (IA), might be a better option. These agreements allow monthly payments for up to 72 months (six years). This provides more flexibility for handling larger tax debts.

➥ You might find the IRS Payment Plan Calculator Guide helpful for exploring payment scenarios.

For example, owing $10,000 can feel daunting. An IA can break that amount into more manageable monthly installments, easing the immediate financial strain and potentially helping you avoid more serious collection efforts.

The IRS offers various types of IAs, including both short-term (up to 180 days) and long-term options. Installment agreements continued as a significant resource for taxpayers in 2025, enabling them to pay their taxes over an extended timeframe through regular monthly payments.

Setting up direct debit (automatic payments) helps ensure timely payments and avoids default.

➥ Learn more about payment plans and installment agreements.

The following table compares different IRS payment arrangement options:

IRS Payment Arrangement Options Comparison This table compares the different payment arrangement options available from the IRS, including their eligibility requirements, setup fees, and key benefits.

| Payment Option | Eligibility | Setup Fee | Maximum Term | Key Benefits |

|---|---|---|---|---|

| Short-Term Payment Plan (STPP) | Owe less than $100,000 (including penalties and interest) | Varies based on how you apply and how much you owe | 180 days | Provides a short-term extension to pay your tax debt in full. |

| Offer in Compromise (OIC) | Doubt as to collectability | Varies based on offer type | N/A | Allows you to settle your tax debt for less than what you owe. |

| Installment Agreement (IA) | Owe less than $50,000 (including penalties and interest) | Varies based on how you apply and how much you owe | 72 months | Allows you to make monthly payments for up to six years. |

This table highlights the differences between short-term relief (STPP), long-term management (IA), and debt reduction (OIC). Each option caters to various financial circumstances, making it crucial to understand which aligns best with your situation.

Which Option Is Right for You?

The best payment arrangement depends entirely on your individual financial situation. Consider factors like the total amount you owe, your capacity to make regular monthly payments, and the total cost of the agreement, including accrued interest and penalties.

Consulting a tax professional can provide valuable guidance in determining the best course of action and navigating the process of making payment arrangements with the IRS.

It's important to remember that establishing such an arrangement can protect you from more aggressive collection tactics the IRS might use if the debt remains unpaid.

From Application to Approval: Making Payment Arrangements With IRS

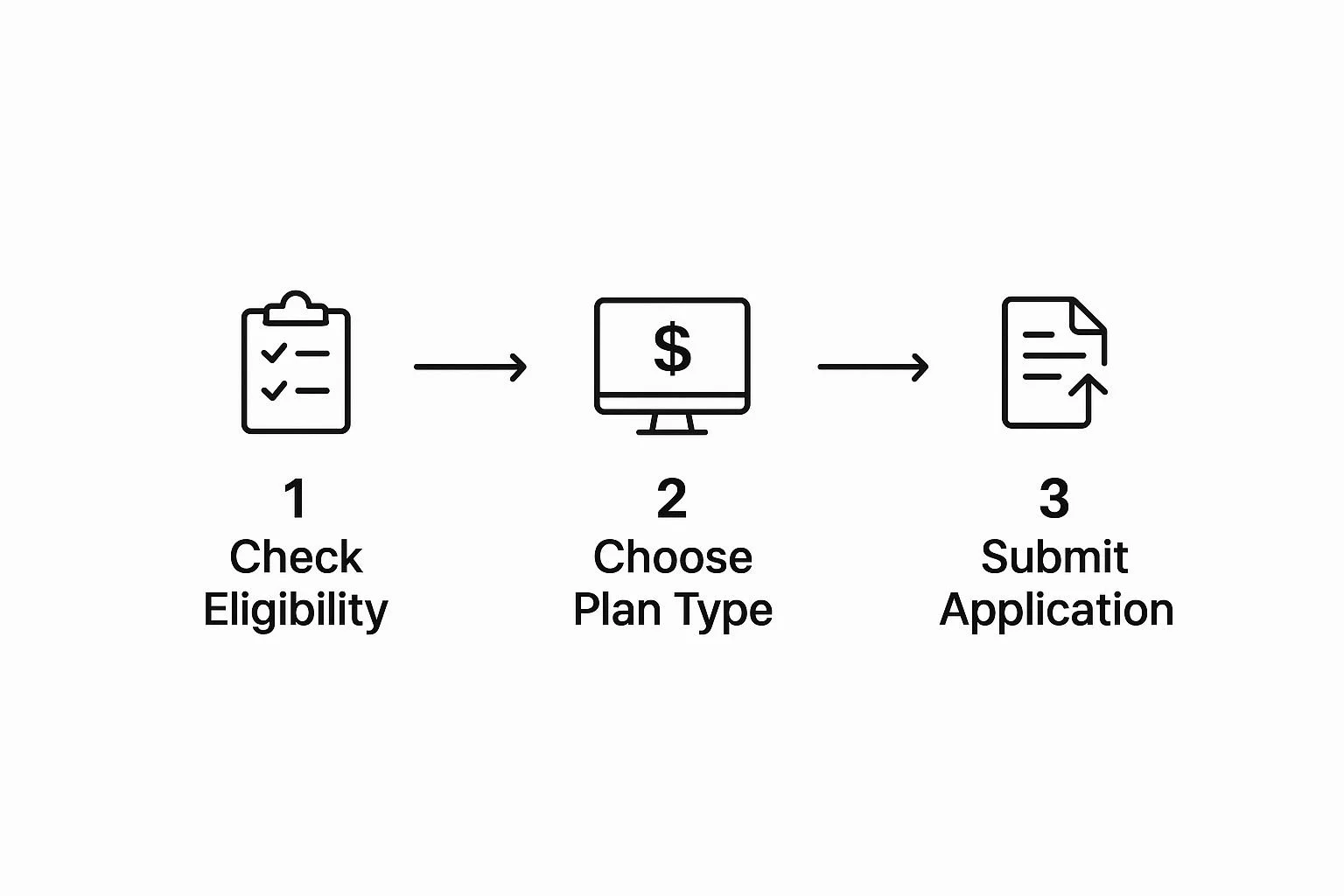

This infographic illustrates the three main steps involved in setting up a payment arrangement with the IRS. These include checking your eligibility, selecting a suitable plan, and submitting your application.

Successfully navigating these steps is essential for securing a payment plan and avoiding potential collection actions.

➥ You might be interested in our ultimate guide to IRS back taxes payment plan strategies.

Preparing For Your Application: Gathering Essential Information

Before applying for an installment agreement, it's important to gather all the necessary documents. This includes your Social Security Number, taxpayer identification number, and the tax year the debt applies to. You’ll also need a realistic estimate of your monthly income and expenses.

Providing accurate information upfront is crucial for a smooth and efficient application process. It will help ensure your application is processed quickly and correctly.

Choosing The Right Payment Arrangement

The IRS offers a few different payment options. These include short-term payment plans (up to 180 days) and long-term payment plans (installment agreements).

The best plan for you will depend on the total amount you owe and how much you can realistically pay each month. A short-term payment plan might be a good option for smaller debts. If you owe a larger amount, a long-term payment plan may be more manageable.

Application Pathways: Online, Phone, Mail, and In-Person

There are several ways you can apply for an IRS payment plan. The IRS Online Payment Agreement tool typically offers the fastest processing time. You can also apply by phone, by mail using Form 9465, Installment Agreement Request, or through an in-person appointment.

Each method has different processing times and document requirements. Online applications often provide the quickest response, while mailed applications might take considerably longer.

The table below summarizes the different application methods, processing times, required documents, and best-case scenarios for each:

IRS Installment Agreement Application Methods

| Application Method | Processing Time | Required Documents | Best For | Limitations |

|---|---|---|---|---|

| Online (IRS Online Payment Agreement tool) | Fastest (Typically within a few days) | Social Security Number, Taxpayer Identification Number, Tax Year, Income and Expense Information | Those comfortable with online applications and seeking the quickest processing | Requires internet access |

| Phone | Moderate (Several weeks) | Social Security Number, Taxpayer Identification Number, Tax Year, Income and Expense Information | Those who prefer speaking directly with an IRS representative | May involve longer wait times on the phone |

| Mail (Form 9465, Installment Agreement Request) | Slowest (Several weeks or more) | Completed Form 9465, Supporting Documentation (as requested) | Those who prefer paper filing | Significantly longer processing times |

| In-Person (IRS Office) | Moderate to Slow (Dependent on appointment availability and office workload) | Social Security Number, Taxpayer Identification Number, Tax Year, Income and Expense Information, Supporting Documentation (as requested) | Complex cases requiring in-person assistance | Requires scheduling an appointment and traveling to an IRS office |

As you can see, choosing the right application method can significantly impact how quickly your request is processed.

Form 9465: Mastering The Application

Accurately completing Form 9465 is essential for approval. Common mistakes include incorrect tax liability calculations or proposing unrealistic payment amounts. Carefully reviewing your information can prevent delays or rejections.

Taking the time to double-check your work can save you time and frustration in the long run.

After Submission: What To Expect

Once you submit your application, the IRS will review it and notify you of their decision. Approval times vary, but online applications typically receive the fastest responses. Knowing the process after submission, including potential IRS reviews, will help you understand the timeline.

Understanding the steps involved can help manage expectations and reduce anxiety during the waiting period.

Common Rejection Triggers and Appeals

Applications can be rejected for several reasons, such as incomplete information, inaccurate calculations, or unaffordable proposed payment amounts. If your application is rejected, you have the right to appeal.

Understanding the appeals process is important for navigating this situation. Remember, the IRS wants to help taxpayers meet their obligations within their financial means.

The Hidden Costs of IRS Payment Plans You Need to Know

While IRS payment plans offer relief from a large tax bill, it's important to understand the associated costs. These often-overlooked costs can significantly increase your overall debt. This means you could end up paying back substantially more than your initial tax liability.

Understanding Interest Accrual

One of the primary costs associated with IRS payment plans is interest. The IRS charges interest on any unpaid tax balance. This interest accrues daily and compounds over time, meaning the interest itself generates further interest. This snowball effect can significantly increase your total debt.

Interest rates play a crucial role in IRS payment arrangements. For the second quarter of 2025, the IRS maintained a 7% annual interest rate, compounded daily, on both overpayments and underpayments for individuals.

This rate, based on the federal short-term rate plus three percentage points, applies to those entering installment agreements. Explore this topic further.

For example, a $5,000 tax debt under a two-year payment plan could accrue hundreds of dollars in interest, significantly increasing the total repayment amount.

Penalties: A Lingering Burden

Even with a payment plan, penalties can continue to accumulate. The failure-to-pay penalty, typically 0.5% of the unpaid taxes each month, can add up quickly.

Additionally, if you haven’t filed your tax return, the failure-to-file penalty, generally much higher than the failure-to-pay penalty, can also apply. While a payment plan prevents further penalties, existing penalties and accruing interest will increase your total payment.

Setup Fees: The Cost of Making Arrangements

The IRS charges setup fees for certain payment arrangements. These fees vary depending on the agreement type and application method (online, phone, or mail). Online applications usually have the lowest setup fees.

However, even small fees contribute to your overall debt. For example, the current fee for a short-term payment plan is lower than a long-term installment agreement, encouraging quicker debt resolution.

Cost Comparison: Immediate Payment vs. Extended Arrangements

Paying your tax liability immediately avoids interest and potentially some penalties, but this isn’t always feasible. Payment plans offer a structured approach to address your debt

However, compare the total cost, including interest, penalties, and setup fees, of an extended arrangement versus paying off your debt quickly.

Sometimes, borrowing funds at a lower interest rate to settle your IRS debt immediately might be more cost-effective than a long-term IRS payment plan. Carefully evaluating these factors will help you make the best financial decision.

Beyond Basic Plans: Alternative Solutions for Serious Tax Debt

When a standard IRS payment plan isn't an option, it's important to explore alternative solutions. These alternatives can potentially save you thousands on your tax debt and put you back on the road to financial recovery. This section examines these alternatives, comparing their processes, success rates, and long-term effects.

Offer in Compromise (OIC): Settling for Less

An Offer in Compromise (OIC) lets you settle your tax debt for less than the full amount. This is a valuable opportunity, but approval depends on demonstrating doubt as to collectability. This means proving to the IRS that collecting the full amount from you is unlikely, based on your current and future finances.

The OIC program has specific requirements and a thorough application process. While some applications are successful, many are rejected because of incomplete documentation or unrealistic offers.

Real case studies show that successful OICs often involve taxpayers with significant financial hardship, supported by detailed financial records. For taxpayers facing wage garnishment, exploring these alternatives can provide relief. Learn more in our article about how to stop IRS wage garnishment.

Currently Not Collectible (CNC) Status: Pausing Collections

Currently Not Collectible (CNC) status temporarily pauses collection activities. This doesn't erase your tax debt, but it stops levies, liens, and other collection actions by the IRS. Approval for CNC status requires proving you're truly unable to make any payments, even small ones, based on your current income and necessary living expenses.

Meeting the requirements for CNC status is crucial. The IRS will meticulously review your financial information to determine if you qualify. While CNC status offers temporary relief, remember that interest and penalties still accrue on your unpaid balance.

Partial Payment Installment Agreements (PPIA): Strategic Debt Resolution

A Partial Payment Installment Agreement (PPIA) lets you resolve your tax debt for less than the full amount through an installment plan. This option combines features of an installment agreement with an offer in compromise.

A PPIA is often granted when the IRS determines it can collect more through partial payments over time than through immediate collection, considering the taxpayer's limited assets and income.

Like an OIC, demonstrating financial hardship is essential for PPIA approval. The IRS analyzes your ability to pay over the collection statute expiration date (CSED), the time frame the IRS can legally collect the debt. PPIA approval requires a strategic approach and a good understanding of your long-term financial outlook.

Choosing the Right Alternative: Expert Guidance

Choosing the best alternative requires a careful review of your specific financial situation. Factors like the total amount owed, your assets, income, expenses, and the CSED are all important. Consulting a tax resolution specialist is extremely helpful in navigating these complex options.

Tax professionals can help you through the application processes, gather necessary documentation, and represent you before the IRS. Their expertise can greatly improve your chances of approval and give you support during a financially difficult time.

Making an informed decision, tailored to your specific circumstances, is key to successfully resolving serious tax debt.

Why IRS Payment Arrangements Matter: The Collection Timeline

Understanding the IRS collection process is crucial for navigating tax debt. Knowing how the IRS operates allows taxpayers to make informed decisions and potentially avoid serious consequences. This overview explores the timeline of IRS collection efforts and emphasizes the importance of proactive engagement.

Initial Contact: Notices and Letters

The IRS collection process typically begins with a series of notices. These notices detail the amount owed, including tax, penalties, and interest. Ignoring these initial communications can lead to more aggressive collection tactics. This is a critical juncture where setting up a payment arrangement with the IRS can prevent the situation from escalating.

For example, a taxpayer might receive a CP14 Notice, a demand for payment. Promptly addressing this notice by establishing a payment arrangement can often halt further collection activity.

Liens: Impacting Credit and Assets

If the tax debt remains unpaid, the IRS may file a Notice of Federal Tax Lien. A lien secures the government's interest in your property, which could include real estate, vehicles, and other assets. This can severely impact your credit score and ability to secure loans.

Proactively making payment arrangements with the IRS can often prevent a lien from being filed. This proactive step can protect your credit and assets.

Levies: Seizing Assets and Income

Following a lien, the IRS may issue a levy. A levy empowers the IRS to seize assets, including wages, bank accounts, and other income sources, to satisfy the outstanding tax debt. Levies represent a serious escalation in collection activity and can have an immediate and significant impact on your finances.

The IRS handles a substantial volume of cases. They processed roughly 100.3 million individual income tax returns for the year ending April 2025. This represents a slight 0.2% increase from the prior year, with 98.2 million returns filed electronically. This high volume underscores the need for clear payment procedures.

Wage Garnishments: Directly Affecting Your Paycheck

The IRS can also garnish your wages. A wage garnishment is a legal order requiring your employer to withhold a portion of your earnings to pay your tax debt. This garnishment continues until the debt is settled or other arrangements are made.

Making payment arrangements with the IRS before a wage garnishment is initiated can help you avoid this disruptive action. It's always better to address the situation proactively.

Collection Statute Expiration Date (CSED): A Critical Deadline

The Collection Statute Expiration Date (CSED) is the final date the IRS can legally collect the tax debt. Making payment arrangements with the IRS, even if the debt isn't fully satisfied before the CSED, can reset this deadline. This is an important strategic factor when dealing with long-term tax debt.

Understanding the CSED and its ramifications can significantly influence your approach to making payment arrangements with the IRS. It's a crucial aspect to consider.

Proactive vs. Reactive: The Impact of Timely Action

Proactively making payment arrangements with the IRS generally leads to better results than waiting for enforced collection actions. By engaging with the IRS early, taxpayers can often negotiate more favorable terms and avoid the negative consequences of liens, levies, and wage garnishments.

The difference between a proactive and reactive approach can dramatically impact your financial stability and long-term financial well-being. Making timely payment arrangements shows a willingness to cooperate and can often lead to a less stressful resolution.

Managing Your IRS Agreement: Staying Protected Long-Term

Securing a payment arrangement with the IRS is a big step toward resolving your tax debt. But maintaining that agreement requires ongoing attention and proactive management. This section offers essential guidance for keeping your agreement in good standing, even when unexpected financial challenges arise.

Critical Payment Practices to Prevent Default

Once your payment arrangement is established, consistently making on-time payments is crucial. Missing payments can lead to default, potentially triggering stricter collection actions. Setting up automatic payments, also known as a Direct Debit Installment Agreement (DDIA), is a great way to avoid this. This automated system ensures timely payments, providing peace of mind.

Keeping your contact information current with the IRS is also vital. Notify them immediately if your address, phone number, or email changes. This ensures you receive important notices and updates about your agreement.

Tax Filing Requirements and Your Agreement

Even with a payment arrangement, you must still file all future tax returns on time. Failing to file can jeopardize your agreement and result in default. For instance, if you have an installment agreement for the 2023 tax year, you still need to file your 2024 return by the April deadline.

You must also pay your estimated taxes for the current year, even while paying off a previous tax debt. Not meeting these ongoing obligations can lead to default on your existing agreement. Understanding the current compliance environment is essential.

➥ Learn more about the potential for an IRD Compliance Crackdown.

Modifying Your Agreement: Adapting to Change

Financial situations can change, and the IRS recognizes this. If you can no longer afford your current payment, you can request a modification to your agreement.

This might involve reducing your monthly payment or extending the payment term.

If your finances improve, you can request to increase your monthly payment and pay off your debt faster, saving you money on interest and penalties.

The IRS aims to work with taxpayers to establish manageable terms, so proactively communicating any financial changes is crucial.

➥ You might be interested in: How to master Form 433-F when resolving an IRS collection case.

Reinstatement After Default: Getting Back on Track

Defaulting on your agreement can have serious repercussions. However, the IRS offers pathways for reinstatement. If you default, contact the IRS immediately to discuss your options. You might qualify for streamlined reinstatement, a simplified process for getting your agreement back on track.

If you've defaulted multiple times or have a more complex situation, you may need to reapply for a new installment agreement, which involves a more extensive application process. Understanding reinstatement options and requirements is crucial for navigating this situation.

Special Provisions: Disaster Relief and Hardship Circumstances

The IRS offers special provisions for taxpayers facing hardship due to natural disasters or other unforeseen events. These may include temporary payment suspensions or penalty abatement. These options provide temporary relief without jeopardizing your long-term resolution plan.

Contact the IRS to see if you qualify. Proactive communication with the IRS is key to successfully managing your payment arrangement and protecting your financial well-being.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034