Not Collectible Status with IRS: Your Complete Guide

Understanding Not Collectible Status With IRS

Owing back taxes to the IRS can feel insurmountable. If you're facing significant financial hardship and unable to pay your tax debt, the IRS offers Currently Not Collectible (CNC) status. This designation provides temporary relief from collection actions, such as wage garnishments and bank levies.

CNC status offers a much-needed pause during difficult financial times. However, it's important to understand that it doesn't eliminate the debt itself. The balance will continue to accrue penalties and interest.

How CNC Status Works

The IRS doesn't grant CNC status lightly. They conduct a thorough review of your financial situation. This involves assessing your income, assets, and allowable living expenses to determine your ability to pay.

To initiate this process, you'll need to submit a comprehensive Collection Information Statement. This statement provides the IRS with a complete overview of your finances. Wage earners and self-employed individuals use Form 433-A, while businesses use Form 433-B.

The IRS regularly reviews accounts designated as CNC. If your financial situation improves, collection activity may resume. This ensures they can collect when taxpayers regain financial stability.

Important Considerations with CNC Status

CNC status offers a temporary reprieve, but the underlying tax debt remains. Penalties and interest continue to accumulate. It's essential to understand this distinction and plan accordingly.

➥ You can learn more about CNC status directly from the IRS: Temporarily Delay the Collection Process

➥ Understanding the levy process is also valuable: Understanding Notice of Levy: The Ultimate Guide for Taxpayers.

Navigating CNC status can be complex. Gaining a full understanding of this process is crucial for managing your finances and communication with the IRS.

Do You Qualify for Not Collectible Status With the IRS?

Navigating the complexities of IRS tax debt can be daunting, especially if you're facing financial hardship. One potential avenue for relief is Currently Not Collectible (CNC) status.

This status offers a temporary reprieve from payment obligations when your financial situation makes paying your tax debt impossible. But understanding the qualification criteria is essential.

Understanding IRS Financial Evaluation

The IRS employs a rigorous process to determine CNC eligibility. It's not enough to simply claim hardship; you must demonstrate it.

Revenue officers use the Collection Information Statement (Form 433-A or 433-F) to gather a comprehensive overview of your finances.

This form requires detailed disclosure of all income sources: wages, self-employment earnings, investments, and government benefits.

The IRS also carefully examines your monthly expenses. Your reported expenses are compared against national and local standards, encompassing necessities like housing, food, transportation, and healthcare.

Documented extenuating circumstances, such as medical emergencies or unexpected job loss, can significantly impact the IRS’s assessment, providing further evidence of genuine hardship.

Assets and Disqualification

While income and expenses are primary considerations, asset ownership also plays a role in CNC qualification. Valuable assets, such as significant property holdings or substantial savings, could suggest an ability to pay, regardless of current income levels.

The IRS takes into account the equity in assets like real estate, vehicles, and investments when evaluating your overall financial capacity.

Understanding your broader tax obligations is crucial. Resources like the IRD Compliance Crackdown offer valuable context on tax compliance, although specific regulations vary depending on your location.

Assessing Your Situation and Documentation

Before applying for CNC status, it's critical to realistically assess your financial standing. Thorough documentation is key. Gather supporting evidence for all declared income, expenses, and assets.

This might include pay stubs, bank statements, medical bills, and loan documents. Comprehensive documentation strengthens your application and demonstrates transparency.

The IRS collected nearly $2.8 billion in delinquent taxes in the period ending in early 2025, and assessed over $25.6 billion in additional taxes for late-filed returns. Find more detailed statistics here.

These figures underscore the importance of accurate record-keeping and compliance. A portion of tax debt remains uncollectible due to taxpayers' inability to pay, and CNC status helps manage such cases. While in CNC status, the 10-year statute of limitations for collection continues to run.

The following table provides a general overview of common living expenses considered by the IRS. Note that these amounts can vary based on location and individual circumstances. Consult a tax professional for specific guidance.

IRS Allowable Living Expenses for CNC Status Qualification

| Expense Category | National Standards | Local Variations | Documentation Required |

|---|---|---|---|

| Housing | Based on HUD Fair Market Rent | Can be adjusted based on actual rent/mortgage payments | Lease agreement, mortgage statement |

| Food | Based on USDA Low-Cost Food Plan | Can be adjusted based on household size and dietary needs | Grocery receipts, food expense logs (optional) |

| Transportation | Includes car payments, insurance, public transportation costs | Can vary based on location and commuting needs | Car loan documents, insurance policy, public transit passes |

| Healthcare | Includes health insurance premiums, medical expenses | Documentation of medical conditions and expenses is crucial | Medical bills, insurance statements, doctor's notes |

| Utilities | Includes electricity, water, gas, and basic phone service | Can vary based on location and usage | Utility bills |

This table summarizes the expense categories and documentation typically required by the IRS when evaluating financial hardship for CNC status. Local variations and specific circumstances can influence the allowable amounts.

Common Pitfalls and Professional Advice

Many CNC applications face rejection due to incomplete documentation, inconsistencies in financial reporting, or an insufficient demonstration of genuine hardship. Consulting a qualified tax professional, such as a tax attorney or enrolled agent, can greatly improve your chances of approval.

These professionals can help you navigate the complexities of the application, ensuring a strong and accurate submission. They can also advise on alternative solutions if CNC status isn't the best fit.

Step-by-Step Guide to Securing Not Collectible Status With the IRS

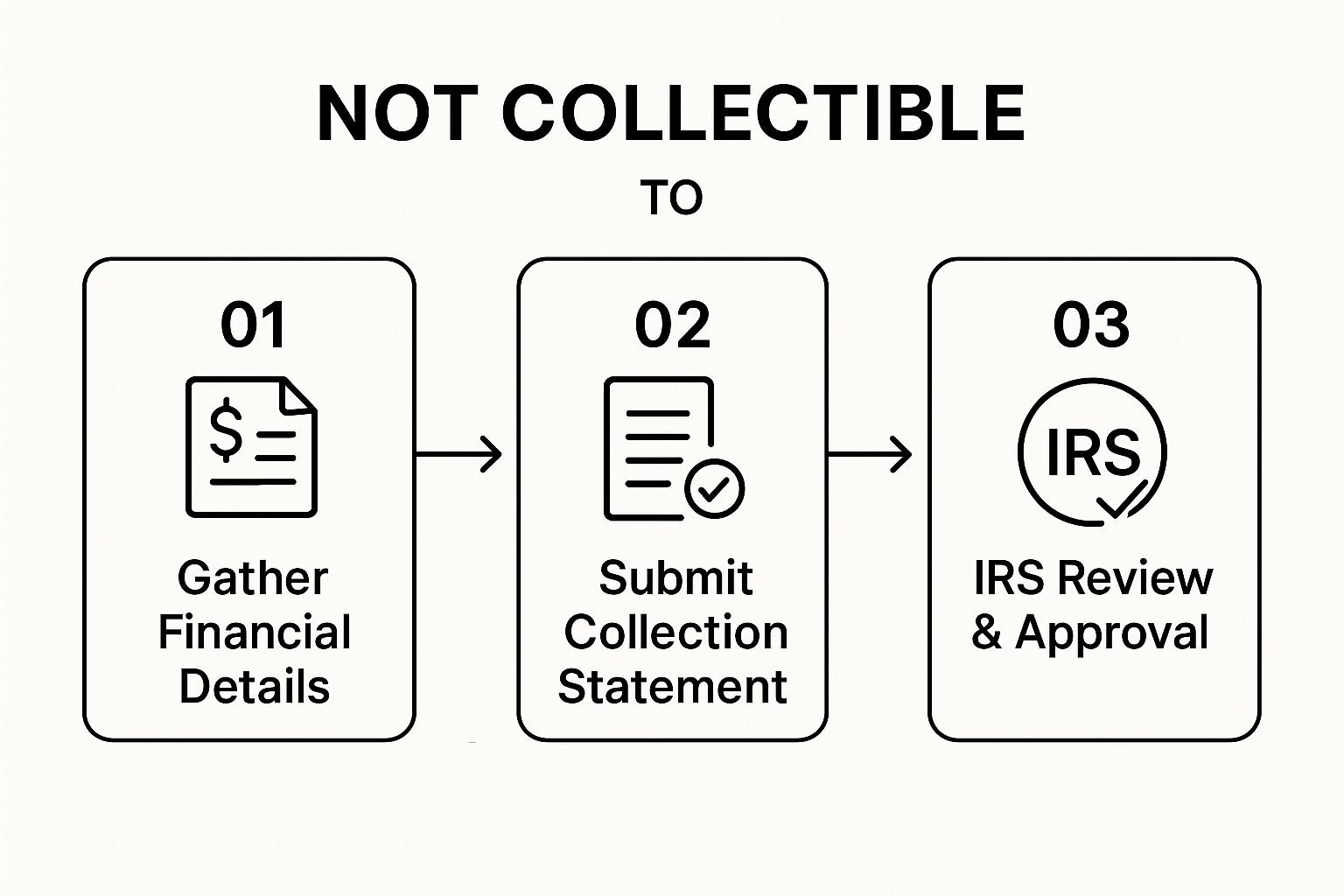

This infographic illustrates the three key steps involved in requesting Currently Not Collectible (CNC) status. These are: gathering your financial details, submitting your collection statement, and undergoing IRS review and approval.

The process appears straightforward, but each step demands careful attention for a successful outcome.

Gathering Your Financial Information

The first step is to gather all your necessary financial information. This includes documentation of all income sources (wages, self-employment, investments, etc.), a detailed list of monthly expenses, and a full account of your assets.

This creates a clear picture of your current financial situation. Accuracy and thoroughness are critical, as the IRS uses this information to assess your ability to pay.

Submitting Your Collection Statement

After compiling your financial information, you’ll submit a Collection Information Statement to the IRS.

Individuals typically use Form 433-A (Collection Information Statement for Wage Earners and Self-Employed Individuals) or Form 433-F (Collection Information Statement).

These forms require detailed information about your income, expenses, and assets, highlighting your financial hardship.

Supporting documentation, such as pay stubs, bank statements, and bills, should be included to verify the information you provide. For instance, if claiming high medical expenses, include copies of medical bills and doctor’s statements.

This helps the IRS understand your financial constraints. Accuracy and honesty are paramount throughout this process.

➥ Learn more about managing back taxes in our article on IRS back taxes payment plan strategies.

IRS Review and Determination

The IRS will review your submitted information and make a determination. This review process can take several weeks or even months.

During this period, the IRS may contact you for additional information or clarification, so maintaining open communication and responding promptly to any requests is essential.

The following table summarizes the application process and expected timeframes.

Application Process Timeline for Not Collectible Status

| Stage | Estimated Timeframe | Actions Required | Notes |

|---|---|---|---|

| Gathering Financial Information | 1-2 weeks | Compile income, expense, and asset documentation | Thoroughness and accuracy are essential |

| Submitting Collection Statement | 1 day | Complete and submit Form 433-A or 433-F with supporting documentation | Ensure all information is accurate and truthful |

| IRS Review and Determination | Several weeks to several months | Respond promptly to IRS requests for information | Maintain open communication with the IRS |

This table outlines the key stages and estimated timeframes involved in the CNC application process. Being organized and proactive throughout each step is crucial for a smoother experience.

➥ You might also find our article on How to master the notice of levy helpful.

While CNC status pauses collection actions, understanding the levy process and your rights is always beneficial. If approved for CNC status, the IRS temporarily suspends collection efforts.

However, remember that interest and penalties continue to accrue on your tax debt, even during this time. The IRS will periodically review your financial situation to determine if your ability to pay has changed.

Beyond CNC: Alternative Solutions to Your Tax Debt

Currently Not Collectible (CNC) status can offer much-needed relief if you're struggling financially and can't pay your tax debt. However, it's not a universal solution. Understanding other available options is crucial for finding the best long-term approach. This means exploring all possibilities before making a decision.

Exploring Installment Agreements

One common alternative to CNC status is an installment agreement. This lets you pay your tax debt in manageable monthly installments over a specific timeframe, instead of a lump sum.

This can be a good option if you have a steady income but can't afford to pay the entire debt at once. If you expect your finances to improve soon, an installment agreement could be a better way to become fully tax compliant.

Considering Offers in Compromise

An Offer in Compromise (OIC) is another potential solution. An OIC allows you to settle your tax debt for less than the full amount owed. This is typically reserved for cases where full payment is unlikely or would cause severe financial hardship.

The IRS has strict criteria for OIC approval, including a detailed review of your assets, income, and expenses.

Penalty Abatement: Reducing Your Burden

Exploring penalty abatement can also be helpful. The IRS may reduce or remove certain penalties, such as failure-to-file or failure-to-pay penalties, if you demonstrate a reasonable cause. This can significantly lower your total tax liability, simplifying repayment.

In fiscal year 2024, over 3.3 million taxpayers entered streamlined installment agreements with the IRS. However, an estimated 36% faced potential economic hardship. Many of these taxpayers might have benefited from alternatives like CNC status or OICs. Explore this topic further.

Combining Relief Options and Bankruptcy

Sometimes, combining relief options offers more comprehensive protection. For example, combining an installment agreement with penalty abatement can lower both your monthly payments and your overall balance.

In some cases, bankruptcy may offer advantages that CNC status doesn't, like discharging certain tax debts completely. Bankruptcy is a complex area, and seeking expert legal advice is essential.

Check out our guide on settling IRS debt for more information on navigating these options. The best solution depends on your individual financial situation and long-term goals. Consulting a tax professional, such as a tax attorney or enrolled agent, is highly recommended.

They can help you evaluate each option, determine your eligibility, and create a personalized strategy. This guidance is invaluable for navigating tax debt complexities and achieving the best possible outcome.

Living With Currently Not Collectible Status: What Happens Next

Receiving Currently Not Collectible (CNC) status from the IRS offers temporary relief from collection activities. However, it's not a permanent solution. Managing your finances responsibly during this time and understanding the implications of CNC status is crucial for your long-term financial health.

Understanding IRS Periodic Reviews

The IRS conducts periodic reviews of your financial situation after granting CNC status. These reviews typically occur every one to two years.

However, they can happen sooner if the IRS receives information suggesting a significant change in your finances. Keeping accurate records and informing the IRS of any substantial income increases or asset acquisitions is essential.

The Impact of Income Fluctuations and Collection Triggers

Changes in your income can affect your CNC status. A substantial raise, a new job, or even an inheritance could trigger the IRS to re-evaluate your ability to pay.

Smaller changes like occasional overtime or a small bonus are less likely to trigger immediate collection actions. Understanding these potential triggers allows you to anticipate and plan for changes.

Interest, Penalties, and the Collection Statute

While collection activities are paused under CNC status, interest and penalties continue to accrue on your existing tax debt, increasing your overall balance.

The ten-year collection statute of limitations also continues to run. This statute limits how long the IRS has to collect the debt. While CNC status offers a temporary reprieve, developing a long-term strategy for resolving your tax liability is vital.

Tax Liens and Their Implications

The IRS might file a Notice of Federal Tax Lien to protect its interest in your property. This lien is public record and can negatively impact your credit score and ability to secure loans. While the IRS generally won't seize assets under CNC status, the lien's presence on your credit report remains a significant factor.

Maintaining Compliance and Documenting Improvement

Staying compliant with your ongoing tax obligations is mandatory, even with CNC status. This includes filing all required tax returns on time and paying any current taxes owed.

Documenting your financial recovery efforts is also important, providing valuable evidence should the IRS review your case.

However, avoid appearing too financially healthy, as this could lead to the reinstatement of collection efforts.

Seeking Professional Guidance

Navigating CNC status can be complex. A qualified tax professional, such as a tax attorney or enrolled agent, can offer valuable guidance.

They can assist with communication with the IRS, explain your rights, and help you develop a strategic plan for resolving your tax debt.

If CNC status isn't an option, veterans can explore other resources like the Financial Assistance for Veterans program.

Professional advice is especially beneficial when facing a complex situation or uncertainty about managing your CNC status.

Financial Recovery While Under Not Collectible Status

Achieving "not collectible" status with the IRS offers a much-needed break from collections. However, it's important to remember this isn't a permanent solution.

This temporary pause provides a valuable window of opportunity to rebuild your finances and create a long-term plan for addressing your tax debt.

Building a Sustainable Budget

Creating a sustainable budget is crucial while you're in "not collectible" status. This means carefully tracking all your income and expenses. Focus on prioritizing essential expenses such as housing, food, and healthcare.

Look for practical ways to reduce spending. For example, consider meal planning and using coupons to lower your grocery bill. Identify and eliminate non-essential spending, then redirect those funds towards debt reduction or building an emergency fund.

Addressing Other Debts and Rebuilding Savings

While under "not collectible" status, focus on tackling any other outstanding debts you may have. A structured debt repayment strategy, like the debt snowball or debt avalanche method, can help you systematically pay down what you owe.

At the same time, start rebuilding your emergency savings. Even small, consistent contributions can make a difference. Having a financial safety net can protect you from future unexpected expenses and help you avoid relying on credit.

Improving Your Credit Profile

A federal tax lien, often filed when you're deemed "not collectible," can negatively affect your credit score. Therefore, rebuilding your credit should be a priority. Regularly monitor your credit report for any inaccuracies and dispute any errors you find.

Consider using secured credit cards or credit-builder loans. These tools can help you establish a positive payment history and gradually improve your credit score.

Increasing Income and Future Tax Compliance

Explore ways to increase your income without jeopardizing your "not collectible" status. This could involve pursuing further education, developing new skills, or even starting a small side hustle. A little extra income can go a long way.

Before making any significant income changes, consult with a tax professional. They can help ensure you don't inadvertently trigger a resumption of collection activities by the IRS.

A tax professional can also guide you in creating a realistic plan for future tax compliance, including strategies for paying down your current tax debt once your financial situation improves.

Planning for Future Tax Debt Resolution

While "not collectible" status provides temporary relief, it's essential to develop a plan for eventually resolving your tax debt. Once your finances are more stable, you might explore options like an Offer in Compromise (OIC) or an installment agreement.

A qualified tax attorney can help you evaluate your options and determine the best course of action for your specific situation. They can also help you prepare for any future interactions with the IRS.

When To Call The Professionals About Not Collectible Status

Navigating the complexities of "not collectible" (CNC) status with the IRS can feel overwhelming, especially when facing financial hardship. While handling your CNC status independently is possible in simple situations, certain circumstances warrant professional guidance.

Knowing when to seek expert help can significantly impact your outcome.

Identifying Situations That Benefit From Professional Representation

Complex tax situations, particularly those involving substantial liabilities or multiple compliance issues, often benefit from professional expertise.

A tax attorney, Certified Public Accountant (CPA), or Enrolled Agent understands the nuances of the IRS collection process and can develop a strategy to maximize your chances of approval.

This is especially important if your financial situation involves multiple income sources, significant assets, or unusual expenses.

Additionally, if you're facing other legal issues, like bankruptcy or divorce, professional representation can ensure your tax situation aligns with your overall legal strategy.

The Advantages of Hiring a Tax Professional

Tax professionals bring specific advantages to CNC cases. They can:

Accurately complete and submit the necessary forms: Ensuring accuracy and completeness in your application is crucial. A professional can help prevent costly errors.

Negotiate with the IRS: Professionals understand IRS procedures and can effectively communicate with revenue officers on your behalf.

Develop a long-term strategy: They can help create a plan for resolving your tax debt even after your CNC status ends.

Identify alternative solutions: If CNC status isn't the best option, they can explore alternatives like Installment Agreements or Offers in Compromise.

For guidance on finding reputable tax debt relief companies, you might be interested in: Tax Debt Relief Companies: A Guide to Finding Expert Help. Choosing a professional who specializes in tax resolution and understands CNC status is crucial.

Evaluating Tax Professionals and Fee Structures

When choosing a tax professional, consider their credentials, experience, and fee structure. Look for licensed attorneys, CPAs, or Enrolled Agents, as these designations indicate specialized knowledge and ethical obligations.

Be wary of companies promising guaranteed results or charging exorbitant upfront fees. A reasonable fee structure should be transparent and tied to the specific services provided.

Real-World Examples of Professional Representation

Many cases demonstrate the positive impact of professional representation. For instance, a tax attorney might negotiate a lower monthly payment on an installment agreement for a client transitioning out of CNC status.

In another case, an Enrolled Agent might secure penalty abatement, significantly reducing a client's overall tax liability. These examples illustrate how professional guidance can lead to better outcomes.

Questions To Help You Decide

Asking yourself these questions can help determine if you need professional help:

Is your financial situation complex?

Are you facing a substantial tax liability?

Do you have multiple unresolved tax issues?

Are you unsure about the application process for CNC status?

Are you feeling overwhelmed by the IRS collection process?

If you answer "yes" to any of these, seeking professional guidance may be a wise investment.

Are you struggling with overwhelming tax debt and considering "not collectible" status with the IRS?

Contact Attorney Stephen A. Weisberg today for a free Tax Debt Analysis. We can help you navigate the IRS, explore available options, and develop a personalized strategy.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034