Statute of Limitations for Tax Evasion: The Complete Guide

Understanding Tax Evasion Time Limits And Legal Protection

The statute of limitations for tax evasion sets a critical timeframe for government prosecution. This legal safeguard prevents individuals from facing indefinite threats. Understanding these time limits is essential for anyone concerned about potential tax problems.

Civil Vs. Criminal Tax Cases: Different Clocks, Different Stakes

The type of case, civil or criminal, significantly impacts the time limit. Civil tax cases, typically involving underpayment, have a standard three-year statute of limitations.

This period can extend to six years if the IRS suspects a substantial understatement of income (generally exceeding 25% of the correct amount). For instance, if a significant income portion goes unreported due to an oversight, the IRS has six years to assess additional taxes.

Criminal tax evasion cases carry harsher penalties, including imprisonment. The statute of limitations is generally six years from the date of the crime. This longer timeframe reflects the higher burden of proof required.

Actions like fleeing prosecution can toll the statute indefinitely, essentially stopping the clock.

The Severity Of Evasion Impacts The Time Limit

The alleged offense's severity also influences the time limit. In willful tax evasion cases, as defined under IRC Section 7201, the six-year limit applies.

However, with more complex schemes like conspiracy to evade taxes, the clock might not start until the last act furthering the conspiracy. This means seemingly older actions can still fall within the statute of limitations if connected to a broader, ongoing evasion effort.

Why Understanding Time Limits Is Crucial

Understanding these time limits is crucial for protecting your rights. It defines the potential liability timeframe, enabling informed decision-making. Knowing the relevant statute of limitations helps assess risk and determine the best course of action.

This knowledge can bring peace of mind. It empowers proactive management of potential tax liabilities.

Consulting a qualified tax attorney is always advisable when facing potential tax evasion issues to understand your specific situation and protect your rights.

Federal Time Limits For Tax Evasion Prosecution

The six-year statute of limitations for tax evasion is a critical element of federal tax law. This timeframe determines how long the government has to bring charges against individuals suspected of tax evasion. However, determining this timeframe isn't always straightforward.

Understanding The Six-Year Limit

This six-year period typically begins on the date the tax return was filed or its due date, whichever is later. For instance, if a 2020 tax return, due on April 15, 2021, was filed on October 15, 2021, the six-year period starts on October 15, 2021.

This means the government generally has until October 15, 2027, to file charges.

For more information on this topic, check out this resource: How to master the IRS statute of limitations.

Exceptions To The Rule: When The Clock Stops and Restarts

Several factors can pause or extend this six-year period. One key exception involves willful evasion under IRC Section 7201. If the government proves willful intent to evade taxes, the statute of limitations could be extended significantly.

Additionally, the statute of limitations can be tolled if the taxpayer takes steps to conceal their evasion, such as leaving the country.

In these cases, the clock stops while the taxpayer is outside the reach of U.S. law enforcement and restarts upon their return.

This can substantially lengthen the government's prosecution window.

Another scenario involves conspiracy charges. If the government alleges a multi-year conspiracy to evade taxes, the six-year timeframe may not begin until the final act that furthered the conspiracy.

This means actions taken years earlier could still fall within the statute of limitations.

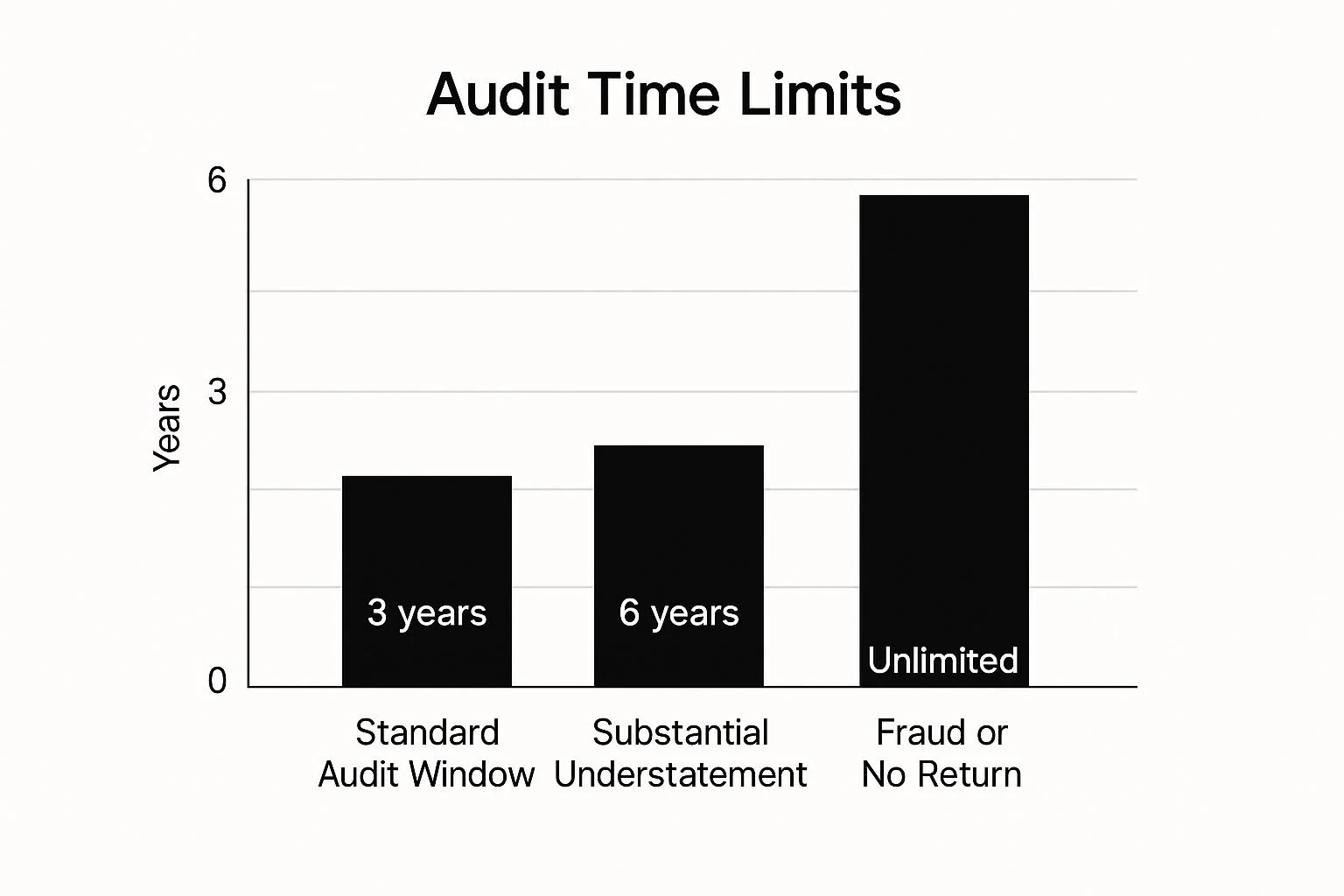

Visualizing Audit Time Limits

The infographic below illustrates the varying audit time limits the IRS uses, based on the severity of the potential violation.

The infographic shows that while the standard audit period is three years, cases involving substantial understatement extend to six years.

Crucially, in cases of fraud or failure to file, the IRS has an unlimited time to audit. This emphasizes the importance of accurate filing and promptly addressing any discrepancies.

U.S. Federal Tax Evasion Statute of Limitations by Offense Type

The following table summarizes the statute of limitations for various tax offenses under U.S. federal law. It highlights the differences in timeframes and potential extensions based on the specific circumstances.

| Offense Type | Standard Limitation Period | Potential Extensions | Special Circumstances |

|---|---|---|---|

| Tax Evasion (IRC 7201) | 6 years | Indefinite if willful evasion is proven; Tolled during periods of taxpayer absence from the U.S. | Conspiracy charges can extend the timeframe based on the last act furthering the conspiracy. |

| Failure to File | Indefinite | None | No limitation period applies. |

| Substantial Understatement of Income Tax | 6 years | None | Applies when the understatement exceeds a certain percentage threshold. |

| General Tax Return Errors | 3 years | None | Standard timeframe for most audits. |

As shown in the table, the standard limitation period is generally six years for tax evasion. However, various factors, such as willful evasion or taxpayer absence, can significantly extend this period.

Calculating the Statute: Not Always Straightforward

Calculating the precise statute of limitations for tax evasion can be complicated due to these various exceptions and extensions.

It isn't simply a matter of marking six years on the calendar. Factors such as the nature of the alleged evasion, actions taken by the taxpayer, and the specific charges influence the timeframe.

Therefore, understanding these nuances is crucial for anyone facing accusations of tax evasion. Seeking legal counsel is essential to determine the applicable timeframe and develop a strong defense strategy.

How Different Countries Handle Tax Evasion Time Limits

The statute of limitations for tax evasion varies significantly worldwide. Each country strives to balance the need for effective enforcement with ensuring legal finality. This creates a complex regulatory landscape for individuals and businesses operating across borders.

Varying Timeframes Across The Globe

Some countries opt for shorter limitation periods. This offers taxpayers a faster resolution, even in cases of suspected evasion. However, it can also restrict the time authorities have to thoroughly investigate complex situations.

Other countries employ longer statutes of limitations. This is particularly true for those grappling with sophisticated international tax evasion schemes.

The differing timeframes reflect the diverse legal frameworks and priorities each country has in combating tax fraud.

For instance, Germany extended the criminal statute of limitations for serious tax evasion cases from 10 to 15 years in 2020. This change highlights the increasing complexity and international nature of these cases.

Learn more about the German Tax Evasion Statute of Limitations. The extension also reflects a broader global trend towards stricter enforcement in response to evolving evasion tactics.

Legal Traditions Shape Enforcement Approaches

These varying approaches are rooted in different legal traditions and priorities. Some legal systems prioritize swift resolution and legal certainty for taxpayers. Others place greater emphasis on thorough investigation and prosecution, even if it requires more time.

For example, countries with a strong emphasis on individual rights often favor shorter statutes of limitations.

Conversely, countries prioritizing tax revenue collection might choose longer timeframes. This allows them more opportunity to recover unpaid taxes.

This can significantly impact individuals with assets or income in multiple jurisdictions. Explore the Tax Implications of Divorce.

Practical Implications For International Taxpayers

Understanding these international differences is crucial for taxpayers with global activities. Overlooking the statute of limitations in various countries can lead to unforeseen legal challenges and financial repercussions.

Consider a taxpayer who believes they are no longer at risk of prosecution because the statute of limitations has expired in their home country.

They might be surprised to discover another country, with a longer statute of limitations, is pursuing charges for the same activity. This underscores the complexities and potential pitfalls of navigating international tax laws.

Global Cooperation's Impact On Tax Enforcement Timing

International cooperation is significantly changing tax enforcement. Initiatives like the Common Reporting Standard (CRS) and automatic information exchange programs have reshaped how governments find and prosecute tax evasion, particularly concerning statute of limitations.

These programs bolster enforcement across borders, making it much harder for tax evaders to hide assets or income offshore.

Information Exchange: Closing Loopholes and Extending Reach

These agreements represent a major change from past limitations on tax enforcement. Previously, tax evaders might have used differences in legal systems or jurisdictional boundaries to hide their activities. Now, information sharing makes it much tougher to simply outwait the clock.

For example, if a U.S. citizen tries to evade taxes by hiding assets in a foreign account, the CRS allows the IRS to get information about that account, even if the foreign country has a shorter statute of limitations. This collaboration effectively closes loopholes and expands the reach of tax authorities.

The fight against international tax evasion has reached important milestones. The EU Savings Directive, enacted in 2005, was an early step in automatic information exchange between nations, including Switzerland.

Later, the G20-endorsed Common Reporting Standard (CRS) expanded international cooperation in tax matters. Discover more insights about international tax cooperation. This shows a global commitment to tackling tax evasion.

Bilateral Treaties and Their Impact on Time Limits

Bilateral treaties further strengthen international tax enforcement by creating clear guidelines for cooperation. These agreements often include provisions for extending or restarting statute of limitations periods.

This means even if the statute of limitations seems to have expired in one country, a bilateral treaty may allow the other country to pursue the case. These treaties have become vital in prosecuting complex, cross-border tax evasion schemes.

Enforcement Successes Highlight the Power of Cooperation

Recent enforcement successes show the impact of these measures. In many cases, international cooperation has identified and recovered hidden assets, resulting in successful prosecutions.

These results show that relying on jurisdictional limits to avoid taxes has become increasingly risky. The ability to share information quickly and efficiently empowers tax authorities to act decisively within applicable timeframes.

Implications for Individuals with International Financial Interests

Anyone with international financial interests should understand these developments. The increased transparency and cooperation mean undeclared offshore accounts or other attempts to evade taxes are more likely to be uncovered. This highlights the importance of proactive tax compliance wherever assets are held.

By understanding these agreements, individuals can better protect themselves from unforeseen legal and financial problems. Seeking professional tax advice is critical for navigating the complexities of international tax law and ensuring compliance.

Today's Tax Evasion Challenges And Detection Methods

Modern tax evasion is far more sophisticated than simply hiding cash under a mattress. Today’s methods often involve complex offshore structures, the use of digital currencies like Bitcoin, and elaborate arrangements across multiple countries.

Unraveling these schemes can be a lengthy and resource-intensive process for authorities. This complexity raises serious questions about the effectiveness of traditional statute of limitations frameworks.

You might be interested in learning more about avoiding IRS audits: How to avoid an IRS audit.

Evolving Tactics Challenge Traditional Time Limits

These new, complex tactics present a significant challenge to the traditional approach to statutes of limitations in tax evasion cases.

What might have once been a relatively straightforward investigation can now involve years of painstaking work across numerous jurisdictions.

This extended timeframe pushes the boundaries of existing time limits, often making successful prosecution difficult.

For example, tracing the flow of money through a network of shell corporations and offshore accounts can add years to an investigation. The increasing use of cryptocurrencies, with their potential for anonymity, adds yet another layer of difficulty.

Technology: A Double-Edged Sword

Technology plays a dual role in the fight against tax evasion. While digital platforms and cryptocurrencies can be used to facilitate evasion, they also provide new tools for investigators.

Data analytics and artificial intelligence are becoming increasingly important in uncovering complex evasion schemes.

This dynamic creates a constant back-and-forth between those seeking to evade taxes and the authorities tasked with enforcing tax laws. Investigators must continually adapt their methods to stay ahead of the curve.

The Challenge of Multi-Jurisdictional Investigations

International tax evasion cases, spanning multiple countries, present unique obstacles. Different legal systems, varying levels of international cooperation, and language barriers can all significantly hinder investigative progress.

Gathering evidence and coordinating efforts across borders require substantial time and resources.

However, recent international collaborations have yielded positive results. The automatic exchange of bank information has played a key role in reducing offshore tax evasion.

Estimates suggest offshore tax evasion by wealthy individuals has decreased by roughly two-thirds over the last ten years. Find more detailed statistics here.

Enforcement Breakthroughs and Ongoing Challenges

Despite the challenges, there have been notable enforcement breakthroughs in recent years. Improved international cooperation and the use of advanced data analysis techniques have resulted in successful prosecutions, even in highly complex cases.

However, the fight is far from over. New technologies and evasion strategies constantly emerge, requiring continuous adaptation from law enforcement and tax authorities. This ongoing struggle highlights the critical need for constant innovation in tax enforcement techniques.

Smart Compliance Strategies And Practical Protection

Understanding the statute of limitations for tax evasion is crucial for making informed decisions about compliance and legal strategies.

This knowledge helps protect your rights and financial well-being. It's not just about knowing the rules; it's about using that knowledge to effectively navigate potential tax problems.

Proactive Compliance: The Best Defense

Maintaining meticulous records is essential for a strong defense. Organized financial documentation demonstrates compliance and is invaluable if questions arise.

This includes keeping bank statements, receipts, invoices, and other relevant financial records. The burden of proof often falls on the taxpayer, so a well-documented financial history is your best asset.

Knowing the early warning signs of potential tax issues is also key. These might include unexplained discrepancies in your financial records, IRS notices or inquiries you don’t understand, or difficulty reconciling income and expenses.

Recognizing these red flags allows you to address them proactively, potentially preventing a minor issue from becoming a major one.

Working Effectively With Tax Professionals

When facing potential tax exposure, seek professional guidance. A qualified tax attorney can explain the complexities of the statute of limitations for tax evasion in your situation.

They can also advise you on the best course of action, whether it’s voluntary disclosure, negotiation with the IRS, or preparing a legal defense. You might be interested in: IRS Innocent Spouse Relief.

Preventive Measures for Long-Term Security

Taking preventive measures can significantly reduce your risk of encountering statute of limitations issues. This includes ensuring accurate and timely filing of tax returns, maintaining complete financial records, and staying informed about changes in tax laws.

If you have international financial interests, understanding the relevant tax laws and reporting requirements in each jurisdiction is vital. This can help avoid unintentional non-compliance and potential penalties.

Key Factors Affecting the Statute of Limitations

The following table summarizes factors that can influence the statute of limitations in tax evasion cases. It highlights the importance of proactive compliance and professional guidance.

Key Factors Affecting Statute of Limitations in Tax Evasion Cases

| Factor | Impact on Statute | Duration of Effect | Preventive Measures |

|---|---|---|---|

| Willful Evasion | Extends | Potentially Indefinite | Accurate reporting, seeking professional advice |

| Taxpayer Absence from U.S. | Tolls (pauses) | Duration of absence | Maintaining U.S. residency or designated agent |

| Newly Discovered Evidence | Restarts or Extends | Depends on the nature of the evidence | Meticulous record-keeping |

| Foreign Accounts/Assets | Complex Interactions, Potential Extensions | Varies by country and treaty | Compliance with international reporting requirements |

By understanding these factors and implementing sound compliance strategies, you can significantly reduce your risk and confidently navigate the complexities of tax law.

Key Takeaways For Tax Evasion Statute Protection

Understanding the statute of limitations for tax evasion is crucial for protecting yourself from potential charges. This knowledge helps you make informed decisions and manage any related stress. Here's a breakdown of key takeaways to keep you informed.

Recognizing Time Limits and Potential Extensions

The standard six-year statute of limitations for federal tax evasion isn't absolute. Several factors can influence this timeframe.

Willful evasion, meaning a deliberate attempt to evade taxes, can significantly extend this period. This gives the IRS more time to file charges.

Additionally, actions like leaving the country to avoid prosecution will toll the statute. This effectively pauses the clock until the individual returns to U.S. jurisdiction.

International Considerations

If you have international financial activity, understanding other countries' tax evasion time limits is essential. These statutes vary significantly.

What might be past the deadline in one country could still be actionable in another. For instance, Germany recently extended its statute of limitations for serious tax evasion cases to 15 years.

This highlights a growing global trend toward stricter tax enforcement.

The Impact of Global Cooperation

International agreements like the Common Reporting Standard promote data exchange between countries. This increased cooperation can impact the statute of limitations. Information sharing can restart or extend deadlines.

Practical Steps for Protection

Organized financial records are your first line of defense. Clear documentation demonstrates compliance and provides a strong defense if necessary.

Be mindful of potential red flags like unexplained discrepancies in financial records or confusing IRS notices. Addressing these promptly can prevent small issues from becoming larger problems.

Seeking Professional Guidance

Facing potential tax evasion issues can be stressful. A qualified tax attorney can provide expert advice specific to your circumstances.

They can explain the complexities of the statute of limitations, explain your rights, and guide you toward the best course of action. Whether you're considering voluntary disclosure or navigating an IRS investigation, professional help is invaluable.

Ready to take control of your tax situation and ensure you're fully protected? Contact Attorney Stephen A. Weisberg today for a free Tax Debt Analysis. With over 10 years of experience, Attorney Weisberg can help you navigate tax law and achieve the best possible outcome.

➥ Contact Attorney Stephen A. Weisberg for a free Tax Debt Analysis.

Contact Me Here: https://www.weisberg.tax/contact-1

Email: sweisberg@wtaxattorney.com

Phone/Text: (248) 971-0885

Address: 300 Galleria Officentre, Suite 402, Southfield, MI 48034